The Bottom Line: Registering their steepest 2022 declines so far, stocks and bonds dropped 9.21% and 3.48% while ESG indices continued to narrow outperformance spread.

Stocks and bonds registered their steepest monthly declines so far this year in September

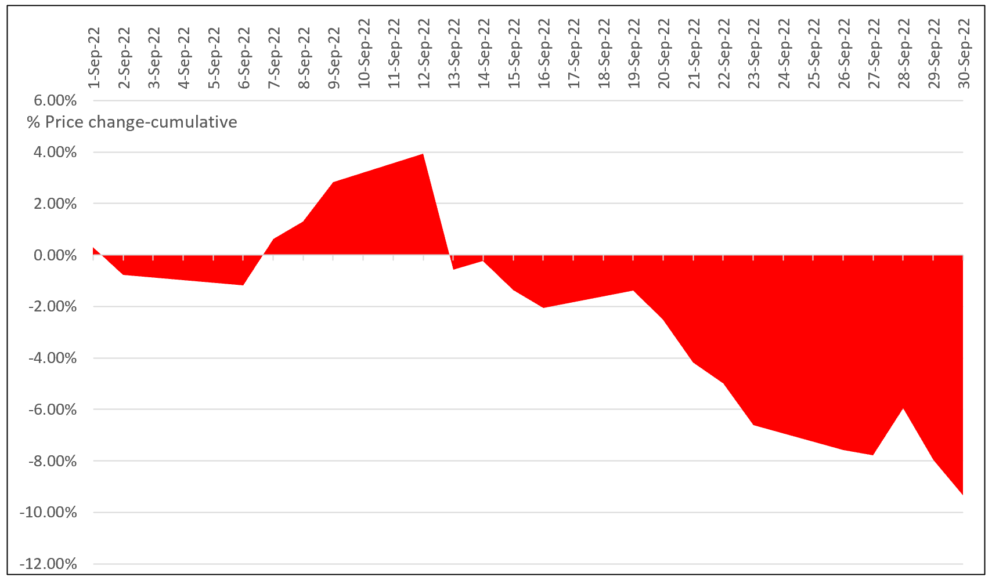

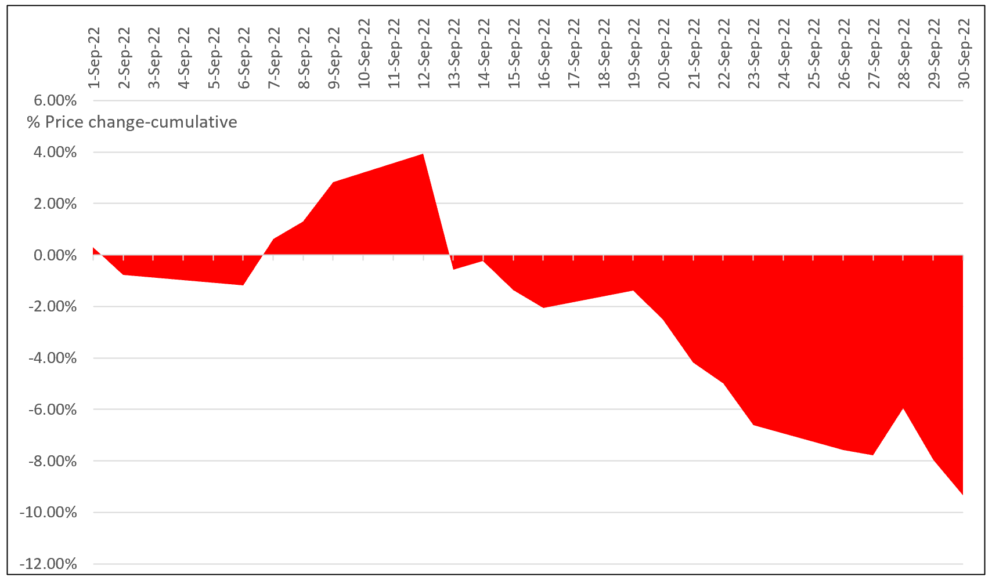

The reality of higher interest rates that are now expected to continue well into 2023 (the Fed raised rates by 75 basis points (bps) on September 21st), high inflation fueled by high employment and strong demand, the dollar’s strength as well as concerns about third quarter earnings and beyond are factors that pushed the S&P 500 lower to post the worst month of the year. The S&P 500 registered a 9.21% decline while the Bloomberg US Aggregate Bond Index gave up 3.48%. Over 21 trading days, the S&P 500 recorded just eight positive return days, five of these occurring by September 12th. Volatility was high, with the benchmark registering eight declines in excess of 1% and one 4.32% decline on September 13th. That drop wiped out the month’s gain and the index continued to slide, reaching -9.34% on a price basis and -9.21% on a total rate of return basis. Refer to Chart 1. All 11 sectors of the S&P 500 Index experienced drops.

Results overseas were even worse. The MSCI ACWI ex USA Index dropped 9.9%, the MSCI EAFE Index gave up 9.35% while the MSCI Emerging Markets Index recorded a decrease of 11.72%.

Bond yields rose significantly in September, and the investment grade intermediate-term bond market also registered the worst month this year.

For the quarter, year-to-date and trailing 12-months, the S&P 500 fell 4.88%, 23.87% and -15.47%, respectively. The Bloomberg US Aggregate Bond Index for the same three month, year-to-date and trailing 12-month intervals was off 4.75%, -14.61% and -14.6, in that order.

Chart 1: S&P 500 Index cumulative price only rates of return-September 2022 Source: Yahoo Finance

Source: Yahoo Finance

Sustainable mutual funds and ETFs recorded a negative average return of -7.8%

The universe of sustainable mutual funds and ETFs as defined by Morningstar, a total of 1,316 funds/share classes as of September 30, 2022 with $289.1 billion in assets cross all asset classes, posted an average total return of -7.8% in September and -19.3% for the trailing 12-months. Returns took another, deeper, downward slide relative to last month’s -3.37% decline.

Results in September ranged from a high of 0.22% to a low of -27.73%. The only funds generating a positive return in September were money market funds along with two Fidelity managed sustainable low-duration bond mutual funds. The best performing fund was the Morgan Stanley Inst Liquidity ESG Money Market Fund Institutional Shares (MPUXX), up 0.22%. At the other end of the range was the Defiance Next Generation H2 ETF (HDRO) that dropped 27.73% in September and 53.07% over the third quarter. The fund tracks the BlueStar Global Hydrogen & Next Gen Fuel Cell Index, consisting of globally listed equities and of companies that generate at least 50% of revenue from their involvement in the development of hydrogen-based energy sources, fuel cell technologies and industrial gases. Refer to Table 1a and 1b for the top and bottom performing funds in September.

Equity funds, including global and international equity funds, posted an average decline of -9.71% in September and -22.3% in the third quarter. At the same time, bond funds gave up an average 3.6% in September and -13.5% over the trailing 12-months.

Table 1a: Top 10 performing funds Table 1b: Bottom 10 performing funds

|

Fund Name

|

1-M TR

(%)

|

12-M TR (%)

|

Fund Name

|

1-M TR (%)

|

12-M TR (%)

|

|

Morgan Stanley Inst Lqdty ESG MMkt Inst

|

0.22

|

0.78

|

KraneShares MSCI China ESG Leaders ETF

|

-15.24

|

-38.59

|

|

Morgan Stanley Inst Lqdty ESG MMkt InsSl

|

0.22

|

0.75

|

Invesco WilderHill Clean Energy ETF

|

-15.63

|

-36.03

|

|

DWS ESG Liquidity Institutional

|

0.22

|

0.78

|

Global X CleanTech ETF

|

-15.88

|

-25.25

|

|

DWS ESG Liquidity Institutional Reserved

|

0.22

|

0.76

|

Global X Wind Energy ETF

|

-16.2

|

-33.89

|

|

DWS ESG Liquidity Capital

|

0.22

|

0.78

|

ETFMG Breakwave Sea Dcrbnztn Tch ETF

|

-16.75

|

-25.68

|

|

State Street ESG Liquid Reserves Pre

|

0.21

|

0.73

|

Invesco Global Clean Energy ETF

|

-16.89

|

-30.87

|

|

State Street ESG Liquid Reserves Opp

|

0.21

|

|

KraneShares MSCI China Clean Tech ETF

|

-17.51

|

-35.65

|

|

Morgan Stanley Inst Lqdty ESG MMkt CslOk

|

0.21

|

0.77

|

Direxion Hydrogen ETF

|

-20.58

|

-33.28

|

|

BlackRock Liquid Environmntlly Awr Drt

|

0.21

|

0.71

|

Global X Hydrogen ETF

|

-23.87

|

-48.71

|

|

State Street ESG Liquid Reserves Instl

|

0.2

|

0.71

|

Defiance Next Gen H2 ETF

|

-27.73

|

-53.07

|

Notes of Explanation: Performance covering both mutual funds and ETFs=total returns in percentage terms for periods ending September 30, 2022. 1-M=1 month, 12-M=12 months. Blank cells=fund was not in operation during entire interval. Source: Morningstar Direct.

The outperformance of ESG screened indices continued to narrow in September

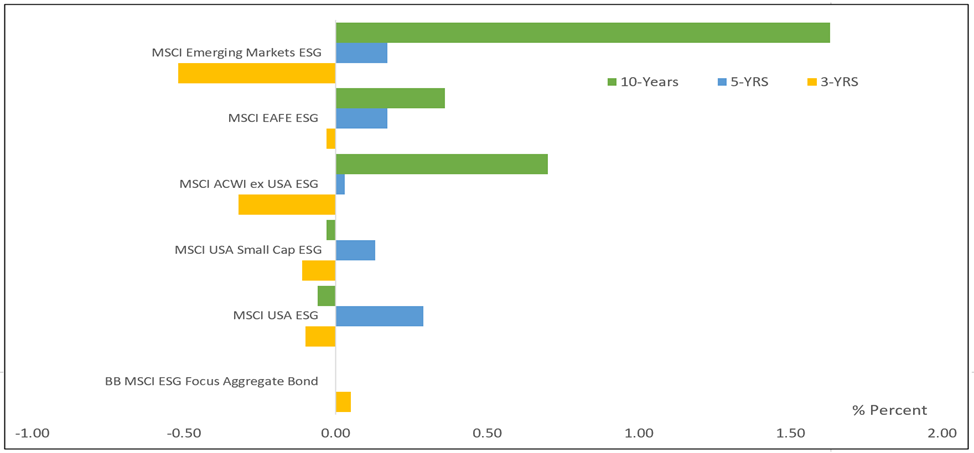

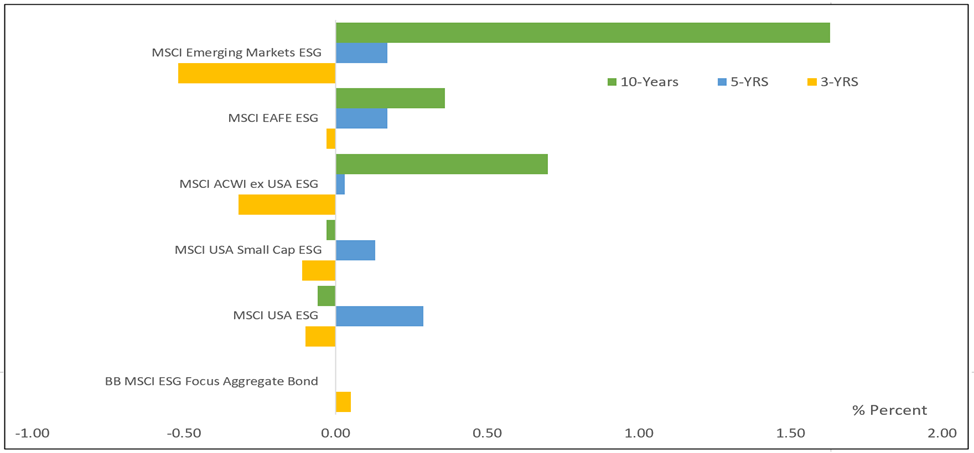

The outperformance of ESG screened indices, a consideration in promoting the alpha generating properties of ESG versus conventional investing in 2021, continued to narrow in September. This observation is based on the tracking of six selected MSCI ESG Leaders indices and their performance, including two US stock indices, three international and one fixed income index.

Three of five selected US and international ESG screened equity indices comprised of companies with high ESG scores relative to sector peers and one bond fund index lagged behind their conventional counterparts, for a total of four underperforming indices of five. This is the third month in a row during which four or more of the same six indices trailed, and the sixth month so far in 2022.

The US-oriented benchmarks, the MSCI USA ESG Leaders Index and the MSCI USA Small Cap ESG Leaders Index, exceeded the total return performance of their conventional counterparts in September by 31 basis points (bps) and 92 bps, respectively. Both indices lagged last month but retain a performance advantage over the 1-year interval. That said, the two indices delivered mixed results in the intermediate 3-year and 5-year time periods while falling behind over the ten year time horizon to September 30, 2022.

The three international indices, including the MSCI ACWI, ex USA, ESG Leaders Index, the MSCI Emerging Markets ESG Leaders Index and the MSCI EAFE ESG Leaders Index, fell behind their conventional counterparts in September by 65 bps, 97 bps and 53 bps, respectively. The indices now also trail over the 1-year and 3-year time periods but continue to lead with narrower margins over 5-years and 10-years.

As for fixed income, the Bloomberg MSCI ESG Focus Aggregate Bond Index posted the sharpest monthly decline so far this year, giving up -4.34% versus -4.32% for the Bloomberg US Aggregate Bond Index. It’s also off by 2 bps over the previous twelve-month interval but leads by 5 bps over the trailing 3-years. The index was launched less than five years ago.

While long-term results continue to support ESG screened international benchmarks, the leads posted by the international indices, in particular, relative to conventional benchmarks have been shrinking by a minimum of 50% over the 10-year and 5-year time periods since January 2021.

Chart 2: Selected sustainable indices intermediate and long-term relative total return performance results to September 30, 2022 Notes of Explanation: The six MSCI ESG indices include the MSCI USA ESG Leaders Index consisting of large and mid-cap companies, MSCI USA Small Cap ESG Leaders Index, MSCI ACWI, ex USA, Leaders Index consisting of large and mid-cap companies in developed and developing countries, MSCI EAFE ESG Leaders Index consisting of large and mid-cap companies in developed markets. MSCI Leaders indices are constructed to provide exposure to companies with high ESG scores relative to their sector peers. Intermediate term covers 3 and 5 years. Long-term=10 years. Source: MSCI

Notes of Explanation: The six MSCI ESG indices include the MSCI USA ESG Leaders Index consisting of large and mid-cap companies, MSCI USA Small Cap ESG Leaders Index, MSCI ACWI, ex USA, Leaders Index consisting of large and mid-cap companies in developed and developing countries, MSCI EAFE ESG Leaders Index consisting of large and mid-cap companies in developed markets. MSCI Leaders indices are constructed to provide exposure to companies with high ESG scores relative to their sector peers. Intermediate term covers 3 and 5 years. Long-term=10 years. Source: MSCI

SRA Select List of funds posted an average decline of 6.84% in September

SRA Select funds posted an average drop of 6.84% in September versus an average -6.85% registered by the performance of corresponding conventional benchmarks¹. Excluding money market funds, returns ranged from low of -11.53% recorded by the iShares ESG MSCI EM Leaders ETF (LDEM) to a high of -3.84% posted by the iShares USD Green Bond ETF (BGRN). Refer to Table 2 for a complete rundown of SRA Select list of mutual funds and ETFs and their performance results over several time periods to September 30th.

Consisting of nine funds² pursuing discrete investment strategies intend for use as building blocks in the creation of a diversified ESG-oriented portfolio, five of the nine funds underperformed their conventional benchmarks in September. Eight of the nine funds trailed for the 12-month interval while six of eight funds underperformed over the trailing three-years³. (Refer to previously published article SRA Select Listing: ESG Integration Investment Fund Q1-2022 https://sustainableinvest.com/sra-select-listing-esg-integration-investment-funds-q1-2022/).

Table 2: Performance of SRA Select listed mutual funds and ETFs-September 2022

Fund name/Index | Expense Ratio (%) | Assets ($ M) | 1-Month Total Return (%) | 3-Month Total Return (%) | Y-T-D Total Return (%) | 12-M Total Return (%) | 3-Year TR (%) |

iShares ESG Advanced Hi Yld Corp Bd ETF (HYXF) | 0.35 | 131.2 | -4.33 | -1.32 | -15.17 | -14.85 | -1.82 |

iShares ESG Aware MSCI EAFE ETF (ESGD) | 0.2 | 5802.7 | -9.44 | -10.35 | -27.91 | -25.61 | -1.81 |

iShares ESG Aware MSCI USA Small-Cap ETF (ESML) | 0.17 | 1335.8 | -9.04 | -2.15 | -23.24 | -20.41 | 6.05 |

iShares ESG U.S. Aggregate Bond ETF (EAGG) | 0.1 | 2039.4 | -4.35 | -4.79 | -14.63 | -14.72 | -3.36 |

iShares MSCI ACWI Low Carbon Target ETF (CRBN) | 0.2 | 760.9 | -9.6 | -7.25 | -26.23 | -21.17 | 3.7 |

iShares MSCI KLD 400 Social ETF (DSI) | 0.25 | 3284.6 | -9.6 | -6.54 | -27.29 | -18.59 | 7.87 |

iShares USD Green Bond ETF (BGRN) | 0.2 | 279.4 | -3.84 | -3.95 | -14.72 | -15.05 | -4.37 |

iShares® ESG MSCI EM Leaders ETF (LDEM) | 0.16 | 53.4 | -11.53 | -13.75 | -29.1 | -31.15 | |

BlackRock Liquid Environmentally Aware Inv A (LEAXX) | 0.45 | 0.3 | 0.18 | 0.51 | 0.56 | 0.55 | 0.45 |

Vanguard Treasury Money Market Fund Investor (VUSXX) | 0.09 | 34,807.90 | 0.19 | 0.47 | 0.64 | 0.64 | 0.52 |

Averages/Total* | 0.217 | 48,495.60 | -6.84 | -5.51 | -19.75 | -17.89 | 0.84 |

S&P 500 Index | | | -9.21 | -4.88 | -23.87 | -15.47 | 8.16 |

MSCI USA Index | | | -9.27 | -4.7 | -24.81 | -17.23 | 8.13 |

MSCI USA Small Cap Index | | | -9.62 | -2.70 | -23.03 | -19.58 | 4.23 |

MSCI EAFE Index (Net) | | | -9.35 | -9.36 | -27.09 | -25.13 | -1.83 |

MSCI ACWI Index (Net) | | | -9.57 | -6.82 | -25.63 | -20.66 | 3.75 |

MSCI Emerging Markets Index (Net) | | | -11.72 | -11.57 | -27.16 | -28.11 | -2.07 |

Bloomberg U.S. Treasury Bill (1-3 M) | | | 0.02 | 0.47 | 0.63 | 0.64 | 0.55 |

Bloomberg U.S. Aggregate Bond Index | | | -4.32 | -4.75 | -14.61 | -14.6 | -3.26 |

Bloomberg U.S. Corporate High Yield Index | | | -3.97 | -0.65 | -14.74 | -14.14 | -0.45 |

S&P Green U.S. Dollar Select Index | | | -3.89 | -3.81 | -14.33 | -15.06 | -2.96 |

Averages** | | | -6.85 | -4.88 | -18.97 | -17.10 | 0.68 |

Notes of Explanation: Assets=Net Assets in millions. Blank cells=fund was not in operation during entire interval. *Average returns exclude the Vanguard Treasury Money Market Fund Investor. **Average returns exclude the S&P 500 Index to avoid double counting. Sources: Morningstar Direct and MSCI.

¹ To avoid duplications, these average results exclude Vanguard Treasury Money Market Fund and S&P 500 Index. ² A tenth fund, the Vanguard Treasury Money Market Fund, is an alternative money market fund.³ iShares ESG MSCI EM Leaders Fund not in operation for the full 3-year time period to September 30, 2022.

Stocks and bonds register steep declines in September 2022

The reality of higher interest rates that are now expected to continue well into 2023 (the Fed raised rates by 75 basis points (bps) on September 21st), high inflation fueled by high employment and strong demand, the dollar’s strength as well as concerns about third quarter earnings and beyond are factors that pushed the S&P…

Share This Article:

The Bottom Line: Registering their steepest 2022 declines so far, stocks and bonds dropped 9.21% and 3.48% while ESG indices continued to narrow outperformance spread.

Stocks and bonds registered their steepest monthly declines so far this year in September

The reality of higher interest rates that are now expected to continue well into 2023 (the Fed raised rates by 75 basis points (bps) on September 21st), high inflation fueled by high employment and strong demand, the dollar’s strength as well as concerns about third quarter earnings and beyond are factors that pushed the S&P 500 lower to post the worst month of the year. The S&P 500 registered a 9.21% decline while the Bloomberg US Aggregate Bond Index gave up 3.48%. Over 21 trading days, the S&P 500 recorded just eight positive return days, five of these occurring by September 12th. Volatility was high, with the benchmark registering eight declines in excess of 1% and one 4.32% decline on September 13th. That drop wiped out the month’s gain and the index continued to slide, reaching -9.34% on a price basis and -9.21% on a total rate of return basis. Refer to Chart 1. All 11 sectors of the S&P 500 Index experienced drops.

Results overseas were even worse. The MSCI ACWI ex USA Index dropped 9.9%, the MSCI EAFE Index gave up 9.35% while the MSCI Emerging Markets Index recorded a decrease of 11.72%.

Bond yields rose significantly in September, and the investment grade intermediate-term bond market also registered the worst month this year.

For the quarter, year-to-date and trailing 12-months, the S&P 500 fell 4.88%, 23.87% and -15.47%, respectively. The Bloomberg US Aggregate Bond Index for the same three month, year-to-date and trailing 12-month intervals was off 4.75%, -14.61% and -14.6, in that order.

Chart 1: S&P 500 Index cumulative price only rates of return-September 2022 Source: Yahoo Finance

Source: Yahoo Finance

Sustainable mutual funds and ETFs recorded a negative average return of -7.8%

The universe of sustainable mutual funds and ETFs as defined by Morningstar, a total of 1,316 funds/share classes as of September 30, 2022 with $289.1 billion in assets cross all asset classes, posted an average total return of -7.8% in September and -19.3% for the trailing 12-months. Returns took another, deeper, downward slide relative to last month’s -3.37% decline.

Results in September ranged from a high of 0.22% to a low of -27.73%. The only funds generating a positive return in September were money market funds along with two Fidelity managed sustainable low-duration bond mutual funds. The best performing fund was the Morgan Stanley Inst Liquidity ESG Money Market Fund Institutional Shares (MPUXX), up 0.22%. At the other end of the range was the Defiance Next Generation H2 ETF (HDRO) that dropped 27.73% in September and 53.07% over the third quarter. The fund tracks the BlueStar Global Hydrogen & Next Gen Fuel Cell Index, consisting of globally listed equities and of companies that generate at least 50% of revenue from their involvement in the development of hydrogen-based energy sources, fuel cell technologies and industrial gases. Refer to Table 1a and 1b for the top and bottom performing funds in September.

Equity funds, including global and international equity funds, posted an average decline of -9.71% in September and -22.3% in the third quarter. At the same time, bond funds gave up an average 3.6% in September and -13.5% over the trailing 12-months.

Table 1a: Top 10 performing funds Table 1b: Bottom 10 performing funds

Fund Name

1-M TR

(%)

12-M TR (%)

Fund Name

1-M TR (%)

12-M TR (%)

Morgan Stanley Inst Lqdty ESG MMkt Inst

0.22

0.78

KraneShares MSCI China ESG Leaders ETF

-15.24

-38.59

Morgan Stanley Inst Lqdty ESG MMkt InsSl

0.22

0.75

Invesco WilderHill Clean Energy ETF

-15.63

-36.03

DWS ESG Liquidity Institutional

0.22

0.78

Global X CleanTech ETF

-15.88

-25.25

DWS ESG Liquidity Institutional Reserved

0.22

0.76

Global X Wind Energy ETF

-16.2

-33.89

DWS ESG Liquidity Capital

0.22

0.78

ETFMG Breakwave Sea Dcrbnztn Tch ETF

-16.75

-25.68

State Street ESG Liquid Reserves Pre

0.21

0.73

Invesco Global Clean Energy ETF

-16.89

-30.87

State Street ESG Liquid Reserves Opp

0.21

KraneShares MSCI China Clean Tech ETF

-17.51

-35.65

Morgan Stanley Inst Lqdty ESG MMkt CslOk

0.21

0.77

Direxion Hydrogen ETF

-20.58

-33.28

BlackRock Liquid Environmntlly Awr Drt

0.21

0.71

Global X Hydrogen ETF

-23.87

-48.71

State Street ESG Liquid Reserves Instl

0.2

0.71

Defiance Next Gen H2 ETF

-27.73

-53.07

Notes of Explanation: Performance covering both mutual funds and ETFs=total returns in percentage terms for periods ending September 30, 2022. 1-M=1 month, 12-M=12 months. Blank cells=fund was not in operation during entire interval. Source: Morningstar Direct.

The outperformance of ESG screened indices continued to narrow in September

The outperformance of ESG screened indices, a consideration in promoting the alpha generating properties of ESG versus conventional investing in 2021, continued to narrow in September. This observation is based on the tracking of six selected MSCI ESG Leaders indices and their performance, including two US stock indices, three international and one fixed income index.

Three of five selected US and international ESG screened equity indices comprised of companies with high ESG scores relative to sector peers and one bond fund index lagged behind their conventional counterparts, for a total of four underperforming indices of five. This is the third month in a row during which four or more of the same six indices trailed, and the sixth month so far in 2022.

The US-oriented benchmarks, the MSCI USA ESG Leaders Index and the MSCI USA Small Cap ESG Leaders Index, exceeded the total return performance of their conventional counterparts in September by 31 basis points (bps) and 92 bps, respectively. Both indices lagged last month but retain a performance advantage over the 1-year interval. That said, the two indices delivered mixed results in the intermediate 3-year and 5-year time periods while falling behind over the ten year time horizon to September 30, 2022.

The three international indices, including the MSCI ACWI, ex USA, ESG Leaders Index, the MSCI Emerging Markets ESG Leaders Index and the MSCI EAFE ESG Leaders Index, fell behind their conventional counterparts in September by 65 bps, 97 bps and 53 bps, respectively. The indices now also trail over the 1-year and 3-year time periods but continue to lead with narrower margins over 5-years and 10-years.

As for fixed income, the Bloomberg MSCI ESG Focus Aggregate Bond Index posted the sharpest monthly decline so far this year, giving up -4.34% versus -4.32% for the Bloomberg US Aggregate Bond Index. It’s also off by 2 bps over the previous twelve-month interval but leads by 5 bps over the trailing 3-years. The index was launched less than five years ago.

While long-term results continue to support ESG screened international benchmarks, the leads posted by the international indices, in particular, relative to conventional benchmarks have been shrinking by a minimum of 50% over the 10-year and 5-year time periods since January 2021.

Chart 2: Selected sustainable indices intermediate and long-term relative total return performance results to September 30, 2022 Notes of Explanation: The six MSCI ESG indices include the MSCI USA ESG Leaders Index consisting of large and mid-cap companies, MSCI USA Small Cap ESG Leaders Index, MSCI ACWI, ex USA, Leaders Index consisting of large and mid-cap companies in developed and developing countries, MSCI EAFE ESG Leaders Index consisting of large and mid-cap companies in developed markets. MSCI Leaders indices are constructed to provide exposure to companies with high ESG scores relative to their sector peers. Intermediate term covers 3 and 5 years. Long-term=10 years. Source: MSCI

Notes of Explanation: The six MSCI ESG indices include the MSCI USA ESG Leaders Index consisting of large and mid-cap companies, MSCI USA Small Cap ESG Leaders Index, MSCI ACWI, ex USA, Leaders Index consisting of large and mid-cap companies in developed and developing countries, MSCI EAFE ESG Leaders Index consisting of large and mid-cap companies in developed markets. MSCI Leaders indices are constructed to provide exposure to companies with high ESG scores relative to their sector peers. Intermediate term covers 3 and 5 years. Long-term=10 years. Source: MSCI

SRA Select List of funds posted an average decline of 6.84% in September

SRA Select funds posted an average drop of 6.84% in September versus an average -6.85% registered by the performance of corresponding conventional benchmarks¹. Excluding money market funds, returns ranged from low of -11.53% recorded by the iShares ESG MSCI EM Leaders ETF (LDEM) to a high of -3.84% posted by the iShares USD Green Bond ETF (BGRN). Refer to Table 2 for a complete rundown of SRA Select list of mutual funds and ETFs and their performance results over several time periods to September 30th.

Consisting of nine funds² pursuing discrete investment strategies intend for use as building blocks in the creation of a diversified ESG-oriented portfolio, five of the nine funds underperformed their conventional benchmarks in September. Eight of the nine funds trailed for the 12-month interval while six of eight funds underperformed over the trailing three-years³. (Refer to previously published article SRA Select Listing: ESG Integration Investment Fund Q1-2022 https://sustainableinvest.com/sra-select-listing-esg-integration-investment-funds-q1-2022/).

Table 2: Performance of SRA Select listed mutual funds and ETFs-September 2022

Fund name/Index

Expense Ratio (%)

Assets

($ M)

1-Month Total Return (%)

3-Month

Total Return (%)

Y-T-D Total Return (%)

12-M Total Return (%)

3-Year

TR

(%)

iShares ESG Advanced Hi Yld Corp Bd ETF (HYXF)

0.35

131.2

-4.33

-1.32

-15.17

-14.85

-1.82

iShares ESG Aware MSCI EAFE ETF (ESGD)

0.2

5802.7

-9.44

-10.35

-27.91

-25.61

-1.81

iShares ESG Aware MSCI USA Small-Cap ETF (ESML)

0.17

1335.8

-9.04

-2.15

-23.24

-20.41

6.05

iShares ESG U.S. Aggregate Bond ETF (EAGG)

0.1

2039.4

-4.35

-4.79

-14.63

-14.72

-3.36

iShares MSCI ACWI Low Carbon Target ETF (CRBN)

0.2

760.9

-9.6

-7.25

-26.23

-21.17

3.7

iShares MSCI KLD 400 Social ETF (DSI)

0.25

3284.6

-9.6

-6.54

-27.29

-18.59

7.87

iShares USD Green Bond ETF (BGRN)

0.2

279.4

-3.84

-3.95

-14.72

-15.05

-4.37

iShares® ESG MSCI EM Leaders ETF (LDEM)

0.16

53.4

-11.53

-13.75

-29.1

-31.15

BlackRock Liquid Environmentally Aware Inv A (LEAXX)

0.45

0.3

0.18

0.51

0.56

0.55

0.45

Vanguard Treasury Money Market Fund Investor (VUSXX)

0.09

34,807.90

0.19

0.47

0.64

0.64

0.52

Averages/Total*

0.217

48,495.60

-6.84

-5.51

-19.75

-17.89

0.84

S&P 500 Index

-9.21

-4.88

-23.87

-15.47

8.16

MSCI USA Index

-9.27

-4.7

-24.81

-17.23

8.13

MSCI USA Small Cap Index

-9.62

-2.70

-23.03

-19.58

4.23

MSCI EAFE Index (Net)

-9.35

-9.36

-27.09

-25.13

-1.83

MSCI ACWI Index (Net)

-9.57

-6.82

-25.63

-20.66

3.75

MSCI Emerging Markets Index (Net)

-11.72

-11.57

-27.16

-28.11

-2.07

Bloomberg U.S. Treasury Bill (1-3 M)

0.02

0.47

0.63

0.64

0.55

Bloomberg U.S. Aggregate Bond Index

-4.32

-4.75

-14.61

-14.6

-3.26

Bloomberg U.S. Corporate High Yield Index

-3.97

-0.65

-14.74

-14.14

-0.45

S&P Green U.S. Dollar Select Index

-3.89

-3.81

-14.33

-15.06

-2.96

Averages**

-6.85

-4.88

-18.97

-17.10

0.68

Notes of Explanation: Assets=Net Assets in millions. Blank cells=fund was not in operation during entire interval. *Average returns exclude the Vanguard Treasury Money Market Fund Investor. **Average returns exclude the S&P 500 Index to avoid double counting. Sources: Morningstar Direct and MSCI.

¹ To avoid duplications, these average results exclude Vanguard Treasury Money Market Fund and S&P 500 Index. ² A tenth fund, the Vanguard Treasury Money Market Fund, is an alternative money market fund.³ iShares ESG MSCI EM Leaders Fund not in operation for the full 3-year time period to September 30, 2022.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact