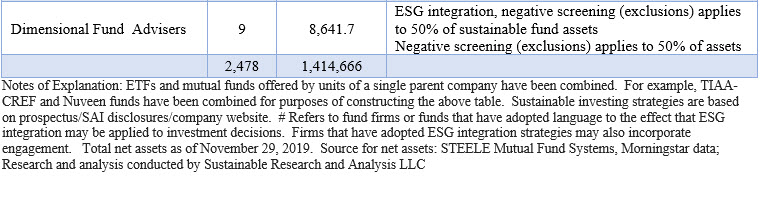

Assets attributable to sustainable funds gain $114.5 billion in net assets, or 8.1% month-over-month to end November and head into year-end 2019 at another new high of $1.5 trillion

Sustainable investment funds, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) across all assets classes, reached $1.53 trillion in assets under management at the end of November 2019, adding $114.5 billion month-over-month, or an increase of 8.1%. Refer to Chart 1. This was the 9th monthly gain so far this year, and the fourth largest during 2019 which saw larger increases ranging from $142.1 billion in March to a high of $372.4 billion in September. Again in November, contributing to the increase were fund re-brandings that added $77.8 billion in net assets as well as market movement that contributed an estimated $26.1 billion. The net fund flows picture changes when adjusted for the more volatile shifts in money market funds that now account for $284.4 billion or 18.5% of sustainable fund assets. Including money market funds, net cash inflows contributed an estimated $10.6 billion in November. Excluding money market funds and focusing on long-term fund flows only, November’s estimated net inflows were a more modest $3.3 billion for a month-over-month contribution of 0.23%. At the same time, market movement combined with additions to money funds assets expands to $33.8 billion

Since the start of the year, sustainable fund assets have expanded by $1.03 trillion, from $390.4 billion at December 31, 2018, or an increase of 263%.

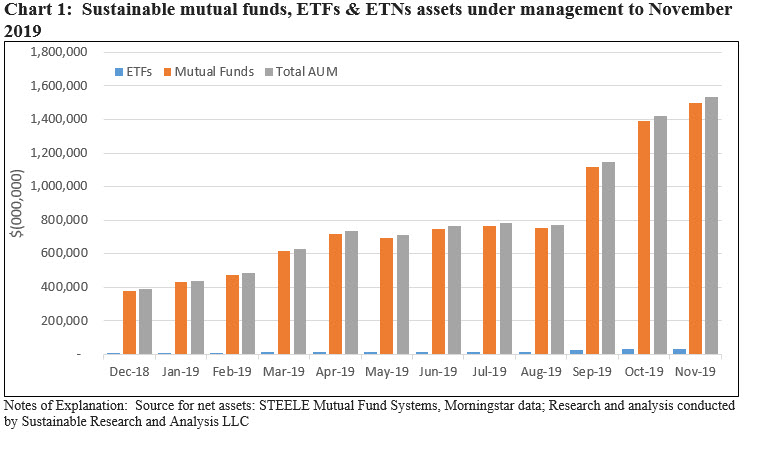

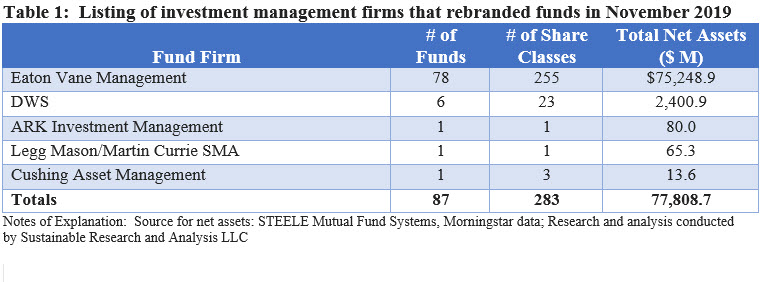

Fund re-brandings add $77.8 billion in November, the fifth monthly highest since the start of the year

Five firms re-branded a total of 87 funds, including one ETF, with total net assets in the amount of $77.8 billion. Two of these firms, Cushing Asset Management and ARK Investment Management, are making their sustainable investing debut. Refer to Table 1.

Eaton Vance Management, which last month re-branded three existing Next Shares products (a new type of actively managed ETF), added 78 re-branded funds consisting of 255 share classes with a combined total of $75.2 billion in net assets. Together with sustainable assets managed by its pioneering responsible investment subsidiary Calvert Asset Management, total net assets sourced to sustainable strategies for the combined firm stood at $94.1 billion and positions the parent company as the 5th ranked firm just below Hartford on the basis of sustainable assets under management. Eaton Vance amended its fund prospectuses by adopting the following prospectus language: “As part of the research process, portfolio management may consider (italics added) financially material environmental, social and governance (“ESG”) factors. Such factors, alongside other relevant factors, may be taken into account in the Fund’s securities selection process.”

Similar to the prospectus amendments adopted by three Eaton Vance NextShares the previous month, the firm, in connection with the latest round of re-brandings, is non-committal regarding its ESG integration approach. Eaton Vance is not alone in adopting this avenue as there are at least three other firms (MFS, DWS and Mainstay) that have likewise amended their prospectus language applicable to at least some or all of their fund offering by adopting a “lighter” form of ESG integration.

Recent fund re-brandings transforms asset allocation profile of the sustainable funds universe

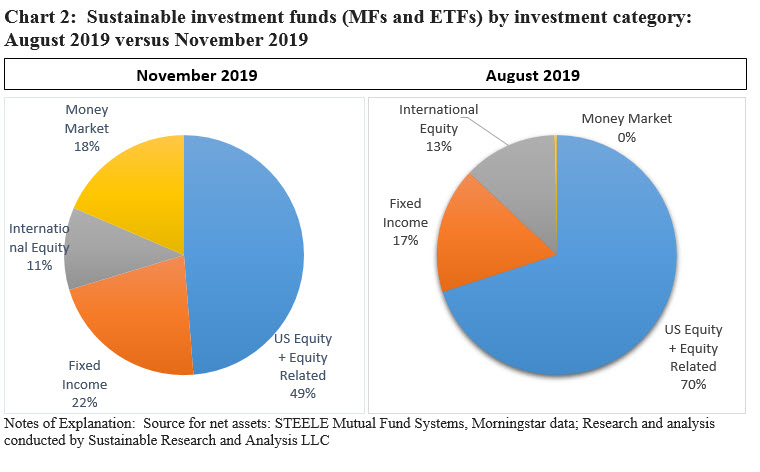

The overall allocation of sustainable assets across security segments did not shift materially in November, however, taxable and municipal funds combined added around $53 billion in assets and now make up 21.6% of sustainable assets versus 19.6% the previous month and 17% at the end of August.

In just the last three months, the profile of the sustainable funds universe has been transformed and the distribution of sustainable fund assets across various security segments and are now more closely aligned with that of the broader mutual fund and ETF universe. In particular, the re-branding of funds managed by J.P. Morgan in September, MFS in October and Eaton Vance in November, each of which reflected the formal adoption of ESG integration approaches across $679.9 billion in assets, shifted the percentage of sustainable assets invested in equity funds, bond funds and money market funds, in particular. The allocation of combined assets across the four major asset segments, including international equities, is now more closely aligned with the allocation of assets reflected across the broader universe of mutual funds and ETFs. Refer to Chart 2.

Sustainable index funds make up 3% of the segment’s net assets

At the same time, sustainable index funds, both mutual funds and ETFs, excluding money market funds, still represents only 3% of sustainable fund assets versus about 36.4% of mutual fund industry assets more broadly. Sustainable index funds rose to $36.9 billion, up from $35.1 billion at the end of October, or an increase of 5%.

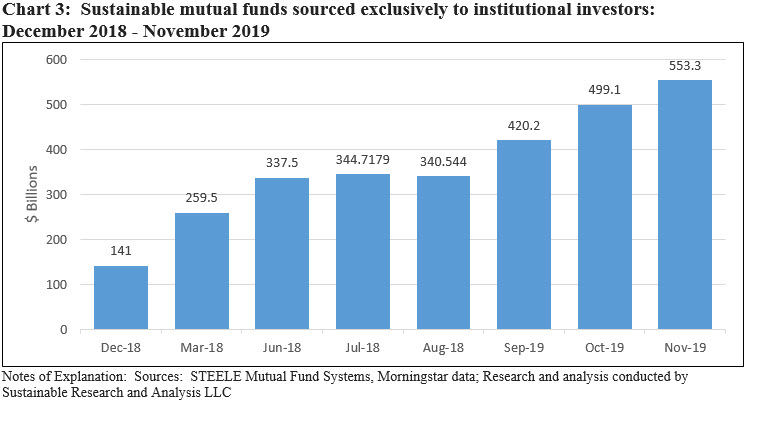

Institutional only mutual funds, excluding money market funds, expand and account for 44.4% of net assets by the end of November

Excluding money market funds which are largely offered to institutional investors, institutional only funds continued to gain assets on the back of fund re-brandings. Institutional only funds gained $56.2 billion in November and now account for 44% of net assets. When combined with money market fund assets that are largely sourced to institutional investors, institutional only assets rise to $839.7 billion, or 54% of net assets. Refer to Chart 3.

It should be noted that this likely represents a floor for the level of institutional investor participation in sustainable funds as such investors also invest in funds through other share classes as well as ETFs.

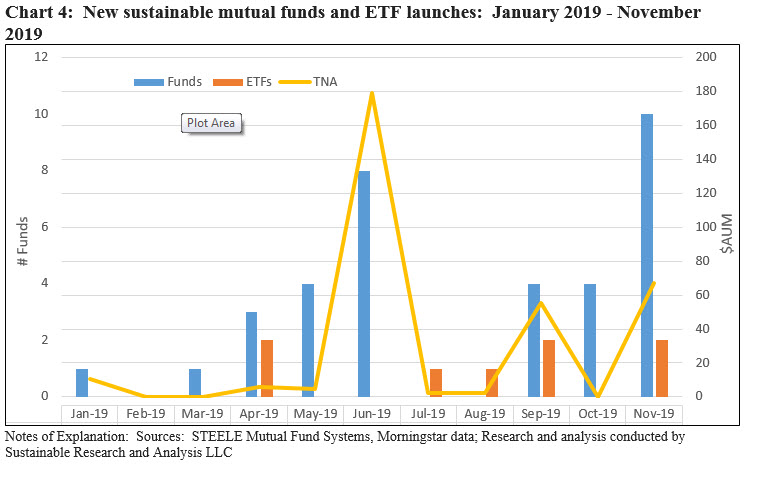

Ten new mutual funds were launched in November along with two new ETFs

The largest number of new funds so far this year were launched in November. In addition to the introduction of four new share classes, seven fund groups launched 12 new sustainable investment funds during the month. Refer to Chart 4.

These included three mutual funds offered by two first time asset managers with offerings in the sustainable investing sphere and two first time ETFs launched by Timothy Partners LTD, a faith-based mutual fund company. All but one are equity-oriented funds.

Also this month, Schroder announced the closing of two sustainable funds, the Schroder Emerging Markets Small Cap Fund and Schroder Short Duration Bond Fund, with $18.5 million in assets.

So far this year, a total of 35 new mutual funds were launched along with eight ETFs. Based on assets at the end of the launch date month, these funds contributed $326.8 million in new assets.

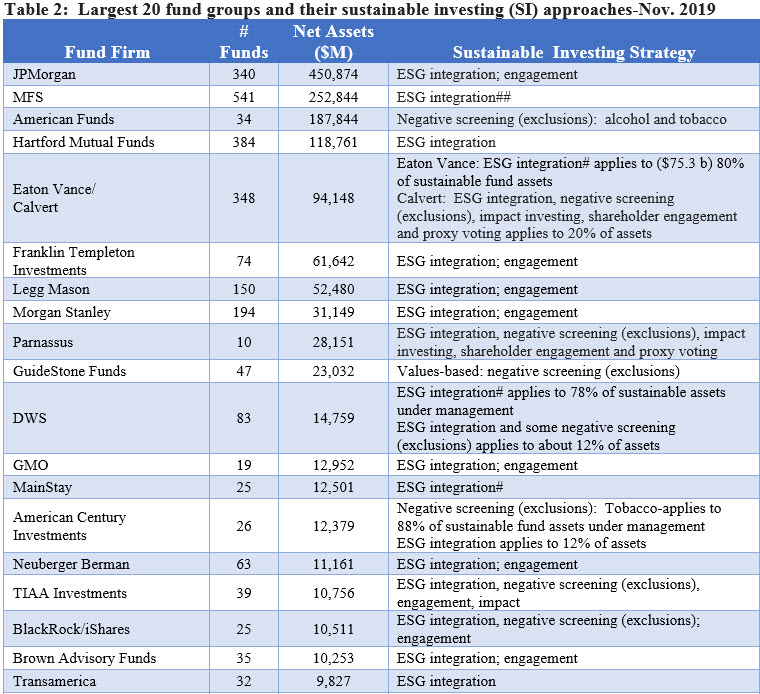

Largest Fund Groups: Top 20 sustainable fund groups now account for $1.4 trillion in assets as concentration month-over-month ticked up slightly to 92.3%

Five new fund groups introduced sustainable mutual funds and ETFs in November, bringing the total number of fund firms offering sustainable funds to 155. Of these, the top 20 fund firms account for $1.4 trillion in net assets or 92.3% of assets sourced to sustainable strategies.

Refer to Table 2. This level of concentration is slightly higher than last month when the top 20 firms were 92% of net assets versus 91.4% at the end of September.

ESG integration approach dominates across the top 20 firms

As reported in previous months, the sizable fund re-brandings over the last three months in particular has brought about a shift in the dominance of ESG integration as the leading sustainable investing strategy or approach, either applied exclusively or in combination with other strategies, for example, such as negative screening (exclusions), impact or shareholder/bondholder engagement. This contrasts with the tilt toward negative screening (exclusions) that dominated the sustainable investing mutual funds and ETF sphere earlier in the year.

About 25% of the assets attributable to the top 20 firms pursue a “light” form of ESG integration while 16% of the assets are sourced exclusively to a values-based investing approach and negative screening (exclusions) pursued by four firms. Refer to Table 2.