Assets attributable to sustainable funds decline by $20.7 billion, ending May at $710.6 billion in assets under management

After six consecutive months of posting asset gains, sustainable funds, including mutual funds, ETFs and ETNs, registered a net decline of $20.7 billion in assets under management, or -2.8%, to end May 31, 2019 with $710.6 billion . The decline exceeded the $19.4 billion fall off in net assets last recorded in October 2018. Sharply lower stock markets in the US and overseas contributed to the drop in sustainable fund assets which stood at $733.5 billion at the end of April. Market movement was responsible for an estimated decline in the amount of $34.6 billion, which was partially offset by gains of $7.8 billion attributable to fund re-brandings while an estimated $6.0 billion is attributable to investor net positive cash flows, or 0.82% relative to April net assets. Refer to Chart 1.

The decline due to market movement exceeded the estimated $20.7 billion drop recorded in December 2018 when the S&P 500 Index posted a drop of 9.03%. At the same time, estimated net inflows in the amount of $6.0 billion exceeded last month’s estimated $2.46 billion and is the highest level observed so far this year.

Sustainable mutual funds versus ETFs: Mutual funds account for about 84% of assets

Mutual funds and exchange-traded notes (ETNs) ended the month of May with $596.4 billion or 83.9% of sustainable fund assets. Sustainable ETFs, on the other hand, stood at $13.7 billion in assets at the end of May, representing just 1.93% of sustainable assets. ETF assets peaked at 3.25% of assets at the end of November 2018 and have trended down since then as mutual funds gained market share largely via net new assets attributable to fund re-brandings. Month-over-month, ETFs gained 10 bps in market share.

Fixed income assets ended the month of May with $114.2 billion in assets, or 16.1% versus equity and all other funds that closed May with $596.4 billion or 83.9% of sustainable assets under management.

New Funds in May: Three new ESG funds launched; 0 ETFs

Three fund firms launched new sustainable funds, including Fidelity Investments, Harbor Capital Advisors and Zeo Capital, adding $4.8 million in assets, while Invesco added four new share classes on top of two existing share classes with $29.5 million in assets, to the newly absorbed Oppenheimer OFI Pictet Global Environmental Solutions Fund which was reorganized.

-

Fidelity Women’s Leadership Fund

Fidelity Investments launched the Fidelity Women’s Leadership Fund, a fund with $4.7 million in net assets offered via 6 share classes, subject to varying sales charges and expense ratios. The fund seeks long term growth of capital by investing in equity securities of domestic and foreign companies that prioritize and advance women’s leadership and development. Such companies include those that, at the time of initial purchase, (i) include a woman as a member of the senior management team, (ii) are governed by a board for which women represent at least one third of all directors, or (iii) in the Fidelity’s opinion, have adopted policies designed to attract, retain and promote women.

-

Zeo Sustainable Credit Fund

San Francisco-based Zeo Capital Advisors, LLC launched the Zeo Sustainable Credit Fund which was still not funded as of May 31st. The fund’s adviser seeks to achieve risk-adjusted total returns consisting of income and moderate capital appreciation by investing primarily in fixed income securities and by actively managing interest rate and default risks. As described in the fund’s prospectus, the fund takes a sustainable credit approach to investment analysis, combining rigorous fundamental analysis with an in-depth evaluation of sustainable investing factors to identify investments. In doing so, the fund’s strategy is managed with a focus on delivering risk-adjusted total returns consistent with capital preservation by constructing a portfolio consisting primarily of carefully selected fixed-income securities issued by companies who are leaders amongst their peers in key areas of sustainable business practices. Relative sustainable practices and exclusions based on specific environmental, social and governance (ESG) risks are both considerations in the adviser’s fundamental and sustainable credit research process. Further, the adviser discloses that it further manages default risk by considering whether an issuer’s management is making deliberate business decisions around the environmental, social and governance (ESG) factors most relevant to its operations. By considering these risk factors, the adviser aims to evaluate if a business is operating in a sustainable and responsible way to preserve its competitive advantage and maintain its staying power. The adviser seeks to invest in companies who are leaders in their sectors in key areas of sustainable business practices or who are making visible progress toward appropriate sustainable practices. Specific key areas will vary by industry, and the weight of consideration can vary by company. The adviser believes that both credit risk factors and sustainability factors contribute to an issuer’s creditworthiness and the combination of fundamental credit research and sustainable and responsible business practices result in a risk profile that is more likely to preserve capital and deliver attractive risk-adjusted total returns.

-

Harbor Capital Advisors

The third new fund, Harbor Focused International, consisting of three share classes not as yet funded as of May 31, was launched by Harbor Capital Advisors, Inc. The fund is sub-advised by Comgest Asset Management International Limited (“CAMIL”), using designated persons of its affiliates, including Comgest S.A., based in Paris, France, and Comgest Singapore Pte Ltd., based in Singapore. The fund invests primarily in the common stocks of non-U.S. companies, including those located in emerging market countries. According to the fund’s prospectus, CAMIL’s investment philosophy centers on the belief that sustainable earnings growth leads to above-average investment returns at below-average risk. As part of its investment process employs fundamental, bottom-up research to assess company quality, growth drivers, and risks, the sub-adviser also includes an analysis of environmental, social and governance factors.

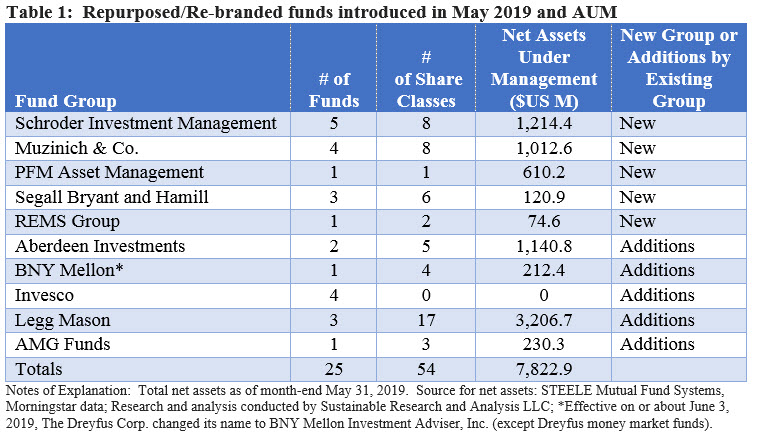

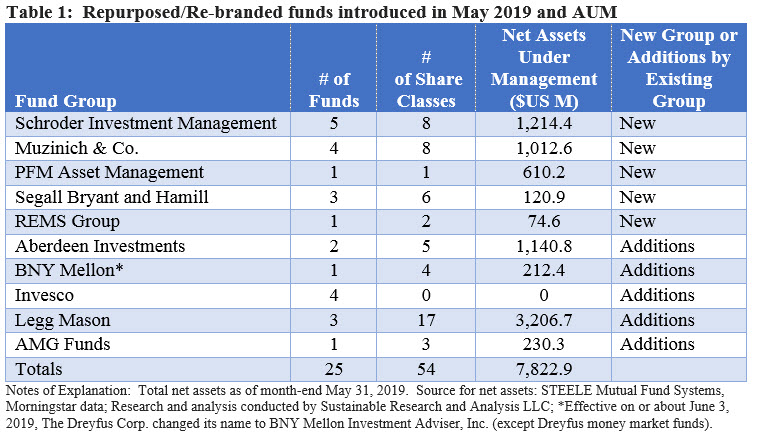

Repurposed or re-branded funds: $7.8 billion added as five new fund groups re-brand existing funds while five existing fund groups add to stable of sustainable funds

Ten fund firms repurposed or re-branded existing funds in May. These included five firms that re-branded funds for the first time as well as five firms that added to their existing roster of sustainable funds.

New fund groups, including Schroder Investment Management, Muzinich & Co. PFM Asset Management, Segall Bryant and Hamill and REMS Group, added 14 funds, 25 share classes and a combined total of about $3 billion in assets. At the same time, additions to an existing stable of sustainable funds on the part of five firms contributed another $4.8 billion in assets, for a combined total of about $7.8 billion. Refer to Table 1.

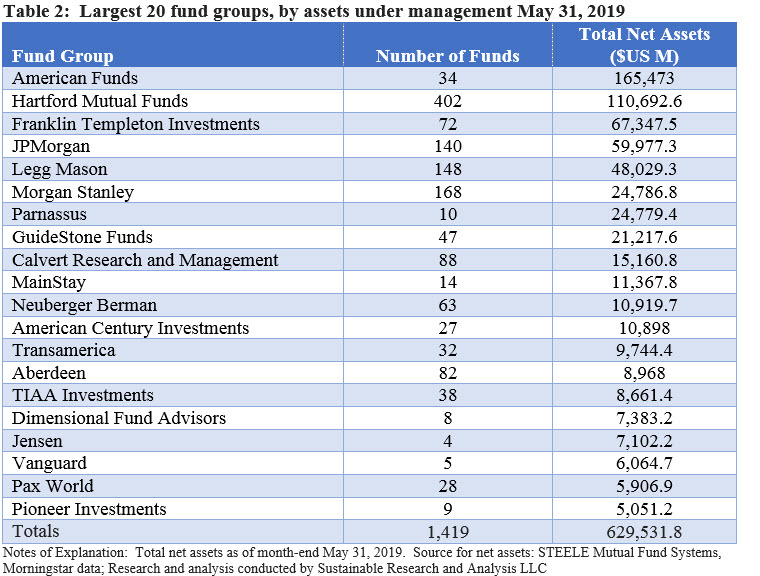

Largest Fund Groups: Top 20 sustainable fund groups account for 88.6% of net assets

The largest fund groups represent $629.5 billion or 88.6% of net assets under management. The top 20 ranked firms did not change relative to April, however, Morgan Stanley squeezed into 6th place within the sustainable segment, with its 168 institutional funds and $24.8 billion in net assets. Morgan Stanley overtook the now 7th ranked Parnassus Investments at the end of May by a mere $7.4 million. Refer to Table 2.

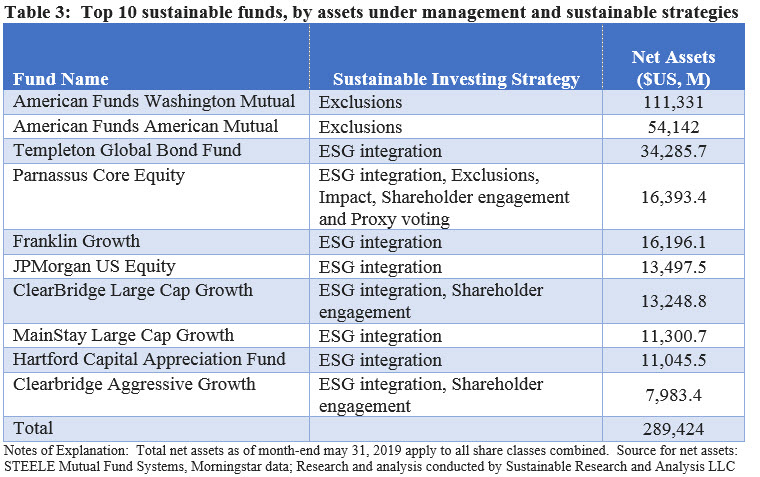

Largest Funds: Top 10 sustainable funds account for $289.4 billion in assets or about 41% of total segment’s assets

While assets declined, the rankings of the ten largest sustainable funds by net assets as of May 31, 2019, including all related share classes, did not change. The largest three funds, all mutual funds, account for $289.4 billion in net assets, or 40.7% of the sustainable segment’s total assets under management. Refer to Table 3.

The top 10 funds gave up $11.4 billion in net assets, or a 3.8% decline, as the month’s challenging equity market conditions resulted in negative performance results for these funds that ranged from -1.78% posted by Templeton Global Bond Adv Shares to -8.54% recorded by ClearBridge Aggressive Growth A Fund.

For a more in-depth analysis of May’s cash flows and additional details regarding new funds, re-branded funds and their strategies, and more, refer to Monthly Sustainable Cash Flows In-Depth: May 2019 that is posted in the Sustainableinvest Premium section of the website.