Summary

The growing universe of sustainable mutual funds and ETFs, up to 3,037 and $1.4 trillion in net assets at the end of October, posted an average return of 1.61%[1]. Returns ranged from a high of 8.28% recorded by Eventide Healthcare & Life Sciences Fund I to a low of -11.68% logged in by Amplify Seymour Cannabis ETF.

These fund-oriented results were achieved over the course of a month that produced market returns ranging from highs of 8.05% posted by European emerging markets to 7.73% recorded by NASDAQ biotech stocks and 4.97% for Japanese stocks to lows between -2.48% and -1.27% recorded by utilities and energy stocks. After a negative start to the month due to geopolitical and economic uncertainties at home and abroad ahead of third quarter earnings season, investor pessimism turned to enthusiasm in response to apparent progress on US and China trade negotiations, better than expected earnings results on the heels of lowered analysts estimates, a third Federal Reserve rate cut this year as well as reassuring economic news. In the end, the US stock market delivered a 2.17% total return gain in October as measured by the S&P 500, the fifth best so far this year, while the intermediate-term investment-grade bond market delivered a narrow 0.3% increase.

To reflect the expansion in the number and type of funds now offered in the sustainable investing sphere and their evolving profile, the scorecards have been refined to include international funds as a separate category while the growing roster of money market funds are now excluded from consideration in the top/bottom performance results tables.

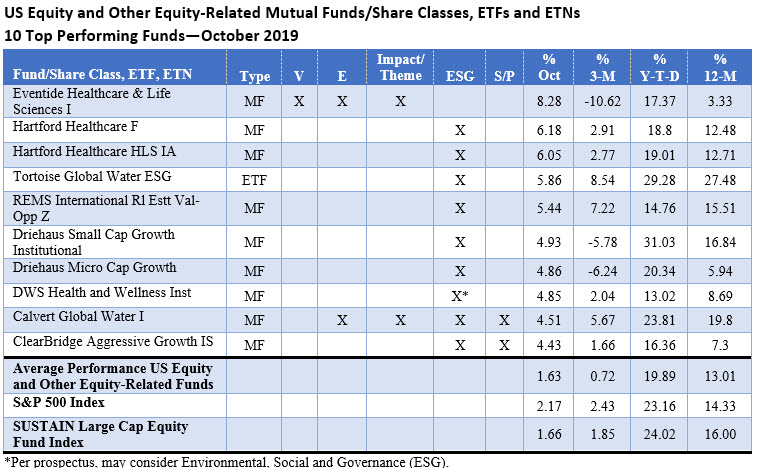

US Equity Funds/Sector Equity and Other Equity and Equity-Related Funds

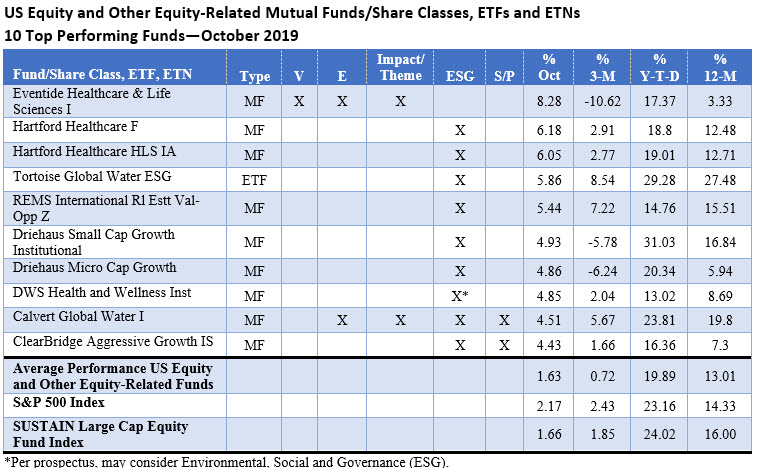

The top 10 funds gained an average of 5.54%, outperforming the average 1.63% for the category by 3.91%. Eventide Health and Life Sciences Fund I was the top performing fund in October, gaining 8.28%. The fund invests in companies in the healthcare and life sciences sectors, including biotechnology, pharmaceuticals, diagnostics, life science tools, medical devices, healthcare information technology, healthcare services, synthetic biology, agricultural and environmental management, and pharmaceutical manufacturing products and services. A values-based thematic fund, Eventide also employs a negative screening approach to sustainable investing. In total, four separate healthcare oriented funds made it onto the list of the best performing funds, along with two funds focusing on water companies, real estate and small cap companies.

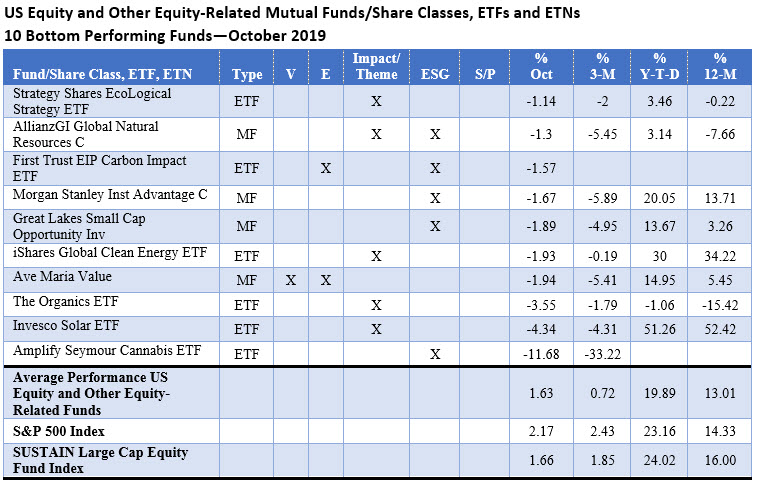

The bottom 10 funds in the category registered an average return of -3.10%. At the end of the range, Amplify Seymour Cannabis ETF, which was launched in July of this year, again this month posted the poorest total return result, giving up -11.68%. This actively managed ETF which integrates ESG, seeks to provide investment exposure to global companies principally engaged in the emerging cannabis and hemp ecosystem. After a strong run-up, stocks in the sector have retreated in recent months. Other funds that trailed behind in October included solar and clean energy funds.

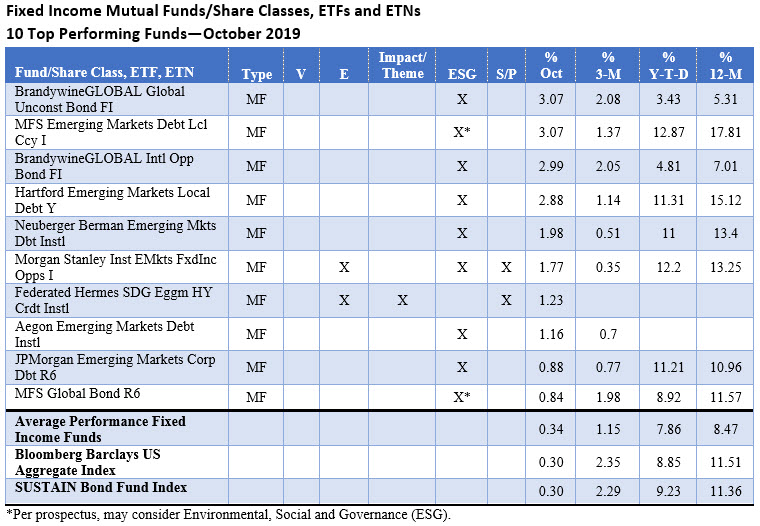

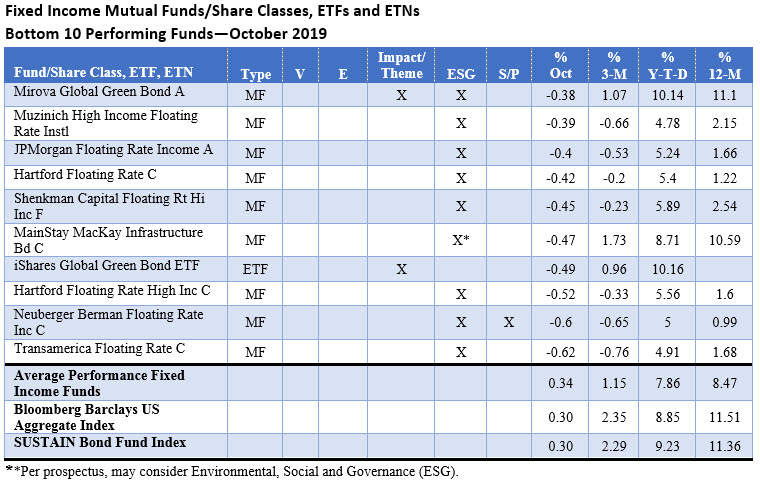

Fixed Income Funds

The top 10 funds, dominated by emerging market funds, gained an average of 1.99% in October while the average performance of all sustainable fixed income funds posted a gain of 0.34% and the Bloomberg Barclays US Aggregate Index (BB) added 0.30%. The best performing fund, the BrandywineGLOBAL Global Unconstrained Bond FI, delivered a 3.07% total return or a differential of just over 3.0% relative to the BB benchmark.

As a group, the bottom ten performing funds dropped an average of -0.47%. Floating rate funds dominated, however, there were also two global green bond funds, the iShares Global Green Bond ETF and Mirova Global Green Bond A that gave up -0.49% and -0.38%, respectively. This is the second month in a row when both funds posted negative results, reversing monthly gains since the start of the year.

International Equity Funds

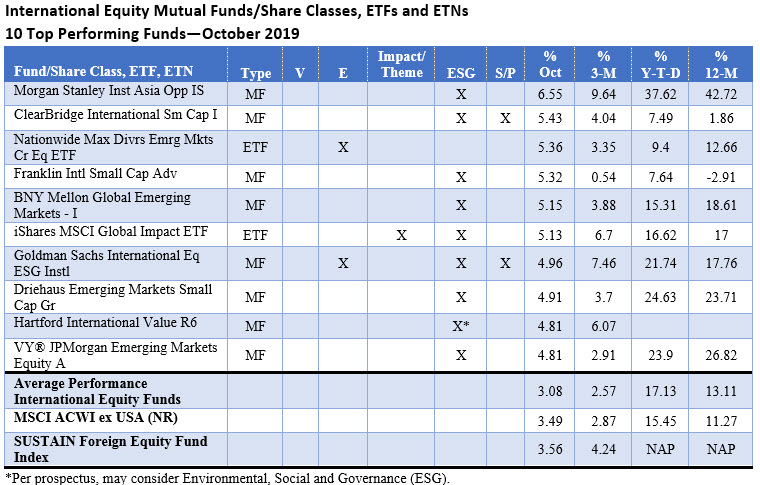

European and Asian markets benefited from a relaxation in trade tensions between the U.S. and China and an improving outlook for a Brexit agreement. As a result, international equity funds delivered an average total return of 3.08% while the top 10 performing funds posted even better results, gaining an average of 5.24%, compared to 3.49% recorded by the MSCI ACWI, ex USA (NR) Index and 3.56% notched by the SUSTAIN Foreign Equity Fund Index. These were led by the Morgan Stanley Institutional Asia Opportunity Fund IS, an ESG integrator that recorded a gain of 6.55%. Emerging market and international small cap funds also posted strong results.

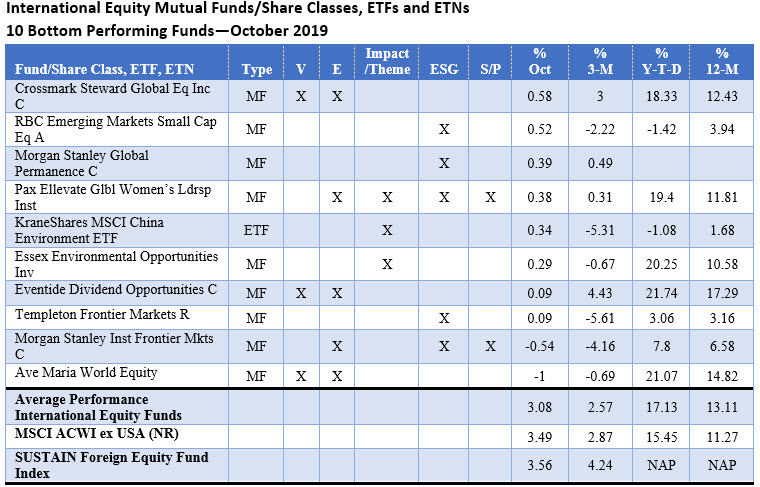

While still in positive territory, the 10 bottom performing funds gained an average of 0.11%, with the Ave Maria World Equity Fund posting the lowest return at -1.0% followed by Morgan Stanley Institutional Frontier Markets Fund C that came in at -0.54%.

Sustainable Investing Strategies

46 of the 60 funds covered across the three scorecards pursue a sustainable investing approach focused on ESG integration, either exclusively or in combination with other approaches. Of these, 35 funds/share classes employ ESG integration exclusively. These are followed by 14 funds/share classes that pursue an impact/thematic-oriented strategy and 13 that apply negative screening (exclusions), in both cases either exclusively or in combination with other approaches.

Only one fund, the Nationwide Maximum Diversification Emerging Markets Core Equity ETF, applies negative screening exclusively.

Based strictly on observation, it seems that leading domestic equity and international funds are dominated by funds/share classes that pursue an ESG integration strategy. This observed relationship does not hold up for fixed income funds where both leading and lagging funds are dominated by ESG integrators.

Also, it should be noted there are five funds/share classes within the universe of 60 funds that, per their prospectus language, may consider ESG factors but these funds, it seems, are not obligation to do so.

October Performance Scorecards

Notes of Explanation: Results are total returns. NAP=Not applicable. For funds that have re-branded (by implementing a prospectus amendment to reflect the adoption of a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Mutual funds and ETFs have are divided into three categories, based on Morningstar designations: (1) Equity funds include allocation funds, alternative funds, commodities funds, sector equity and US equity funds, (2) International funds, and (3) fixed income funds, including taxable bond and municipal bond funds. A total of 2,949 funds/share classes are covered, consisting of funds/share classes with performance data for the entire month of October 31, 2019. Funds/share classes that fall into the top and bottom categories have been reviewed to validate that associated prospectuses and/or Statement of Additional Information include explicit references to the application of one or more sustainable investment strategy. In cased where this could not be validated, funds/share classes are excluded (For example, excluded in October were the Columbia EM Core ex-China ETF and Columbia India Consumer ETF). Top 10 and bottom 10 funds exclude multiple share classes of the same fund (i.e. if more than one share class landed in the top or bottom listing of the 10 funds, only the best performing one fund/share class is included. Glossary of sustainable investing terms: V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

[1] Excluding money market funds but including MFS managed funds that adopted ESG integration language in its various prospectuses as of October 31,

Sustainable Investment Funds Performance Scorecard: October 2019

Summary The growing universe of sustainable mutual funds and ETFs, up to 3,037 and $1.4 trillion in net assets at the end of October, posted an average return of 1.61%[1]. Returns ranged from a high of 8.28% recorded by Eventide Healthcare & Life Sciences Fund I to a low of -11.68% logged in by Amplify…

Share This Article:

Summary

The growing universe of sustainable mutual funds and ETFs, up to 3,037 and $1.4 trillion in net assets at the end of October, posted an average return of 1.61%[1]. Returns ranged from a high of 8.28% recorded by Eventide Healthcare & Life Sciences Fund I to a low of -11.68% logged in by Amplify Seymour Cannabis ETF.

These fund-oriented results were achieved over the course of a month that produced market returns ranging from highs of 8.05% posted by European emerging markets to 7.73% recorded by NASDAQ biotech stocks and 4.97% for Japanese stocks to lows between -2.48% and -1.27% recorded by utilities and energy stocks. After a negative start to the month due to geopolitical and economic uncertainties at home and abroad ahead of third quarter earnings season, investor pessimism turned to enthusiasm in response to apparent progress on US and China trade negotiations, better than expected earnings results on the heels of lowered analysts estimates, a third Federal Reserve rate cut this year as well as reassuring economic news. In the end, the US stock market delivered a 2.17% total return gain in October as measured by the S&P 500, the fifth best so far this year, while the intermediate-term investment-grade bond market delivered a narrow 0.3% increase.

To reflect the expansion in the number and type of funds now offered in the sustainable investing sphere and their evolving profile, the scorecards have been refined to include international funds as a separate category while the growing roster of money market funds are now excluded from consideration in the top/bottom performance results tables.

US Equity Funds/Sector Equity and Other Equity and Equity-Related Funds

The top 10 funds gained an average of 5.54%, outperforming the average 1.63% for the category by 3.91%. Eventide Health and Life Sciences Fund I was the top performing fund in October, gaining 8.28%. The fund invests in companies in the healthcare and life sciences sectors, including biotechnology, pharmaceuticals, diagnostics, life science tools, medical devices, healthcare information technology, healthcare services, synthetic biology, agricultural and environmental management, and pharmaceutical manufacturing products and services. A values-based thematic fund, Eventide also employs a negative screening approach to sustainable investing. In total, four separate healthcare oriented funds made it onto the list of the best performing funds, along with two funds focusing on water companies, real estate and small cap companies.

The bottom 10 funds in the category registered an average return of -3.10%. At the end of the range, Amplify Seymour Cannabis ETF, which was launched in July of this year, again this month posted the poorest total return result, giving up -11.68%. This actively managed ETF which integrates ESG, seeks to provide investment exposure to global companies principally engaged in the emerging cannabis and hemp ecosystem. After a strong run-up, stocks in the sector have retreated in recent months. Other funds that trailed behind in October included solar and clean energy funds.

Fixed Income Funds

The top 10 funds, dominated by emerging market funds, gained an average of 1.99% in October while the average performance of all sustainable fixed income funds posted a gain of 0.34% and the Bloomberg Barclays US Aggregate Index (BB) added 0.30%. The best performing fund, the BrandywineGLOBAL Global Unconstrained Bond FI, delivered a 3.07% total return or a differential of just over 3.0% relative to the BB benchmark.

As a group, the bottom ten performing funds dropped an average of -0.47%. Floating rate funds dominated, however, there were also two global green bond funds, the iShares Global Green Bond ETF and Mirova Global Green Bond A that gave up -0.49% and -0.38%, respectively. This is the second month in a row when both funds posted negative results, reversing monthly gains since the start of the year.

International Equity Funds

European and Asian markets benefited from a relaxation in trade tensions between the U.S. and China and an improving outlook for a Brexit agreement. As a result, international equity funds delivered an average total return of 3.08% while the top 10 performing funds posted even better results, gaining an average of 5.24%, compared to 3.49% recorded by the MSCI ACWI, ex USA (NR) Index and 3.56% notched by the SUSTAIN Foreign Equity Fund Index. These were led by the Morgan Stanley Institutional Asia Opportunity Fund IS, an ESG integrator that recorded a gain of 6.55%. Emerging market and international small cap funds also posted strong results.

While still in positive territory, the 10 bottom performing funds gained an average of 0.11%, with the Ave Maria World Equity Fund posting the lowest return at -1.0% followed by Morgan Stanley Institutional Frontier Markets Fund C that came in at -0.54%.

Sustainable Investing Strategies

46 of the 60 funds covered across the three scorecards pursue a sustainable investing approach focused on ESG integration, either exclusively or in combination with other approaches. Of these, 35 funds/share classes employ ESG integration exclusively. These are followed by 14 funds/share classes that pursue an impact/thematic-oriented strategy and 13 that apply negative screening (exclusions), in both cases either exclusively or in combination with other approaches.

Only one fund, the Nationwide Maximum Diversification Emerging Markets Core Equity ETF, applies negative screening exclusively.

Based strictly on observation, it seems that leading domestic equity and international funds are dominated by funds/share classes that pursue an ESG integration strategy. This observed relationship does not hold up for fixed income funds where both leading and lagging funds are dominated by ESG integrators.

Also, it should be noted there are five funds/share classes within the universe of 60 funds that, per their prospectus language, may consider ESG factors but these funds, it seems, are not obligation to do so.

October Performance Scorecards

Notes of Explanation: Results are total returns. NAP=Not applicable. For funds that have re-branded (by implementing a prospectus amendment to reflect the adoption of a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Mutual funds and ETFs have are divided into three categories, based on Morningstar designations: (1) Equity funds include allocation funds, alternative funds, commodities funds, sector equity and US equity funds, (2) International funds, and (3) fixed income funds, including taxable bond and municipal bond funds. A total of 2,949 funds/share classes are covered, consisting of funds/share classes with performance data for the entire month of October 31, 2019. Funds/share classes that fall into the top and bottom categories have been reviewed to validate that associated prospectuses and/or Statement of Additional Information include explicit references to the application of one or more sustainable investment strategy. In cased where this could not be validated, funds/share classes are excluded (For example, excluded in October were the Columbia EM Core ex-China ETF and Columbia India Consumer ETF). Top 10 and bottom 10 funds exclude multiple share classes of the same fund (i.e. if more than one share class landed in the top or bottom listing of the 10 funds, only the best performing one fund/share class is included. Glossary of sustainable investing terms: V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

[1] Excluding money market funds but including MFS managed funds that adopted ESG integration language in its various prospectuses as of October 31,

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact