Sustainable Investors Should Have a Way to Track and Evaluate Fund Outcomes

Sustainable investors who seek to achieve a positive societal outcome with their investments should have a way to track, evaluate and compare the range of outcomes, if any, linked to their investment portfolios and overarching objective of achieving a positive societal outcome. Otherwise, it’s not really possible to assess the fund manager’s sustainability performance and, at the same time, substantiate that the strategy is having some positive impact or outcome—optimally in line with investor expectations. In the event of unexpected outcomes, investors should have an understanding of the reasons for such results. Mutual funds, exchange-traded funds (ETFs) and other similar investment vehicles are required to publish at least twice a year semi-annual and annual reports that describe the financial results achieved by the funds, to compare the results relative to securities market indexes, disclose securities holdings and provide other relevant financial information. Some fund firms report to shareholders even more frequently. In particular for investment vehicles such as mutual funds and ETFs with explicit sustainable mandates, no such requirement regarding non-financial outcomes applies. That said, self-described sustainable investment funds, and to a much lesser extent funds without explicit sustainable mandates that integrate environmental, social and governance (ESG) factors into their investment strategies to identify potential value and manage risk, do offer regular and, in some cases, extensive voluntary sustainability oriented fund level updates even as the level and extent of disclosures vary. It’s also evident that such disclosures are evolving and these are in the process improving over time. Some fund firms, including Calvert and Neuberger Berman, have recently begun to publish fund specific impact reports that describe, through the use of selected metrics, how portfolios are performing with regard to sustainability and ESG considerations. This is very much in line with what investors should expect to receive from such funds along with expanded insights into the way sustainability considerations are integrated into the investment process.

Reviewing Current and Evolving Sustainable Disclosure Practices

To get an updated perspective of sustainable investing disclosure practices and how these may be evolving, a review was conducted into the disclosures offered by the largest 10 sustainable large cap US equity oriented funds with explicit sustainable mandates. Admittedly, the survey is limited in scope given the existence of 648 sustainable funds and ETFs managed or offered by 94 fund firms, but these the surveyed funds, managed by seven firms, represent the largest actively managed large cap domestic equity mutual funds that employ a broad-based sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. The funds comprise the SUSTAIN Large Cap Equity Fund Index and account for around 20% of the entire sustainable US equity sector’s assets under management. Refer to article entitled “Introducing the Sustainable Large Cap Equity Fund Index (SUSTAIN Large Cap Equity Fund Index).

Fund Level Sustainable Outcomes Not to be Confused with Ratings or Rankings

To clarify, fund level impact or outcome oriented disclosure practices, in particular, are not to be confused with ratings or rankings assigned to individual companies, issuers or even to funds, either by the investment management company or an independent third party. Rather, outcome oriented disclosures refers to reporting intended to reflect how sustainable policies and strategies are integrated into the investment process, including explanations to amplify the basis for company inclusions, particularly in connection with companies that might be exposed to low level and in some cases high level controversies, or exclusions, and the rationale for taking such actions. In addition, relevant disclosures should include or evolve to include measurable ESG targets and outcomes, expressed either in qualitative or, if possible and to the maximum extent possible, quantitative terms using relevant metrics. Admittedly, standards for some of these assessments are currently lacking and/or evolving. Also, periodic disclosures should extend to data on proxy voting as well as shareholder/investor dialogues with issuers covering important ESG factors. For example, the achievement of a specific reduction in carbon emissions based on information derived from individual company disclosures or specific outcomes achieved through engagement with companies to encourage them to improve or through proxy voting initiatives.

On the other hand, disclosure of sustainability ratings or rankings, whether these are applied to individual securities or to funds in the aggregate, much like the recently introduced Morningstar Sustainability Ratings, are useful in that they offer a point in time opinion about how well the companies held by a fund are approaching their ESG risks and opportunities when compared to similar funds. These are not substitutes for outcome oriented disclosures. Moreover, such ratings could potentially turn out to be volatile over time.

Sustainability Reporting Guidelines or Regulations Don’t Exist in the US Today

At the present time, sustainable or outcome-oriented disclosure standards do not exist in the US while in Europe some standards are beginning to emerge. For example, in 2016, the French government passed into law the Energy Transition for Green Growth Bill, a sweeping piece of climate legislation that includes a significant piece of legislation for the finance industry. Article 173 of the Energy Transitions law, which came into law in January, for the first time requires portfolio managers in France, both asset owners, and asset managers, to report on the environmental profile of their funds. The reporting not only must cover environmental, social and governance issues, but also must provide information on carbon footprints and green revenues. Although the reporting requirement is not mandatory, investors either must publish relevant disclosures by the end of 2017 or explain why they have chosen not to do so. It theoretically applies to more than 840 asset owners, including insurance companies, mutual funds, asset managers and provident institutions. While still early, results to-date are mixed and lack standardization. Moreover, no such legislation has been adopted to-date anywhere else, but this could change as sustainable investment products proliferate.

Current Sustainable Investing Disclosure Practices

For now, sustainable investors are dependent on the voluntary practices of investment management firms and, as the survey results below points out, practices vary, with the most comprehensive disclosures today being provided by sustainable-oriented investing managers. Also, it remains to be seen what the nature of future disclosures, if any, might be provided by firms that integrate environmental, social and governance (ESG) factors into their investment strategies strictly for the purpose of identifying potential value and manage risk.

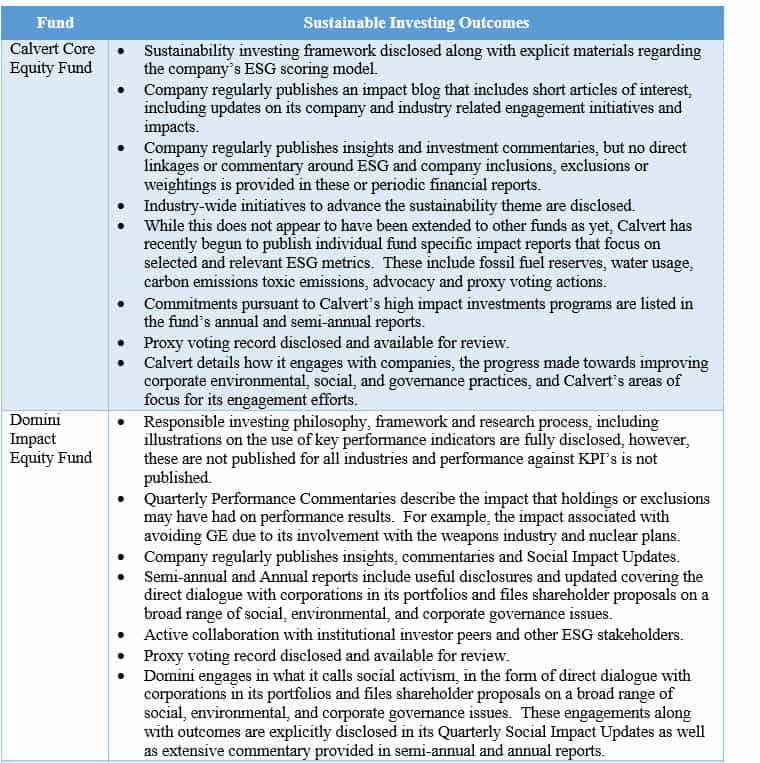

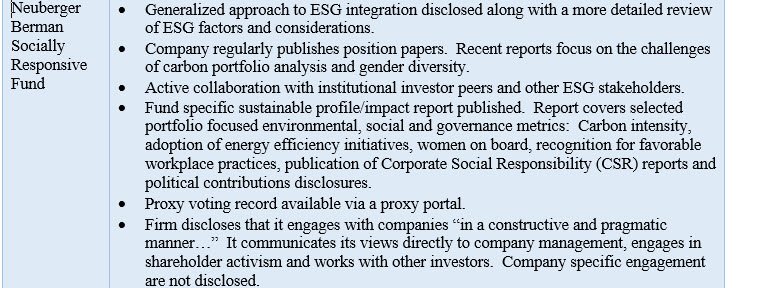

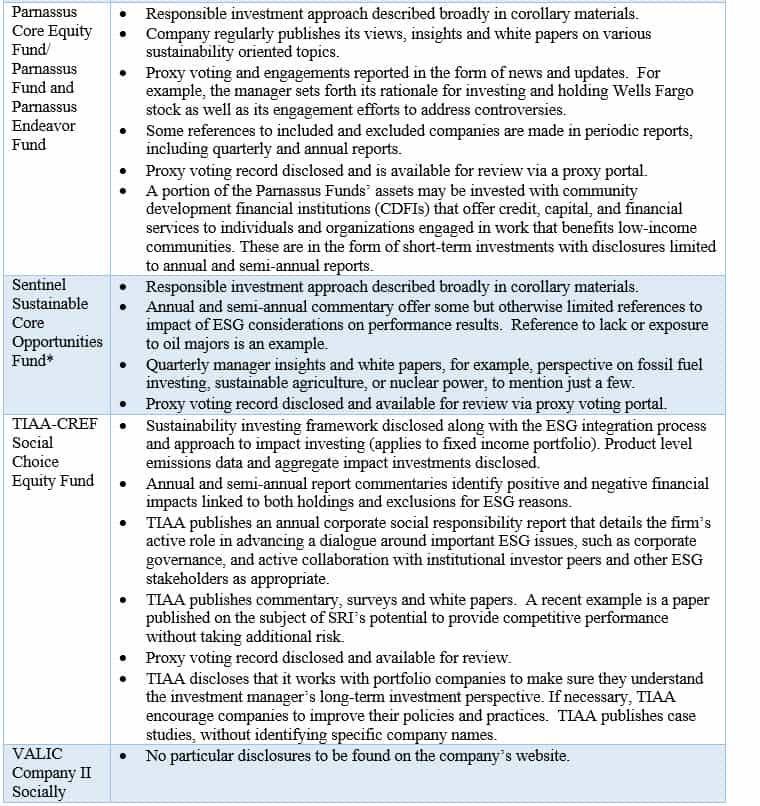

In brief, the conclusions of the review, set out in Table 1, are summarized below:

- Sustainable-oriented fund firms or firms that have made substantial commitments to the integration of sustainable investing themes over the years, either across all fund offerings or a subset of these, such as Calvert Research, Domini, Neuberger Berman, Parnassus and TIAA, offer more comprehensive and detailed reporting and disclosures relative to other firms.

- Two firms have begun to publish fund specific impact reports, including Calvert and Neuberger Berman. While this does not extend to all their funds as yet, Calvert’s report is applicable to the U.S. Large Cap Core Responsible Index Fund and it focuses on selected relevant ESG metrics. For example, these cover fossil fuel reserves, water usage, carbon emissions, toxic emissions, advocacy and proxy voting actions. In the case of Neuberger Berman, the report is applicable to its one explicitly mandated sustainable fund, and it characterizes the portfolio using specific environmental, social and governance metrics. These reports are not yet comparable and even while standards for calculating various metrics are evolving, they represent a good beginning for a new class of fund-specific impact reporting.

- All but one firm describe their approaches to sustainable investing, covering their sustainable investing philosophies, strategies, ESG integration, proxy voting and shareholder engagements, including outcomes, various research papers, and case studies. Some approaches and methodologies are more comprehensive and explicit than others.

- Sustainable-oriented fund firms offer informative and in some cases extensive updates on their proxy voting practices as well as company and industry related engagement initiatives and impacts.

What Sustainable Disclosures Should Investors Seek?

Practices are continuing to evolve but, in the end, investors in explicitly mandated sustainable investment funds, both actively managed as well as passively managed investment vehicles, should seek out and expect to receive transparent disclosures that inform their understanding of a fund’s sustainability achievements. These should allow investors to track, evaluate and also compare the range of outcomes across funds. To this end, the following information should, at minimum, be disclosed to investors:

- The approach and methodologies used to integrate sustainability practices into the investment management process.

- Information about how the sustainable methodologies have impacted decisions to include, exclude and weight companies, if applicable, based on the methodologies used. Explanations, illustrations, and case studies are useful.

- Portfolio performance focused on targeted sustainability and ESG objectives. Standards for assessment are evolving, are lacking or these are in the early stages of development and may not be available as yet across all impact areas. Still, investor-oriented annual fund specific reports should become common practice. These should describe and quantify the impacts achieved by the fund and its investments, using relevant and material metrics along with relevant explanations and assumptions.

- Shareholder engagement activities and outcomes, if any, and proxy voting records.

Items 1 and 2 above are also candidates for disclosure on the part of firms that integrate ESG into investment strategies and decisions–in line with disclosures that typically accompany financial considerations.

Table 1: Sustainable Investing Reporting and Disclosure Practices: Largest 10 Actively Managed Sustainable Large Cap Equity Funds (listed in alphabetical order)

Notes of Explanation: Sustainable investing practices, exclusion practices and ESG integration strategies are

set forth in in the Principle Investment Strategies section of each fund’s Summary Prospectus, Prospectus and

SAI. In addition to any proxy voting commentary and disclosures that may be provided on its website, fund

companies must file Form N-PX Annual Report of Proxy Voting Record of Registered Investment Company

which may be found on the SEC’s Edgar site at: https://www.sec.gov/edgar/searchedgar/mutualsearch.htm

*Effective 10/30/2017, in connection with the completion of the acquisition of the Sentinel mutual funds by

Touchstone Investments, the fund was reorganized into the existing Touchstone Sustainability and Impact

Equity Fund.