Parnassus Funds

Parnassus Asset Management

12/31/2017 Annual Report filed as of 2/9/2018

Observations:

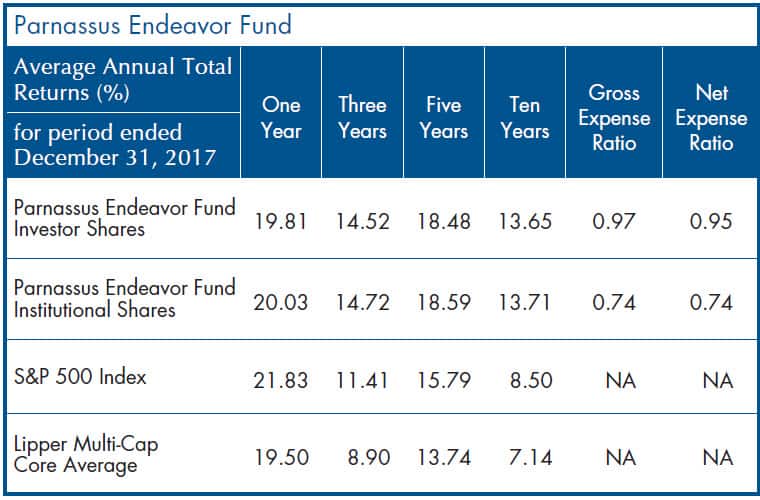

- The annual report covers six funds and their corresponding share classes, 12 in total, including the Parnassus Fund, Parnassus Core Equity Fund, Parnassus Endeavor Fund, Parnassus Mid Cap Fund, Parnassus Asia Fund and Parnassus Fixed Income Fund. None of the funds and share classes outperformed their designated non-ESG securities market indexes during the one year period ended December 31, 2017. Over five time periods, 1-year, 3-year, 5-year and 10-year periods to December 31, 2017, 31% of the funds beat their designated indexes. Of these, Parnassus Endeavor achieved the best intermediate and long-term track record. Refer to performance chart below.

- Fund specific year in reviews and outlook and strategies do not offer specific links or references to sustainable considerations affecting sector or stock selection. At the same time, the report includes Responsible Investing Notes that highlights the company’s two significant engagement initiatives and outcomes with companies held in the Parnassus Funds.

Principal Sustainable Investment Strategy:

Hover over fund group name or refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Report Commentary:

Responsible Investing Notes

As I reflect on 2017, I’d like to highlight two significant engagements with companies held in the Parnassus Funds. One of these engagements resulted in Parnassus divesting from two companies and the other netted a significant win for responsible investors.

As part of the ESG team’s ongoing reviews, we surveyed the Parnassus Funds holdings to identify high-risk companies. As the year unfolded, we became increasingly concerned about our exposure to the nation’s burgeoning opioid crisis through two companies, McKesson Corporation and Cardinal Health. These are two of the largest drug distributors in the country.

The opioid crisis is a complex national public health emergency that has resulted from a systemic failure across the entire drug supply chain. Opioids like oxycodone and hydrocodone are inexpensive, loosely prescribed and highly addictive; they are also often gateways to illicit street drugs like heroin. The human impact of the opioid crisis is immense, killing 91 Americans a day1. The Center for Disease Control and Prevention estimates that the economic burden of prescription opioid misuse is $78.5 billion per year. This estimate includes the costs of healthcare, lost productivity, addiction treatment and criminal justice involvement.

Our due diligence included engaging with McKesson and Cardinal Health executives, third-party research providers and litigation experts, as well as monitoring the growing number of lawsuits and investigations. It became clear to us that these two companies did not adequately monitor and stop suspicious opioid orders even though they are legally required to under the Title 21 United States Code Controlled Substances Act to implement controls to prevent diversion. While the distributors do not manufacture or prescribe opioids, they are in a unique position that affords them the visibility – and therefore the responsibility – to help prevent diversion. In our view, both companies’ responses to the opioid crisis have been insufficient compared to the harmful impact their distribution practices have had on affected communities. For these reasons, we concluded that McKesson and Cardinal Health no longer met our ESG standards, and we divested our positions across the Parnassus Funds.

On a brighter note, I’m delighted to share with you a positive development with Wells Fargo, which has worked hard over the past year to repair its damaged reputation. From eliminating sales goals in its Community Banking division to replacing three board members, Wells Fargo has taken significant steps to improve its relationships with its customers, stakeholders and shareholders. (If you would like to review the details of our ongoing engagement with Wells Fargo, please visit the News & Updates page on www.parnassus.com or read our past quarterly reports.)

One issue we believed Wells Fargo needed to address was its involvement in the Dakota Access Pipeline (DAPL) project. This controversial pipeline project caused an uproar across the nation, leading to closely watched protests and negative sentiment towards companies involved in its construction. A consortium of seventeen banks, including Wells Fargo, lent money to finance the DAPL.

We concluded from our discussions with Wells Fargo that they could not have predicted the consequences of financing the DAPL. More importantly, we became convinced Wells Fargo would not have financed the project had it known how much it would upset its customers, shareholders and stakeholders. We understood that Wells Fargo was contractually obligated to finance the project, but we believed the bank could take action to repair its relationship with the Standing Rock Sioux Tribe. In February, as part of our engagement with Wells Fargo about the DAPL, we asked the bank to donate its profits from financing the DAPL to the Standing Rock Sioux Tribe. Wells Fargo indicated they would consider this donation.

Over the course of the year, we engaged in multiple calls and meetings with Wells Fargo, urging the bank to act. We had three calls with Wells Fargo’s Head of Corporate Responsibility and Community Relations, Jon Campbell. We met with Wells Fargo’s CEO Tim Sloan, and later in the year with incoming Board Chair Elizabeth Duke. During each conversation, we discussed our proposed DAPL donation. In October, Wells Fargo acknowledged to us that financing the DAPL had affected the bank’s relationship with the American Indian and Alaskan tribes that are customers of the bank. In December, Wells Fargo announced a five-year $50 million commitment to the American Indian and Alaskan tribes, which was significantly greater than our request. These monetary grants, to be issued starting in early 2018, will target environmental sustainability, economic empowerment, and diversity and social inclusion programs focusing on the impacted tribes.

We recognize this commitment will not solve the problems created by DAPL; however, we believe these grants are an important first step as Wells Fargo begins mending its relationships with the American Indian and Alaskan tribes. We are pleased to see Wells Fargo take a leadership role in its support of Native Americans, and our hope is that the other banks involved in financing the DAPL will follow in Wells Fargo’s footsteps. Parnassus Investments thanks you for your continued investments throughout this period. Furthermore, we will continue to put your shares to work to help achieve positive impacts.

Thank you for your investment in the Parnassus Funds. It is a privilege to have you as an investor.

Performance Results (Limited to Parnassus Endeavor Fund):

Pax World Funds

Pax World Management

Impax Asset Management LLC (formerly known as Pax World Management LLC)

12/31/2017 Annual Report filed as of 3/7/2018

Observations:

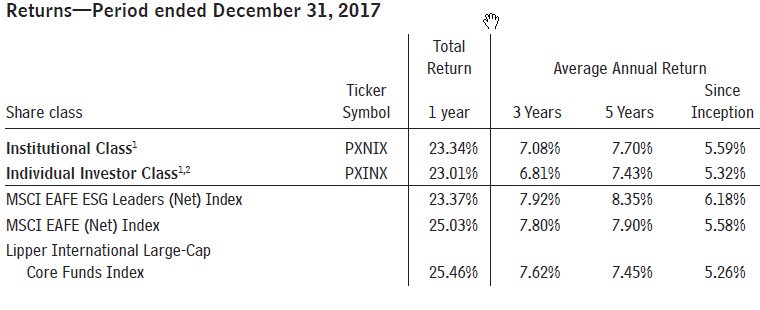

- The annual report covers 11funds and their corresponding share classes, 23 in total, including the Pax Large Cap Fund, Pax Mid Cap Fund, Pax Small Cap Fund, Pax ESG Beta Quality Fund, Pax ESG Beta Dividend Fund, Pax MSCI EAFE ESG Leaders Index Fund, Pax Ellevate Global Women’s Index Fund, Pax Global Environmental Markets Fund, Pax Core Bond Fund, Pax High Yield Bond Fund and Pax Balanced Fund. Only four funds report performance results in excess of their designated non-ESG securities market indexes for intervals ranging from 1-year to 10-years or since inception. In fact, the funds/share classes outperform their designated non-ESG indexes in 24% of the time, with two significant exceptions. The Pax Ellevate Global Women’s Index Fund, a thematic fund, outperformed its designated MSCI World (Net) Index over the previous 1-year and 3-years during which it sought to replicate the Pax Global Women’s Leadership Index (start is June 4, 2014) and the Pax Global Environmental Markets Fund

- The annual reports, via a letter to shareholders and also a sustainable investing update that are reproduced below, highlight the investment manager’s engagement initiatives to advance gender equality as well as disclosure and mitigation efforts to reduce greenhouse gas emissions. Further, some funds, such as the Pax Large Cap Fund refers to a general increase in the fund’s exposure to companies with a high Pax Sustainability Score while the Pax Bond Fund notes that the fund purchased a number of impact holdings during the year, to increase its impact holdings to 13.1% of the portfolio, including a Tesla Energy Solar asset-backed securities (ABS), green Fannie Mae Commercial mortgage-backed securities (CMBS) and green taxable municipal bonds. Two funds in particular link the fund’s sustainability strategy to sector and/or stock selection. These are two thematic funds and the comments are reproduced below.

Principal Sustainable Investment Strategy:

Hover over fund group name or refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Report Commentary:

Letter to Shareholders

2017 was a tale of two cities: a banner year for financial markets but a much more troubled, unsettled year in our larger national life. As investors, we were lifted up by markets; as citizens, perhaps many did not find the year quite so uplifting.

We live in unsettled, difficult times, obviously, but there is also a fundamental strength underlying the American economy, and more importantly, the character of the American people – something politicians and politics may test from time to time, or even undermine, but ultimately cannot destroy. This at least remains my fervent and abiding hope.

Equity markets had an extraordinary year, extending an eight-year run dating back to March 2009. The animal spirits that fuel markets tend to be favorably disposed toward easy money, liquidity and tax cuts, regardless of the long-term consequences, so this buoyancy has only accelerated the market’s climb. Perhaps more importantly, I think the rising market reflects strong fundamentals in the U.S. economy, and to some extent in Europe and elsewhere: low inflation, low interest rates and low unemployment coupled with strong corporate earnings and continued economic expansion.

Pax World shareholders have participated in this remarkable market growth even though some of our high-quality, lower-risk strategies don’t perform quite as well in a momentum-driven market such as the one we have been witnessing. That said, some of our funds experienced noticeable growth in 2017. The Pax Global Environmental Markets Fund (PGRNX), for example, grew from under $350 million at the beginning of the year to over $600 million at year end. This is a testament not only to its strong performance (see pp. 42 herein) but also to investors’ growing interest in companies that are providing solutions to global environmental challenges.

The big story at Pax this year was probably the sale of our investment adviser, Pax World Management LLC, whose name changed to Impax Asset Management LLC after being purchased by a wholly-owned subsidiary of Impax Asset Management Group plc of London, England. The name of Pax World Funds will not change, of course, nor will the sustainable investing approach we have pursued for many, many years.

As you undoubtedly know, the Funds’ shareholders have overwhelmingly approved new investment advisory agreements in connection with the acquisition. We view this as further recognition of the tremendous synergies that accompany this combination. Pax and Impax are two of the leading investment managers – indeed pioneers – focused on investing in the risks and opportunities arising from the transition to a more sustainable global economy. The two firms – now one – have highly complementary areas of investment management expertise, together with a strong product and geographic fit. We will now have significantly expanded investment management, research and client service capabilities, which in turn will enhance the resources and services we hope to offer existing and prospective shareholders and clients. Moreover, Pax and Impax already know each other well as Impax Asset Management Ltd. has been the sub-adviser for the Pax Global Environmental Markets Fund since we launched it in 2008. We could not be more pleased by this exciting combination.

The big story outside Pax this year – in addition to the daily drama of the Trump administration – was not only the parade of famous names (Harvey Weinstein, Matt Lauer, Charlie Rose, etc.) linked to sexual harassment scandals, but more importantly, the brave women who came forward, the meteoric rise of the #MeToo and “Time’s Up” movements, and Time Magazine bestowing “Person of the Year” honors on the victims of sexual abuse who have stood up to put an end to it.

At Pax, we strongly believe that eliminating sexual harassment and violence in the workplace requires strong corporate cultures and strong governance, and these in turn are bolstered by more women in the boardroom and more women in senior management. Gender diversity may not be the only answer to eliminating workplace harassment and violence, but we believe it is a key answer.

Yet women only hold 24% of corporate board seats and 17% of senior management positions globally. This needs to change – and at Pax we are working hard to change it.

Pax has been a recognized leader in gender lens investing from its earliest days, and in 2014 we launched the Pax Ellevate Global Women’s Index Fund (PXWEX), the first mutual fund to invest in the highest-rated companies in the world for advancing women through gender diversity on their boards and in executive management. Of the companies in the Fund, 99% have two or more women on their board and 91% have three or more women on their board. Women hold 35% of board seats and 29% of senior management positions among companies in the Fund, vs. global averages of 24% and 17%, respectively.1 The Fund provides our shareholders with the opportunity to invest in companies that are promoting gender diversity, building stronger cultures and governance, and making a genuine difference when it comes to sexual harassment and violence.

In fact, as investors we can not only invest in companies that are advancing women, we can also put pressure on companies that aren’t doing enough. A key element of gender lens investing is engaging with companies, encouraging them to do better. For example, since 2010, Pax has voted its proxies against or withheld support from more than 1,100 corporate board slates due to insufficient gender diversity. We also file shareholder resolutions asking companies to add more women to their boards. As a founding member of the Thirty Percent Coalition, we have worked with other institutional investors to convince over 150 companies to add women to their boards.

We have also filed shareholder resolutions asking companies to conduct pay audits to determine if disparities exist between male and female employees. We convinced Apple – the largest company in the world – to take such steps while a shareholder resolution we filed with Oracle received a majority of votes from outside shareholders. We petitioned the Securities and Exchange Commission to require companies to disclose pay ratios between male and female employees. We are committed to using our clout as investors to try to close the wage gap.

The point is this: our investments can make a profound difference when it comes to promoting gender equality – and indeed, on a range of other critical social and environmental issues. On behalf of Pax World Funds and our renamed management company, Impax Asset Management LLC, I can tell you that we remain committed, as always, to careful stewardship of your investment portfolios and to making a difference – for you, your families and the world we live in.

Pax Ellevate Global Women’s Index Fund

How did the Pax Ellevate Global Women’s Index Fund (the Fund) perform for the period?

For the one-year period ended December 31, 2017, the Individual Investor and Institutional Class had total returns of 24.86% and 25.14%, respectively, compared to 22.78% for the Pax Global Women’s Leadership Index (Women’s Index), 22.40% for the MSCI World (Net) Index (World Index) and 22.55% for the Lipper Global Multi-Cap Core Funds Index.

The Fund’s investment process, which overweights companies with favorable gender leadership characteristics, added value in 2017. The Institutional share class (PXWIX)1 outperformed the World Index by 274 basis points (bps)2 and the Women’s Index by 236 bps.

Investing in companies with greater representation by women in leadership is the Fund’s strategy for obtaining better long-term investment performance. For the 42-month period ended December 31, 2017 – since the Fund was reorganized as the Pax Ellevate Global Women’s Index Fund – the Fund has outperformed the World Index: Institutional Class shares and Individual Investor Class shares have returned 8.43% and 8.17%, respectively, versus the World Index return of 7.85%. Outperformance during this period came with lower risk.3 Over the 42-month period ending December 31, 2017, the Fund’s Institutional Class has produced 12% lower beta, 10% lower standard deviation and 15% lower downside capture versus the World Index.4

In addition, the Fund has produced strong results compared with peers. The Institutional Class shares of the Fund (PXWIX) has posted a top 32% ranking (out of 139 funds) over the 42-month since reorganization period, and a top 32% ranking (out of 144 funds) for the three-year period ended December 31, 2017, based on average annual returns within the Lipper Global Multi-Cap Core classification.5

The Fund’s gender leadership profile added the most to relative performance versus the World Index during the 42-month since reorganization period ending December 31, 2017. Over this period, the Fund’s overweight to the highest-rated gender leadership group and its underweights to the lowest-ranked companies within the bottom two quartiles have fueled the Fund’s outperformance. In addition, companies with three or more women directors and at least 25% women in senior management have contributed significantly to long-term performance.

What is the investment objective of the Fund?

The Fund seeks investment returns that closely correspond to or exceed the price and yield performance, before fees and expenses, of the Women’s Index, an index of companies around the world that are leaders in advancing women through gender diversity on their boards of directors and in management, and through other policies and programs.

The Fund’s strategic beta investment approach overweights companies with more favorable gender leadership characteristics – e.g., the number of women on the board of directors and women in management – rather than weighting companies in the Fund based solely on market capitalizations.

Women hold 35% of the board seats and 29% of senior management positions in companies in the Fund, compared to 24% and 17%, respectively, within the World Index. In addition, 91% percent of companies in the Fund have three or more women on the board and 99% have two or more women on the board, compared with 41% and 67%, respectively, for companies in the World Index. 34% of companies in the Fund have a woman CEO or CFO, compared with 14% of companies in the World Index.6

What contributed positively and negatively to performance

The Fund’s gender leadership profile added the most to relative performance versus the World Index during the year. For the year, companies ranked in the top quartile or the highest-rated gender leadership group added the most to relative performance, while no allocation to the gender laggards in the bottom quartile detracted slightly. In addition, companies with three or more women directors and companies with at least 25% women in senior management contributed meaningfully during the year.

On a sector basis, the Fund’s underweight allocation in Energy produced the most relative performance versus the World Index. This sector has notably fewer women in board and senior management roles than most others. The Information

Technology sector added to relative performance and was the highest performing sector in 2017. Notable Information Technology companies that were among the highest contributors include: Texas Instruments, Salesforce, Facebook, Xerox and Microsoft. Within Health Care, Pharmaceuticals and Health Care Equipment & Supplies added to outperformance. Consumer Staples and Telecommunications detracted the most during the year, driven by the underperformance of companies within Food Products: Kellogg Company and General Mills, and Diversified Telecom: AT&T and Verizon.

On a regional basis, the Fund’s North American and European region holdings added the most to relative performance, while holdings in the Pacific detracted during the year. Within North America, gender leaders in the U.S. produced the best relative results. Within Europe, gender leaders in France, Norway and the Netherlands added the most to relative performance. In the Pacific region, the Fund’s underweight to Japan – no Japanese companies rank among the top 400 companies in the world based on our gender diversity criteria – and Hong Kong, and selections within Australia detracted from relative performance.

Pax Global Environmental Markets Fund

How did the Pax Global Environmental Markets Fund (the Fund) perform for the period?

For the one-year period ended December 31, 2017, the Individual Investor Class, Class A, and Institutional Class of the Fund had total returns of 26.42%, 26.45%, and 26.79%, respectively, versus 23.97% for the MSCI All-Country World (Net) Index (“ACWI”) and 31.02% for the FTSE Environmental Opportunities Index Series (“FTSE EOAS”).

What factors contributed to the Fund’s performance?

A backdrop of robust global economic growth accompanied by muted inflation proved to be a supportive environment for global equity markets in 2017. Interest rates started to normalize, and while some regional political and certain geopolitical risks remained, stocks were buoyant given continued strong earnings delivery and much improved consumer confidence. Not surprisingly these dynamics supported Emerging Market equities as well, outperforming Developed Markets.

Severe weather events and natural disasters featured prominently in the news this past year. Record breaking hurricanes, torrential monsoon rains, and historic flooding claimed lives and destroyed property in the Caribbean, South Asia and the United States. Nations (and insurance companies) are increasingly footing record bills for such hard-to-anticipate and non-economic events around the world.

Not by coincidence, it is our view that global governments’ resolve to invest in sustainable economies is stronger than ever. Last year, the world emitted historic levels of carbon, resulting in many European countries forming an alliance to ‘Power Past Coal’ and several moving to ban fossil fuel cars by 2040. Strong environmental agendas in Europe include further investments in clean energy, a more sustainable transportation infrastructure, initiatives on Buildings Energy Efficiency improvements, smart grids, and waste. In China, Xi Jinping is moving aggressively on issues of air, water, and soil pollution, rolling out a combination of incentivizing and punitive environmental policies at an unprecedented pace. China is also prioritizing the building of a clean energy and transportation infrastructure, dealing with polluters and waste, and recognizing that clean water is essential to growing an economy. On the policy side, the United States government is lagging, but large states like California and New York are taking the lead instead.

At the company level, in addition to healthy economies and supportive policy, we believe that it is increasingly resource efficient economics for end market users and consumer preferences that are driving strong earnings for this portfolio of well-managed environmental solution providers.

Can you discuss any significant changes to the Fund’s positioning throughout the period?

The portfolio has been more defensively positioned given overall global equity valuations, and retains its underweight position in North America and an overweight position in Europe versus the ACWI.

The weighting in the Energy subsector increased over the year, with new allocations incorporating exposure to the transition to low carbon transportation and Buildings Energy Efficiency. Exposure to the Water subsector decreased as a result of profit taking on strong performing stocks in Water Infrastructure, Water Utilities, and Environmental Testing & Gas Sensing. The Waste allocation rose slightly, while exposure to the Sustainable Food & Agriculture subsector is roughly unchanged.

What portfolio holdings contributed positively to performance relative to the FTSE EOAS?

The Water sector contributed most to performance on both an absolute basis and relative to the FTSE EOAS. The Water Infrastructure subsector, including industrial capital goods companies active inflow and pump technologies, was notably strong as municipal budgets have recovered and much needed water infrastructure investments are being implemented. Pollution Control solution providers, especially Environmental Testing companies, also performed strongly all year. Whether for vehicle emissions testing, water quality monitoring or to detect toxins in food, it is our view that analytical instruments are a core part of the process of detection and therefore the management and solution for pollution challenges.

Stock selection within the Buildings Energy Efficiency and Transport Energy Efficiency subsectors also contributed positively to performance relative to FTSE EOAS. Buildings can use as much as 40% of their energy costs for heating and cooling alone, thus companies delivering energy-efficient insulation, heating & cooling and efficient hot water solutions, and smart lighting, added robust returns.

The acceleration away from petrol and diesel engines benefited companies with exposure to the electric and hybrid vehicle value chain, such as Delphi Automotive (now split into Aptiv and Delphi Technologies), a top contributor for the year. The portfolio managers favor investments in companies supplying critical components for this transition such as power electronics for vehicles and charging infrastructure. Forecasts for the arrival of the ‘tipping point’ in electric vehicle and hybrid sales are continuing to move closer, prompting automotive companies, related original equipment manufacturers (OEM) and technology providers to move in this direction.

What portfolio holdings detracted from performance relative to the FTSE EOAS?

All environmental markets subsectors produced positive absolute returns during 2017. An underweight to the Industrial Energy Efficiency subsector relative to the FTSE EAOS detracted most from performance as these names performed well during the year.

At the stock level, the few detractors suffered from stock specific issues. The notable laggard for the year was Acuity Brands (Buildings Energy Efficiency, US) which saw significant weakness due to inventory concerns and softness in certain product end markets.

Sustainable Investing Update, Julie Gorte, Ph.D

2017 was a year that many expected to be a disaster, from the perspective of sustainability. The year started off with the election of a climate-skeptic president who appointed someone who denies climate science to lead the Environmental Protection Agency (EPA), followed by announcements that the Administration intended to roll back the Clean Power Plan and withdraw from the Paris Agreement on climate change. The new cabinet is also 75% white and male, and you have to go back to the Reagan Administration to find one less diverse. The Administration also halted a rule that would have obliged large companies to report on pay by race and gender.

There may be no better way to illustrate the fact that the world is not only driven by public policy in Washington DC than what has actually happened. 2017 saw the launch of the “We Are Still In” coalition, a group of businesses and investors (including Pax), city and county leaders, state and tribal leaders, and higher education institutions that has committed to reducing emissions at levels compatible with the Paris Agreement.

While the regulatory pressure for reducing greenhouse gas emissions may have abated nationally, investors kept up the pressure on companies. For the first time in 2017, shareholder proposals filed with large oil companies asking for them to report on the impact of climate change on their future businesses passed—largely because many of the largest investors, including BlackRock and Vanguard, as well as many large pension plans—see climate change as a significant, possibly existential risk at such companies. Pax cofiled one of those shareholder proposals, at Occidental Petroleum. We also filed three others with UPS, ConocoPhillips, and Dominion Resources, asking that the companies assess what climate change means for them and establish incentives to reduce emissions, or adopt renewable energy targets.

Investors also launched a new engagement platform, the Climate Action 100+,that asks the world’s largest greenhouse gas emitters to strengthen governance on climate change, reduce emissions and improve climate-related financial disclosures. Pax is also a member of this initiative.

To put it bluntly, national policies aimed at relieving regulatory pressure on climate change have done nothing to assure investors that climate change is not a risk; a growing number of investors, large and small, see it as a significant source of risk that companies must accommodate.

Similarly, national rollbacks of policies supporting gender equality have not diminished financial pressure for companies to advance it. 2017 was also the year that some of the world’s largest investors began making their wishes for more gender-diverse boards known through their proxy voting: State Street reportedly voted against some directors at 400 companies that had no women on their boards of directors, joining Pax and other investors and asset owners who have voted this way for years. Other large investors have also begun voting for shareholder proposals to diversify boards.

And while the Trump Administration’s Equal Opportunity Employment Commission dropped an Obama-era proposal requiring corporate reporting on pay by gender and race, Great Britain instituted a gender pay reporting requirement. If reporting on pay by gender, race and other demographics becomes the norm elsewhere, U.S. companies that take advantage of Trump’s policy stance risk being seen as backward and uncompetitive. That is part of the reason that Pax filed six shareholder proposals asking for gender pay equity reporting this year; we were able to withdraw five of them after reaching agreements with the companies involved. At the sixth, Oracle Corp., our proposal received favorable votes by nearly 39% of the votes cast—and considering that Larry Ellison owns over 26% of Oracle’s shares, that constitutes a majority of all the other shareholders.

If there ever was a time when most of what corporations did was driven by public policy, we believe it is over now. The drivers of action are legion, and include investors, customers, stakeholders, workers, and, well, any interested citizen. Rolling back regulation may be popular in the short term, but when the regulations in question are aimed at solving real-world problems that have significant economic and financial costs, we expect the rollbacks to have limited impact.

Political headwinds are no fun, but they’re not show-stoppers either. If anything, the political sentiment of the current administration has stimulated action by us and other investors to keep the terms of sustainability firmly in the conversations and decisions of corporate boards and executive suites.

Performance Results (Limited to Pax Ellevate Global Women’s Index Fund):

ALPS ETF Trust-Workplace Equality Portfolio

ALPS Advisors, Inc.

11/30/2017 Annual Report filed as of 2/5/2018

Observations:

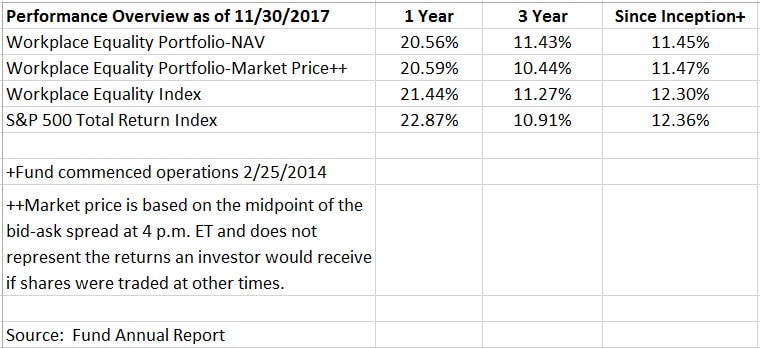

- For the 2017 fiscal year, the Workplace Equality Portfolio slightly outperformed its Workplace Equality Index (vs. NAV) but slightly underperformed the S&P 500 Index benchmark, returning 21.44% versus the benchmarks 22.87% return for the year.

- Fund commentary reflects on the rationale behind the creation of the index and investment vehicle.

Principal Sustainable Investment Strategy:

Hover over fund group name or refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Report Commentary:

Performance Overview

For the 2017 fiscal year, the Workplace Equality Index slightly underperformed its benchmark S&P 500 Index, returning 21.44% versus the benchmarks 22.87% return for the year. We originally created the screening process used in the Workplace Equality Index® as a way for LGBT oriented foundations to satisfy their fiduciary duty for broad equity market exposure while aligning with their support of companies that treat their LGBT employees with dignity, respect and equality. As an equally-weighted index, the small- and mid-cap exposure were a drag on performance in 2017 as the largest stocks in the benchmark index provided outsized contributions to return based on their large weights.

The bulk of the underperformance came from the technology sector. Our equal-weight methodology had a negative impact on performance relative to the benchmark. For example, the index’s average weight in Apple was 0.48% which gave Apple a performance contribution of 0.24% for the year. Compared to the benchmark’s average weight in Apple of 3.68%, providing a performance contribution of 1.84% for the year. This theme played out in the large technology companies that have come dominate market-cap weighted indices such as Facebook, Alphabet, and Microsoft.

The best performing stocks for the year included NVIDIA (+129%), Chemours Co. (+109%), PayPal (+98%), Boeing (+82%) and Yahoo spin-off Altaba (+77%). The worst performing stocks in the Underlying Index all came from the retail space, including Sears Holding (-69%), Avon Products (-61%), Macy’s (-44%), Barnes & Noble (-44%) and Mattell (-39%).

The positive relative performance came from Energy, Financials, Health Care, Industrials, Materials and Real Estate. The Consumer sectors struggled on a relative basis during the year, as did Information Technology as discussed above.

Stocks in the Workplace Equality Index outperformed their respective GICS sector peers in a majority of the economic sectors for the year, confirming our thesis that companies that treat all of their employees equally provide better shareholder returns in the long run.

Performance Results:

Note: Refer to annual reports for footnotes explanations.

The commentary appearing in this document represents excerpts taken from selected semi-annual and annual reports published by sustainable mutual funds and exchange-traded funds (ETFs) during the past month. The intention of the Round Up is to track relevant commentary and performance results provided by funds that pursue sustainable strategies across varying sectors and asset classes in an effort to better understand how such strategies are directly affecting performance results achieved during the covered reporting periods and also to tease out any information regarding positive societal outcomes achieved through the implementation of these sustainable strategies. These are juxtaposed against the fund’s sustainable investing strategy. Interested readers should consult the funds’ annual and semi-annual reports for the complete text of management’s discussions of investment outlook and fund performance.

The Round Up is not intended to cover all semi-annual and annual reports filed during the course of the month, but rather to offer a representative sampling by some of the leading sustainable funds in their respective sectors. The report for February 2018 also includes a March 7, 2018 Pax World filing.