The Bottom Line: A start-up exchange for the buying and selling of proxy voting rights, Shareholder Vote Exchange, is a two-edged sword for sustainable investors.

Corporate engagement and shareholder actions dominate across the various sustainable investing strategies worldwide

Active approaches to voting on proxies and shareholder proposals are some of the strategies employed by investors pursuing sustainable investing mandates, either in concert with other strategies, such as ESG integration, or an independent strategy. As of 2022, corporate engagement and shareholder action, according to Global Sustainable Investment Alliance (GSIA), 2022, is a strategy employed by asset owners and investment managers with $8.0 trillion in assets under management. This is the single largest sustainable investing strategy, following a significant adjustment by GSIA as to the level of adoption by firms employing ESG integration.

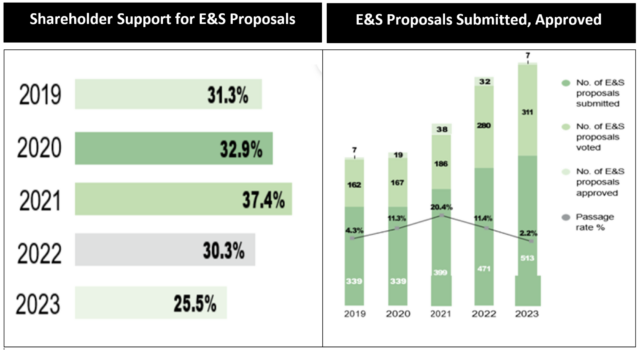

The number of environmental and social shareholder proposal submissions have been expanding, but support has declined due to a degradation in their quality

In recent years, the number of shareholder proposal submissions have been expanding, with the number of submissions increasing about 44% over the last five years, according to a report published by the Harvard Law School Forum on Corporate Governance. At the same time, the average support for the number of environmental and social shareholder proposals has declined sharply in 2022 and 2023. Some attribute this to the contentious political debate that has surrounded ESG and the success of the “anti-ESG movement.” But according to the same report, a close examination suggests that an important contributing factor is the low quality of E&S shareholder proposals submitted in 2022 and 2023 proxy seasons rather than a rejection of ESG. The quality of recent shareholder proposals has suffered due to their prescriptive nature, non-targeted and repetitive proposals.

Limited opportunity available to mutual fund and ETF shareholders to vote their proxies and shareholder proposals

Unless investing directly in stocks or via separate account portfolios, shareholders, for the most part, may not have the opportunity to vote their proxies or shareholder proposals as this power is retained by the investment manager. A new development in recent years may bring about a positive change in this regard. BlackRock has introduced a capability called “Voting Choice” which allows clients to engage more directly in proxy voting. This initiative, as well as several others like it, has seen significant interest. According to some accounts, clients representing 25% of the $1.8 trillion in eligible assets enrolled in Voting Choice.

Another example involves the $105.7 million S&P 500 Equal Weighted Index fund managed by ONEFUND LLC that has been in operation since May 1, 2015. and carries a 25 bps expense ratio net of waivers in effect until July 31, 2021. Since April 2021 when the fund’s prospectus was amended, underlying investors are permitted to express their views on proxy voting, including any environmental, social and governance (ESG) issues.

A just launched marketplace that lets investors sell their votes for a small fee represents a two-edged sword for sustainable investors

On the other hand, a just announced innovation introduces the potential for reversing this positive change. As reported in the Wall Street Journal on January 23rd, a new marketplace has been launched to let investors sell their votes. Called Shareholder Vote Exchange, this California-based startup allows shareholders of record to sell off their proxy voting rights to interested parties for a small fee. In turn, the buyer can use the seller’s proxy to vote on agenda items and a company’s annual meeting. Promoted as return enhancing, sustainable as well as conventional investors could be selling off their rights to an entity that may decide to vote their acquired shares in a manner contrary to the best interests of sustainable shareholders of record. Of course, voting rights may also be acquired by ESG advocates. In this sense, this development is a two-edged sword.

Notes of explanation: Sources Harvard Law School Forum on Corporate Governance, A Review of the 2023 Proxy Season: An E&S Backlash? posted by Lara Aryani, William Kim, Shearman Sterling LLP, December 21, 2023, with additional sourcing to Broadridge and The Conference Board, Shareholder Voting Trends and Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue. The data shown in the chart on the right hand side covers companies constituent of the Russell 3000 index for the full year, except for 2023 in which the period considered was from January 1 through June 30.

Notes of explanation: Sources Harvard Law School Forum on Corporate Governance, A Review of the 2023 Proxy Season: An E&S Backlash? posted by Lara Aryani, William Kim, Shearman Sterling LLP, December 21, 2023, with additional sourcing to Broadridge and The Conference Board, Shareholder Voting Trends and Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue. The data shown in the chart on the right hand side covers companies constituent of the Russell 3000 index for the full year, except for 2023 in which the period considered was from January 1 through June 30.

![Securities-market-stockphoto-1313684291-612×612-2[1] Motion blurred Financial District buildings with Trading Screen Data. Digitally generated image.](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/Securities-market-stockphoto-1313684291-612x612-21-qyx7jp198m2il039id2zeqfdy2r85srxb7rq7lxy98.jpg)