Assets attributable to sustainable funds exceed $1 trillion for first time as JPMorgan transforms sustainable investing landscape

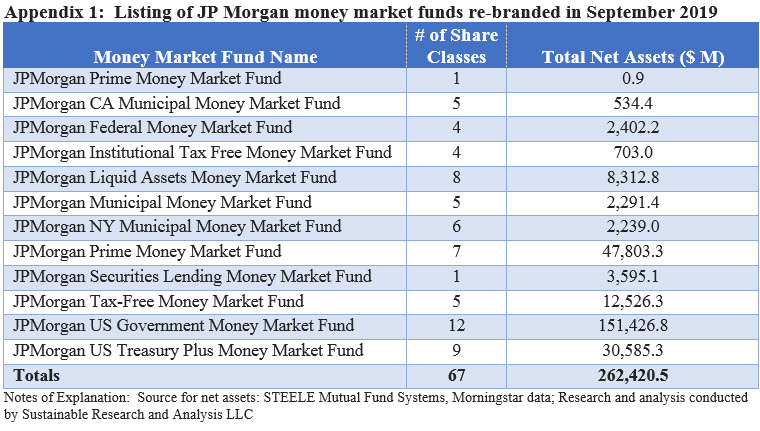

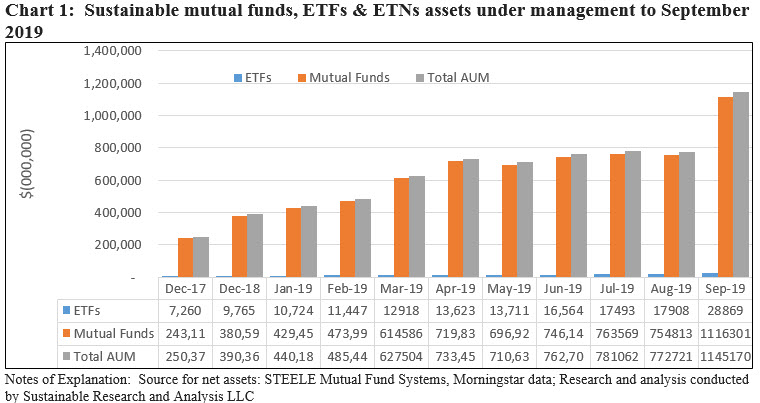

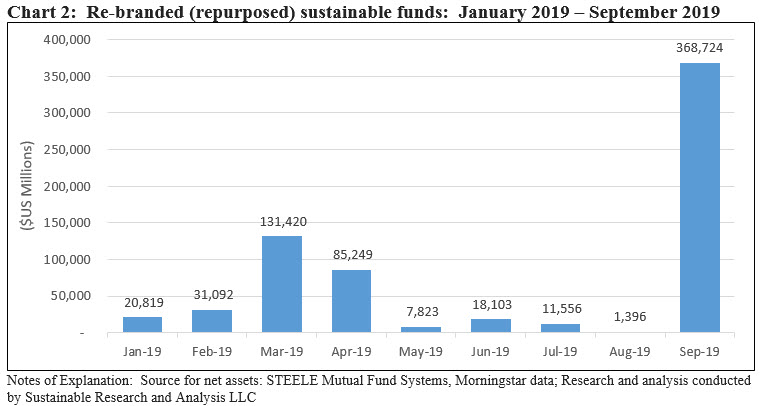

Sustainable investment funds[1], including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), exceeded $1 trillion in assets under management for the first time in September, registering a gain of $372.4 billion, or an increase of 48.2%. Refer to Chart 1. Posting yet another monthly gain so far in 2019, the seventh this year, sustainable investment funds benefited once again from fund re-brandings that added $368.7 billion and, to a much lesser extent, market appreciation in September as large cap stocks posted a total return gain of 1.87% and bonds dropped -0.53%[2]. Market appreciation added an estimated $8.2 billion while net cash flows were negative, as investors pulled out an estimated (net) $4.5 billion. J. P. Morgan Asset Management, in particular, re-branded a total of 36 JPMorgan funds/163 share classes, including 4 ETFs, with total net assets in the amount of $359.8 billion. These were all taxable and municipal bond funds, including 12 money market funds with $262.4 billion in net assets as of month-end. Refer to Appendix 1 for a listing of JPMorgan’s re-branded money market funds. In the process, the firm reshaped the sustainable investing landscape. Not only did it assume the lead long held by American Funds in terms of the fund firm with the largest book of assets managed pursuant to a sustainable mandate, but it also shifted the profile of allocated assets by pushing up the value and percentages of money market funds as well as bond funds while also lifting the proportion of sustainable assets sourced to institutional investors.

Fund re-brandings add $368.7 billion in September to reach highest monthly level ever

Three firms rebranded a total of 46 funds, including 4 ETFs representing $368.7 billion in total net assets. JPMorgan alone added 36 funds/163 share classes valued at $359.8 billion at the end of September 2019 by amending its fund prospectuses in September to reflect that as “part of its security selection strategy, the adviser also evaluates whether environmental, social and governance factors could have material negative or positive impact on the cash flows or risk profiles of many companies in the universe in which the Fund may invest. These determinations may not be conclusive and securities of issuers that may be negatively impacted by such factors may be purchased and retained by the Fund while the Fund may divest or not invest in securities of issuers that may be positively impacted by such factors.” From an environmental (E) and social (S) integration perspective, the impact of such analysis on the credit and liquidity risks of money fund eligible short-dated securities is significantly restricted, especially when such securities are held to maturity. In addition, DWS (Deutsche Bank AG) and Morgan Stanley adopted similar prospectus language for 10 funds/44 share classes covering an additional $8.9 billion in net assets. In the case of DWS, however, the prospectus language is more nuanced, noting that “portfolio management may consider (italics added) information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.”

So far this year, re-branded funds have added a total of $676.2 billion in net assets to the universe of sustainable investment funds. Re-branding volumes in September exceeded the previous high achieved in March 2019 when a total of $131.4 billion in assets were rebranded. On a year-to-date basis, JPMorgan contributed $391.6 billion or 58% of the total. Refer to Chart 2.

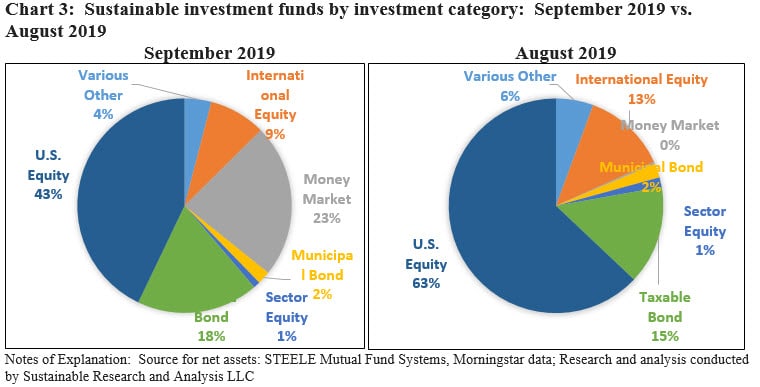

Money market funds pivot to become second largest sustainable funds investment category and bond funds get a lift too

In just one short month, JP Morgan’s money market fund re-brandings shifted the money market funds category from one of the smallest to the second largest with $265.2 billion in net assets. In addition to JPMorgan’s taxable and municipal money market funds, there are now a total of 81 sustainable money market funds/share classes offered by four investment management firms, including GuidStone Funds, DWS and BlackRock. The money market funds category now ranks second after US equity funds with $491.2 billion and 42.9% of the segment’s assets. Refer to Chart 3.

Bond funds, both taxable and municipal funds have also been lifted and now account for 20% of the assets managed in line with a sustainable investing approach.

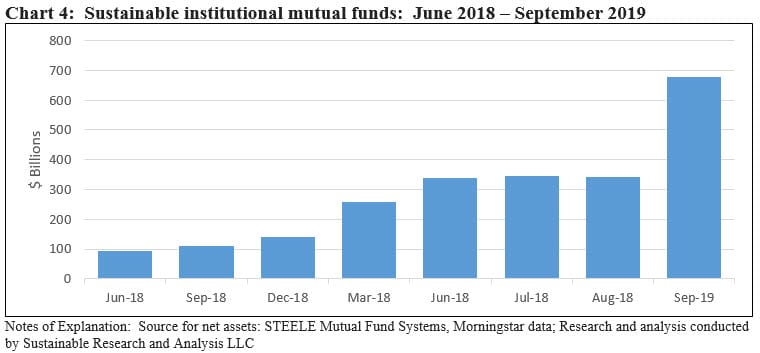

Sustainable fund assets sourced to institutional investors expand by $337.6 billion and now account for a minimum of 59.2% of sustainable fund assets

As JPMorgan’s re-branded assets are largely sourced to institutional investors[3], assets attributable to this investor type now account for more than half of the segment’s assets under management. Institutional only funds added $337.6 billion, or an increase of 99.1% relative to last month’s position. The number represents a floor and the exact number is likely higher as institutional money is invested in ETFs as well as other mutual fund share classes that are not strictly designated for investment by institutional investors. Refer to Chart 4.

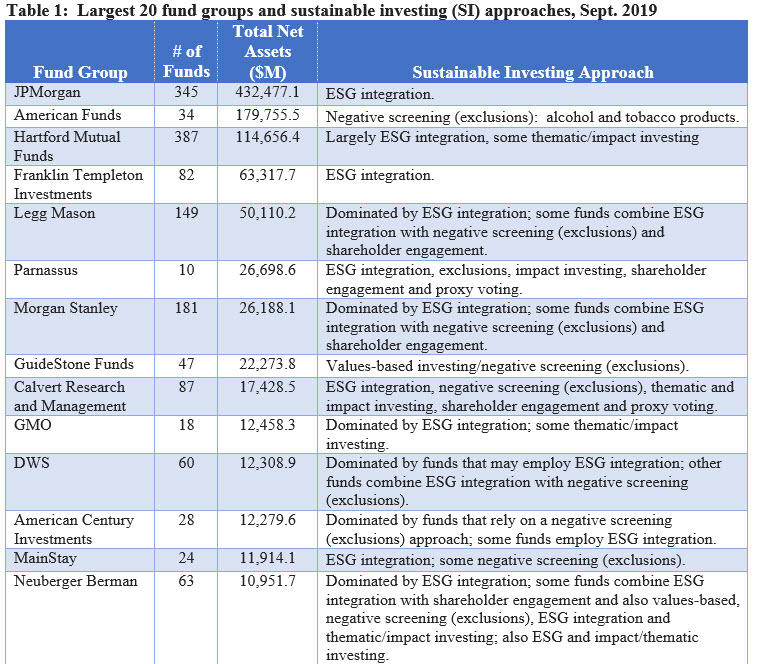

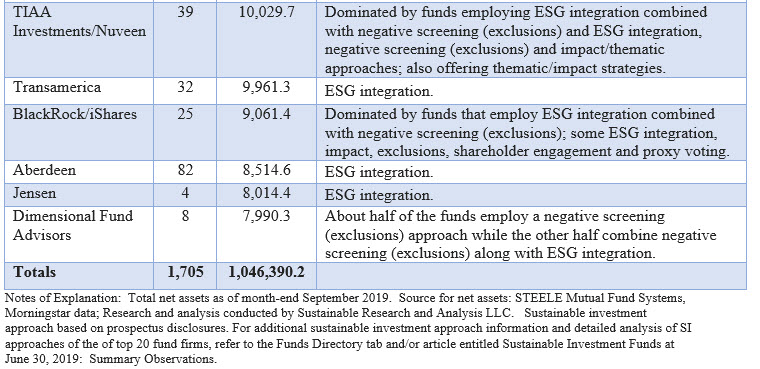

Largest Fund Groups: Top 20 sustainable fund groups now account for $1.04 trillion in assets and get even more concentrated

A total of 149 fund groups, a net uptick of three firms relative to August, offered sustainable mutual funds and ETFs at the end of September 2019. Of these, the largest 20 fund groups now account for $1,046,390.2 million or 91.4% of net assets versus 87.9% last month. Dominating these twenty firms in terms of sustainable investing strategies are ESG integration and negative screening approaches. Refer to Table 1.

As noted above, JPMorgan has now displaced American Funds as the fund firm with the largest book of assets managed pursuant to a sustainable mandate. American Funds, whose American Mutual and Washington Mutual funds with combined assets of $179.8 billion avoid investing in alcohol and tobacco stocks, has now been displaced by JPMorgan with its $432.5 billion or 37.8% of sustainable assets under management managed pursuant to an ESG integration mandate. The two firms manage a combined total of $612.2 billion and account for 53.5% of the segment’s assets under management. Benefiting from its seven fund re-brandings, DWS shifted positions and moved into the top 20 sustainable funds cohort. It now ranks 11th and, in the process of moving into this spot, the firm displaced the Vanguard Group. It is now ranked 21st among fund firms offering sustainable fund products.

[1] While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

[2] Per the S&P 500 Index and Bloomberg Barclays US Aggregate Index.

[3] Funds/share classes designated specifically for institutional investors.