The Bottom Line: Sustainable fund assets reached a new high in April 2020 at almost $2.5 trillion, boosted largely by market movement and fund re-brandings.

Sustainable mutual fund and ETF assets reached a new high of almost $2.5 trillion at the end of April

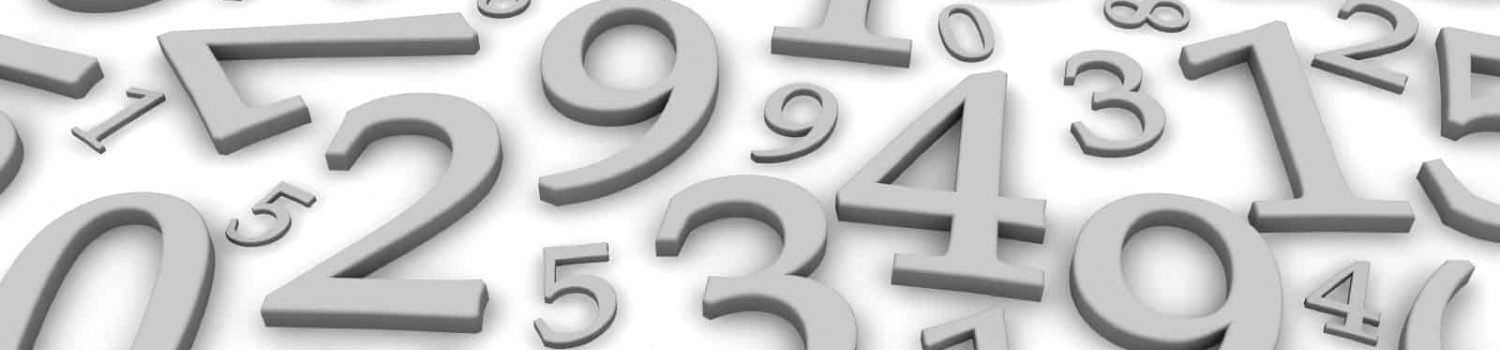

Stocks and bonds moved sharply higher in April, with the S&P 500 gaining 12.8% and investment-grade intermediate bonds adding 1.78%. The combination of fund re-brandings, positive market movement and net inflows, in that order, led to another month over month gain in total sustainable fund[1] assets of $329.5 billion, or 15.4%, to reach a new high of almost $2.5 trillion. Refer to Chart 1.

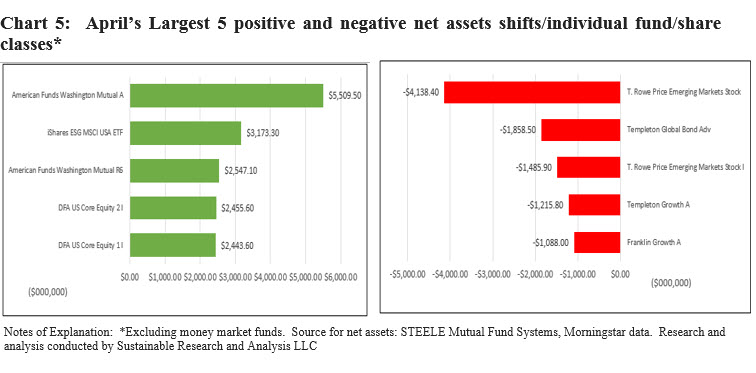

ETFs added about $7.9 billion, for a gain of 22.2% fueled by additions to the largest ETFs, in particular, BlackRock’s iShares. The iShares ESG MSCI USA ETF alone added $3.2 billion. Mutual fund assets reached $2.4 trillion, increasing by $321.6 billion, or 15.3%.

Since the start of the year, mutual funds and ETFs have added an astounding $852.1 billion in net assets, posting an increase of 46%.

Estimated cash inflows in April bring in $28.3 billion, including money market funds, while market appreciation added an estimated $128.7 billion

Market movement in April, including money market funds that accounted for 29.4% of assets, added an estimated $128.7 billion and contributed 39.1% of the month’s total gain in assets. Positive cash flows added an estimated $28.3 billion. Excluding money market funds, the sustainable funds segment recorded an estimated net outflow of $38.3 billion.

By far the most significant contributor to the month’s positive growth in assets were fund re-brandings (see below) that added $172.5 billion.

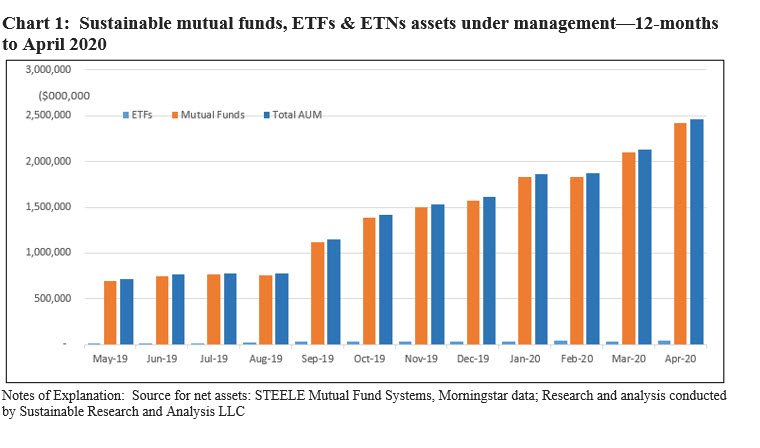

Fund re-brandings slowed in April but still account for $172.5 billion in April

Re-brandings in April declined to less than half the level reached in March to $172.5 billion in assets. Seven firms re-branded 34 funds consisting of 164 funds/share classes. Refer to Chart 2.

T. Rowe Price contributed 74% of the total additions due to re-brandings by adopting ESG integration language covering 11 funds offering 33 share classes and $127.6 billion in net assets.

The next two firms with significant re-branding activity in April included Cohen & Steers ($20.6 billion) and Lord Abbett, which re-branded $16.9 billion by adopting non-committal ESG integration language in fund prospectuses.

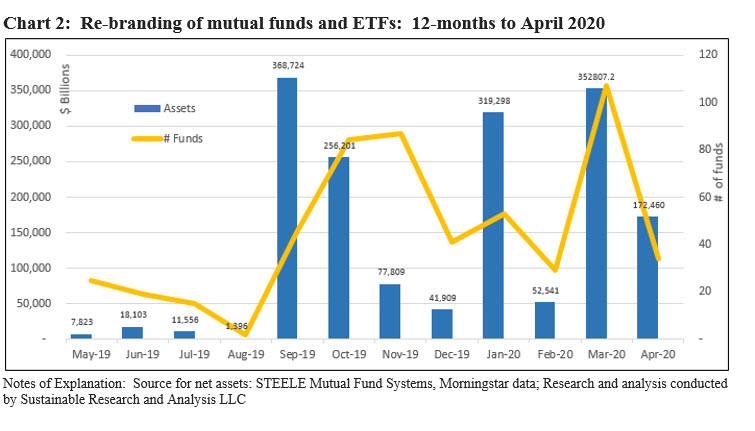

Allocation across fund types/asset classes: US equity and sector equity funds added a combined $201.4 billion

Bolstered by fund re-brandings and market appreciation, US equity and sector equity funds added $201.4 billion in April, a month-over-month increase of 29.9%, followed by money market funds that gained $69.9 billion and bond funds, $34.9 billion. In the process, the assets allocated to US equity and sector equity funds increased by 4%, from 31.6% in March to 35.6% in April. Refer to Chart 3.

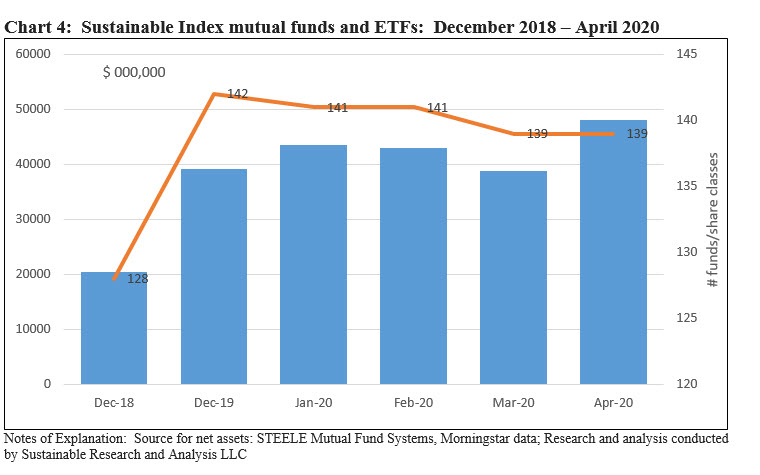

Sustainable index funds register the strongest gain so far this year, adding $9.2 billion in net assets

The number of sustainable index funds, both mutual funds and ETFs, was unchanged at 139 funds but net assets increased by a strong $9.2 billion, or 23.8%, to end April at the highest month-end level of $48.0 billion. Refer to Chart 4.

ETFs make up 89 funds and $30.9 billion or 64.3% of the sustainable index funds segment.

Institutional only mutual funds, including money market funds, gained $182.2 billion and ended April at $1.5 trillion

Adding $182.2 billion in April, institutional fund assets reached $1,549,812.2 million, representing a minimum of at least 62.9% of assets sourced to institutional investors as of April 2020. This level is down from 65.2% of assets last month, still, the number is likely higher as institutional investors are not limited to invest via institutional only share classes.

New Funds: Seven new funds were launched in April

Even as only $5 million in assets were associated with newly launched funds in April, seven funds commenced operations versus only four funds in March. This was the highest number of new funds so far in 2020. The Lord Abbett Short Duration High Yield Fund, consisting of nine share classes, was the source for the new money.

The new Lord Abbett fund states in its prospectus that the “investment team may also consider the risks and return potential presented by environmental, social, and governance (ESG) factors in investment decisions.”

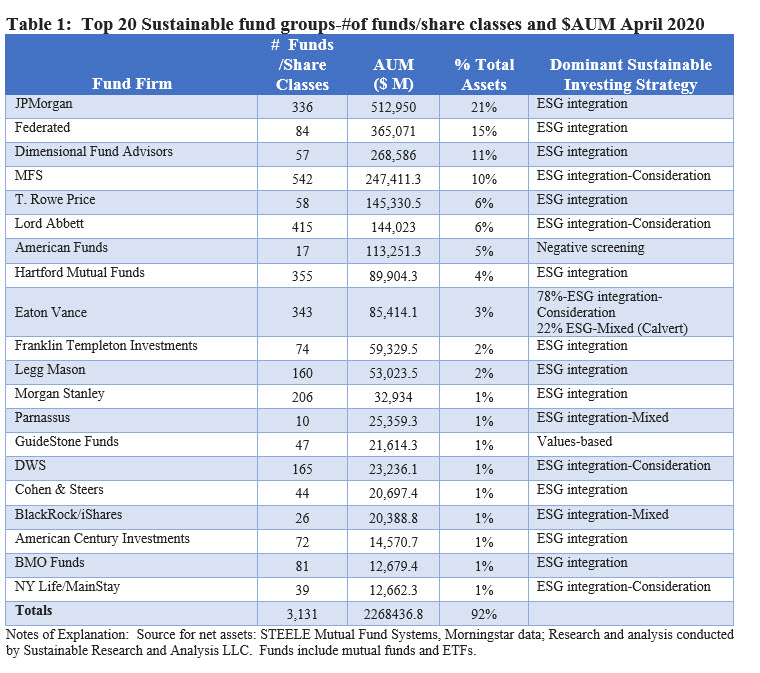

Market share of top 20 sustainable fund firms remains unchanged at 92% of sustainable fund assets even as two firms move into the top ranks

Concentration of sustainable fund assets managed by the top 20 firms, out of a total 176 firms now offering funds in the sphere, remained unchanged in April at 92%. Refer to Table 1. There were some changes, however, in the line-up of the firms. T. Rowe Price gained in the rankings, moving from 12th ranked in March to 5th ranked as the fund firm’s standing was lifted due to its fund re-brandings. The re-branding of Cohen and Steers funds also catapulted the firm to the top ranks which was also joined by NY Life/Mainstay. These factors combined with relative shifts in fund assets during the month of April pushed Transamerica and TIAA Investments/Nuveen to drop below the top 20 ranked firms.

ESG integration remains the dominant strategy employed by managers ranked among the top 20 fund groups, based on assets under management. It should be noted that some firms manage funds that employ a more varied portfolio of funds, for example BlackRock, however, the combined assets of such funds account for less than 50% of their sustainable funds under management.

ESG integration, which is further broken down into three categories defined below, is in turn dominated by firms pursuing ESG integration strategies. But this month, with the addition of NY Life/Mainstay into the ranks of the top 20 firms, the number of firms pursuing ESG-Consideration strategies has now moved up to 5 firms, including Eaton Vance, and the strategy accounts for $494 billion or 21.8% of the assets managed by the top 20 firms[2].

ESG integration is broken down and defined, as follows: ESG Consideration-refers to the adoption of prospectus language by which the fund may but is not obligated to account for ESG factors. ESG integration refers to funds that have explicitly committed to account for ESG and typically but not always also combine this with investee engagement. ESG-Mixed refers to fund groups that combine ESG along with companion strategies such as negative screening (exclusions), and/or impact and/or thematic investing. Four fund groups, including Calvert, a unit of Eaton Vance, fall into this category.

Fund categories and fund specific asset gains/declines in April

Excluding money market funds, the fund categories that experienced the largest asset gains in April included growth funds, growth and income funds, corporate bond-high yield funds, specialty-real estate funds, and small company funds, adding $139.6 billion, $35.2 billion, $17.6 billion, $13.5 billion and $12.5 billion, in that order. At the same time, the five largest declines were experienced by asset allocation funds, municipal bonds-national, precious metals funds, municipal bonds single state and government bonds-mortgage, as follows: -$0.547 billion, -$0.482 billion, -$0.130 billion, $-0.109 billion and -$0.061 billion.

The five funds/share classes with the greatest changes in net assets in April due to market movement as well as flows, both positive and negative, are displayed in Chart 5. These exclude money market funds and fund re-brandings.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Proactive shareholder/bondholder engagement and proxy voting may be employed as well. These are not mutually exclusive.

[2][2] Eaton Vance included in the count but limited to 78% of assets. Refer to Table 1.