The Bottom Line: Coronavirus crisis introduces profound challenges that will reverse for a time asset gains by sustainable funds that ended February at $1.87 trillion.

A severe market downturn that started at the end of February didn’t prevent the achievement of another new all-time high for sustainable fund assets that gained $4.8 billion

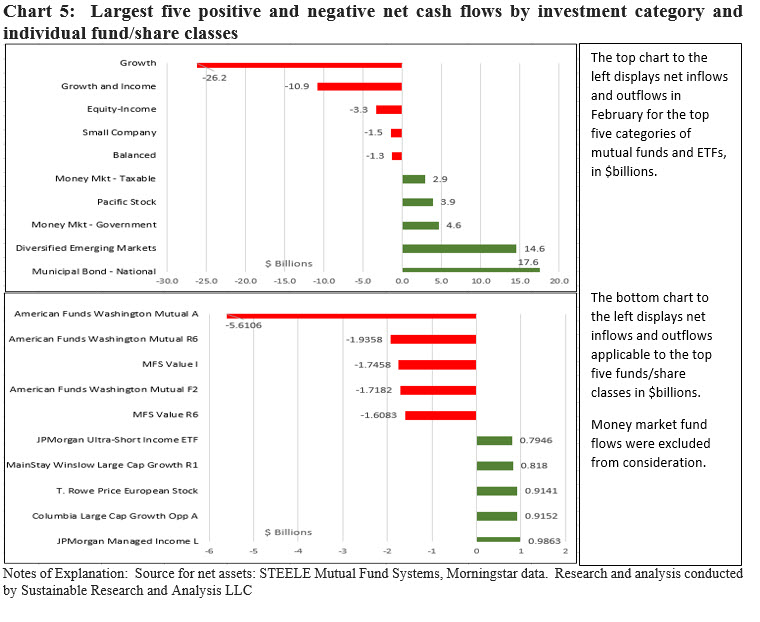

The coronavirus crisis poses a profound challenge for public health and the financial markets that will continue to play out in the second quarter and beyond. These will effect stock and bond markets in ways yet to be determined but that will surely reverse for a time the gains achieved by sustainable funds through the end of February. That said, net assets of sustainable mutual funds and ETFs reached another all-time high of $1.871 trillion at the end of February, or an increase of $4.8 billion. Mutual funds added a net of $3.3 billion, contributing 69% of the gain to end the month at $1.83 trillion while exchange-traded funds attracted a net of $1.5 billion to end February at $39.8 billion. Mutual funds and ETFs added $4.8 billion, the smallest 0.3% increase since the start of 2019, to close the month at yet another new high of $1.871 trillion. Refer to Chart 1.

Including money market funds, that now account for $586 billion or 31.2% of sustainable fund assets, the segment experienced estimated net inflows of $46.3 billion in February and market deprecation registered a decline estimated at $62.6 billion. Excluding money market funds, net inflows were an estimated $46.3 billion. Municipal bond funds reported the largest net assets gain ($18.0 B) while US equity funds the largest outflow ($43.9 B). Fund re-brandings also offset the negative market impact in February.

Fund re-brandings added $52.5 billion, a level considerably lower than the average over the previous 12-months

Re-brandings in February dropped to $52.5 billion as eight firms primarily adopted ESG integration approaches for a total of 29 funds comprised of 92 funds/share classes.

This level was considerably lower than the average assets of $114.3 million re-branded over the previous twelve months. Three firms introducing re-branded firms have entered the sustainable investing sphere for the first time, including T. Rowe Price, Lord Abbett & Co. and Lateef Investment Management.

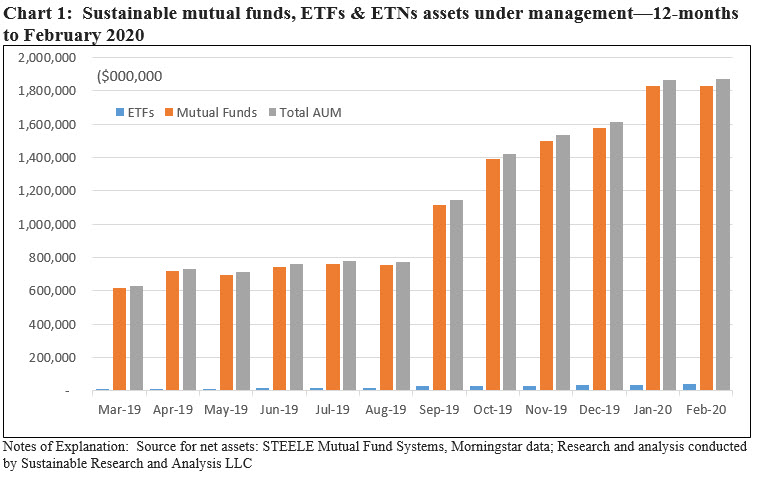

Allocation across fund types/asset classes: Bonds and allocation funds gain at the expense of US equities

US equity and sector funds, sourcing some $607.5 billion in assets and accounting for 32% of sustainable funds experienced a drop from 35% of assets at the end of the prior month. At the same time, international funds and bond funds recorded 1% gains each in assets largely attributable to fund re-brandings. Money market funds, at around 31% of assets, picked up almost $9 billion in net assets. Refer to Chart 2.

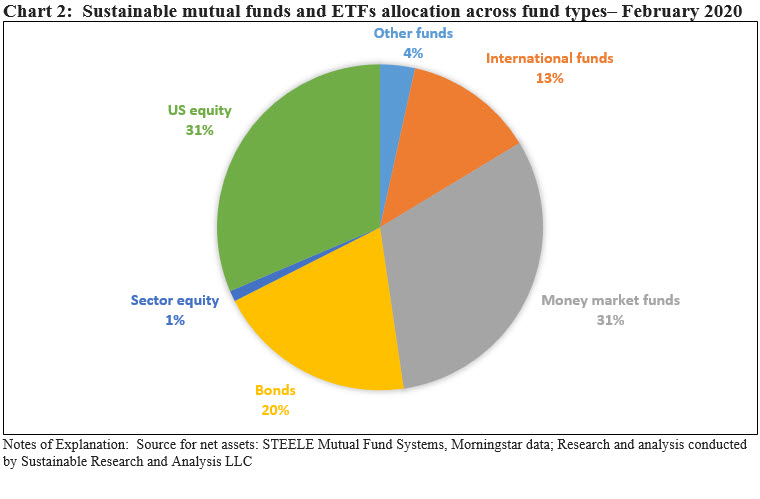

Sustainable index funds register a month-over-month decline of $588.4 million

Sustainable index funds, including mutual funds and ETFs registered a rare decline in February, dropping $588.4 million to end the month with about $46.0 billion. The number of index funds remained unchanged at 146. Refer to Chart 3. Three funds, including one index ETF and two index mutual funds, sustained net outflows in a range between $106.3 million and $488.10 million. These are the Vanguard FTSE Social Index Fund, GuideStone Funds Equity Index Fund and iShares MSCI KLD 400 Social ETF.

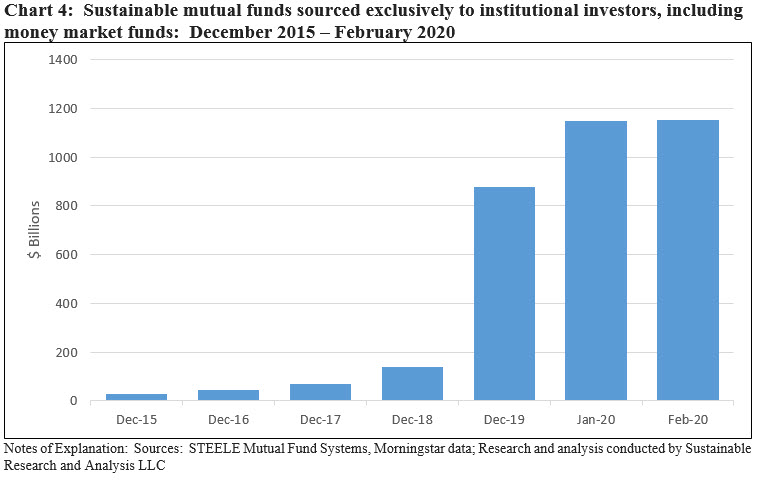

Institutional only mutual funds, including money market funds, gained $4.96 billion and end at $1,152.2 billion

Largely influenced by net flows into money market funds that now account for 31.3% of sustainable fund assets under management, institutional only funds gained $4.96 billion in assets to end the month at almost $1.2 trillion. As a percentage of money market fund assets 93.4% of assets are sourced to institutional investors. When money market funds are excluded from the assessment, institutional funds only drop to $604.9 billion or 32% of sustainable fund assets. Refer to Chart 4.

It should be noted that this likely represents a floor for the level of institutional investor participation in sustainable funds as such investors also invest in funds through other share classes as well as ETFs.

New fund launches: Two funds added in February

Five new funds were launched in February, up from two new funds introduced in January. Of these, three were ETFs, including the iShares ESG MSCI EM Leaders ETF at $587.7 million in assets. This largest of the new fund offerings was reported to have received an initial $600 million investment from Ilmarinen, Finland’s largest pension insurance company.

Direxion MSCI USA ESG Leaders vs. Laggards ETF, with $11.5 million, introduced a new twist by emphasizing highly rated ESG firms and shorting poorly ESG rated companies or companies exposed to controversies.

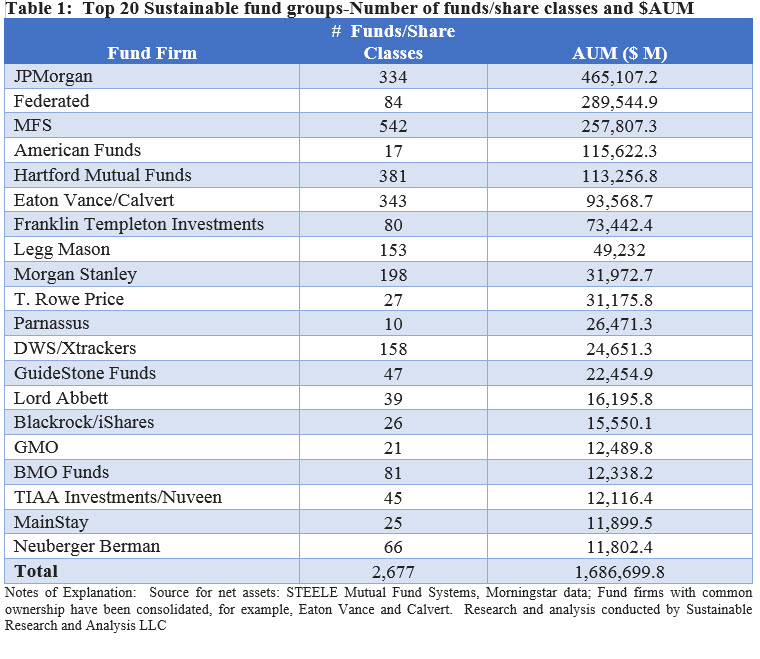

Top 20 sustainable fund firms account for 90% of sustainable fund assets

As in January, five new firms were added to the roster of sustainable fund firms in February. There are now 173 (with related fund firms combined) declared firms that offer sustainable mutual funds and/or ETFs.

Two of the five firms launched new funds while three re-branded existing mutual funds. Of these, T Rowe Price and Lord Abbett immediately reached a ranking within the top 20 sustainable fund firms with their $31.2 billion and $16.2 billion in re-branded assets.

The top 20 firms account for almost $1.7 trillion of the segment’s assets, or 90% of sustainable fund assets, down slightly from 90.9% at the end of the previous month. Refer to Table 1.

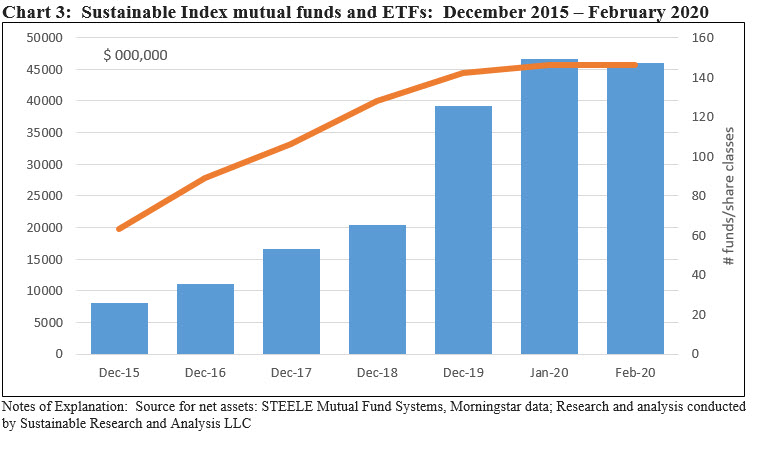

Top investment category and fund flows-February

Refer to Chart 5 for the largest positive and negative net cash flows by investment category and individual fund/share classes.