The Bottom Line: Recent sustainable fund investment option additions to 529 college-savings plans by Fidelity still leaves significant room for growth given increased investor interest.

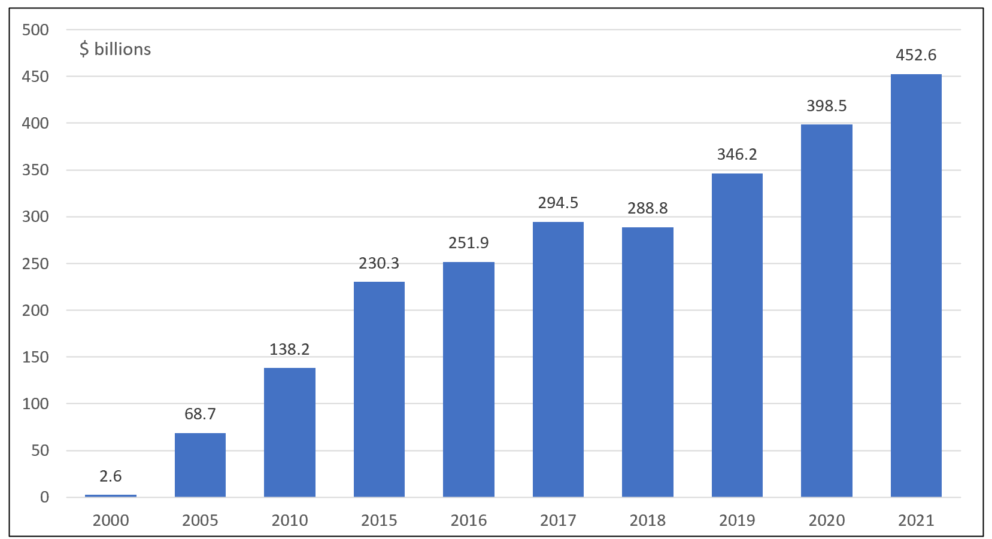

Section 529 Savings Plan Assets: Growth in assets under management 2000 – 2021 Note of Explanation: Data were estimated for a few individual state observations in order to construct a continuous time series. Source: Investment Company Institute.

Note of Explanation: Data were estimated for a few individual state observations in order to construct a continuous time series. Source: Investment Company Institute.

Observations:

- In early August, Fidelity Investments announced that it added sustainable investment options to five 529 college-savings plans in Connecticut, New Hampshire and Massachusetts. This investment option, a Sustainable Multi-Asset Portfolio, began operations on July 27, 2022 and became available for investment on August 1, 2022. An asset allocation fund whose assets are invested in underlying equity and bond funds managed by Fidelity, the fund invests in securities of issuers that Fidelity Management & Research Company believes have proven or improving sustainability practices based on an evaluation of such issuer’s individual environmental, social, and governance (ESG) profile and in Fidelity index funds that track an ESG index. The addition, according to Fidelity, was motivated by an increased interest in ESG.

- According to the Investment Company Institute, assets in Section 529 savings plans were $453 billion at year-end 2021, up 14% from year-end 2020. Sustainable investment options and sustainable assets under management in 529 college-savings plans are still limited today considering a strong interest on the part of investors generally in sustainable investing. Also, the long-term investment time horizon associated with college savings initiatives synch’s up with the market-level returns achieved by certain sustainable investing strategies while potentially offering investors an opportunity to achieve sustainability preferences.

- For example, based on a selected set of five MSCI US and foreign stock oriented ESG Leaders indices and one ESG Focus bond index that rely on positive screening and exclusions, intermediate-to-long term results continue to favor ESG benchmarks, except for small cap ESG stocks, a fractional 1 bps lag over 10-years for the MSCI USA ESG Leaders Index and a shift in the 3-year outcome of the MSCI Emerging Markets ESG Leaders Index. (Note: Refer to recent article entitled Sustainable stock and bond funds post an average gain of 6.5% in July at https://sustainableinvest.com/sustainable-stock-and-bond-funds-post-an-average-gain-of-6-5-in-july/). That said, it should be noted that short-term results versus conventional benchmarks tend to vary.

- Sustainable investing options in 529 plans has significant room for growth. The addition of Fidelity’s sustainable investing option brings to about 14 the number of state sponsored college-savings plans that offer at least one sustainable investment option offered by firms such as TIAA-CREF/Nuveen, Calvert, PIMCO, Vanguard and now Fidelity, to mention just a few.