Summary

- The S&P 500 Index posted its second consecutive monthly decline in March, giving up -2.54% as volatility prevails in the light of shifting investor sentiments.

- Sustainable equity funds, as measured by the SUSTAIN Equity Fund Index, outperformed the S&P 500 benchmark by 54 basis points (bps).

- Sustainable model portfolios post declines but outperform their corresponding non-sustainability oriented indexes.

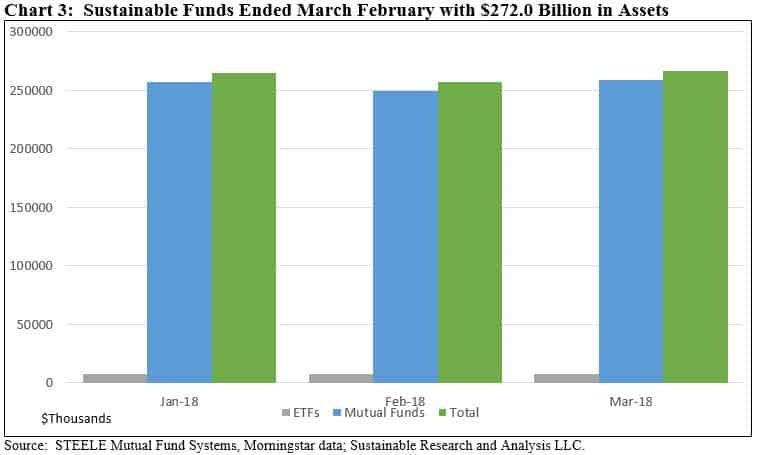

- Sustainable funds close March at $272.0 billion managed across 909 mutual funds and exchange traded funds (ETFs), adding $9.7 billion versus February as two fund groups repurpose existing funds by formally adopting ESG criteria.

SUSTAIN Equity Fund Index Outperforms by 54 bps; S&P 500 Index Posts its Second Consecutive Monthly Decline in March, Giving Up -2.54%, as Volatility Prevails

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

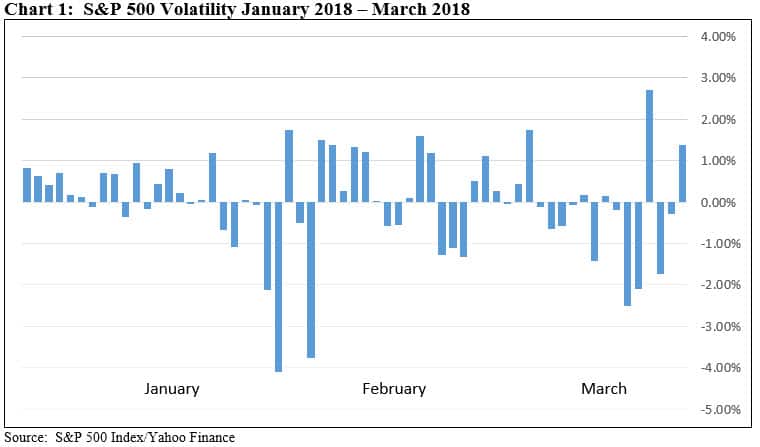

The S&P 500 Index posted its second consecutive monthly decline in March, giving up -2.54% while the NASDAQ Composite Index and Dow Jones Industrial Average (DJIA) recorded even steeper drops of -2.79% and -3.59%, respectively, as investor sentiment shifted after January due to concerns around trade, inflation, interest rates, as well as increasing fears starting in March that social network companies and other internet firms might face revenue constraints if they were to become subject to new regulations designed to protect customer data and user privacy. These anxieties were likely accentuated by deepening concerns about the lack of strategic and thoughtful leadership emanating from Washington D.C. and reflected in a dramatic uptick in volatility that began at the end of January. The S&P 500 Index moved up or down by more than 1% during nine trading days in March, 12 trading days in February and in contrast, only two trading days in January, for a total of 23 trading days during the first quarter. This is already triple the number of volatile days in all of 2017. Refer to Chart 1.

During the month, eight of the eleven sectors that make up the S&P 500 suffered reversals ranging from -1.12% for the Telecommunications Sector to -4.46% recorded by Financials. Only three sectors posted positive results, including Utilities (+3.41%), Real Estate (+3.26%) and Energy (+1.55%), the latter benefiting from oil prices that rose 7.5% during the quarter. Information Technology was the second worst performing sector, down -3.95%. Small-cap stocks moved in the opposite direction, gaining 2.04% according to the S&P SmallCap 600 Index and ending the quarter with a slight gain of 0.57%. In general, larger value stocks outperformed growth stocks in March by around 94 basis points, but both market segments sustained declines in excess of 2% while diverging over the entire quarter. A slight blend-to-value tilt on the part of the underlying funds may have helped the SUSTAIN Equity Fund Index outperform the S&P 500 by 54 bps. European stocks were down -1.80% while emerging markets recorded a similar -1.86% total return. On the other hand, bonds, according to the BBgBarc U.S. Aggregate Bond Index, gained 0.64% as interest rates, measured by 10-Year Treasury yields, dropped by 13 basis points from 2.87% to 2.74% at the end of March. At the same time, the SUSTAIN Bond Fund Indicator was up 0.50%. For the full quarter, investment-grade bonds ended with a -1.46% loss.

Against a backdrop of broad underlying fundamentals that remain attractive but subject to skepticism in some quarters, bolstered in March by the passage of a $1.3 trillion spending bill crafted by Congress and signed by the President that once again avoided a government shutdown, the S&P 500 Index registered the second monthly loss of the quarter, thus erasing entirely January’s strong gain and ending the first three months of the year in the red at -1.46% and the first down quarter going back to the third quarter of 2015. Since reaching its peak on January 26th, the market is down 8.08% through the end of March and it remained in correction territory after dropping -10.2% in a nine trading day period to February 8th. Still, this leaves stocks ahead 13.99% over the trailing 12-months, as measured by the S&P 500 Index.

Sustainable Model Portfolios Post Declines but Outperform their Corresponding non-ESG Indexes

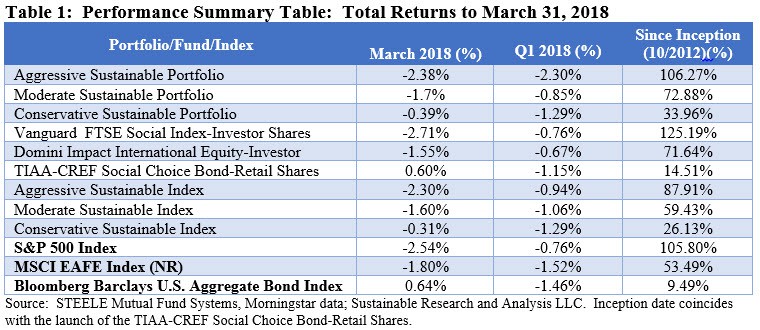

Each of the three model portfolios, Aggressive Sustainable Portfolio, Moderate Sustainable Portfolio and Conservative Sustainable Portfolio, posted declines for the second month in a row. While less severe relative to February when both equities and bonds produced losses, the March results ranged from -0.39% recorded by the Conservative Portfolio to -2.38% attributable to the Aggressive Portfolio. In each instance, the Portfolios lagged their corresponding benchmarks within a narrow range of one to eight basis points. This was due to the fact that only one of the three underlying funds exceeded the performance of their corresponding non-sustainability oriented indexes. Refer to Table 1.

The Domini Impact International Equity Fund Investor Shares is the only fund in March to beat its MSCI EAFE Index, posting a -1.55% return versus -1.8% recorded by the index. On the other hand, the Vanguard FTSE Social Index Investor Shares and TIAA-CREF Social Choice Bond Retail Shares posted returns that trailed their respective benchmarks by 17 bps and 4 bps, respectively.

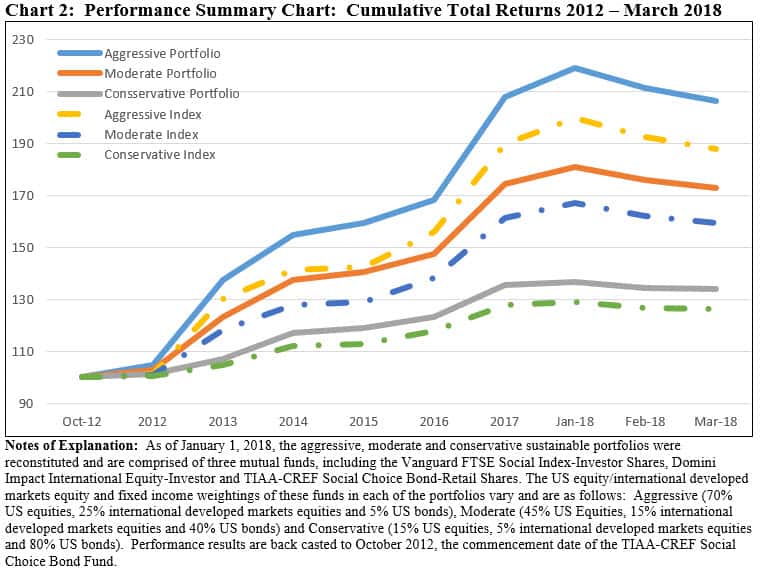

For the quarter, each of the SRI Portfolios outperformed their corresponding non-sustainability oriented indexes but offered small comfort with their negative returns. In a reversal due to the strong results achieved by stocks in January (+5.73%) as contrasted to the decline posted by bonds (-1.15%), the Aggressive Sustainable Portfolio ended the quarter with a smaller loss relative to the heavy bond-weighted Conservative Sustainable Portfolio. Refer to Chart 2.

Sustainable Funds Register Average Loss of -0.69% in March, Ranging from a Low of -4.33% to a High of +34.4%

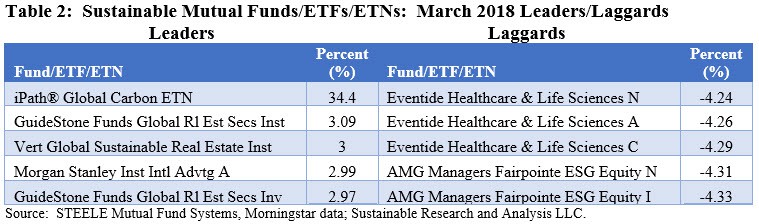

Within a universe of 909 sustainable funds, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) and their corresponding share classes, returns for the month of March averaged -0.69%. A total of 278 funds, or 31%, posted 0.00 to positive results for the month.

The highest return for the third consecutive month was delivered by the iPath Global Carbon ETN, a $5.7 million exchange-traded note that provides exposure to the global price of carbon by referencing the price of carbon emissions credits from the world’s major emissions related mechanisms. This highly volatile ETN was up +34.4% and +69.71% on a year-to-date basis.

At the other end of the range is the AMG Manager Fairpointe ESG Equity Fund that posted a decline of -4.33%. This mid-cap value equity oriented fund invests in companies that are deemed to have strong environmental, social and governance (ESG) records and seeks to avoid those with inferior ESG records relative to the market and peers. Refer to Table 2.

Sustainable Funds Close March at $272.0 Billion, Adding $9.7 Billion as Two Fund Groups Repurpose Existing Funds

The net assets of 909 sustainable funds, including mutual funds, ETFs and ETNs, ended the month of March at $272.0 billion versus $257.2 billion at the end of February. An estimated $2.1 billion is attributable to the decline in stock prices that was offset slightly by the gains posted by bond funds. Two fund firms, Putnam and Aberdeen Asset Management, repurposed 93 funds by formally integrating ESG factors into their funds’ investment strategies. These fund groups came in with $17.4 billion in March. At the same time, the universe of sustainable funds experienced approximately $4.7 billion in net outflows or 1.8%. Refer to Chart 3.

Mutual funds ended the month at $264.3 billion, comprised of 842 funds and share classes, accounting for 97% of sustainable fund assets. ETFs and ETNs closed the month with $7.7 billion in assets across 67 ETFs.

Corrected as to net outflows 4/14/2018

[/ihc-hide-content]