Introduction/Summary

A review and analysis of the top 10 stocks held by the largest actively managed sustainable investment foreign mutual funds based on holdings as of September 30, 2019, all members of the Sustainable (SUSTAIN) Foreign Equity Fund Index and benchmarked against the MSCI ACWI ex USA Index consisting of stocks issued by large or mid cap companies domiciled in 26 emerging and 22 developed markets excluding the US, reveals that the ten funds are more concentrated with respect to their top 10 holdings. The funds also reflect varying sector preferences and exposure to a wider universe of stocks relative to the conventional benchmark. The most commonly held company is Unilever NV (or Unilever PLC). In addition, these funds invest in but maintain below top 10 index level exposure to three companies, namely HSBC Holdings PLC, Taiwan Semiconductor Manufacturing Co Ltd and Tencent Holdings Ltd. That said, three funds, whether for fundamental and/or ESG considerations, have excluded the three companies from their portfolios altogether. These findings are reviewed in this research article.

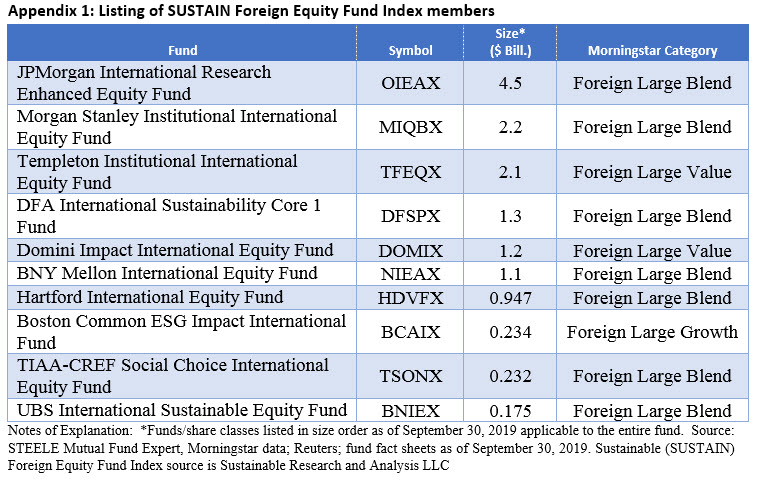

10 funds with about $14 billion in AUM

The ten funds, members of the SUSTAIN Foreign Equity Fund Index, all employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. On a combined basis, the funds managed $14.5 billion in assets as of September 30, 2019 . The funds invested over 88% of their assets in equity securities of non-US companies. These range from the highest, 97.71%, invested by the DFA International Sustainability Core 1 Fund to the lowest, or 88.26%, managed by the UBS International Sustainable Equity Fund. Seven of the ten funds are foreign large blend funds according to Morningstar’s classification, two funds fall within the foreign large value category and one is classified as foreign large growth fund. Refer to Appendix 1.

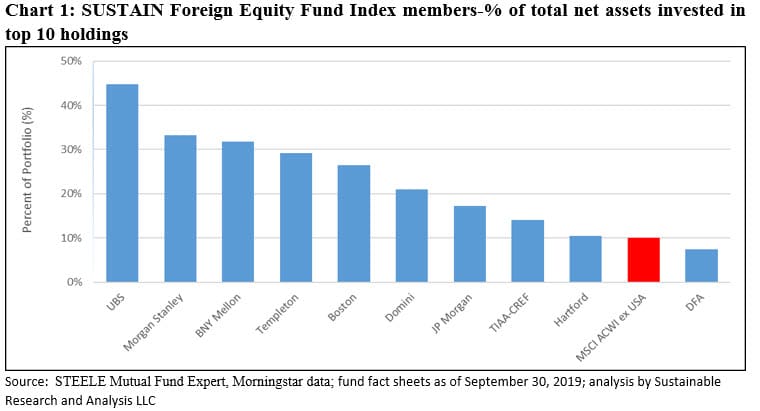

Sustainable fund portfolios are more concentrated in the top 10 holdings as compared to the MSCI ACWI ex USA Index

The top 10 holdings of the ten funds account for an average of 23.56% of each fund’s net assets versus 9.98% for the conventional MSCI ACWI ex USA Index. Varying from the Index, portfolio concentration runs as high as 44.76% for the UBS International Sustainable Equity. At 7.5%, the DFA International Sustainability Fund allocates the smallest percentage of its assets to its top 10 stocks as compared to the MSCI ACWI ex USA Index. Refer to Chart 1.

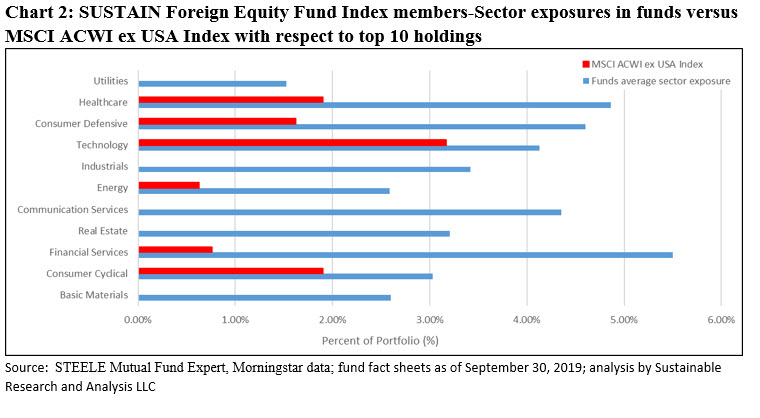

Sustainable funds reflect varying sector preferences relative to the MSCI ACWI ex USA Index

Viewed through the lens of each fund’s top ten holdings as well as the top 10 holdings of the MSCI ACWI ex USA Index, the top 10 fund holdings are allocated across four to seven of the 11 sectors that make up the Index whereas the holdings of the Index are spread across six sectors. The dominant fund sectors include Healthcare (all 10 funds invest in healthcare companies), Financial Services, Consumer Defensive and Industrials, with the last three being represented in the top 10 holdings of eight funds. For comparison purposes, the top 10 stocks that make up the MSCI ACWI ex USA Index belong primarily to companies in Technology, Healthcare and the Consumer Cyclical sectors.

In terms of sector concentration, the Morgan Stanley Institutional International Equity Fund is the most concentrated in the top 10 stocks, with four sectors accounting for 33.24% of assets, including the Consumer Defensive sector that represents 17.25% of the fund’s net assets. Another fund with a relatively high sector concentration is the UBS International Sustainable Equity Fund whose ten largest investments are allocated to five sectors, with Financial Services representing the largest share of 17.85% of its net assets.

Relative to the Index, none of the funds’ top ten investments were allocated to the following sectors: Utilities, Industrials, Communications Services, Real Estate and Basic Materials. On the other hand, the funds’ maintained the highest average overweight positions in Financial Services, 4.74%, Communications Services, 4.36%, and Industrials, 3.42%. While to a lesser extent, the average exposure to the Energy sector which was maintained by only four of the ten funds, also exceeded the Index weighting at 2.59% versus 0.63% for the Index, or a 1.96% differential. Refer to Chart 2. It should be noted that some funds, such as Domini Domini Impact International Equity Fund , exclude as a matter of policy companies included in the Integrated Oil & Gas or Oil & Gas Exploration & Production Industries sub-sectors.

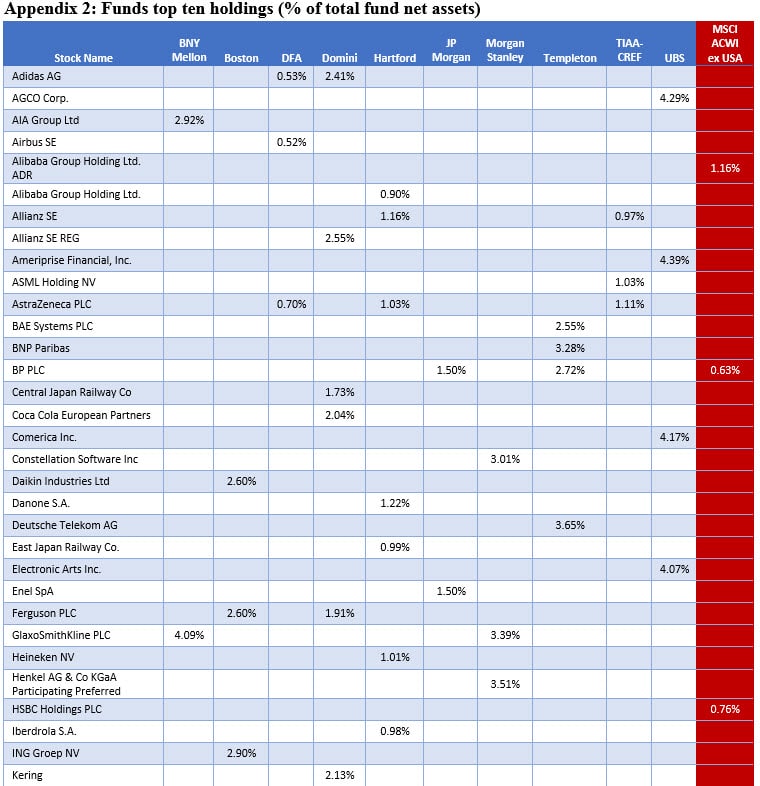

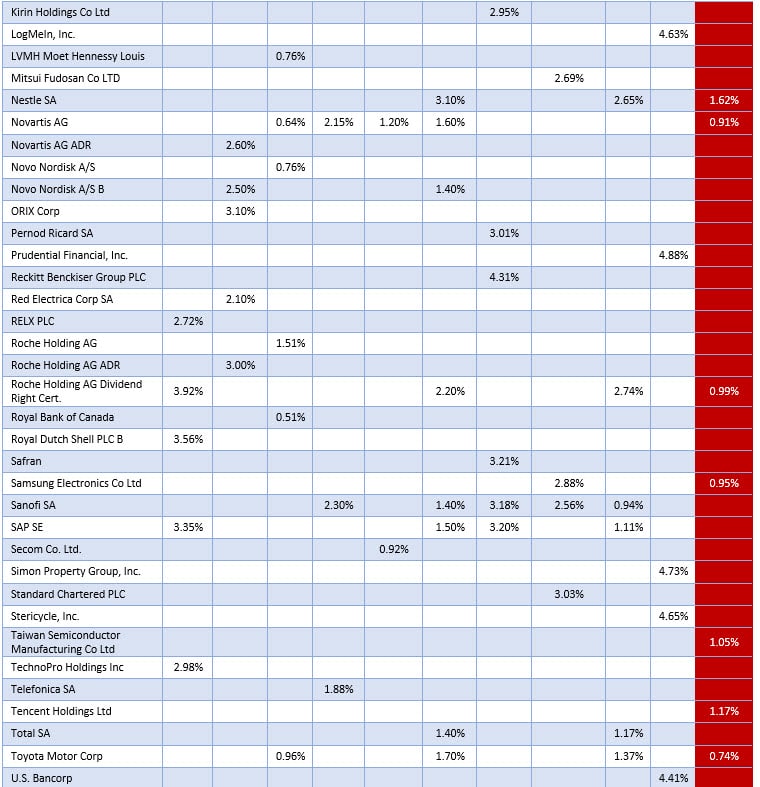

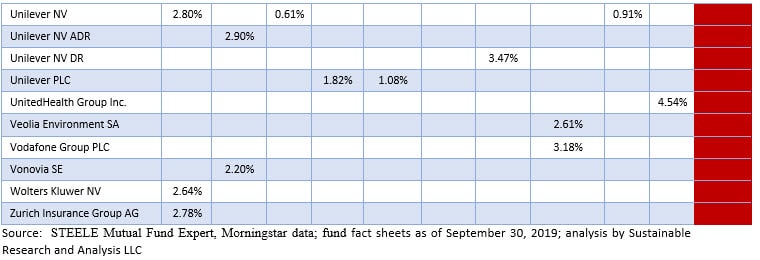

Wide range of top 10 stock holdings: 73 stocks issued by 65 companies

73 stocks issued by 65 separate companies are represented across the top 10 holdings of the 10 funds under consideration. This number consolidates various forms of ownership, including for example ADRs (Novartis AG ADR, Roche Holding AG ADR, Unilever NV ADR), dividend right certificates (Roche Holding AG Dividend Right Cert.), Class B shares (Novo Nordisk A/S B, Royal Dutch Shell PLC B) and preferred stock (Henkel AG & Co KGaA Participating Preferred).

Across all ten funds, not a single stock is commonly held by all ten funds. The most commonly held company is Unilever NV (or Unilever PLC) which in its various forms, including for example ADRs, is found among the top 10 holdings of seven funds. The exposure to Unilever NV or Unilever PLC ranges between 0.61% held by DFA International Sustainability Fund and 3.47% held by Morgan Stanley Institutional International Equity Fund. However, neither Unilever NV, nor Unilever PLC rank in the top 10 of the MSCI ACWI ex USA Index.

The next most widely held stocks are Roche Holding AG and Novartis AG with a portfolio share ranging between 1.51% and 3.92% and 0.64% and 2.60%, respectively. MSCI ACWI ex USA Index exposures to both companies are below 1%. Refer to Appendix 2. Three top 10 MSCI ACWI ex USA Index stocks are held in smaller proportions by sustainable funds Three stocks, including HSBC Holdings PLC, Taiwan Semiconductor Manufacturing Co Ltd, and Tencent Holdings Ltd that are ranked in the top 10 of the MSCI ACWI ex USA Index are absent from the top 10 holdings of the SUSTAIN constituent funds but are nevertheless held by one or more of the funds in small proportions. That said, three funds have omitted the above companies from their portfolios all together. These include Domini Impact International Equity Fund, TIAA-CREF Social Choice International Equity Fund and UBS International Sustainable Equity Fund. As noted earlier, such omissions may be due to fundamental considerations or ESG factors.

Only two of the ten funds, including Morgan Stanley Institutional International Equity Fund and Hartford International Equity Fund, have exposure to Tencent Holdings Ltd, China’s internet services company and owner of the popular messaging platform WeChat. Like Facebook in the US, the company has been exposed to controversy due to its data privacy and security policies.