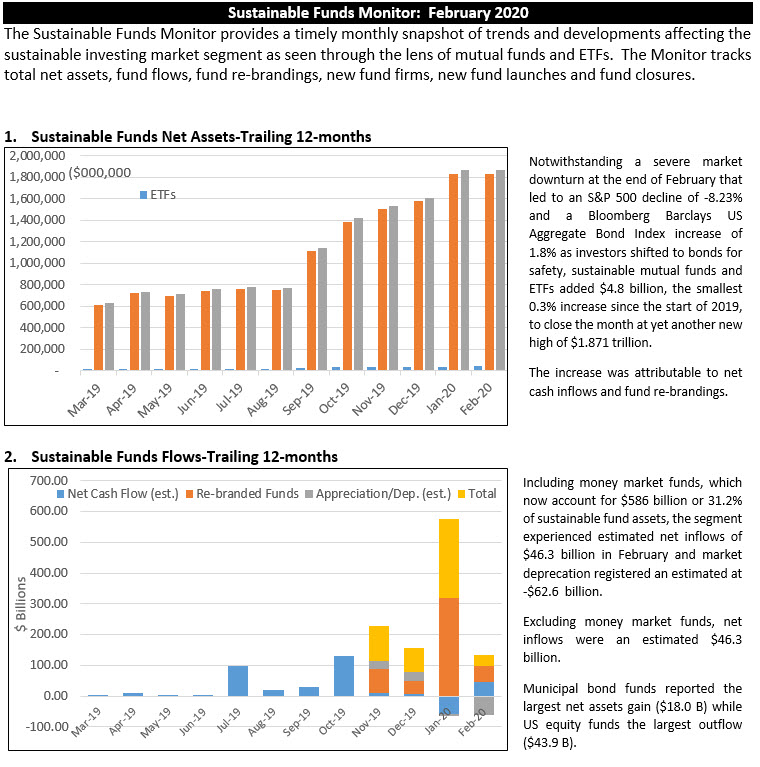

The Bottom Line: Notwithstanding a severe market downturn at the end of February, sustainable MFs and ETFs added $4.8 billion to end at $1.871 trillion.

The Sustainable Funds Monitor provides a timely monthly snapshot of trends and developments affecting the sustainable investing market segment as seen through the lens of mutual funds and ETFs. The Monitor tracks total net assets, fund flows, fund re-brandings, new fund firms, new fund launches and fund closures. FEBRUARY HIGHILIGHT: Notwithstanding a severe market downturn at the end of February that led to an S&P 500 decline of -8.23% and a Bloomberg Barclays US Aggregate Bond Index increase of 1.8% as investors shifted to bonds for safety, sustainable mutual funds and ETFs added $4.8 billion, the smallest 0.3% increase since the start of 2019, to close the month at yet another new high of $1.871 trillion.[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”reg” ihc_mb_template=”4″ ]