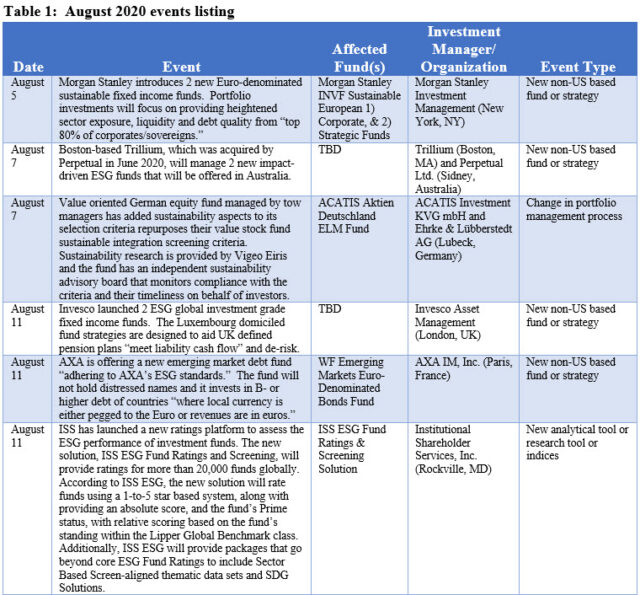

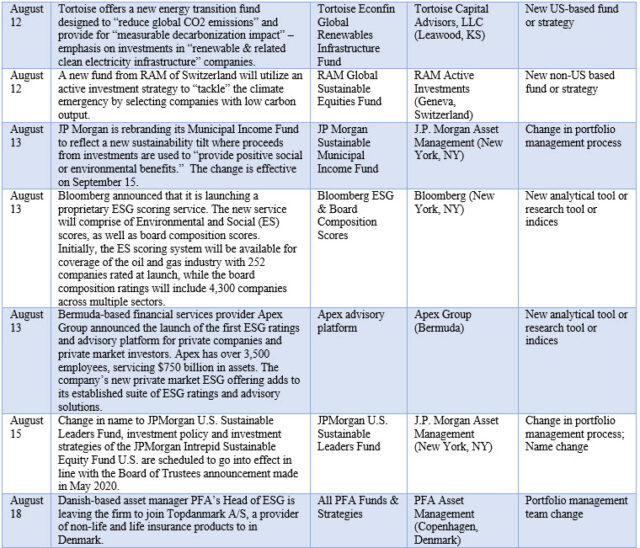

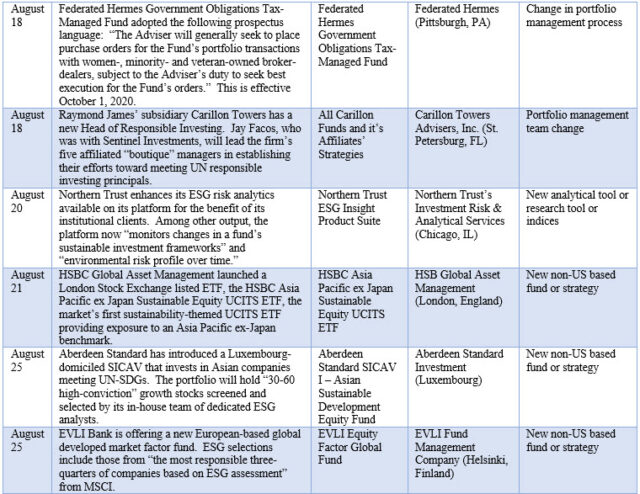

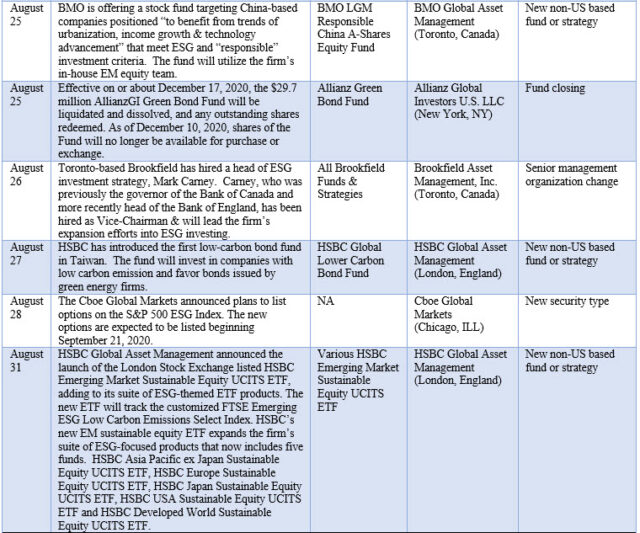

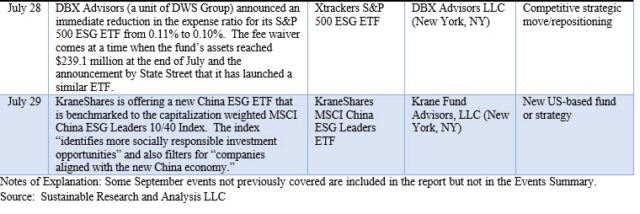

The Bottom Line: Twenty-five August 2020 reported events include first time ESG scores released from two notable firms, Bloomberg and ISS covering companies and funds.

August 2020 events summary

Twenty-five events have been identified for August 2020.

o 12 new ESG fund offerings dominate the events listing, with 11 non-US based funds versus one new US-based strategy.

o Four events cover changes in portfolio management processes.

o Four new analytical tools, or research tools or indices were introduced in August.

o There were two portfolio management team changes.

o The remaining three events included the introduction of a new security type and one green bond fund closing.

Two events have been brought forward from July that had not previously been reported. One of these involves the announced reduction of a sustainable ETFs expense ratio.

Observation:

Four firms launched new analytical tools or research tools or indices, including first time ESG scores released from two notable firms, Bloomberg and ISS. Bloomberg announced that it is launching a proprietary ESG scoring service while ISS launched a new ratings platform to assess the ESG performance of investment funds. A third firm, Apex Group, announced the launch of the first ESG ratings and advisory platform for private companies and private market investors. These firms are adding ESG scoring and ratings products in an increasingly crowded field that, based on an estimate attributed to finance-consulting firm Opimas earlier this year, may reach $1 billion by 2021.

Refer to Table 1.[ihc-hide-content ihc_mb_type=”block” ihc_mb_who=”reg” ihc_mb_template=”4″ ]