Positive Economic Data and Corporate Earnings Push S&P 500 to New Records

Global equity markets discounted ongoing geopolitical risks and instead responded to positive economic data that signal continued health in the global economy and stronger global growth. This combination is expected to boost corporate profits that have already gained more than 10% in the first and second quarters of the year, although the pace of profit growth may decelerate. Against this backdrop, the S&P 500 Index was driven to new records as share prices of energy, industrial firms and banks revived during the month of September. After lagging behind for much of this year, small-capitalization stocks also picked up momentum. The S&P 500 added 2.06% during another low volatility month.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

The S&P 500 also registered an impressive gain of 4.48% for the quarter ended September 29th, its eighth consecutive quarterly increase, while year-to-date results were nudged up to 14.24%. Developed markets in Europe and Asia registered even stronger returns, with the MSCI EAFE Index adding 2.5% whereas emerging markets cooled in September, dropping -0.4% according to the MSCI Emerging Markets Index which nevertheless retains the year-to-date lead with an increase of 27.8%. At the same time, U.S. bonds, measured by the Bloomberg Barclays U.S. Aggregate Bond Index, declined -0.48% in September as 10-Year U.S. Treasury yields rose to 2.33%, their highest level since July.

Interest Rates Expected to Move Higher by Year-End

Yields rose after the Federal Reserve Bank left rates unchanged following the central bank’s two-day meeting during the third week of the month. At the same time, the Fed indicated that it remained on track to raise short-term rates later this year and said that it would begin shrinking its portfolio of bonds next month.

At a National Association for Business Economics conference in Cleveland just before month-end, Federal Reserve Chairwoman Janet Yellen reiterated the central bank’s projection for a gradual path of interest rate increases over the next few years despite inflation readings below the Fed’s 2% target for much of the past five years, based on its preferred measure. Yellen noted that “it would be imprudent to keep monetary policy on hold until inflation is back to 2%.”

Yellen’s speech boosted market expectations of a rate increase at the Fed’s December meeting.

Market Reacts Positively to Tax Plan Announcement

Just before month-end, the first details of the Republican tax plan were announced. While still in broad outline form, the plan calls for U.S. corporate tax rates to drop to 20% from its current 27%, a tax on overseas profits, and the high end of personal income-tax rates to drop to 35% from its current 39.6%. The proposed tax plan retains the mortgage-interest deduction but would eliminate state and local tax deductions.

This is still a proposal that should not be confused with an actual bill. There is significant skepticism surrounding the bill’s passage and the hurdles for passage are high, still the market will receive a boost when and if a tax cut should come about as it would be expected to lift both corporate earnings and consumer spending.

Sustainable Portfolios Turned In Positive Results and Outperformed Their Benchmarks

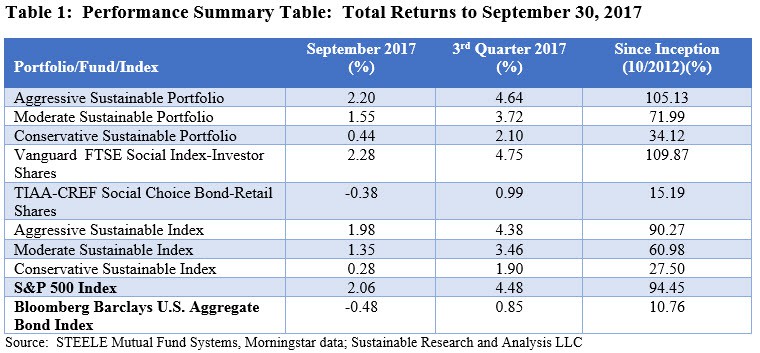

Even as the U.S. bond market declined and yields rose during the month, positive rates of return were generated by each of the sustainable portfolios, led by the Aggressive Sustainable Portfolio (95% stocks/5% bonds) that benefited from the strong results achieved by the Vanguard FTSE Social Index Investor Shares. The fund outperformed the S&P 500 Index, gaining 2.28%. The TIAA-CREF Social Choice Bond-Retail Shares also outperformed its benchmark, giving up 38 bps versus the Bloomberg Barclays U.S. Aggregate Bond Index that experienced a decline of 48 bps. The Moderate Sustainable Portfolio (60% stocks/40% bonds) and the Conservative Sustainable Portfolio (20% stocks/80% bonds) produced gains of 1.55% and 0.44%, respectively. Each of the sustainable portfolios outperformed their designated indexes.

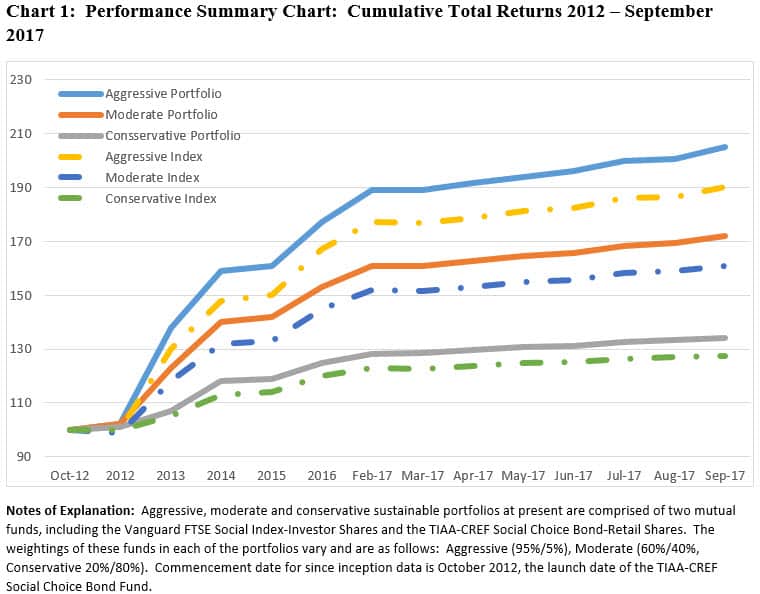

Strong results were achieved in the third quarter, with sustainable portfolio gains ranging from 2.10% to 4.64%. On a cumulative basis since October 2012, the three portfolios, Aggressive, Moderate and Conservative, are up 105.13%, 71.99% and 34.12%, respectively, comfortably in excess of their corresponding indexes that are up 90.27%, 60.98% and 27.50%. Refer to Table 1 and Chart 1.

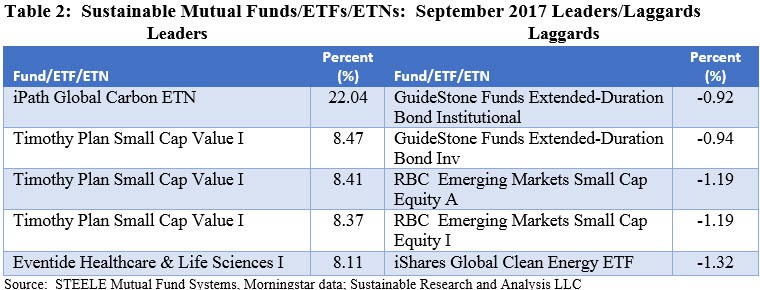

Significant Variation in Performance Observed in September Across Sustainable Funds

Within a universe of 665 sustainable funds, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), the iPath Global Carbon ETN, a $1.4 million structured note, generated the best performance in September with a gain of 22.04%. The fund invested almost entirely in ICE Futures Europe ECX Futures Contracts that are designed to facilitate the trading, risk management, hedging and physical delivery of emission allowances created under the EU Emissions Trading Scheme (EU ETS). At the other end of the range, iShares Global Clean Energy ETF suffered a decline of -1.32%. Refer to Table 2.

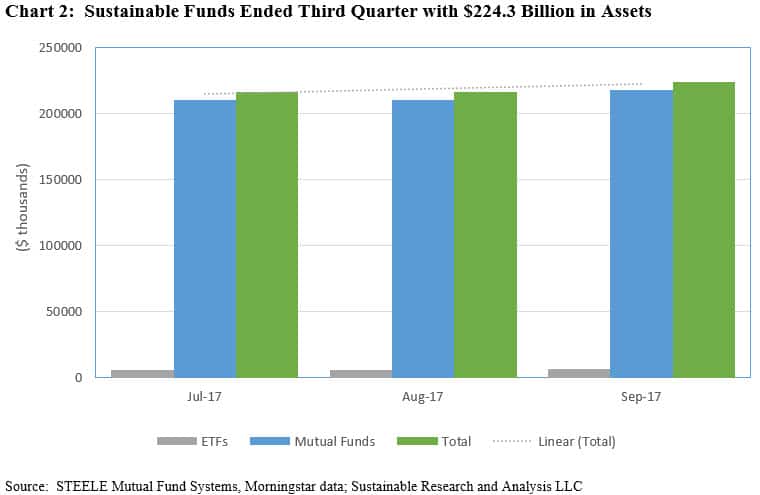

Sustainable Funds Add $13.2 Billion in Assets

The net assets of sustainable funds, including mutual funds, ETFs and ETNs, ended the third quarter with $224.3 billion in net assets, up $13.2 billion or 3.6% for the month and 6.24% for the quarter. Of the gain, $12.4 billion was sourced to mutual funds while the rest represents net flows into ETFs and ETNs. Given the 2.06% gain for the S&P 500 Index, an estimated 31% of the assets increase can be attributed to net positive cash inflows into the sector. Refer to Chart 2.

ETFs and ETNs ended the month of September with $6,397.1 million in net assets, up $352.4 million month-over-month, or 5.8%, and $735 million during the third quarter.

Stock investments dominate the sector, accounting for $199.7 billion in assets at the end of September while fixed fund assets stood at $18.2 billion. Actively managed assets dominate, representing 83% of the assets allocated to sustainable funds.

[/ihc-hide-content]