The Bottom Line: The decisions by high profile investment management firms to withdraw from the Climate Action 100+ does not signal a retreat from ESG.

Investment management firms and companies don’t seem to be retreating from ESG related programs

The Wall Street Journal (WSJ) concluded the previous week that the tide may have turned on ESG investing. This was put forward in an editorial published on February 16, 2024 entitled “An ESG Asset Manager Exodus” citing that BlackRock, J.P. Morgan Asset Management and State Street Global Advisors are withdrawing from the Climate Action 100+. In the same edition of the WSJ, an article on the inequality characteristic of municipal bonds noted that “on some parts of Wall Street, values-based funds seem to be losing popularity amid rising rates and conservative backlash.” While there may be varying facts and reasons driving the decisions by these high-profile firms to withdraw as signatories to the Climate 100+ initiative, it doesn’t appear to signal a retreat from their stewardship activities. These range from considering relevant and material ESG risks and opportunities facing investee companies and their securities offerings to engagements with portfolio companies and proxy voting. At the same time, companies across the globe are also standing by their ESG related programs.

Climate Action 100+ Compact was launched in 2017 and recently shifted to a new phase

Climate Action 100+ (CA100+) represents itself as an investor-led initiative launched at the end of 2017 to ensure that the world’s largest corporate greenhouse gas emitters take necessary action on climate change. The initiative, which is coordinated by five investor networks, including Asia Investor Group on Climate Change (AIGCC), Ceres, Investor Group on Climate Change (IGCC), Institutional Investors Group on Climate Change (IIGCC) and the UN affiliated Principles for Responsible Investment (PRI), aims to coordinate engagement activities and unify messaging of dialogue with more than 160 of the world’s most systemically important carbon emitters. According to the organization’s website, upwards of 700 investors signed on to the initiative that was established with a core goal of addressing climate-related disclosures. Today, these include some 89 investment managers and 50 asset owners in the US. In June 2023, it was announced that the Climate Action 100+ initiative would be entering into a second phase and evolve its core goals from corporate-climate related disclosure to the implementation of climate transition plans—a more intrusive investor engagement model. In this connection, signatories have been asked to commit and sign on by June 2024 to using client assets to pursue net zero emissions reductions in investee-companies through stewardship management. In advance of this deadline, several high-profile signatories announced their withdrawal as signatories to the Climate Action 100+ initiative.

The list of withdrawing companies includes J.P. Morgan Asset Management, State Street Global Advisors, PIMCO and BlackRock, Inc. In the case of BlackRock, the firm transferred participation in the initiative to BlackRock International which, according to BlackRock, is the organization that engages with most clients that have adopted net zero targets.

Firms in the US reconsider their Climate Action 100+ membership for various reasons

The reasons for withdrawing as signatories may vary from one firm to the next, however, some common reasons for these actions are likely linked to the pivot taken by Climate Action 100+ from an emphasis on disclosure to one that attempts to enlist asset management firms and financial institutions in the effort to seek changes in investee company strategies. For asset management firms based in the US, the Climate Action 100+ updated mandate likely introduces conflicts with the interpretation of their fiduciary responsibilities as well as contractual obligations, potential exposure to litigation risks, which have been rising in the US, as well as a response to the politicization of ESG. That said, this action doesn’t appear to signal a retreat from their stewardship activities that range from considering relevant and material ESG risks and opportunities facing investee companies and their securities offerings to engagements with portfolio companies and proxy voting.

Here is a case in point. J.P. Morgan Asset Management presents itself as an active investment manager and a fiduciary. According to the firm per its 2022 Investment Stewardship Report, this means that it has a “deeply held conviction that in-depth research and rigorous analysis – by experts across functions, sectors and regions – are key to delivering long term, risk-adjusted returns for our clients.” The firm seeks to “deliver stronger financial outcomes, including by focusing on the most financially material environmental, social and governance (ESG) issues that we believe impact the long-term performance of companies in which we invest. Additionally, we advocate for robust corporate governance and sound business practices. We believe that understanding financially material ESG factors plays an important role in delivering long-term value creation for our clients.” Regarding its approach to stewardship, J.P. Morgan Asset Management considers active engagement as an important tool to maximize shareholder returns through industry participation and proxy voting across asset classes. J.P. Morgan’s approach applies to its $2.8 trillion in assets under management (as of December 31, 2022) but may deviate, for example, in cases involving client’s contractual obligations that impose certain investment guidelines or in cases of focused funds that are subject to explicit sustainable investing guidelines. Based on Morningstar’s classifications, J.P. Morgan offers 16 funds/share classes in the US with $504.7 million in assets.

While firms like State Street, BlackRock and PIMCO may differ in their business profiles and approaches to investment management, views regarding their fiduciary responsibilities, integration of ESG and approach to stewardship are similar and do not appear to be undergoing any changes.

Companies across the globe are also standing by their ESG-related programs

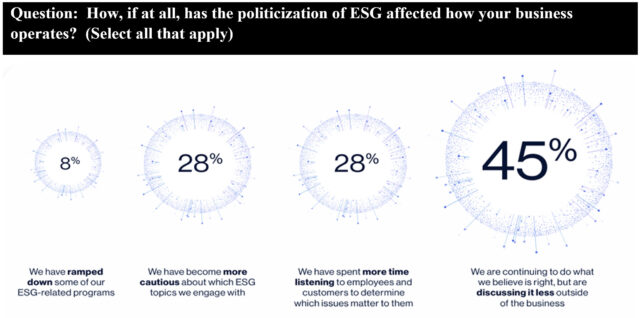

Just as importantly, companies also don’t appear to be retreating from ESG in their business operations. A survey study recently conducted by Teneo, which offers advisory services to CEOs globally, reports that 92% of CEOs are standing by their company’s ESG-related programs even as 72% of CEOs polled are making one or more changes in how they operate in response to the shifting environments. This is based on Teneo’s Vision 2024 CEO and Investor Outlook Survey that was conducted by the firm’s in-house data, insights and analytics team between October 12 and November 27, 2023. The survey includes the views of more than 260 global CEOs and institutional investors representing more than $3.4 trillion of company and portfolio value.

Notes of Explanation: Sources: Teneo Vision 2024 CEO and Investor Outlook Survey, Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Sources: Teneo Vision 2024 CEO and Investor Outlook Survey, Morningstar Direct and Sustainable Research and Analysis LLC. The survey goes on to state that “…whether they chose to be less vocal about their ESG initiatives externally – or even eliminate the acronym from their communications altogether – a vast majority of CEOs continue to believe that certain ESG issues are critical to their business and to their stakeholders. In fact, only a very small percentage of companies (8%) report ramping down some of their ESG-related programs in response to these political headwinds. Those that do so may avoid some short-term backlash, but still face increased scrutiny from stakeholders and forego benefits to the business in the longer-term.”

![ESG-Investing-1[1] ESG Sustainable environmental Investing concept. Autumn forest Top View landscape. Sustainable investing ESG Technology of renewable resources to reduce pollution and carbon emission of Nature.](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/ESG-Investing-11-qyx7jm7qo3ynm67cytv3p9505x54ipgqatt9rs24rw.jpg)