Synopsis: This article defines impact investing, the small but growing segment that represents another one of the key sustainable investing strategies, and broadly identifies some of the impact investing options available to investors.

Introduction

Still a relatively small but growing slice of the sustainable investing segment, impact investments are moneys directed to companies, organizations, and funds with the intention to achieve measurable social and environmental impacts alongside a financial return. Impact investments can be implemented in both emerging and developed markets and made across asset classes, such as cash equivalents, equities, fixed income, venture capital, and private equity. In each instance, the objective is to direct capital to address the world’s pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services, including housing, healthcare, and education.

Historically, impact investments have targeted a range of returns from below market to market rate, depending on the investors’ strategic goals. But increasingly, impact investing strategies are expected to at least achieve risk-adjusted market rates of return.

Core Characteristics of Impact Investing

Impact investing as a segment of the sustainable investing sector is still small but growing and evolving. The size of the market remains difficult to pin down with precision. By some estimates as of 2014, about $109 billion was invested directly or indirectly in various impact strategies[1].

The practice of impact investing is further defined by the following core characteristics which, on a combined basis, serve to differentiate this strategy from other sustainable investing approaches:

- Intentionality. Essential to impact investing is an investor’s intention to have a positive social or environmental impact through investments.

- Return expectations. Impact investments are expected to generate a financial return on capital or, at minimum, a return of capital. That said, impact investments target financial returns that range from below market (sometimes called concessionary) to at least risk-adjusted market rates of return.

- Impact measurement. A hallmark of impact investing is the commitment of the investor to measure and report the social and environmental performance and progress of underlying investments, ensuring transparency and accountability while informing the practice of impact investing and building the field. The approaches of investors to impact measurement will vary, based on their objectives and capacities, and the choice of what to measure and how. These may reflect the complexity associated with measuring impact, and, consequently, investor intentions. In general, components of impact measurement best practices for impact investing include:

-Establishing and stating social and environmental objectives to relevant stakeholders.

-Setting performance metrics/targets related to these objectives, using standardized metrics where possible, or via qualitative descriptions.

-Monitoring and managing the performance of investees against these targets.

-Reporting on social and environmental performance to relevant stakeholders.

Investing Options

Issues of scale, diversification, liquidity and costs present challenges when it comes to making individual direct impact investments and therefore, with some exceptions, investing in managed funds is a more viable strategy for retail as well as a large segment of institutional investors. One exception is direct investment in green bonds, fixed-income securities, both taxable and tax-exempt, that raise funds specifically to finance new and existing projects with environmental sustainable benefits. These may include securities issued by sovereigns, development or supranational banks, corporations, states, cities and local government entities, such as water, sewer or transportation authorities. Green bonds offer yields and returns equivalent to their non-green bond counterparts.

There are currently a limited number of impact oriented mutual funds, including several established and newly launched green bond funds and one passively managed green bond ETF. But otherwise, qualifying investors may choose from several hundred impact investment funds that generally operate offshore. These funds cover a variety of asset classes and geographic focus, as well as a number of impact investing themes, including access to finance, access to basic services, employment generation, green technology, environmental markets and sustainable consumer products, to mention just a few.

Financial Return Expectations

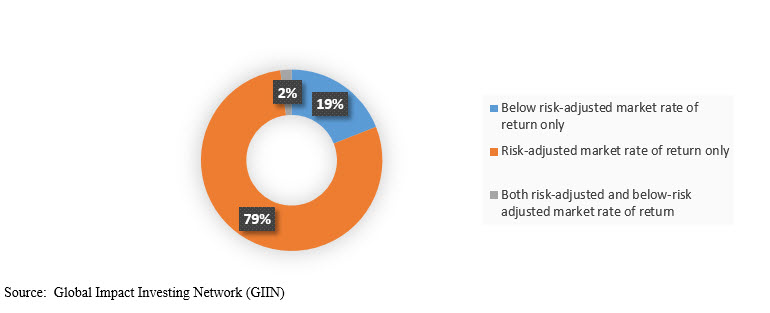

Impact investors have diverse financial return expectations. Some intentionally invest for below-market-rate returns, in line with their strategic objectives. Others pursue market-competitive and market-beating returns, as may be required for direct and indirect investments that are subject to fiduciary responsibility standards. According to a survey covering 405 funds (not including green bond funds) that was conducted by the Global Impact Investing Network (GIIN), impact funds listed in GIIN’s Impact Investment Fund Database (ImpactBase) in 2016 predominantly seek risk-adjusted market rate returns. This segment accounted for 79% of the funds while 19% sought below risk-adjusted market rates of return only. Refer to Exhibit 1.

Exhibit 1: Number of Funds by Return Targe

[1] Source: 2014 Global Sustainable Investment Review