Summary

Stock and bond markets worldwide delivered excellent returns in 2019. In December, markets favored stocks that posted above average monthly results while bond returns continued to decelerate. Encouraging news that the US China Phase 1 trade agreement will be signed on January 15 signaled a significant de-escalation of trade tensions between the two nations that have affected markets throughout the year both positively and negatively. This factor, combined with interest rate cuts, Fed liquidity, easing anxiety regarding the strength of the US economy and prospects that the longest expansion in US history will continue, moved markets higher in December notwithstanding continuing geopolitical and domestic political uncertainties linked to the President’s impeachment proceedings. The S&P 500 posted a total return gain of 3.0%, while the Dow Jones Industrial Average and Nasdaq Composite recorded 1.9% and 3.6% increases. Outside the US, developed and emerging market equities achieved even stronger returns, with the MSCI ACWI ex USA gaining 4.4% and emerging markets climbing 7.5%. Across other asset classes, investment-grade bonds dropped -0.1%, longer-dated bonds gave up almost 3.0%, while gold and energy in that order recorded increases of 3.6% and 6.9%. Within the energy sector, natural gas was the only commodity to fall back, giving up -3.0%.

The average performance of long-term sustainable funds in December, regardless of asset class or sector, a total of 3,313 funds/share classes, was 2.36%. International funds gained an average 4.11%, followed by US equity and specialty funds, up 2.70% on average and bond funds, taxable and municipals combined, added 0.77%.

Funds integrating ESG factors, including some funds offered by firms that equivocate on this point, dominated the roster of 60 top and bottom performing funds in December. But there were also variations within the three fund segments, most notably across the top performing US equity and sector funds that were dominated by thematic funds focused on the alternative energy sector. A total of 16 funds that ranked within the top 10/bottom 10 funds pursue thematic investing approaches.

US Equity and Sector Equity Funds/Share Classes: Average +2.70% in December

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

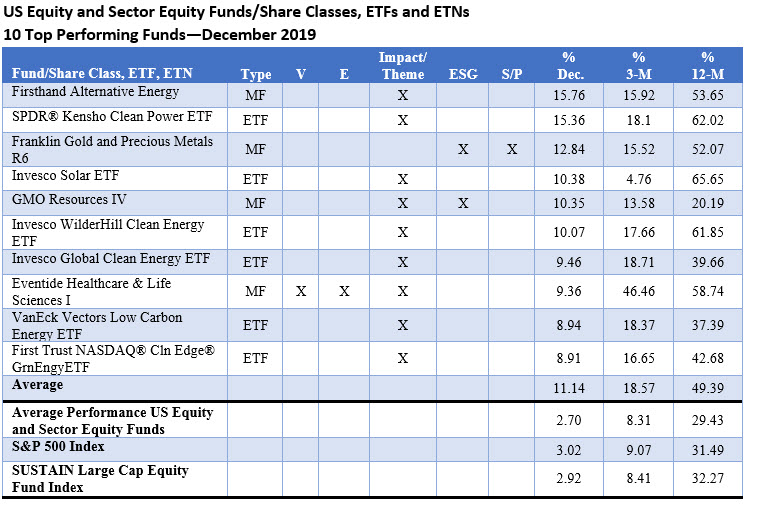

Franklin Gold and Precious Metals Fund R6 aside, the roster of top 10 US equity and sector equity funds was dominated mutual funds and ETFs investing in alternative energy companies, such as solar, wind, electric vehicles, mobile devices and renewable energy more generally. The top ten funds delivered an average 11.14% return in December, beating the average for all US equity and sector equity funds, up 2.70% and the S&P 500, up 3.02%. The top performing fund, Firsthand Alternative Energy, posted a gain of 15.76%. This smallish $6.2 million thematic fund invests its assets in alternative energy and alternative energy technology companies, both U.S. and international. The Franklin Gold and Precious Metals Fund R6, that integrates ESG factors, benefited from the uptick in gold prices that rose 3.6% during the last month of the year.

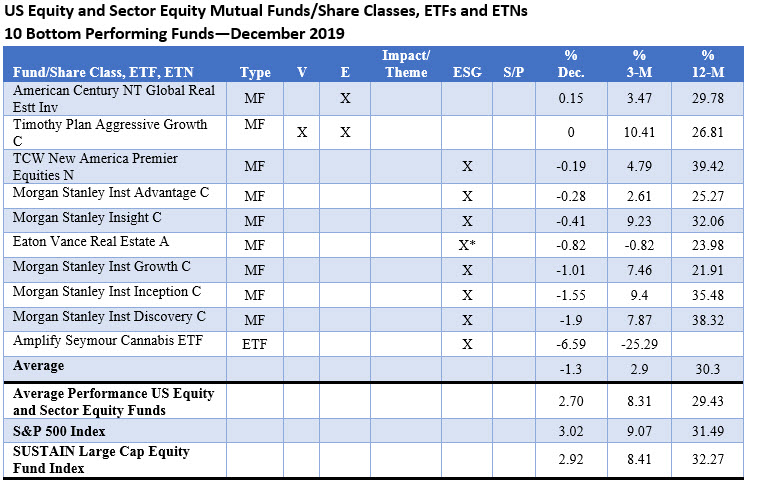

Very few funds within this segment consisting of 1,223 funds/share classes recorded zero to negative returns in December, but nine funds did. These funds reside within the bottom 10 performing US equity and sector equity funds that delivered an average return of -1.3%. That said, their returns range from the lowest, posted by the Amplify Seymour Cannabis ETF, that dropped -6.59% in December to a high generated by the American Century NT Global Real Estate Fund-Inv shares of 0.15%. The former fund integrates ESG scoring in its investment analysis while the latter employs and exclusionary approach that sidesteps tobacco companies from its portfolio.

International Equity Funds: Average 4.11% in December

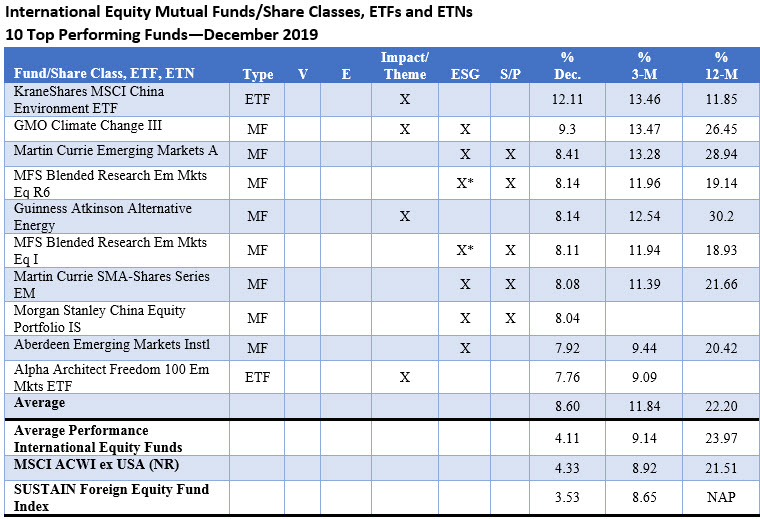

Even during a month when the MSCI ACWI, ex USA (Net) Index outperformed the S&P 500 in December by 1.4%, top performing international equity funds performed well but still posted a lower average return of 8.6% relative to the top performing US equity funds. In addition to several funds investing in emerging markets, environment and alternative energy, top funds include two China focused funds. The KraneShares MSCI China Environment ETF led the top funds category with its 12.11% return. This $1.9 thematic index ETF seeks to replicate the performance of the MSCI China IMI Environment 25/50 Index by investing in Chinese companies that derive at least a majority of their revenues from environmentally beneficial products and services, as determined by MSCI Inc.

A relative newcomer, the $15.1 million Alpha Architect Freedom 100 Emerging Markets ETF, launched in May 2019, posted a 7.76% return. The fund is designed to track the performance of a portfolio of approximately 100 equity securities listed in emerging market countries qualified by data covering 79 personal and economic freedom factors, including the rights to life (such as absence of terrorism, human trafficking, torture, and political detentions), liberty (such as rule of law, due process, freedom of the press, freedom of religion, freedom of assembly), and property (such as marginal tax rates, access to international trade, business regulations, established monetary and fiscal institutions, and size of government).

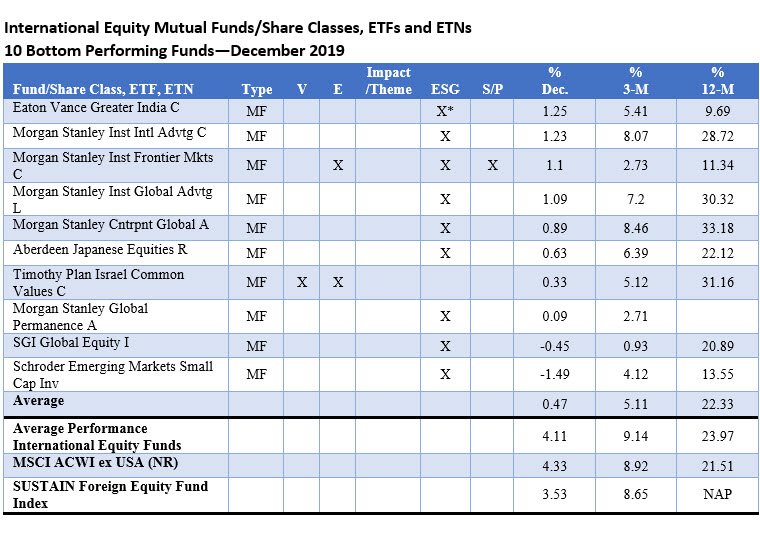

At the other end of the range, the ten worst performing international funds generated an average return of 0.47%. This cohort was led by the Schroder Emerging Markets Small Cap Inv. that was down -1.49%. The fund was scheduled for liquidation as of December 31, 2019. But also in the mix were funds investing in frontier markets, Japanese equities and India—the month’s emerging markets laggard that posted a return of just 1.5% in December.

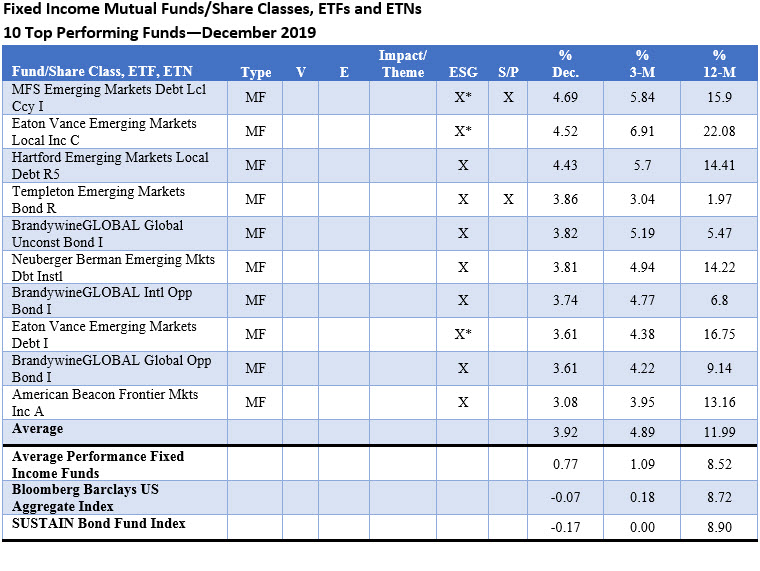

Fixed Income Funds: Average 0.77% in December

As the performance of fixed income fund continued to decelerate in December, emerging market debt funds denominated in local currency bucked the trend. The top 10 fixed income funds gained an average 3.92% and were led by MFS Emerging Markets Debt Local Currency Fund I that added 4.69% in December. Effective in October, the fund’s prospectus was amended to note that it “may also consider environmental, social, and governance (ESG) factors in its fundamental investment analysis.” MFS Emerging Markets was one of six leading funds focused on emerging or frontier markets.

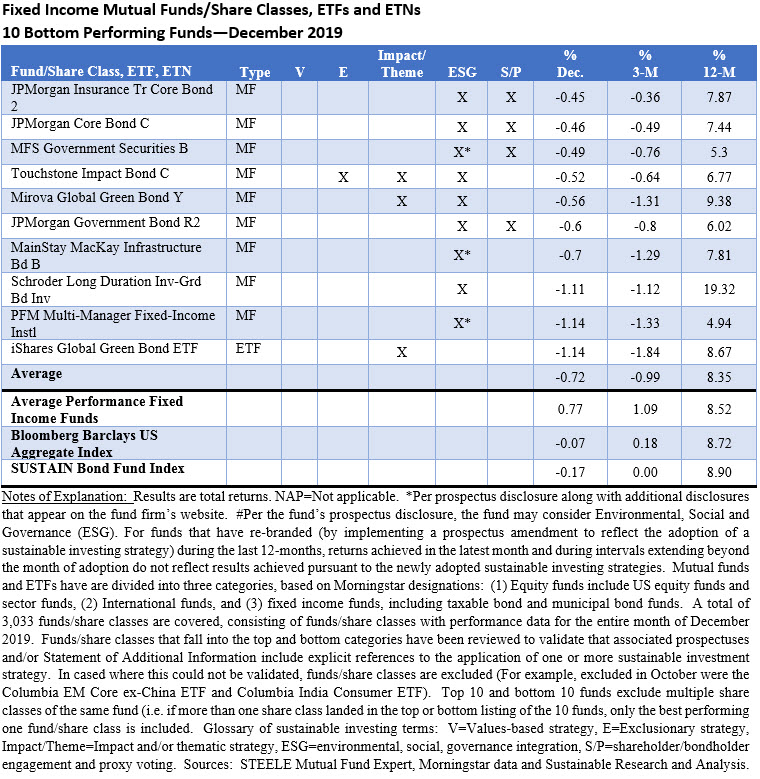

The bottom 10 performing bond funds recorded an average return of -0.72%. These included two green bond funds that gave up -1.14% and -0.56%, respectively. For the year, however, the thematic iShares Global Green Bond Fund ETF was up 8.67% while Mirova Global Green Bond Fund, that also integrates ESG in making green bond investment decisions, was up 9.38%. Long-dated fixed income funds in the 20+ years range lagged in December, posting a return of -2.9%.

Sustainable Investing Strategies: Dominated by Funds that Integrate ESG

The roster of 60 top and bottom performing funds in the month of December was dominated by 45 funds/share classes integrating ESG factors, either exclusively or in combination with other approaches, most commonly engagement with investee firms. 16 funds pursue thematic investing approaches.

Eight firms equivocate regarding their commitment to ESG integration. These include firms that, by prospectus, note that they may integrate ESG rather that firmly committing to doing so. These include funds offered by Eaton Vance, MFS, MacKay Shields and PFM. In the case of the PFM Multi-Manager Fixed-Income Institutional that’s managed by 5 sub-advisers, only some but not all managers integrate ESG.

There were also variations with regard to ESG integration within the three US equity, international and fixed income segments, most notably across the top performing US Equity and Sector funds that were dominated by thematic funds focused on the alternative energy sector.

December Performance Scorecards

[/ihc-hide-content]