Summary

The performance of equities and bonds reversed positions in September as large cap equities, tracked by the S&P 500 Index, posted a total return gain of 1.87% while investment-grade intermediate bonds ended the month lower at -0.53% on the back of higher yields. The stock market advanced as high as 2.84% at the close on September 12th just about a week after the US and China set a date for the resumption of trade negotiations in early October. But the sense of optimism engendered by the resumption of trade talks was in part eclipsed in the second half of the month by worries over weaker US economic reports, the surprise introduction of liquidity risk in the overnight funding market as well as domestic political and geopolitical uncertainties. 2.457 sustainable investment funds consisting of mutual funds/share classes, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) recorded an average gain of 0.88%. Total returns ranged from a low of -12.98% to a high of 6.59%[1]. 1,740 funds, or 71%, produced 0.00 to positive rates of return. By way of further comparison, the Sustainable (SUSTAIN) Large Cap Equity Fund Index was up 1.44% and the Sustainable (SUSTAIN) Bond Fund Index slid -0.58%.

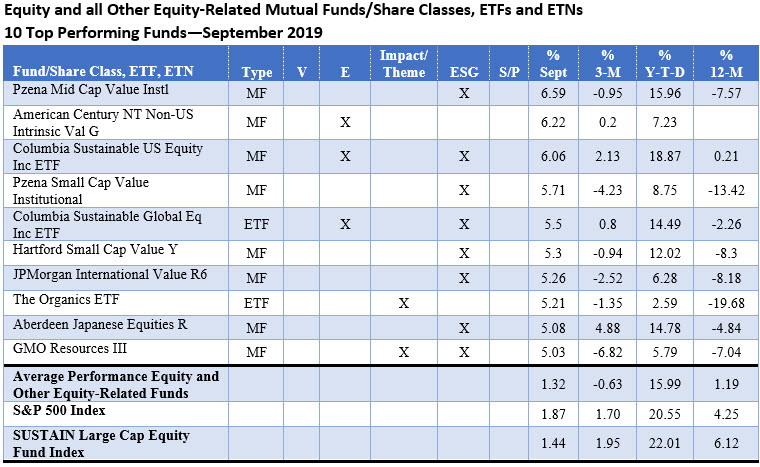

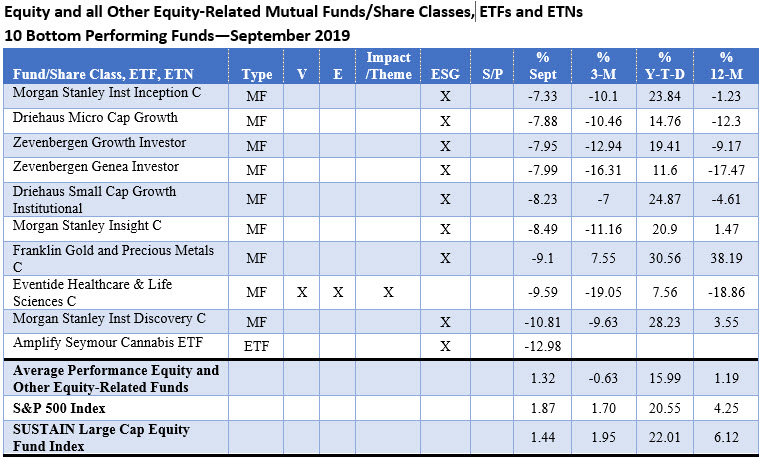

Equity Funds and Other Equity and Equity-Related Funds

Equity and equity related sustainable funds, including US focused and overseas funds for a total of 1,712 funds that were in operation for the entire month, recorded an average gain of 1.32%. Returns ranged from a low of -12.98% posted by Amplify Seymour Cannabis ETF, a newly launched (July 2019) fund that relies on an ESG integration approach for investment decisions to a high of 6.59% achieved by Pzena Mid Cap Value Fund-Institutional shares, another ESG integrator.

Pzena Mid Cap Value Fund-Institutional Shares seeks to achieve capital appreciation by investing in stocks of mid-cap companies using what the manager describes as a classic value strategy. According to its prospectus, the fund’s portfolio will generally consist of 30 to 80 stocks identified through a research-driven, bottom-up security selection process based on thorough fundamental research. The fund seeks to invest in mid cap company stocks that, in the opinion of the adviser, sell at a substantial discount to their intrinsic value but have solid long-term prospects.

Some of the other categories of funds that registered strong performance in September included international value and small cap value funds, such as American Century NT Non-US Intrinsic Value and Pzena Small Cap Value Fund Institutional shares, up 6.22% and 5.71%, respectively. These funds also benefited from the outperformance of value versus growth stocks in September. At the other end of the range, lagging funds included small cap growth funds and gold and precious metals funds.

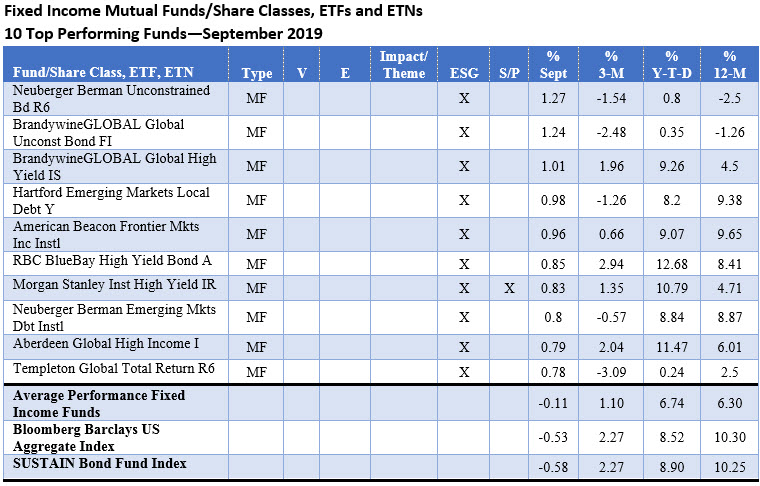

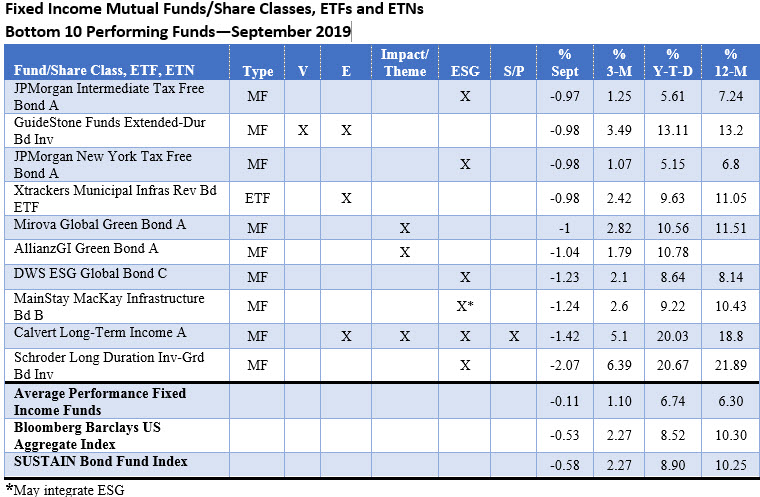

Fixed Income Funds

After a very strong August when investment-grade intermediate bonds added 2.59%, bond funds, both taxable and municipal, posted an average decline of -0.11%. Returns ranged from a low of -2.07% delivered by Schroder Long-Duration Investment-Grade Bond Fund-Inv. shares to a high of 1.27% registered by the Neuberger Berman Unconstrained Bond Fund R6. Both funds explicitly integrate ESG factors into their investment process.

High yield and emerging market debt funds led the roster of the top performing funds for the month of September while long-duration and green bond funds, in particular, lagged behind. Two green bond funds, AllianzGI Green Bond Fund A and Mirova Global Green Bond A, dropped -1.04% and -1.0%, respectively. Both funds pursue a global green bonds mandate that are exposed to currency risk that may be hedged and their returns were more line with the Bloomberg Barclays Global Aggregate Index which was down -1.02% in September. Interestingly, the VanEck Green Bond Fund recently revised its mandate to eliminate currency risk exposure by adopting a revised benchmark, the S&P Green Bond US Dollar Select Index.

Sustainable Investing Strategies

Funds/share classes that exclusively employ an ESG integration approach in their investment management, 28 in total, dominate the 40-fund universe of leaders and laggards in September. One of these funds, Mainstay MacKay Infrastructure Bond Fund hedges its approach by noting in its prospectus that it may integrate ESG. Five additional funds/share classes combine ESG integration with one or more sustainable investing approaches, such as shareholder/bondholder engagement and proxy voting or negative screening (exclusions). When combined, ESG integration has been adopted as a strategy by 33 funds or 66% of the universe consisting of the top and bottom performing investment funds.

The remaining seven investment vehicles are dominated by funds that employ negative screening (exclusions) either exclusively or in combination with other strategies. Of these, only two funds/share classes limit themselves totally to negative screening (exclusions). These include American Century NT Non-US Intrinsic Value Fund and the Xtrackers Municipal Infrastructure Revenue Bond ETF. Both funds omit tobacco stocks from their portfolios.

September Performance Scorecards

Notes of Explanation covering equity and all other funds: Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Equity funds include all US and international equity as well as all other funds, except for fixed income funds, a total of 1,712 funds/share classes, ETFs, ETNs with performance for the full month of September 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Notes of Explanation covering equity and all other funds: Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Equity funds include all US and international equity as well as all other funds, except for fixed income funds, a total of 1,712 funds/share classes, ETFs, ETNs with performance for the full month of September 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Notes of Explanation covering fixed income funds: Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Fixed income funds include short and long-term taxable and tax-exempt bond funds and ETFs, a total of 746 funds/share classes, ETFs, ETNs with performance for the full month of September 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

[1] Excludes Columbia India Consumer ETF, up 8.37% in September and listed by Morningstar as an SRI fund, however, this could not be verified via the fund’s prospectus.