The Bottom Line: Sustainable mutual funds and ETFs achieve a ninth consecutive monthly gain to reach new high of almost $2.6 trillion at May 2020.

Sustainable mutual fund and ETF assets reached a new high of almost $2.6 trillion at the end of May

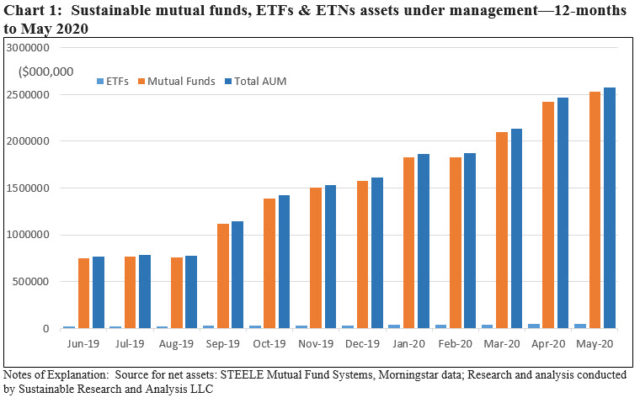

Continuing a streak of nine consecutive monthly gains, sustainable mutual funds and ETFs[1] added a combined total of $112.6 billion in assets to end the month of May at $2,575,746.2 million. The 4.6% month-over-month increase was roughly in line with the S&P 500’s total return of 4.8%, however, net cash inflows and fund re-brandings, in that order, also contributed to the uptick. Refer to Chart 1.

May’s rise in assets was significantly below the levels reached in April and March when net assets added 15.4% and 14.0%, respectively. Both mutual funds and ETFs recorded increases, with ETFs gaining $5.0 billion or 11.5% to end the month at $48.3 billion. ETFs now account for 1.9% of sustainable fund assets.

Estimated cash inflows in May, including money market funds, added $19.8 billion

Market movement was the single largest contributor to May’s increase in net assets, adding an estimated $83.3 billion, including money market funds. This was followed by estimated net cash inflows of $19.8 billion and fund re-brandings at $9.5 billion.

Excluding money market funds, net cash inflows were estimated at $12.5 billion. Excluding January’s estimated outflows of $59.2 billion, May’s inflows were the lowest this year to-date. Net cash inflows dropped from the March 2020 year-to-date high of an estimated $220.3 billion and compares to an estimated inflow of $28.3 billion in April.

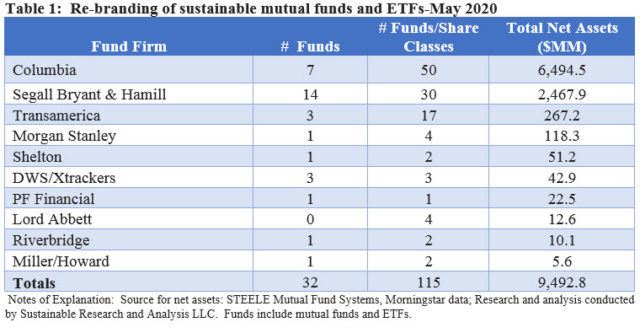

Fund re-brandings dropped to $9.5 billion, the lowest level since August 2019

Assets attributable to fund re-brandings in May, at $9.5 billion (revised 6/22/2020), declined to the lowest level since August 2019. Still, ten firms repurposed a total of 32 existing mutual funds and ETFs, including four first time firms. The largest of these by assets were Columbia Management Investment Advisers that shifted 7 funds/50 share classes with $6.5 billion in net assets by explicitly amending fund documents to reflect the integration of ESG factors as well as possible exclusions. This was followed by 14 funds and $2.5 billion explicitly repurposed by Segall Bryant & Hamill—a new entrant to the sustainable investing sphere that also adopted an ESG integration approach across the 14 funds. In addition to ESG integration, in the case of Segall Bryant & Hamill’s Workplace Equality Fund, the firm’s sustainable strategy extends to evaluating workplace equality practices and inclusionary hiring and promotion policies using the firm’s “proprietary workplace equality screen.” Combined, these two firms accounted for 94.4% of re-branded assets. Refer to Table 1.

Unlike mutual fund re-brandings, the same strategy on the ETF side has not been common. DWS’s Xtrackers repurposed three bond index tracking ETFs that will now employ ESG integration and exclusions approaches, adding $42.9 million in assets to the ETF segment. So far this year, a total of six ETFs have been re-purposed, including three ETFs with $144.8 million in assets that were re-branded by Wisdom Tree in March. This compares to 251 mutual funds that have been repurposed year-to-date.

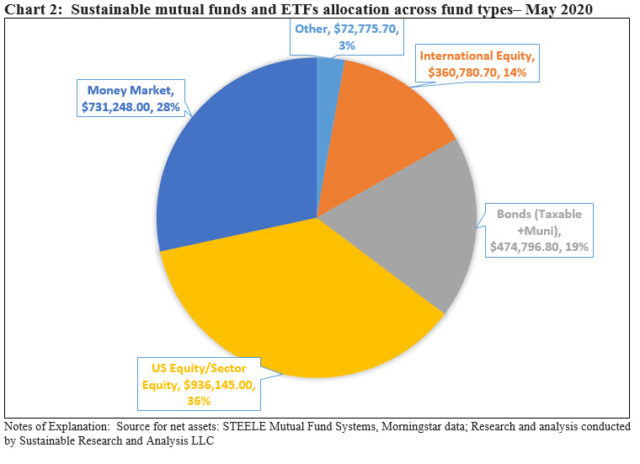

No material change in the allocation of assets across fund types/asset classes: US equity and sector equity funds added a combined $60.4 billion

There was no material month-over-month shift in the allocation of fund assets across five investment categories. The biggest gainers again this month were US equity and sector funds, up $60.4 billion, followed by bond funds, up $19.8 billion and international equity funds which gained $16.2 billion.

Refer to Chart 2.

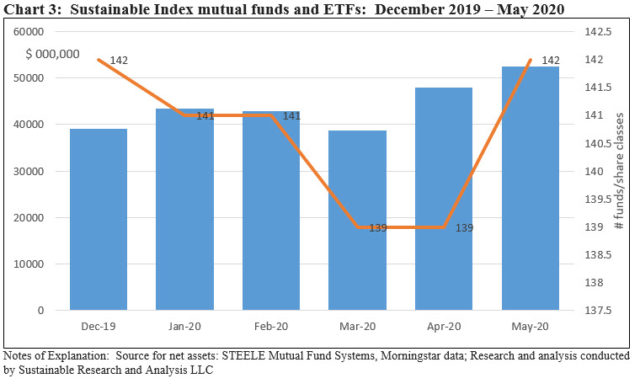

Sustainable index funds closed May with $52.5 billion in assets under management and added 3 new index funds via re-brandings

Sustainable index funds, both mutual funds and ETFs added $4.5 billion in assets, due to a combination of market appreciation as well as positive cash flows and, to a lesser extent, 3 ETF re-brandings. Refer to Chart 3.

The top three index funds, led by the Vanguard FTSE Social Index Fund with $7.7 billion in assets and followed by iShares ESG MSCI USA ETF, $7.3 billion, and iShares ESG MSCI Emerging Markets ETF at $3.2 billion, added a combined total of $1.2 billion in May.

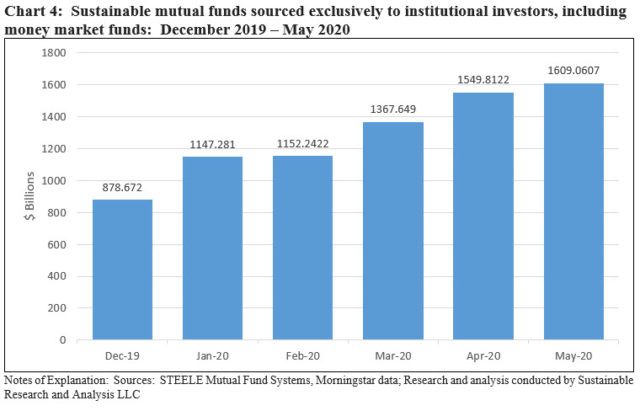

Institutional only mutual funds, including money market funds, gained $1.6 billion and ended April at $1.6 trillion

Institutional only funds/share classes reached $1.6 trillion at the end of May, increasing $1.6 billion on a month-over-month basis. This compares to an increase of $182.2 billion in April and represents the second smallest increase so far this year—likely related to the lower level of fund re-brandings in May. Refer to Chart 4.

Institutional fund assets now represent a minimum of at least 62.5% of sustainable fund assets (64.5% if ETFs are excluded) versus 62.9% in April and 65.2% at the end of March, including money market funds that are dominated by institutional investors. In fact, 94.1% of money market fund assets are sourced to institutional investors. Excluding money market funds drops the percentage of institutional investors to 49.9%. That said, the number is likely higher or lower as institutional investors are not limited to invest via institutional only share classes while at the same time a number of firms source their investors through financial intermediaries who funnel retail investor money into funds via designated institutional share classes.

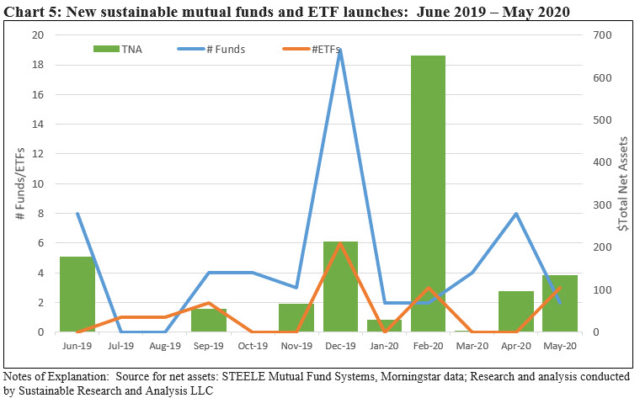

New Funds: Five new funds were launched in May, including 3 new ETFs

Five new funds were launched in May, including 3 new ETFs, after a two month drought. The new sustainable ETFs are managed by ClearBridge, J.P. Morgan and Tuttle Tactical Management. Refer to Chart 5.

Also, two new mutual funds were introduced versus last month’s adjusted new fund launch number of eight, to include the new $13.5 million Domini Sustainable Solutions Fund. The fund, sub-advised by SSGA Funds Management, invests in securities of companies that demonstrate a commitment to sustainability, naming seven explicit solutions, including transition to low-carbon, sustainable communities and clean water, to mention just three.

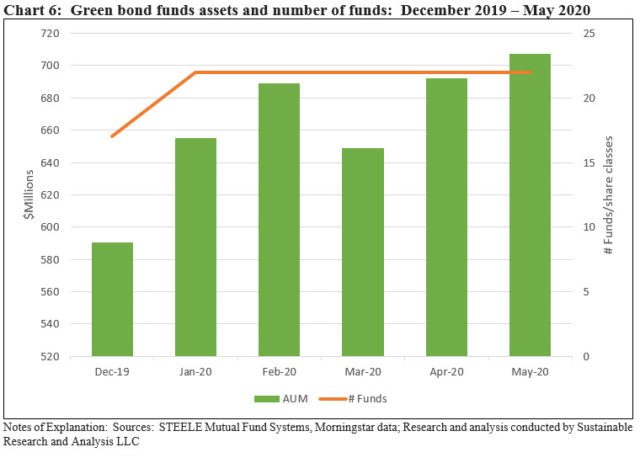

Green bond funds edge up to $707.3 million in assets with a gain of $15.2 million

Eight firms offering green bond funds, including 2 ETFs, experienced a gain of $15.2 million in assets, or 2.2%. Since the start of the year, green bond funds have added $116.7 million or 19.8%. During this time, two new firms, Franklin Templeton and PIMCO, launched green bond funds that together now account for $10.6 million in assets. Still, Calvert Investment Management continues to dominate the category with its $488.8 million or 69.1% of the category’s assets buoyed by the 86% of assets sourced to institutional investors. Refer to Chart 6.

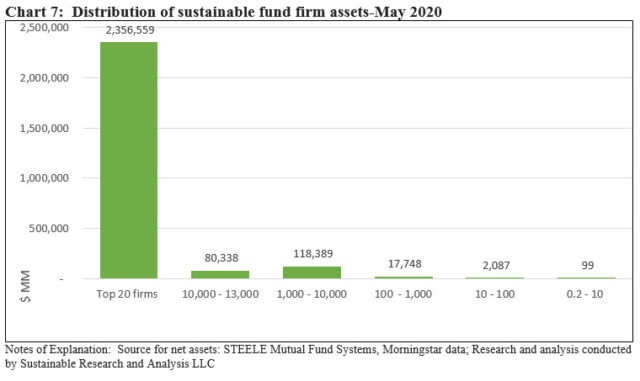

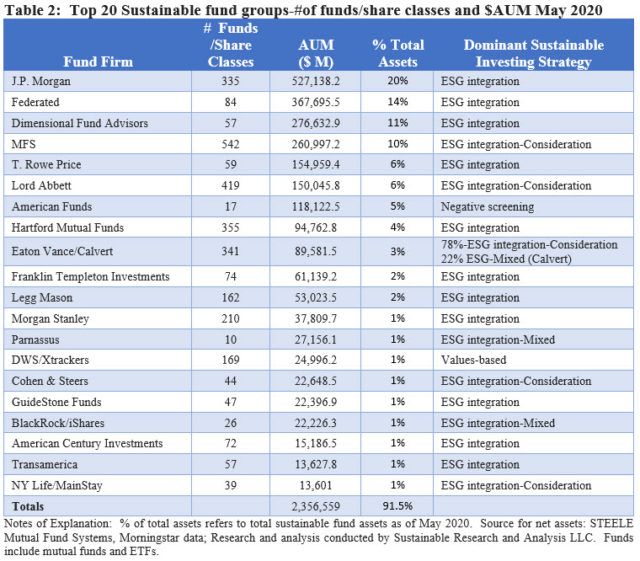

Market share of top 20 sustainable fund firms drops slightly to $91.5% of sustainable fund assets

As of May 2020, 179 firms manage a total of 4,472 funds ranging from money market funds to commodity funds with total net assets in the amount of $2.58 trillion. The top 20 firms within this segment managed $2.4 trillion that makes up 91.5% of the segment’s assets and 70% of the funds. This is down slightly from the 92% concentration level as of April month end. The line-up of the top 20 firms shifted by one firm, with Transamerica displacing BMO which dropped in its ranking to 21st. Transamerica’s ranking was boosted by its rebranding of 3 funds with $267.2 million in assets.

Beyond the top 20 firms, there are 159 firms with sustainable fund assets spread from a low of $0.2 million to $13,601 billion in assets. The distribution of these assets by size categories is displayed in the chart below. Refer to Chart 7 and Table 2.

In addition to listing the top 20 sustainable fund firms, Table 2 identifies the dominant sustainable strategies employed by these firms across their sustainable fund offerings. ESG integration, which combines investee engagement with an approach by which ESG factors are considered in a systematic and consistent manner in investment decisions where such factors are deemed to be relevant and material, is the dominant strategy pursued by 11 firms and applies to 69% of the assets across the top 20 firms. ESG mixed, by which the fund’s core strategy consists of ESG integration, but exclusions, impact or thematic approaches may also be employed, applies to 29% of the assets across the top 20 firms, followed by ESG-consideration, pursuant to which the fund may integrate ESG, stands at 22%.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Each of these may also employ shareholder/bondholder engagement and active proxy voting strategies. These strategies are not mutually exclusive.