A small category, sustainable municipal ETFs reach over $1.0 billion in October

Overall, 141 sustainable ETFs with $70.0 billion in assets were on offer in the US at the end of October 2020, including one new fund that was launched during the month. Of these, 30 funds with $20 billion in assets are classified as fixed income, both index funds and actively managed investment vehicles. The overall category expanded by $7.3 billion or an increase of 11.6% across the three month interval to the end of October. A net of $5.4 billion, or 74.5%, was added during the month October alone. Equity-oriented funds added $5.1 billion, or 11.7%, while fixed income ETFs expanded by $2.1 billion or 11.4%.

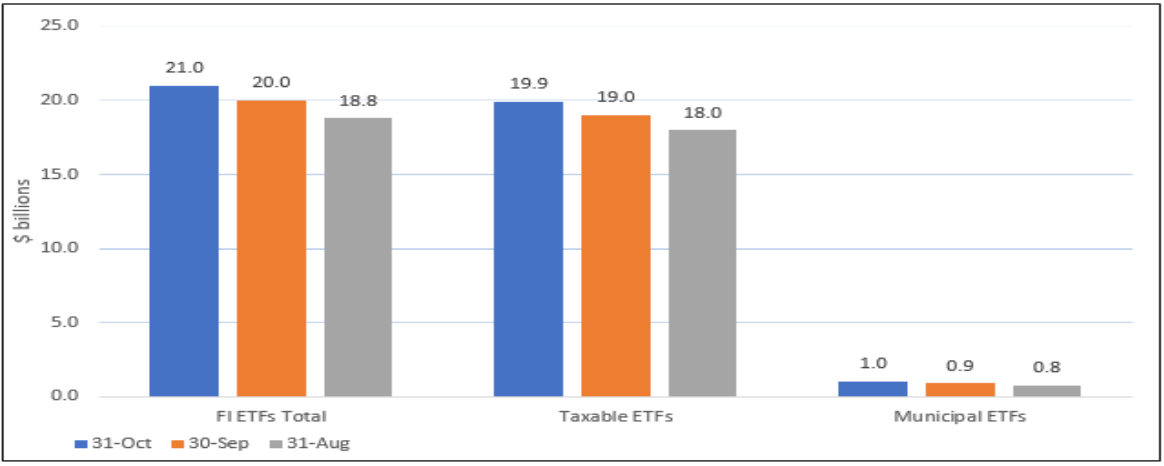

Sustainable fixed income ETFs passed the $20 billion level in October, reaching $21 billion. Refer to Chart 1. Comprised of both sustainable taxable and municipal ETFs, sustainable fixed income ETFs now account for 30% of sustainable ETF assets in the US. At only $1.0 billion, sustainable municipal ETFs make up a small 5% percentage of total sustainable fixed income ETF assets. That said, municipal sustainable ETFs expanded by $262.9 million, or an increase of 34% over the trailing three-months. The investment category consists of only four funds, all actively managed by Eaton Vance, Hartford Funds (Wellington Mgt.) and J.P. Morgan. J. P. Morgan Investment Management dominates the category with its $836 million JPMorgan Ultra-Short Municipal ETF. This ESG integrator accounts for 81% of the segment’s assets and was responsible for $252 million of the increase experienced over the last three months. As part of its security selection strategy, J. P. Morgan also evaluates whether environmental, social and governance factors could have material negative or positive impact on the cash flows or risk profiles of securities universe in which the fund may invest. The firm also manages the much smaller JPMorgan Municipal ETF. Refer to Table 1.

| Fund Name | $ AUM | Sustainable Investing Strategy |

| JPMorgan Ultra-Short Municipal Inc ETF | 835,819,258 | ESG Integration |

| Hartford Municipal Opportunities ETF | 120,816,641 | ESG Integration |

| JPMorgan Municipal ETF | 62,341,547 | ESG Integration |

| Eaton Vance TABS 5to15Yr Ldrd MuniBd NS | 7,471,825 | ESG-Consideration |

| Total | 1,026,449,271 |