The Bottom Line: Tesla, already a member of some leading US equity ESG indices, is now eligible for addition to the S&P 500 ESG Index.

Tesla now eligible for addition to the S&P 500 ESG Index

Tesla was in the news again, this time in connection with the addition of the stock as a member of the S&P 500 Index, effective on Monday, December 21st. Given its market value of around $659 billion, the stock entered the benchmark as a top 10 constituent along with tech giants such as Microsoft, Apple, Amazon, Alphabet and Facebook that together make up 23.49% of the S&P 500 . Tesla’s entry into the S&P 500 index, at 1.56% of the index weight as of December 22, 2020, means that the stock is likely to be added to positions in US large cap portfolios that pursue environmental, social and governance (ESG) mandates. Also, Tesla is also now eligible for consideration as a constituent in the S&P 500 ESG Index. Should this take effect at the next rebalancing or sooner provided the company passes S&P’s ESG screens, the S&P 500 ESG will follow a trail already blazed by two leading ESG indexers, namely MSCI and FTSE. These two firms have already incorporated Tesla into their US large to-mid cap indices but the security is less commonly held among the largest ESG large cap equity funds. This is now likely to change.

S&P 500 ESG Index

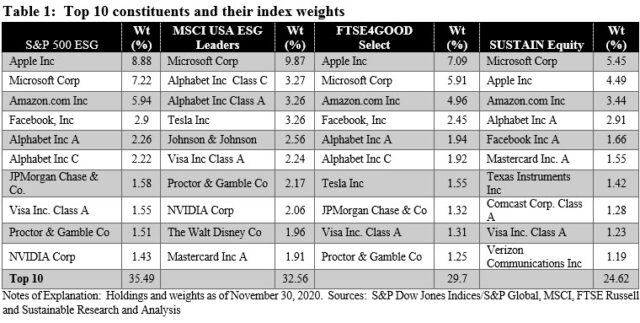

A relative newcomer, the index was launched in January 2019. It is a broad-based index designed to measure the performance of securities meeting S&P’s sustainability criteria while maintaining similar overall industry group weights in the S&P 500. Constituents of the index must be part of the S&P 500 and are qualified based on ESG scoring or excluded due to engagement in certain business activities or controversies. The top 10 holdings, which still exclude Tesla, account for 35.49% of the index weight. Refer to Table 1. As the index is rebalanced annually, effective after the close of business day of April, Tesla would ordinarily not be added until April 30, 2021. That said, Tesla could be added earlier via an extraordinary rebalancing in line of the one that occurred in September of this year when S&P made the decision to exit thermal coal companies.

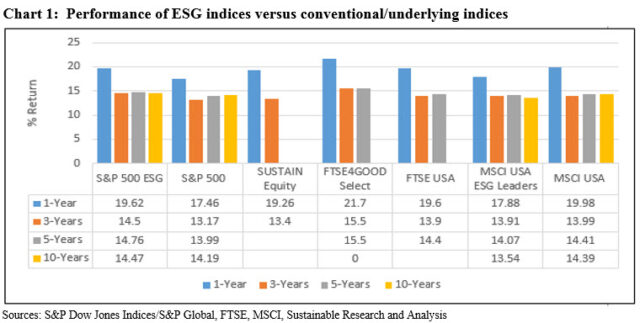

The index, based on backcasting, has beaten the S&P 500 in each of the last 1-year, 3-years, 5-years and 10 years to November 30 with positive performance differentials ranging from 28 bps to 2.16%. Refer to Chart 1.

MSCI USA ESG Leaders Index

The index tracks large and mid-cap companies in the US with high ESG scores relative to their sector peers, and is used as the reference index for the $2.7 billion ESG-oriented passively managed iShares ESG MSCI USA Leaders ETF. As of November 30, 2020, Tesla accounted for 3.26% of the index weight that together with technology giants Microsoft Corp. Alphabet C and A, represent a total weight of 19.7% within the index’s top 10 holdings that on a combined basis account for 32.56% of the index weight. Refer to Table 1. Unlike the other two leading securities market ESG indices, the MSCI USA ESG Leaders Index is the only one that has been underperforming its parent index, the MSCI USA Index, on a long-term basis. The index has lagged over the 1-year, 3-year, 5-year and 10-year intervals to November 30 by a range from 8 bps to 2.1%. At the same time, the MSCI USA ESG Leaders has outperformed the S&P 500 Index, except over the 10-year interval. Refer to Chart 1.

FTSE4Good US Select Index

The index is comprised of US companies that are screened for certain environmental, social, and corporate governance criteria and specifically excludes stocks of certain companies various industries such as adult entertainment, alcohol, tobacco, weapons, fossil fuels, gambling, and nuclear power, to name just a few. Included as an index member since the end of 2016, Tesla is one of the top ten index members and accounts for 1.55% of the benchmark’s weight along with nine other companies that make up 29.7% of the benchmark. Refer to Table 1.

FTSE4Good US Select Index serves as the underlying benchmark for the largest sustainable passively managed mutual fund, the $10.0 billion Vanguard FTSE Social Index Fund. The index has outperformed its underlying benchmark over the 1-year, 3-year and 5-year time intervals by a range from 1.1% to 2.1%. Refer to Chart 1.

Sustainable (SUSTAIN) Large Cap Equity Index

The index, initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds benchmarked against the S&P 500 Index that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, qualifying funds must actively apply environmental, social and governance criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

Across the top ten funds that comprise the index, exposure to Tesla is limited to an average weight of 0.21%. Only two funds reported any exposure to Tesla. The largest of these funds and falling within its top 10 holdings at 1.32% of assets, is the $6.0 billion TIAA-CREF Social Choice Equity Fund. The second only Tesla holding was reported by the almost $18 billion JPMorgan US Equity Fund, with a 0.82% position that the fund has held since August of this year. Refer to Table 1.

The addition of Tesla into the S&P 500 Index will likely also trigger additions to current Tesla holdings and/or the introduction of first-time positions.

The SUSTAIN index has beaten the S&P 500 in each of the last 1-year and 3-years with positive performance differentials ranged from 1.8% over the trailing 1-year and 23 bps over the trailing 3-year intervals. Refer to Chart 1.