The Bottom Line: A parallel exists between recent GameStop volatility, a stock’s vulnerability to social media actions and the potential exposure of sustainable investment funds.

Introduction and Summary

A convergence of factors recently empowered a group of retail traders to fuel stock market volatility and disrupt trading in some U.S. listed stocks. Extraordinary price volatility for some stocks exposed investors to rapid and severe gains and losses and in the process served to undermine market confidence. Enabling this has been a fundamental shift on Wall Street brought about by low-to-zero trading costs, voluminous and rapid information flows, and technological innovations that help harness social media to create an online community of traders. These traders “took on Wall Street” by short squeezing hedge funds that had bet heavily against a number of stocks, in particular: GameStop (GME), AMC Entertainment (AMC), Nokia (NOK) and Blackberry (BB).

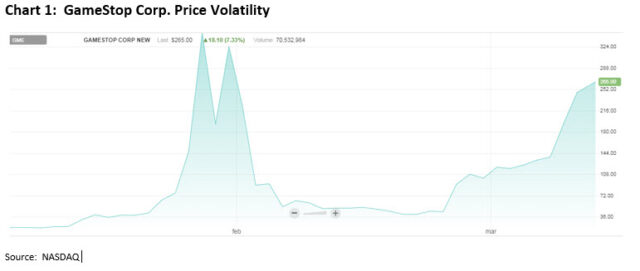

The investing public continues to be “enthralled” by the “GameStop” trading incident while regulators seek to understand this development and its implications. In general, the share price for GameStop Corp. skyrocketed in response to social media instigated and fueled posts, even though company fundamentals were anything but positive. Refer to Chart 1. Stock pickers, many of whom were identified as less experienced investors employing the online community Reddit and user-friendly trading platform Robinhood, were reportedly “egged on” by web chatter to take specific investment positions targeting established hedge funds. GameStop share prices continue to experience significant volatility.

The use and leveraging of social media to channel investors as well as build-up significant and concentrated investment positions such as those seen with GameStop, is concerning from a market manipulation standpoint. Moreover, the speed and breath of the social media’s influence further complicates this matter. Reports that self-styled “activists” encouraged other investors to take bullish positions to manipulate stock trading creates a serious affront to the credibility, and general confidence and trust in the market. It also serves to transform investing to a form of gambling.

We believe that there is a parallel between what has been observed with regard to GameStop and a stock’s vulnerability to social media actions via new technologies and the potential exposure of sustainable[1] investment funds, ETFs in particular, to heightened redemptions and price volatility.

The following are a few examples of some features of sustainable investment funds that could make them especially vulnerable to market manipulation.

- Some Sustainable Investment Positions Are Inherently Open to Conflict: By their nature sustainable investment funds could take positions that may not rest well with everyone. This potential conflict goes beyond financial fundamentals, and may strike at individual cultural, social, lifestyle, religious, and political beliefs, to name a few. Further, the discretionary character of such beliefs make it challenging to predict public reaction to all of the potential ESG considerations that a sustainable investment manager may encounter. Needless to say, adverse investor and broader public responses are to be expected.

- Attract Investors Wishing to Express Personal “Values”: For those seeking to take issue with various ESG factors, sustainable investment funds make easy and ripe targets. After all, the growing presence of ESG funds has been widely publicized and touted over the last few years. To some, mutual funds and ETFs of all sorts, including sustainable funds, represent “Wall Street” and “big” money. And as noted above, sustainable mutual funds and ETFs touch on beliefs and values-based issues that not only attract those wishing to do good, but also those who may have other agendas.

- Portfolios Designed to Address Explicit Sustainability Themes: Fund managers investing to meet specific ESG themes may be inadvertently “painting” an even larger target on themselves for those wishing to encourage opposing views. Sustainable investing as a policy defines what a manager is committed to and working toward. As such, it implicitly suggests a heightened level knowledge, thought, and a sustainability-related purpose. In these cases, those wishing to discredit such initiatives, are given additional reasons to “attack” the most visible and leading proponents. Sustainability-oriented initiatives may serve to elevate attention even further when asset managers take on public roles to promote corporate alignment with such policies.

- Sustainable ETFs Are a Venue for More Active & Tactically-Oriented Investors, Possibly Leading to Heightened Volatility: Active and passively managed ETFs are gaining traction among sustainable investors. At the end of December, there were 170 sustainable ETFs with $126.7 billion in assets under management. These funds, however, are vulnerable to extreme volatility that can arise when investors, in concert, decide to liquidate their shares. While procedural rules adopted following the “flash crash” of August 24, 2015 were designed to limit the exposure of ETFs to extreme volatility events, wide variations in spreads between market prices and NAVs are still possible as illustrated recently when State Street’s SPDR S&P Retail ETF (XRT), which held GameStop, traded at a 3.1% discount just after the market opened on January 28 with gaps widening during the trading session due to trading halts on GameStop.

- Sustainable Mutual Funds May be Exposed to Greater Liquidity Risk: Sustainable mutual funds may also be susceptible to adverse investor behavior, requiring rapid liquidations of securities at lower prices in order to accommodate large and unexpected redemption requests.

- A Lack of Standards & Transparency May “Invite” Investor Reaction: Currently, sustainable investment funds lack a universally accepted standard definition of what constitutes sustainable investing, ESG is undefined, fund classifications are not standardized and disclosure practices vary. This generally introduces confusion and an element of uncertainty to the investment process. For investors who are not convinced of either the validity of sustainable investing, the relevance of selected sustainable investing approaches or ESG factors and outcomes, the absence of standardization may “invite” an adversarial argument and point of contention.

- Mismatched Sustainable Fund Manager & Parent Company’s Sustainability Practices: It’s not uncommon to see new sustainable funds being launched by fund managers whose parent companies may not have as stringent sustainability guidelines and policies of their own. This mismatch can expose the most dedicated sustainable investment manager and their fund products and bring this into question, even from a supportive and friendly public. Sometimes this occurs when the public doesn’t fully understand investment management processes and related portfolio selection policies and restrictions. It may even occur for fund managers who operate with some independence from their parent companies.

Concluding Remarks

The social media-driven and sometimes “vindictive” trading activity involving GameStop and other stocks, raises concerns for those who trust the potential value of sustainable investing. There are reasons to believe that sustainable investment managers and their fund products could be exposed to similar “targeting”. This may be especially the case given the politically sensitive and sometimes controversial nature of some sustainability factors as well as opportunities for “green washing,” especially In the absence of industry-wide standards.

From a technical standpoint, sustainable funds and ETFs are believed to have added reason for concern. ETFs are sometimes the investment of choice for strategic, short-term traders i.e., “day traders”, and increasingly by new investors utilizing trading platforms. These are some of the characteristics of those deemed to have fueled the GameStop frenzy. It is only a short jump for investors holding anti-hedge fund sentiment to shift their focus to sustainable ETFs.

Finally, the possibility that some of the GameStop trading action was motivated by targeting other investors, we believe raises larger moral questions. Fundamentally, the market is not a forum to cause or inflict harm. Those basing their investment decisions on such criteria are for multiple reasons, considered to be harming the integrity and general efficiency of the markets for all of its participants.

Written by Steve Schoepke and Henry Shilling

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic investing, impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.