The Bottom Line: Sustainable MFs and ETFS posted average return of -11.94% in March; 52 of 60 top and bottom performers employ ESG integration strategy.

Summary

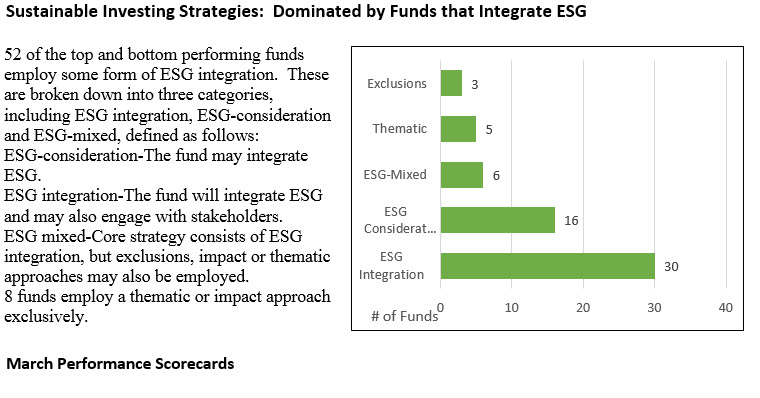

The month of March has been one of the most volatile in stock market history, as the world-wide corona virus pandemic produced a simultaneous health crisis, financial crisis and potentially widespread business failures. Sustainable mutual funds/share classes and ETFs[1] in March, 4,236 in total, posted a negative average return of -11.94%. Sustainable US equity funds, international funds as well as bond funds recorded average declines of -15.89%, -15.47% and -6.68%, in that order, versus -12.35%, -15.47% and -0.59% for comparable conventional securities market indices. At the same time, the top and bottom performing funds in each of these broad categories, 60 funds in total, achieved varying results that ranged from 0.72% to -40.32%. 52 of these top and bottom performing funds employed some form of ESG integration strategy while the remaining 8 funds relied on a thematic or impact approach exclusively.

US Equity and Sector Equity Funds/Share Classes: Average Performance -15.89%

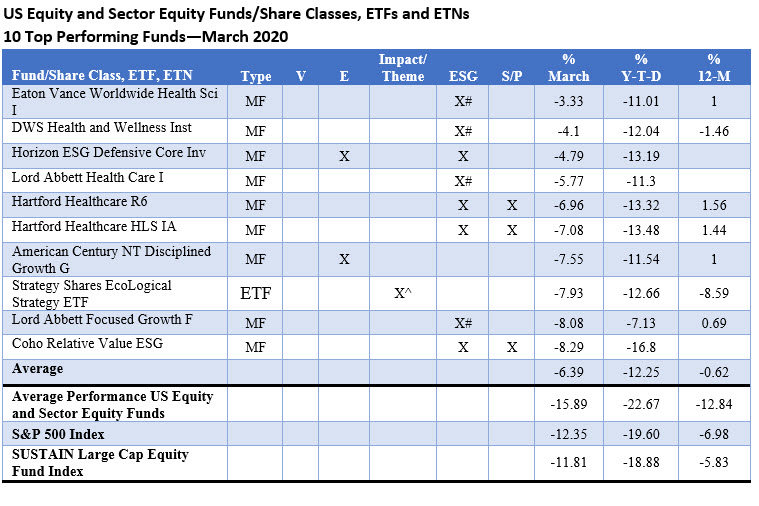

On a combined basis, US equity and sector funds posted a negative average total return of -15.89% in March and lagged the S&P 500 Index by 3.53%. While in negative territory, the 10 top performing funds did considerably better, recording an average decline of -6.39%. This group of 10 funds was aided by the more limited declines posted by sector funds focused on the healthcare sector—the best performing sector in March that across S&P 500 companies gave up a more limited -3.98%. Within this group of funds, the Eaton Vance Worldwide Health Science Fund I was the best performer. Its -3.33% Mach result was achieved by allocating the entire portfolio to the Healthcare Sector. The fund’s top stock allocations, including Johnson & Johnson, Roche Holding, Merck & Co., Sanofi SA and Abbot Laboratories, accounted for almost one-quarter of the fund’s portfolio.

Eight of the ten funds integrate ESG. That said, four of the funds represent that ESG may be considered and, by inference, ESG factors may not be accounted for in investment decision making. Only two of the lagging funds fall into this particular category of eight funds that integrate ESG factors.

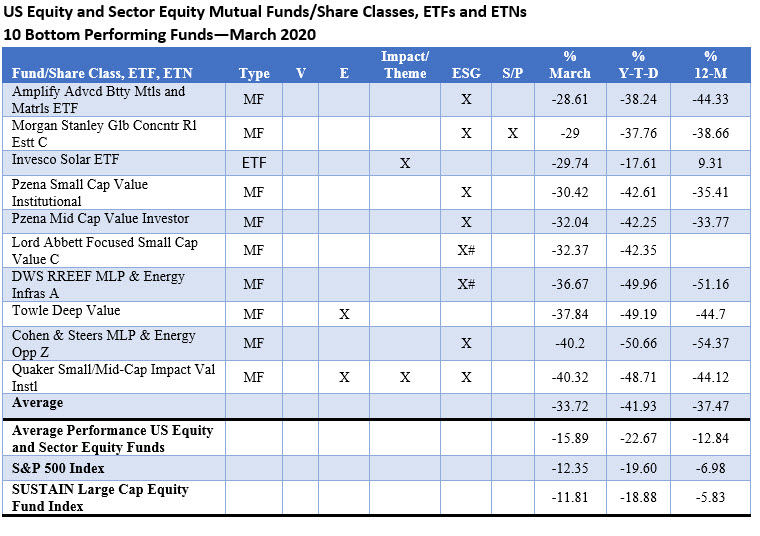

At the other end of the range, the 10 bottom performing funds dropped an average of -33.72%. The cohort was led by MLP and energy funds as well as small cap value stock funds, some of March’s worst performing market segments that posted returns of -34.8% (Energy) and -24.7% (small cap).

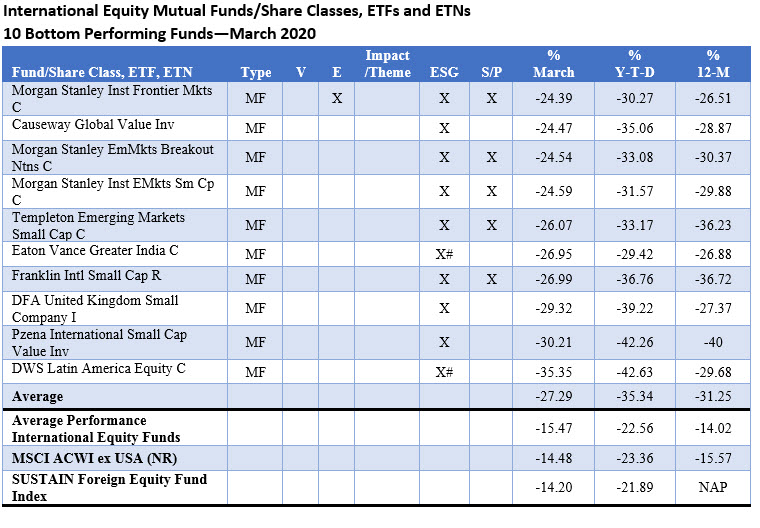

International Equity Funds: Average Performance -15.47%

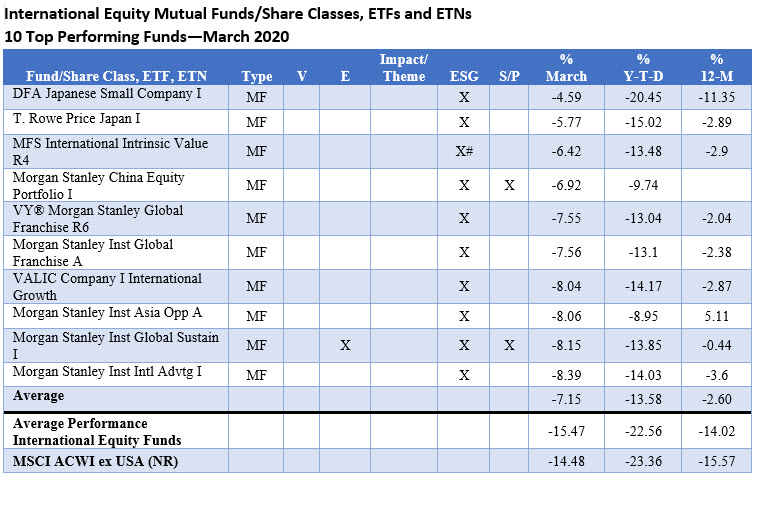

International equity funds recorded an average decline of -15.47%, but the range of results varied from -4.59% to -27.29%. The top 10 best performing funds, which posted an average decline of -7.15%, were led by three country specific mutual funds investing in Japan and China. These were the best performing national markets, with MSCI China leading at -6.6% and MSCI Japan registered a decline of -7.0%. While its 20% or so exposure to Japan aided performance results, the MFS International Intrinsic Value, a fund that may integrate ESG, the fund likely benefited from its above benchmark exposure to the Consumer Defensive and Technology sectors and more restricted investments in the Financial Services sector.

At the other end of the range, the 10 bottom performing funds suffered an average drop of -27.29%. Funds investing in Latin America, India or concentrated in small cap emerging markets brought up the rear.

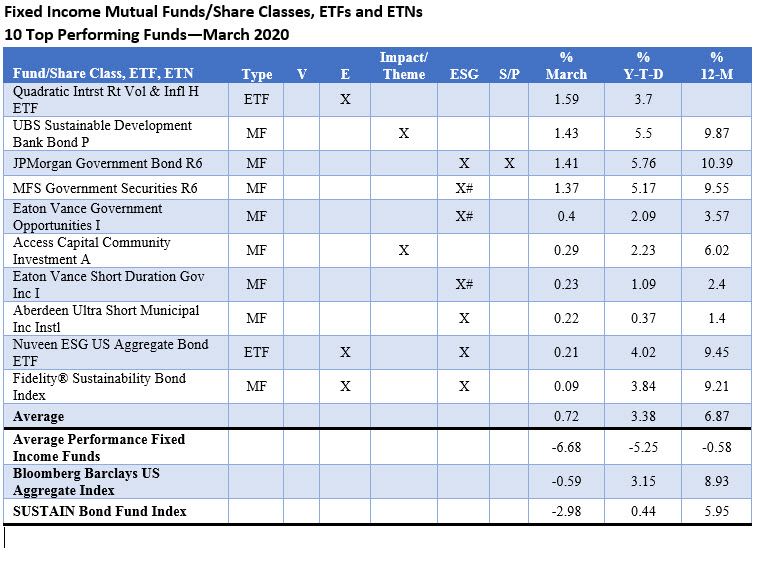

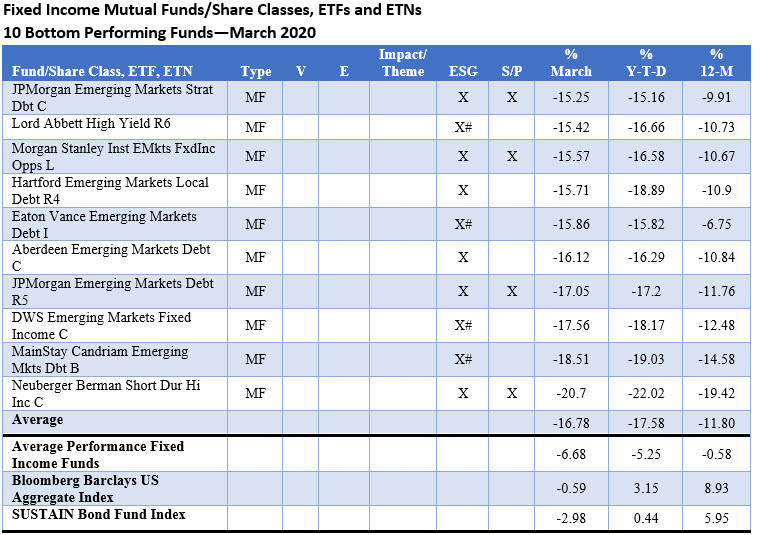

Fixed Income Funds: Average Performance -6.68%

A wide cross section of fixed income funds recorded an average return of -6.68%, but results spanned from a positive 1.59% to a low of –20.7%. This range is reflected in the divergence of performance between the top 10 and bottom 10 performing mutual funds and ETFs. The former group posted a positive average return of 0.72%, bolstered by the results achieved government bond funds, including short duration government funds. At 1.59%, the best performing fund is the Quadratic Interest Rate Volatility & Inflation Hedge ETF, an actively managed fund designed to hedge against inflation risk and generate positive returns from the fund’s position in options during periods when interest rate volatility increases and/or the interest rate yield curve steepens. The fund invests primarily in a mix of U.S. Treasury Inflation-Protected Securities and long options tied to the shape of the interest rate yield curve and it represents that its investments are generally expected to adhere to ESG principles by excluding issuers involved in, and/or which derive significant revenue from, certain practices, industries or product lines, such as firms involved in extreme event controversies, controversial weapons, UN Global Compact violations, civilian firearms, thermal coal extraction and tobacco. The second best performing fund in the category is the impact-driven UBS Sustainable Development Bank Bond Fund. Launched in 2018, the fund invests in bonds issued by development banks. While each development bank has a distinct focus, development banks generally use their capital for projects that seek to improve the state of the developing world, promote sustainable growth and raise living standards.

Bringing up the rear, the bottom ten performing funds consisted of funds investing in emerging markets and/or high yield bonds. The cohort gave up -16.78%, bracketed by the lowest return, -20.7%, achieved by the smallish $11.3 million Neuberger Berman Short Duration High Income Fund that was whipsawed by its exposure to shorter-dated but lower rated bonds (average credit quality B) and the J.P. Morgan Emerging Markets Strategic Debt Fund C that was down -15.25%. All ten funds employ ESG integration strategies either exclusively or in combination with investee engagement.

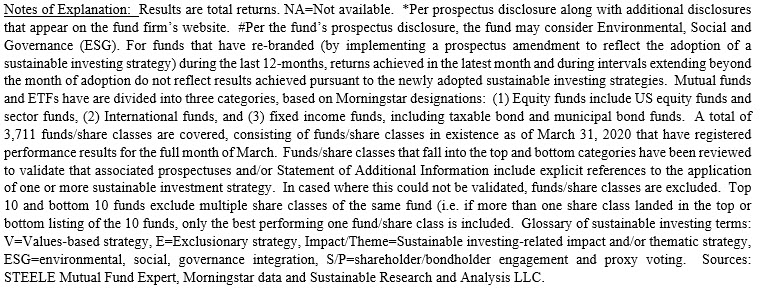

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Sustainable Investment Funds Performance Scorecard: March 2020

The Bottom Line: Sustainable MFs and ETFS posted average return of -11.94% in March; 52 of 60 top and bottom performers employ ESG integration strategy.

Share This Article:

The Bottom Line: Sustainable MFs and ETFS posted average return of -11.94% in March; 52 of 60 top and bottom performers employ ESG integration strategy.

Summary

The month of March has been one of the most volatile in stock market history, as the world-wide corona virus pandemic produced a simultaneous health crisis, financial crisis and potentially widespread business failures. Sustainable mutual funds/share classes and ETFs[1] in March, 4,236 in total, posted a negative average return of -11.94%. Sustainable US equity funds, international funds as well as bond funds recorded average declines of -15.89%, -15.47% and -6.68%, in that order, versus -12.35%, -15.47% and -0.59% for comparable conventional securities market indices. At the same time, the top and bottom performing funds in each of these broad categories, 60 funds in total, achieved varying results that ranged from 0.72% to -40.32%. 52 of these top and bottom performing funds employed some form of ESG integration strategy while the remaining 8 funds relied on a thematic or impact approach exclusively.

US Equity and Sector Equity Funds/Share Classes: Average Performance -15.89%

On a combined basis, US equity and sector funds posted a negative average total return of -15.89% in March and lagged the S&P 500 Index by 3.53%. While in negative territory, the 10 top performing funds did considerably better, recording an average decline of -6.39%. This group of 10 funds was aided by the more limited declines posted by sector funds focused on the healthcare sector—the best performing sector in March that across S&P 500 companies gave up a more limited -3.98%. Within this group of funds, the Eaton Vance Worldwide Health Science Fund I was the best performer. Its -3.33% Mach result was achieved by allocating the entire portfolio to the Healthcare Sector. The fund’s top stock allocations, including Johnson & Johnson, Roche Holding, Merck & Co., Sanofi SA and Abbot Laboratories, accounted for almost one-quarter of the fund’s portfolio.

Eight of the ten funds integrate ESG. That said, four of the funds represent that ESG may be considered and, by inference, ESG factors may not be accounted for in investment decision making. Only two of the lagging funds fall into this particular category of eight funds that integrate ESG factors.

At the other end of the range, the 10 bottom performing funds dropped an average of -33.72%. The cohort was led by MLP and energy funds as well as small cap value stock funds, some of March’s worst performing market segments that posted returns of -34.8% (Energy) and -24.7% (small cap).

International Equity Funds: Average Performance -15.47%

International equity funds recorded an average decline of -15.47%, but the range of results varied from -4.59% to -27.29%. The top 10 best performing funds, which posted an average decline of -7.15%, were led by three country specific mutual funds investing in Japan and China. These were the best performing national markets, with MSCI China leading at -6.6% and MSCI Japan registered a decline of -7.0%. While its 20% or so exposure to Japan aided performance results, the MFS International Intrinsic Value, a fund that may integrate ESG, the fund likely benefited from its above benchmark exposure to the Consumer Defensive and Technology sectors and more restricted investments in the Financial Services sector.

At the other end of the range, the 10 bottom performing funds suffered an average drop of -27.29%. Funds investing in Latin America, India or concentrated in small cap emerging markets brought up the rear.

Fixed Income Funds: Average Performance -6.68%

A wide cross section of fixed income funds recorded an average return of -6.68%, but results spanned from a positive 1.59% to a low of –20.7%. This range is reflected in the divergence of performance between the top 10 and bottom 10 performing mutual funds and ETFs. The former group posted a positive average return of 0.72%, bolstered by the results achieved government bond funds, including short duration government funds. At 1.59%, the best performing fund is the Quadratic Interest Rate Volatility & Inflation Hedge ETF, an actively managed fund designed to hedge against inflation risk and generate positive returns from the fund’s position in options during periods when interest rate volatility increases and/or the interest rate yield curve steepens. The fund invests primarily in a mix of U.S. Treasury Inflation-Protected Securities and long options tied to the shape of the interest rate yield curve and it represents that its investments are generally expected to adhere to ESG principles by excluding issuers involved in, and/or which derive significant revenue from, certain practices, industries or product lines, such as firms involved in extreme event controversies, controversial weapons, UN Global Compact violations, civilian firearms, thermal coal extraction and tobacco. The second best performing fund in the category is the impact-driven UBS Sustainable Development Bank Bond Fund. Launched in 2018, the fund invests in bonds issued by development banks. While each development bank has a distinct focus, development banks generally use their capital for projects that seek to improve the state of the developing world, promote sustainable growth and raise living standards.

Bringing up the rear, the bottom ten performing funds consisted of funds investing in emerging markets and/or high yield bonds. The cohort gave up -16.78%, bracketed by the lowest return, -20.7%, achieved by the smallish $11.3 million Neuberger Berman Short Duration High Income Fund that was whipsawed by its exposure to shorter-dated but lower rated bonds (average credit quality B) and the J.P. Morgan Emerging Markets Strategic Debt Fund C that was down -15.25%. All ten funds employ ESG integration strategies either exclusively or in combination with investee engagement.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact