The Bottom Line: Six thematic funds focusing on gender equality are in operation, offering investors three ETFs and three mutual funds managed by five firms.

Investing case

Last week world leaders, including political leaders, executives and other stakeholders, gathered in Paris to attend the Generation Equality Forum convened by U.N. Women—an organization formed by the UN in 2010 to work for the elimination of discrimination against women and girls, empowerment of women, and achievement of equality between women and men as partners and beneficiaries of development, human rights, humanitarian action and peace and security. Together, this group, which has not gathered together since the 1995 Beijing World Conference on Women, unveiled a total commitment of $40 billion to advance gender equality. This is reportedly the largest dollar amount ever dedicated to the issue. The funding will go toward instituting hundreds of new gender-focused policy proposals on issues including gender-based violence, which spiked globally during the coronavirus pandemic, economic empowerment and access to reproductive health services. The $40 billion was pledged by various stakeholders, including a $2.1 billion commitment by the Bill and Melinda Gates Foundation to be spent over the next five years on health and family planning programs, economic empowerment projects and other initiatives. This largest-ever single commitment was among other pledges that came from foundations, including the Ford Foundation and the George Soros-funded Open Society Foundation and PayPal that each pledged more than $100 million.

Not everyone is in a position to make such pledges, however, investors with a preference for advancing gender equality can take another tact, by allocating a percentage of their portfolio assets in mutual funds or ETFs that invest in securities of issuers that demonstrate a commitment to advancing and empowering women through gender diversity on their boards, in management and through other policies and programs. In a similar fashion, these investment vehicles represent an option for sustainable investors wishing to align their investments with the UN Sustainable Development Goals (SDGs) and in particular SDG Number 5 that seeks to achieve gender equality and empower all women and girls.

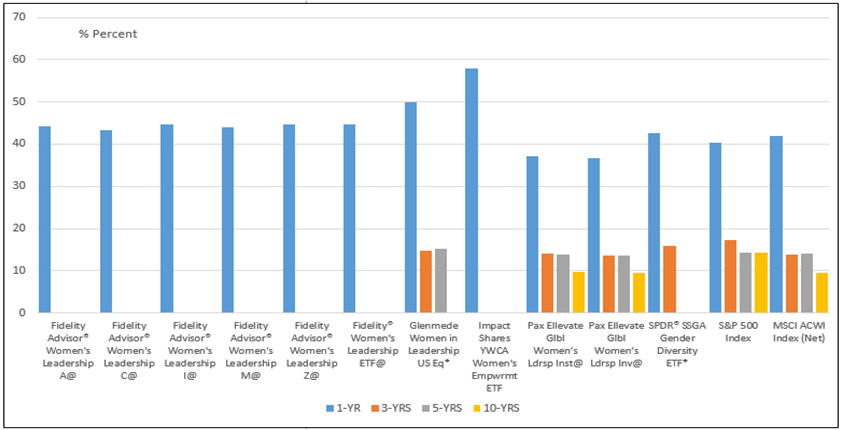

At least six thematic funds, with total net assets of $1.3 billion as of May 31, 2021 are available for consideration by investors. Refer to Table 1. These funds include three ETFs and three mutual funds managed by Fidelity Management and Research Company, Glenmede Investment Management, Impact Shares Corp., Impax Asset Management and State Street Global Advisors. Three of these are passively managed while three of the six invest in US as well as non-U.S. securities. While individual strategies vary, the funds tend to concentrate in similar sectors, the largest of which are technology, financial services and consumer services or healthcare. The top pick SPDR SSGA Gender Diversity ETF, for example, allocates 53% of portfolio assets to the following three sectors: 21.7% to financial services companies, 17.9% to technology companies and 13.3% to companies in the health care sector. Top securities holdings include PayPal Holdings, Inc., Texas Instruments, Inc., Visa, Inc., The Walt Disney Company and Johnson and Johnson, Inc. Performance results over the twelve months ended May 2021 were generally strong, averaging 44.5% versus 40.3% recorded by the S&P 500 and 41.85% achieved by the MSCI ACWI Index (Net), with only one fund (two share classes) lagging their broad designated benchmarks. Refer to Table 2 and Chart 1. At the same time, intermediate to-long-term performance results, while limited as only three of six funds that have been in operation for 3 years or more, lack distinction as they fall just short of their benchmarks.

Summary analysis

- Five investment management firms managing six funds are available to investors, including three ETFs and three mutual funds offered in the form of one-to-multiple share classes; three of these are passively managed. The latest edition to this small universe of funds includes the Fidelity Women’s Leadership ETF¹ that was launched on June 17th of this year.

- Three of the six funds focus on the stocks of US listed companies while the other three funds cast a broader net that extends to foreign firms. These include Pax Ellevate Global Women’s Leadership Fund, the oldest of the six funds in operation since October 1993, Fidelity Advisor Women’s Leadership Fund and the recently launched Fidelity Women’s Leadership ETF. As of May 31, 2021, exposure to non-US companies stood at 31.7% and 11.7%, respectively².

- Fund expense ratios are high for some of the fund offerings, which can detract from performance results. Expense ratios range from a low of 0.2% to a high of 2%, with the median expense ratio landing at 0.85%.

- The performance track record of the five funds in the segment is limited, with only two funds in operation beyond a full 12-month period. Four of the five funds posted strong near-term results, beating their respective benchmark, either the S&P 500 or the MSCI ACWI Index (net) over the 12-month period to May 2021. Pax Ellevate Global Women’s Leadership funds was the exception, trailing the MSCI ACWI Index (net) not only over the last year but also over the trailing 3 and 5-year intervals.

Top picks

- SPDR SSGA Gender Diversity ETF (SHE), managed by State Street Global Advisors, is the second largest fund in the small category. It seeks to replicate the performance of the SSGA Gender Diversity Index that consists of US large capitalization companies that are “gender diverse.” These are defined as companies that exhibit gender diversity in their senior leadership positions. The fund levies the lowest expense ratio at 2 bps and has recorded total return results exceeding the S&P 500 over the trailing twelve months but not over the preceding three year time period.

- Glenmede Women’s Leadership Fund (GWILX), managed by Glenmede Investment Management LP, has been in operation since December 2015. The fund is considerably smaller than SHE and passes on a higher 85 bps expense ratio. That said, it posted strong performance results in the twelve months ended May 2021, up 50.03%; and with a 15.1% total return, the fund has delivered the best 5-year average annual return (even as it missed over the 3-year mark) based on its value-oriented approach that emphasizes reasonable prices, good fundamentals and rising earnings expectations. The approach has been accompanied by higher volatility and turnover ratio.

| Fund Name | MF/ETF | Active/Passive | Geographic Mandate | Explicit Sustainable Investing Approach |

| Fidelity Advisor Women’s Leadership A (FWOAX) | MF | Active | G | Thematic |

| Fidelity Advisor Women’s Leadership C (FWOCK) | MF | Active | G | Thematic |

| Fidelity Advisor Women’s Leadership I(FWMNX) | MF | Active | G | Thematic |

| Fidelity Advisor Women’s Leadership M (FWOEX) | MF | Active | G | Thematic |

| Fidelity Advisor Women’s Leadership Z (FWOZX) | MF | Active | G | Thematic |

| Fidelity Women’s Leadership ETF (FDWM) | ETF | Active | G | Thematic |

| Glenmede Women in Leadership US Equity Fund (GWILX)* | MF | Active | US | Thematic |

| Impact Shares YWCA Women’s Empowerment ETF (WOMN) | ETF | Passive | US | Thematic, and exclusions of companies involved in weapons, gambling and tobacco, that do not meet certain ethical standards and companies that have experienced legal controversies. |

| Pax Ellevate Global Woman’s Leadership Institutional (PXWIX) | MF | Passive | G | Thematic, and exclusion of companies that fail to meet certain ESG thresholds including tobacco products and fossil fuel companies. Fund is fossil fuel free. |

| Pax Ellevate Global Woman’s Leadership Inv (PXWEX) | MF | Passive | G | Same as above. |

| SPDR SSGA Gender Diversity ETF (SHE)* | ETF | Passive | US | Thematic |

| Fund Name | MF/ETF | Expense Ratio (%) | Assets ($millions) | 12-Month Return (%) | 3-YR Return (%) | 5-YR Return (%) | 10-YR Return (%) |

| Fidelity Advisor® Women’s Leadership A | MF | 1.25 | 3 | 44.33 | |||

| Fidelity Advisor® Women’s Leadership C | MF | 2 | 1 | 43.28 | |||

| Fidelity Advisor® Women’s Leadership I | MF | 1 | 4.5 | 44.66 | |||

| Fidelity Advisor® Women’s Leadership M | MF | 1.5 | 1 | 43.95 | |||

| Fidelity Advisor® Women’s Leadership Z | MF | 0.85 | 9.7 | 44.78 | |||

| Fidelity® Women’s Leadership ETF# | ETF | 0.59 | NA | ||||

| Glenmede Women in Leadership US Eq* | MF | 0.85 | 30 | 50.03 | 14.67 | 15.1 | |

| Impact Shares YWCA Women’s Empwrmt ETF | ETF | 0.75 | 25.6 | 57.85 | |||

| Pax Ellevate Glbl Women’s Ldrsp Inst | MF | 0.53 | 745.9 | 37.06 | 13.98 | 13.8 | 9.77 |

| Pax Ellevate Glbl Women’s Ldrsp Inv | MF | 0.78 | 148.9 | 36.71 | 13.7 | 13.51 | 9.5 |

| SPDR® SSGA Gender Diversity ETF* | ETF | 0.2 | 234.3 | 42.68 | 16 | ||

| Total/Average | 1,305.5 | 44.54 | 14.18 | 14.14 | 9.64 | ||

| S&P 500 Index | 40.32 | 17.16 | 14.38 | 14.38 | |||

| MSCI ACWI Index (Net) | 41.85 | 13.86 | 14.18 | 9.58 |