Summary

- Sustainable funds close September having achieved another high point with $321.9 billion in assets under management, up $11.4 billion of which $10.99 billion, or 96%, is sourced to repurposed funds.

- Top 10 performing funds/share classes over the 12-months to September 30, 2018: Performance ranges from 25.99% to 228.44%. These funds vary in their approach but cover the full range of sustainable investing strategies and practices.

- Sustainable fund groups expanded to an adjusted 119 firms with the addition of Jensen Investments and Calamos Advisors.

- Top 20 sustainable fund groups account for $279 billion or 86.7% of segments assets under management; top 10 firms manage $231.5 billion, or 72%.

- Largest monthly net gains recorded by American Funds Washington Mutual and various TIAA-CREF and DFA funds.

- Largest monthly declines were recorded by Vanguard, Aberdeen and Morgan Stanley funds.

- Repurposed funds add 8 funds, 31 share classes and $11.0 billion in assets under management to the sustainable investing sector.

- New Funds: Three new funds launched in September, including the Vanguard ESG US Stock ETF, Vanguard ESG International Stock ETF and Impact Shares.

Sustainable funds closed September having achieved another high point with $321.9 billion in assets under management, up $11.4 billion of which $10.9 billion, or 96%, is sourced to repurposed funds

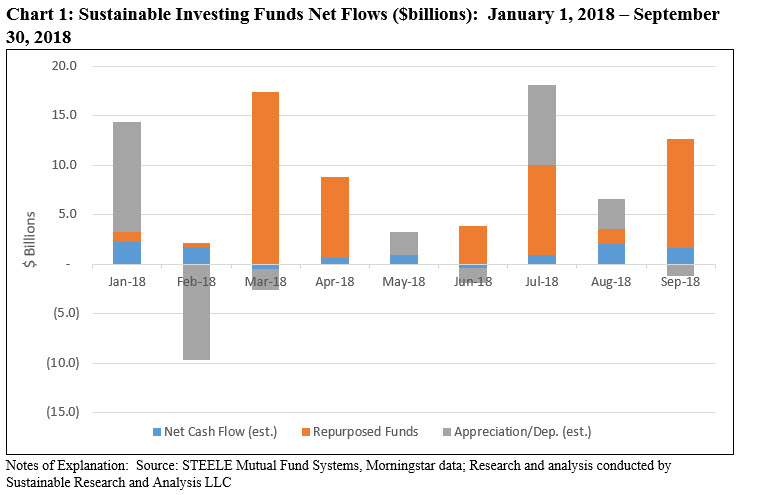

The net assets of 1,096 sustainable funds[1], including mutual fund share classes, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), ended the month of September with $321.9 billion in assets under management versus $310.5 billion at the end of August. The increase in net assets for the month, in the amount of $11.4 billion, was sourced to repurposed funds that added a total of $10.99 billion attributable to three fund firms, including two new fund group additions to the sustainable funds segment, and a total of eight funds and 31 share classes in total. In addition, the segment benefited from an estimated positive net cash flow in the amount of $1.65 billion, including the launch of three new ETFs in September, while market movement contributed to a decline in assets to the tune of about -$1.2 billion. Refer to Chart 1.

Mutual fund assets stood at $312.6 billion as of the end of September while ETFs and ETNs closed the month at $9.3 billion, for increases of $11.2 billion (3.7%) and $220.7 million (2.3%), respectively, relative to last month. The relative proportion of the two segments remain unchanged at about 97% and 3%, respectively. Assets sourced to institutional only mutual funds/share classes, 408 in total, versus all other funds gained $7.6 billion, or 7.4%, to $110.3 billion. This investor group accounts for 34.2% of the segment’s assets, versus $102.7 billion at the end of August.

Sustainable fund groups expanded to an adjusted 119 firms with the addition of Jensen Investments and Calamos Advisors

Explicitly designated sustainable mutual funds and ETFs/ETNs are offered by a universe of 119 fund group (as adjusted) as of September 30th, reflecting an increase of two fund groups. Both fund groups, Jensen Investments and Calamos Advisors, repurposed 2 mutual funds consisting of 7 share classes in total that added $7.2 billion to the existing universe of sustainable funds. At the same time, Dreyfus, which had already been offering the Dreyfus Sustainable US Equity Fund (originally the Dreyfus Third Century Fund, launched in 1999, until its name change as of May 2017), weighed in with an explicit ESG amendment to the prospectus covering six additional funds managed by Newton Investment Management, a Dreyfus subsidiary, with total net assets of $6.9 billion.

Top 20 sustainable fund groups account for $279 billion or 86.7% of segments assets under management

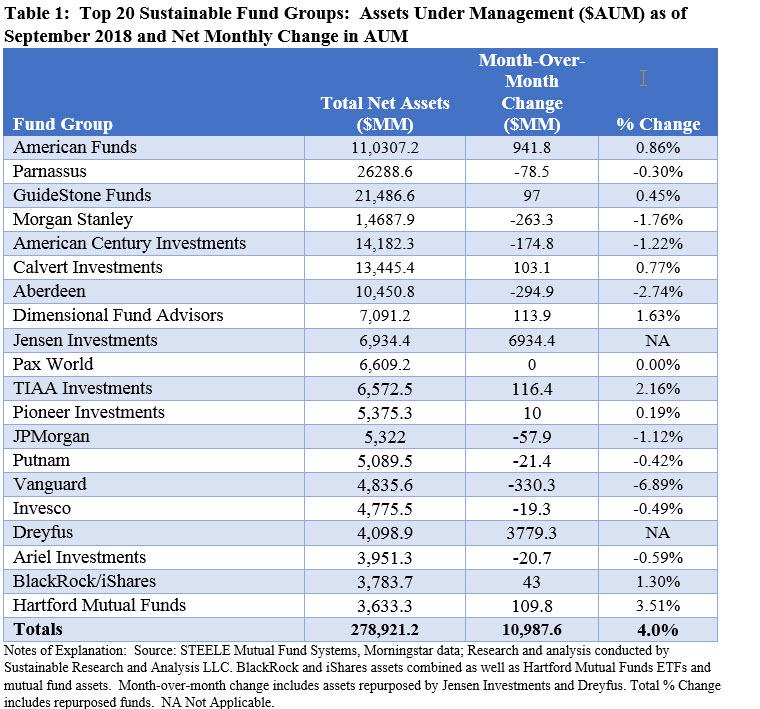

The sustainable funds segment is highly concentrated. The top 20 sustainable fund groups held $278.9 billion in assets under management, accounting for 86.7% of the segment’s assets versus $274.1 billion the prior month. The top 20 funds added a net of $10,987.6 million, representing 96.5% of the segment’s net gain of $11.4 billion. Refer to Table 1.

There was a shift in the rankings of the top 20 fund groups, attributable to the repurposing of funds by Jensen and Dreyfus that between these two firms added a combined total of $10.7 billion. In the process, Jensen now ranks 9th largest sustainable fund group in terms of assets under management while Dreyfus shifted in rank to 17th. In the process, Amana and Eventide fund groups were shifted out of the ranks of the top 20 firms.

Within this segment, the top 10 firms dominate with $231.5 billion in assets under management or 72% of the segment’s total AUM.

Largest monthly net gains recorded by American Funds Washington Mutual and various TIAA-CREF and DFA funds

The following fund firms and funds contributed to the largest gains attributable to market movement, positive flows or repurposed funds, or some combination these factors:

- Again this month, the largest monthly net gain, in the amount of $941.8 million, was realized by the American Funds $11.03 billion Washington Mutual Fund, a fund offered by American Funds that excludes companies deriving a majority of their revenues from alcohol or tobacco products. The fund group’s Washington Mutual Fund is the only fund in the group that is explicitly described as a sustainable fund. While slightly down from last month’s 35.2%, the fund accounts for 34.3% of the sustainable segment’s assets under management.

- The second largest monthly gain was realized by TIAA-CREF that added $116.4 million in net assets. The largest net inflow was sourced to the TIAA-CREF Social Choice Bond Fund that added $65.1 million in net assets, including $45.1 million allocated to the institutional share class. The Social Choice Equity Fund also benefited from a net inflow into the institutional share class, attracting $39.1 million.

- Dimensional Fund Advisors achieved a net gain of $113.9 million in net assets, with four funds contributing in excess of $10 million each. These include, in descending order, DFA International Social Core Equity Institutional ($49.4 million), DFA International Sustainability Core 1 ($31.50 million), DFA US Sustainability Core 1 ($29.40 million) and DFA Social Fixed Income Institutional ($16.20 million).

Largest monthly declines were recorded by Vanguard, Aberdeen and Morgan Stanley funds

The following fund firms and funds experienced the largest net outflows due to a combination of market depreciation and cash outflows:

- The $4.8 billion Vanguard FTSE Social Index Fund sustained a $330.3 million net decline in assets, entirely attributable to the institutional share class that saw a net decline in the amount of $394.4 million. This was offset by a $41.5 million net increase sourced to the fund’s investor share class.

- Aberdeen Funds experienced a decline in net assets in the amount of $294.9 million. The largest contributors to the fall off included Aberdeen Emerging Markets Fund ($178.5 million), Aberdeen Small Cap Equity Institutional Fund ($59.0 million) and Aberdeen Total Return Bond Fund ($35.10 million).

- Morgan Stanley sustained a net decline in the amount of $263.3 million, largely attributable to three funds. These include the Morgan Stanley Global Real Estate Fund ($86.3 million), Morgan Stanley Institutional Emerging Markets Fund ($75.4 million) and the Morgan Stanley Institutional Frontier Markets Fund ($62.3 million).

Repurposed funds add 8 funds, 31 share classes and $11.0 billion in assets under management to the sustainable investing sector

Three fund firms repurposed existing mutual funds in the month of September, expanding the sustainable sector with the addition of 8 funds and $11 billion in assets under management. These include the following:

- Portland, Oregon-based investment manager of two mutual funds, Jensen Investment Management, adopted an ESG integration approach for its $$6.9 billion Jensen Quality Growth Fund, consisting of 4 share classes, as of September 30, 2018.

- Dreyfus, manager of the long-lived Dreyfus Sustainable US Equity Fund, repurposed six funds, consisting of 24 share classes with total net assets in the amount of $3.8 billion, each one managed by Newton. In a prospectus amendment dated September 21, 2018, the fund manager added: Integrated into the investment process, Newton has a well-established approach to responsible investment. This process includes identifying and considering the Environmental, Social and Governance (ESG) risks, opportunities and issues throughout the research process via Newton’s proprietary quality reviews, in an effort to ensure that any material ESG issues are considered.”

- Calamos International Growth Fund, a $276.7 million fund managed by Calamos Advisors LLC, adopted the following ESG integration language: The investment adviser takes environmental, social and governance (“ESG”) factors into account in making investment decisions.

New Funds ESG Funds

Three new funds launched in September include the Vanguard ESG US Stock ETF, Vanguard ESG International Stock ETF and Impact Shares:

- The Vanguard ESG US Stock ETF and ESG International Stock ETF track the performance of the FTSE US All Cap Choice Index and FTSE Global All Cap ex US Choice Index that, with regard to ESG, are screened for certain environmental, social, and corporate governance (ESG) criteria that relies on an approach by which the stocks of companies in the following industries are excluded: adult entertainment, alcohol and tobacco, weapons, fossil fuels, gambling, and nuclear power. The index methodology also excludes the stocks of companies that do not meet the labor, human rights, environmental, and anti-corruption standards as defined by the United Nations Global Compact Principles, as well as companies that do not meet certain diversity criteria. It should be noted that these approaches to ESG contrast with the methodology pursued by the Vanguard FTSE Social Index Fund that, in addition to excluding certain companies, largely relies on the integration of ESG factors.

- Impact Shares. The fund is intended to exhibit risk and return characteristics similar to those of the Morningstar Global Markets Large-Mid Index with a universe of companies that (i) display a commitment to the UN’s Sustainable Development Goals, (ii) adhere to the principles of the UN Global Compact, (iii) display a commitment to reducing poverty and supporting economic development globally and (iv) have exposure to countries with low levels of socioeconomic development. For additional details on the selection criteria, refer to the Sustainable Investment Glossary under the Investment Research/The Basics tab.

[1] Morningstar recorded 1,101 funds, including 5 share classes offered by the Franklin Select US Equity Fund with $99.8 million in assets that had been repurposed as of August. These are excluded from the analysis as their most recent prospectus does not reflect the adoption of a sustainable strategy or approach.