The Bottom Line: 21 events reported in July, including the launch of two long/short funds. Direxion’s long-short fund is beating the S&P 500 since inception.

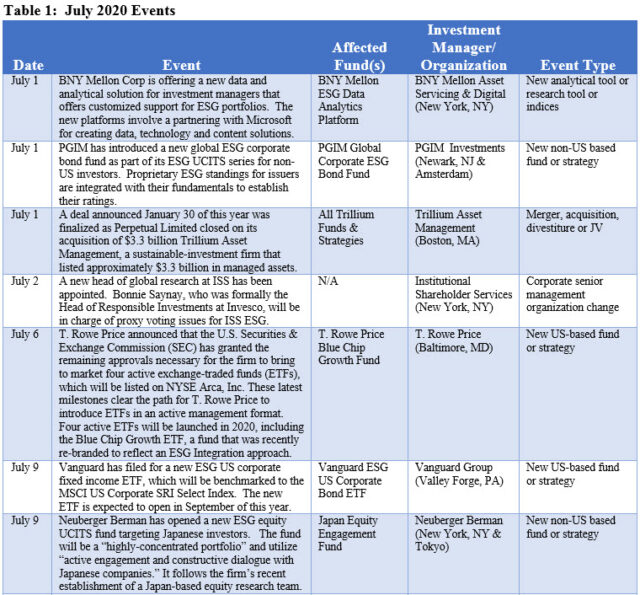

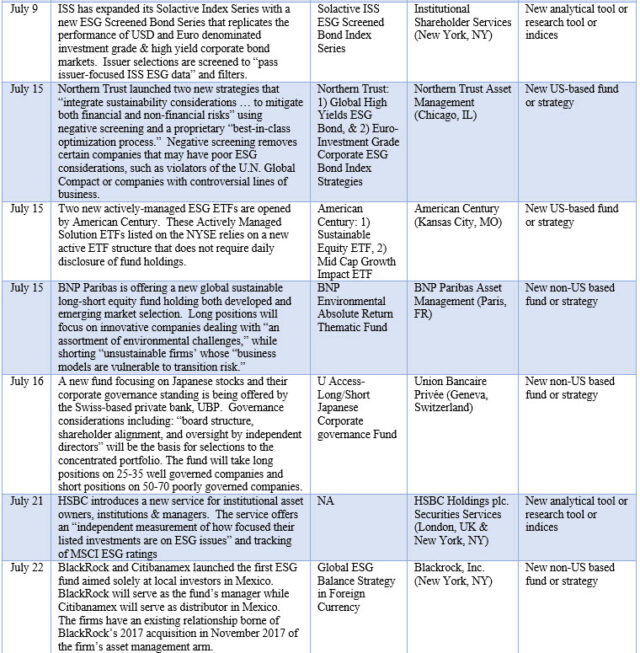

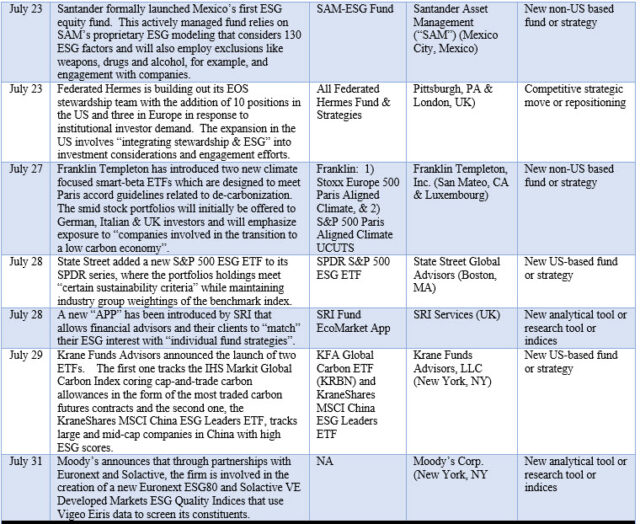

July 2020 Event Summary

-

-

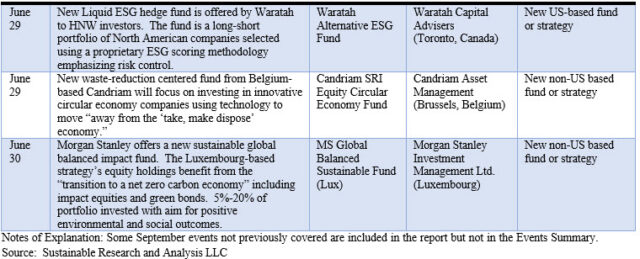

- 21 events are reported in July along with 3 events that are carried forward from June.

- 13 events or 62% are related to new funds or strategies, including US and non-US-based launches.

- 7 track new non-US based funds or strategies.

- 6 track US-based funds or strategies.

- Five events involve the introduction of a new analytical tool or research tool or indices.

- The three remaining events, one each, include a management change, M&A and a strategic positioning move on the part of Federated Hermes.

Observation

Included in new non-US product introductions are two funds that will employ sustainable long-short strategies. While not likely the only long-short strategies in existence today, these two introductions add to one that was launched in the US as of February 11, 2020. The passively managed fund, Direxion MSCI USA ESG Leaders vs. Laggards ETF (ESNG), that reached $12.8 million as of June 30, seeks to capture excess returns by emphasizing the thesis that high and positively trending environmental, social and governance (ESG) ratings are correlated with superior accounting and financial results over time. And unlike the 91 passive and 24 actively managed sustainable investment ETFs on offer today, this fund amplifies the bet via leverage using a 150/50 structure, or a ratio of 3:1, to emphasize highly rated ESG companies with positive rating movement while simultaneously selling short poorly rated companies. Since its launch, the fund is up 5.2% to July 31 while the S&P 500 has registered a -2.6% return over the same time interval.Refer to Table 1 for details.

[ihc-hide-content ihc_mb_type=”block” ihc_mb_who=”reg” ihc_mb_template=”4″ ]

-