The Bottom Line: Sustainable municipal bond fund investors have taken notice of potential buying opportunities in municipal bonds and stayed firm even as returns plunged.

0:00

/

0:00

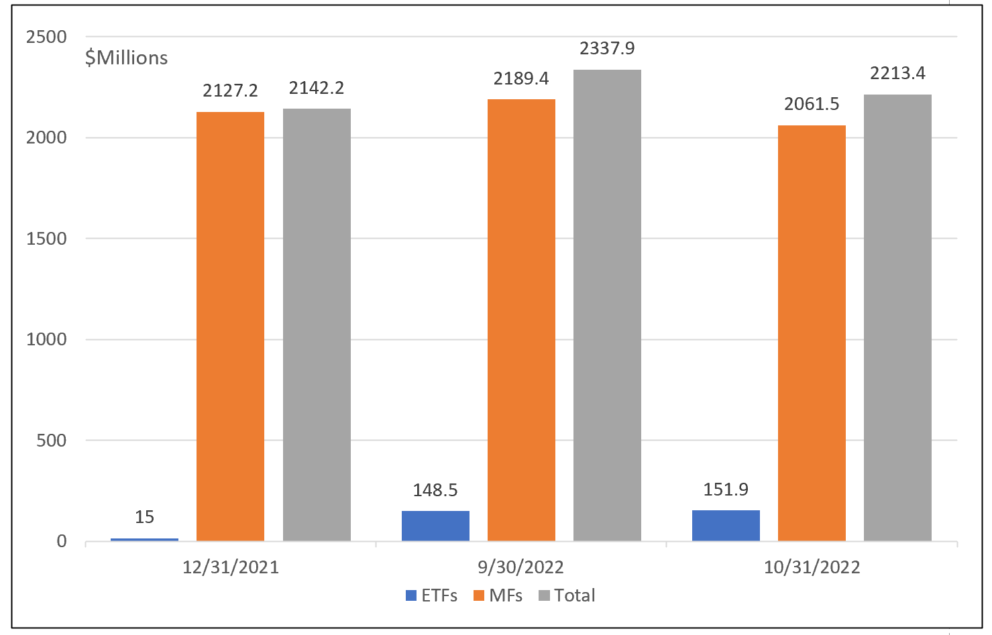

Notes of explanation: 12/31/2021 ETF assets exclude the Franklin Municipal Green Bond Fund that was rebranded and renamed in early May. Fund assets source: Morningstar Direct. Research: Sustainable Research and Analysis LLC.

Notes of explanation: 12/31/2021 ETF assets exclude the Franklin Municipal Green Bond Fund that was rebranded and renamed in early May. Fund assets source: Morningstar Direct. Research: Sustainable Research and Analysis LLC.

Observations:

- Further reinforcement that the Fed’s tighter interest rate policy remains a priority for as long as inflation persists at unacceptably high levels translated into an extension of the bond market’s historic downward slide through the end of October. Unlike equities that gained 8.1% in October, according to the S&P 500 Index, intermediate-term investment grade bonds gave up 1.3% per the Bloomberg US Aggregate Bond Index. The same benchmark is down 15.7% on a year-to-date basis. Municipal bonds weren’t spared. The Bloomberg Municipal Total Return Index posted declines of 0.83% in October and 12.86% year-to-date. High yield municipals performed even worse, dropping 2.05% in October and 17.75% year-to-date.

- That said, the yields on municipal bonds have been increasing in tandem with rising rates, reaching the highest yields in many years. Yields on municipal bonds are now in the 3% to 5% range, up from 1% to 2% at the start of the year. Investors seem to have taken notice of this buying opportunity. Even as sustainable municipal bond funds registered total return declines of 0.78% and 13.4% in October and over the first ten months of the year, assets under management have recorded gains.

- Sustainable municipal bond funds still represent a small 5.5% segment of the sustainable fixed income universe, consisting of 17 mutual funds and 49 share classes with $2.1 billion in assets plus three actively managed ETFs with $151.9 million in assets under management. Combined assets started the year at $2.1 billion, gaining some $195.7¹ to September 30th only to give up $124.5 million to end October at $2.2 billion. Since the start of the year, assets expanded by 3.3% while net cash inflows are estimated at $271 million.

- The universe of sustainable municipal bond funds is limited at this point in terms of fundamental investing options relative to conventional municipal funds. For example, the segment does not include any index fund offerings, state specific funds are limited to two California tax-exempt funds nor is there any stratification along investment-grade and non-investment grade lines. At the same time, the segment does offer a variety of actively managed sustainable investing approaches. For example, there are three actively managed ETFs, one of which is the thematic $100.6 million Franklin Green Municipal Bond Fund that invests in tax-exempt green and sustainable bonds and charges 30 bps. Other options among the mutual funds managed by 14 different firms pursue a range of sustainable investing strategies from values-based to impact to ESG integration, or some combination of these. These include, for example, (1) the large $493.9 million AB Impact Municipal Income Fund (ABIMX) available through wrap fee programs that invests in securities with high ESG scores and are also deemed to have an environmental or social impact in underserved or low socio-economic communities and (2) the $417 million Calvert Responsible Municipal Income Fund (three share classes CTTLX, CTTCX and CTTIX) that’s managed pursuant to the Calvert Principles for Responsible Investment. The Principles provide a framework for the investment adviser’s evaluation of investments considering environmental, social and governance factors. The Principles seek to identify issuers that operate in a manner that is consistent with or promote: environmental sustainability and resource efficiency; equitable societies and respect for human rights; and accountable governance and transparency, among other factors.

- Broadly, sustainable municipal bond funds are subject to an average expense ratio of 68 bps versus 78 bps for actively managed conventional mutual funds.

¹ This includes $100.6 million Franklin Municipal Green Bond Fund that was rebranded and renamed as of early May 2022 from the Franklin Federal Tax-Free Bond ETF.