The Bottom Line: S&P Global Ratings becomes the third credit rating agency to issue ESG credit indicators intended to inform the CRA’s assessment of creditworthiness.

S&P Global Ratings becomes third credit rating agency to issue ESG credit-related indicators

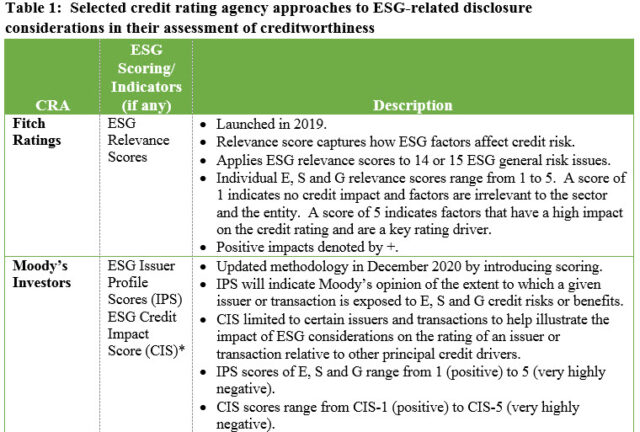

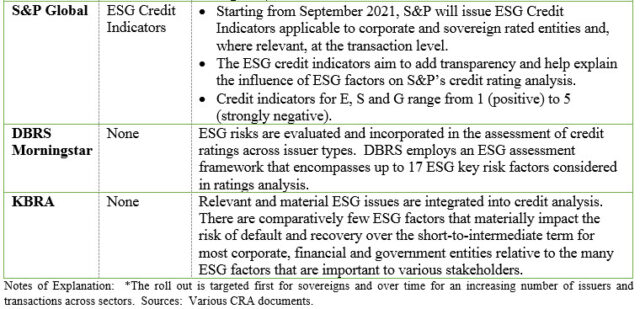

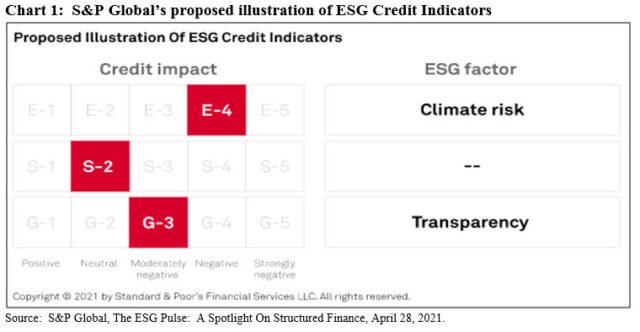

S&P Global Ratings became the third credit rating agency (CRA), after Fitch Ratings and Moody’s Investors, to introduce ESG credit-related indicators. In an announcement made on April 28, 2021, S&P Global announced that starting from September 2021, it will issue so called ESG Credit Indicators applicable to corporate and sovereign rated entities and, where relevant, at the transaction level. The ESG credit indicators are intended to add transparency and help explain the influence of ESG factors on S&P’s credit rating analysis. Currently, S&P includes qualitative ESG insights in many of its credit rating reports. As noted by S&P, ESG Credit Indicators “will not affect our credit ratings because they do not belong in our credit rating methodologies. Instead, they will reflect our qualitative assessment—determined during a rating review, typically by a rating committee-about whether ESG factors have a neutral, positive, or negative influence on the key components of our credit rating analysis specific to each entity or transaction.” The ESG credit indicators, which don’t apply to structured finance transactions, will be in the form of alpha-numerical designations for E, S and G factors ranging from 1 (positive) to 5 (strongly negative). Refer to Chart 1.

S&P’s ESG Credit Indicators, along with Fitch Ratings’ Relevance Scores and Moody’s Credit Impact Scores are each linked to the credit rating agency’s core credit ratings. These incorporate all material credit considerations that have a material impact on credit quality, including ESG risks and opportunities, and represent an assessment of an entity’s ability to repay financial obligations in full and on time. Credit ratings are forward-looking opinions that extend over some time interval. These may vary from one CRA to the next. For example, time intervals may extend from a three-to-five year horizon to the most forward looking perspective that visibility of risks and opportunities may permit.

ESG ratings and scores issues by firms like MSCI and Sustainalytics are not linked to credit assessments. In the case of MSCI, for example, the ratings are designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks. Similarly, the ESG Risk Ratings issued by Sustainalytics, which are absolute ratings, measure a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks. Still, the CRA credit related indicators or scores also attempt to capture and describe ESG risks. Over time, it will be instructive to understand the nature of the relationship, if any, between ESG credit-related indicators and ESG ratings or scores.