The Bottom Line: Thematic environmental and alternative energy funds led the performance pack in July 2020 while Japan-focused ESG Integration funds brought up the rear.

10 Top Performing Funds—July 2020

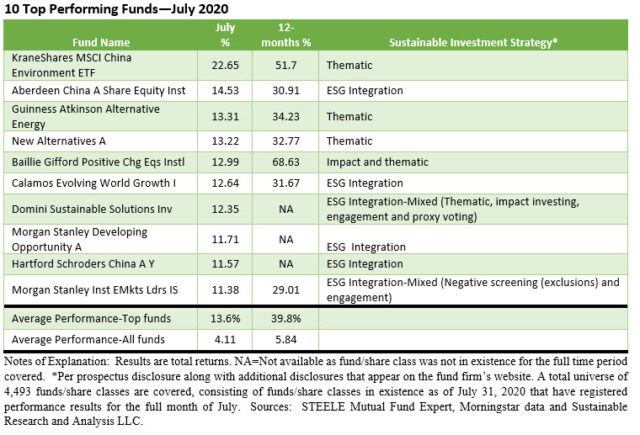

The top 10 performing sustainable mutual funds/share classes and ETFs[1] registered an average 13.6% gain in July, beating the average sustainable fund results by a wide 9.5% margin. Sustainable funds across all security types and asset classes registered an average total return of 4.1% while the average performance of various fund categories, including US equity funds, foreign funds and fixed income funds and corresponding securities market indices, conventional as well as ESG-oriented, registered gains ranging from 0.62% to 6.6%.

From a low of 11.4% to a high of 22.7%, the best performing funds included three China-focused funds that either invested in alternative energy themes or that took account of ESG factors in investment decisions. The leading fund, for example, KraneShares MSCI China Environment ETF that gained 22.7% in July, invests in Chinese issuers that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating environmental degradation. Eligible securities are issued by small-cap, mid-cap and large-cap companies that derive at least 50% of their revenues from products and services in one or more of the following five themes: (1) alternative energy; (2) sustainable water; (3) green building; (4) pollution prevention; and (5) energy efficiency.

While a combination of funds that have adopted ESG Integration or ESG Integration-Mixed approaches dominated the best performing funds league table, there were also four thematic oriented funds that led with strong performance results in July.

10 Bottom Performing Funds—July 2020

10 Bottom Performing Funds—July 2020

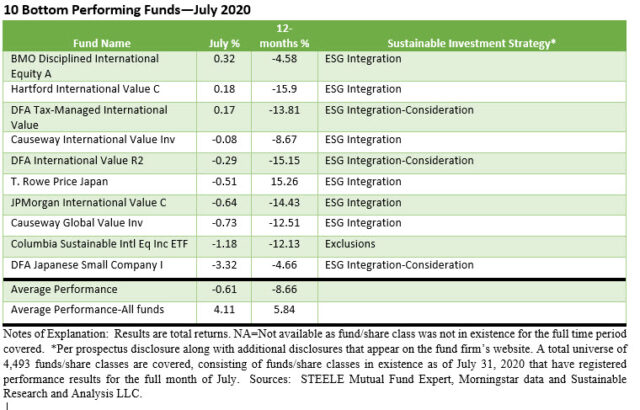

The 10 worst performing funds/share classes and ETFs posted an average return of -0.61% in July, with results ranging from -3.31% to 0.32%. Dominating the performance laggards were funds investing in Japan, which on a national level, gave up -1.6% in July, as well as value-oriented international funds. All but one of the poorest performing funds in July employed an ESG Integration investing approach. The one exception is Columbia Sustainable International Equity Income ETF, -1.18%, a fund that relies on an exclusionary approach that screens companies for “sustainability” through the application of an MSCI environmental, social and governance (ESG) rating methodology designed to exclude companies with unfavorable corporate ESG practices. Otherwise, the funds integrate ESG or, as is the case with the three funds managed by DFA, the advisor may also adjust the representation of an eligible company in the portfolio, or exclude a company, that DFA believes to be negatively impacted by environmental, social or governance factors (including accounting practices and shareholder rights) to a greater degree relative to other issuers.

Fund strategy definitions:

Values-based Investing. A strategy based on the guiding principle of investments that are based on a set of beliefs that contain a view toward achieving a positive societal outcome. Typically, this approach is executed via negative screening, divestiture or divestment.

Exclusionary Investing. The exclusions of companies or certain sectors from portfolios based on specific ethical, religious, social or environmental guidelines. Traditional examples of exclusionary strategies cover the avoidance of any investments in companies that are fully or partially engaged in gambling, sex related activities, the production of alcohol, tobacco, firearms, fossil fuels or even atomic energy. These exclusionary categories have been extended, in recent years, to incorporate serious labor-related actions or penalties, compulsory or child labor, human rights violations and genocide.

Impact Investing. A still relatively small but growing slice of the sustainable investing segment. Impact investments are investments directed to companies, organizations, and funds with the intention to achieve measurable social and/or environmental impacts alongside a financial return. The direct capital in this strategy addresses challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, affordable and accessible basic services, including housing, healthcare, and education. Some funds may seek to achieve impact without necessarily making a commitment to achieve measurable outcomes.

Thematic Investing. An investment approach with a focus on a particular idea or unifying concept. Clean energy, clean tech and gender diversity are a few of the leading sustainable investing fund themes. Investing in green bonds or low carbon emitting stocks, bonds and funds also fall into the thematic investing category.

ESG Integration. The investment strategy by which environmental, social and governance factors and risks are systematically analyzed and, when deemed relevant and material to an entity’s long-term performance, influence the buy, hold and sell decision of a security. For these reasons, ESG integration is referred to as a value-based investing approach.

There are at least three distinct forms of ESG Integration: (1) ESG Integration-Consideration. ESG may be factored into investment decisions, (2) ESG Integration. ESG is accounted for in investment decision making and it may be accompanied by investee engagement and proxy voting, and (3) ESG Integration-Mixed in which ESG Integration is the overarching strategy but additional approaches may also be employed, such as exclusionary investing or impact investing.

Engagement/Proxy Voting. Engagement/Proxy Voting leverage the power of shareholder ownership in publicly listed companies using action-oriented approaches that rely on influencing corporate behavior through direct corporate engagement, filing shareholder proposals and proxy voting. These tools may be employed as a complement to one or more of the five sustainable investing strategies set out above.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

Sustainable Funds Performance Scorecard: July 2020

The Bottom Line: Thematic environmental and alternative energy funds led the performance pack in July 2020 while Japan-focused ESG Integration funds brought up the rear.

Share This Article:

The Bottom Line: Thematic environmental and alternative energy funds led the performance pack in July 2020 while Japan-focused ESG Integration funds brought up the rear.

10 Top Performing Funds—July 2020

The top 10 performing sustainable mutual funds/share classes and ETFs[1] registered an average 13.6% gain in July, beating the average sustainable fund results by a wide 9.5% margin. Sustainable funds across all security types and asset classes registered an average total return of 4.1% while the average performance of various fund categories, including US equity funds, foreign funds and fixed income funds and corresponding securities market indices, conventional as well as ESG-oriented, registered gains ranging from 0.62% to 6.6%.

From a low of 11.4% to a high of 22.7%, the best performing funds included three China-focused funds that either invested in alternative energy themes or that took account of ESG factors in investment decisions. The leading fund, for example, KraneShares MSCI China Environment ETF that gained 22.7% in July, invests in Chinese issuers that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating environmental degradation. Eligible securities are issued by small-cap, mid-cap and large-cap companies that derive at least 50% of their revenues from products and services in one or more of the following five themes: (1) alternative energy; (2) sustainable water; (3) green building; (4) pollution prevention; and (5) energy efficiency.

While a combination of funds that have adopted ESG Integration or ESG Integration-Mixed approaches dominated the best performing funds league table, there were also four thematic oriented funds that led with strong performance results in July.

The 10 worst performing funds/share classes and ETFs posted an average return of -0.61% in July, with results ranging from -3.31% to 0.32%. Dominating the performance laggards were funds investing in Japan, which on a national level, gave up -1.6% in July, as well as value-oriented international funds. All but one of the poorest performing funds in July employed an ESG Integration investing approach. The one exception is Columbia Sustainable International Equity Income ETF, -1.18%, a fund that relies on an exclusionary approach that screens companies for “sustainability” through the application of an MSCI environmental, social and governance (ESG) rating methodology designed to exclude companies with unfavorable corporate ESG practices. Otherwise, the funds integrate ESG or, as is the case with the three funds managed by DFA, the advisor may also adjust the representation of an eligible company in the portfolio, or exclude a company, that DFA believes to be negatively impacted by environmental, social or governance factors (including accounting practices and shareholder rights) to a greater degree relative to other issuers.

Fund strategy definitions:

Values-based Investing. A strategy based on the guiding principle of investments that are based on a set of beliefs that contain a view toward achieving a positive societal outcome. Typically, this approach is executed via negative screening, divestiture or divestment.

Exclusionary Investing. The exclusions of companies or certain sectors from portfolios based on specific ethical, religious, social or environmental guidelines. Traditional examples of exclusionary strategies cover the avoidance of any investments in companies that are fully or partially engaged in gambling, sex related activities, the production of alcohol, tobacco, firearms, fossil fuels or even atomic energy. These exclusionary categories have been extended, in recent years, to incorporate serious labor-related actions or penalties, compulsory or child labor, human rights violations and genocide.

Impact Investing. A still relatively small but growing slice of the sustainable investing segment. Impact investments are investments directed to companies, organizations, and funds with the intention to achieve measurable social and/or environmental impacts alongside a financial return. The direct capital in this strategy addresses challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, affordable and accessible basic services, including housing, healthcare, and education. Some funds may seek to achieve impact without necessarily making a commitment to achieve measurable outcomes.

Thematic Investing. An investment approach with a focus on a particular idea or unifying concept. Clean energy, clean tech and gender diversity are a few of the leading sustainable investing fund themes. Investing in green bonds or low carbon emitting stocks, bonds and funds also fall into the thematic investing category.

ESG Integration. The investment strategy by which environmental, social and governance factors and risks are systematically analyzed and, when deemed relevant and material to an entity’s long-term performance, influence the buy, hold and sell decision of a security. For these reasons, ESG integration is referred to as a value-based investing approach.

There are at least three distinct forms of ESG Integration: (1) ESG Integration-Consideration. ESG may be factored into investment decisions, (2) ESG Integration. ESG is accounted for in investment decision making and it may be accompanied by investee engagement and proxy voting, and (3) ESG Integration-Mixed in which ESG Integration is the overarching strategy but additional approaches may also be employed, such as exclusionary investing or impact investing.

Engagement/Proxy Voting. Engagement/Proxy Voting leverage the power of shareholder ownership in publicly listed companies using action-oriented approaches that rely on influencing corporate behavior through direct corporate engagement, filing shareholder proposals and proxy voting. These tools may be employed as a complement to one or more of the five sustainable investing strategies set out above.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact