Model portfolios: All three sustainable portfolios outpaced their conventional benchmarks in July by 1 bps to 17 bps

As markets across the globe took a breather in July, the three sustainable model portfolios posted positive total returns that exceeded the performance of their corresponding conventional benchmarks by a range extending from 1 basis point (bps) to 17 bps. The Conservative Sustainable Portfolio (20% stocks/80% bonds), Moderate Sustainable Portfolio (60% stocks/40% bonds) and Aggressive Sustainable Portfolio (95% stocks/5% bonds) recorded gains of 0.51%, 0.67% and 0.73%, respectively. Refer to Table 1.

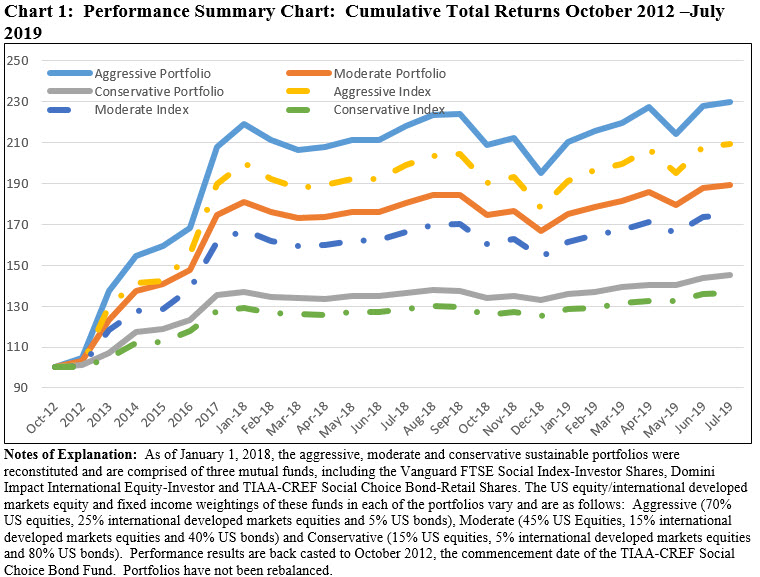

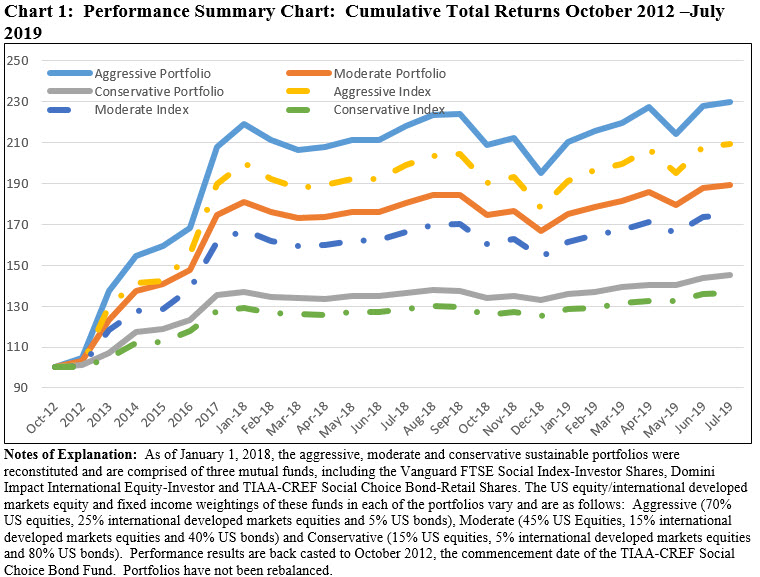

While still outperforming their conventional benchmarks by wide margins since inception as of October 2012, performance over intervals ranging from three-months to 12-months are mixed. The Conservative Sustainable Portfolio maintains the best relative record over the three time periods under consideration, leading its conventional index over two of the three time intervals, including year-to-date and over the trailing 12-months. On the other hand, the Moderate Sustainable Portfolio lagged over the latest three-months, year-to-date and trailing 12-months. Refer to Chart 1.

Driving the performance of the model portfolios in July are the above benchmark returns recorded by two of the three underlying funds. These include the equity-oriented Vanguard FTSE Social Index Fund Investor shares and bond-oriented TIAA-CREF Social Choice Bond Fund Retail shares that beat their benchmarks by a wide 65 bps and 20 bps, respectively. On the other hand, the Domini International Equity Investor shares, down -3.25% in July, underperformed the conventional MSCI EAFE Index by 1.98%. Exposure levels to Domini range from 15% to 5%, commensurate with each sustainable portfolio’s risk profile.

Markets take a breather in July: the S&P 500 Index ended the month up 1.4%, bonds gained 0.22% and foreign stocks were down -1.21%

Compared to gains posted in June that ranged from 2.36% to 6.52%, the total returns recorded by the three model portfolios in July were dialed down as stocks in the US and bonds took a breather while foreign stocks landed in negative territory. The S&P 500 Index ended the month of July up 1.4%. The Dow Jones Industrial Average and Nasdaq Composite each recorded gains of 1.12% and 2.15%, respectively. For both the S&P and Nasdaq indices, these were the smallest positive returns so-far this year, excluding the negative results of -6.4% and -7.79% recorded in May, even after stocks reached a new all-time high on July 26 just ahead of the Federal Reserve Bank’s decision on the last day of July to lower the target range for the federal funds rate to 2 to 2-1/4 percent. The rate cut was the first in 11 years, set against a backdrop of a strong labor market and moderate economic activity but prompted by the Federal Reserve Open Market Committee’s view that “sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain.” In addition to concerns regarding the slowing economy led, for now, by a decline in business investment, exports and growth abroad, investor uncertainty focused on other economic and percolating geopolitical risks, including the continuing US/China trade tensions, slower growth in Europe and China, Boris Johnson’s appointment as Britain’s new prime minister and the possibility that the UK would leave the European Union without a BREXIT deal, and Iran strains. At the same time, US corporates looked set to deliver low single-digit earnings growth for the second quarter. Approximately three-quarters of companies that had reported earnings through the end of July, or about 60% of S&P 500 companies, have beaten analyst earnings estimates so far, although this was largely driven by share buybacks and, in part, reflects a lower hurdle after analysts had grown more pessimistic.

Returns for the month across sectors and asset classes ranged from a high of 5.11% to a low of -5.83% for the narrowest range of returns so far this year. Small-company stocks were up just 0.58% and while this segment has been losing momentum over the last three months it is still up 17.66% year-to-date while large caps are up 20.24%. Also in July, growth stocks outperformed value stocks.

In the fixed income markets, 10-year Treasury yields ended the month at 2.02%, 2 basis points (bps) higher relative to the prior month-end. 90-day Treasury yields remained inverted for the entire month, ending July 6 bps lower than the 10-year. The Bloomberg Barclays US Aggregate Index was up 0.22%. Long-dated and lower-rated securities posted better returns relative to short-dated and highly rated bonds.

Outside the US, stocks didn’t perform as well. The MSCI ACWI ex USA NR Index was down -1.21%, dragged down by the performance of emerging market stocks. MSCI EAFE recorded a decline of -1.27% while China was lower -0.54%.