SUSTAIN Large Cap Equity Fund Index Description

The index is designed to track the total return financial performance of actively managed sustainable mutual funds investing in large cap domestic stocks and provide a basis for comparison to other similarly managed funds and various securities market indexes. Initiated as of June 30, 2017 with data back to December 31, 2016, the SUSTAIN Large Cap Equity Index tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious and ethical reasons. While methodologies vary, to qualify for inclusion in the index, funds must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact-oriented investment approaches and shareholder advocacy.

Multiple funds managed by the same management firm may be included in the index, however, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

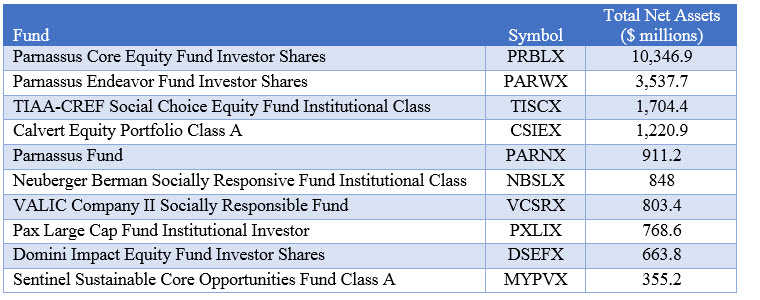

The index constituents in size order as of June 30, 2017, are listed below. The combined assets associated with the ten funds stood at $21.2 billion and represent about 13.7% of the entire sustainable US equity sector comprised of 220 funds/share classes, including actively managed funds and index funds, with $154.4 billion in assets under management.

Table 1: Sustainable Large Cap Equity Fund Index Constituents

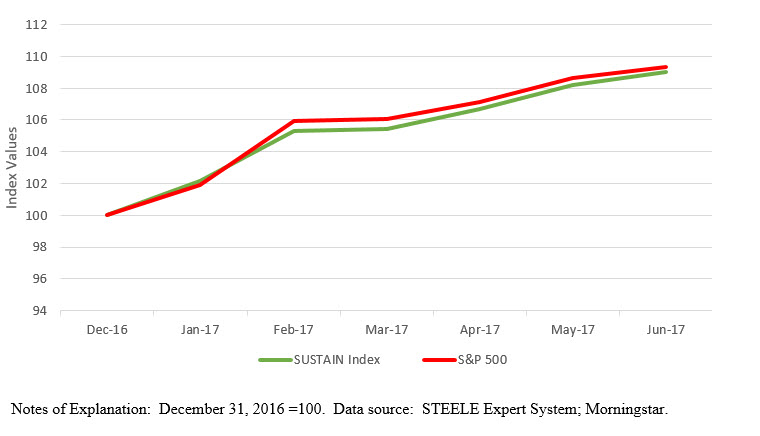

SUSTAIN Large Cap Equity Fund Index Performance: December 31, 2016 – June 30, 2017

For the first six months of the year through the end of June, the S&P 500 gained 9.34% on a total return basis and outperformed the SUSTAIN Large Cap Equity Fund Index, up 8.99%, by a slight 0.34% or 34 bps. Refer to Chart 1. This occurred even as the SUSTAIN Index managed in June to exceed by 10 bps the results achieved by the S&P 500. The index profited from the strong performance achieved by both the Parnassus Endeavor Fund Investor Shares and Parnassus Fund which were up 3.04% and 2.54% respectively as these concentrated funds benefited from the Information Technology and Health Care sector exposures and effective stock selection. The gains recorded by these funds were tempered by the performance of five funds that lagged the S&P 500.

Chart 1: SUSTAIN Large Cap Equity Fund Index Performance Y-T-D June 30, 2017