The Bottom Line: Sustainable investors who wish to focus on water-related investments have a number of mutual fund and ETF thematic pure plays to consider.

Investing case

It’s been widely reported in recent weeks that nearly three-fourths of the American West is grappling with the most severe drought in the recorded history of the U.S. Drought Monitor. Conditions this spring are much worse than a year ago and hot and arid conditions will exacerbate the threat of wildfires and water supply shortages this summer. Parts of California, Nevada and Washington State experienced sweltering triple-digit temperatures over the past week and states released excessive-heat warnings and heat advisories in some areas. At the same time, factors such the reopening of industrial and commercial activities following the successful development and distribution of COVID vaccines and fiscal as well as monetary stimulus that are leading to broader economic strength and recoveries around the world all contribute to a favorable outlook for the water sector-one of a number of sectors qualifying as a thematic approach to sustainable investing¹.

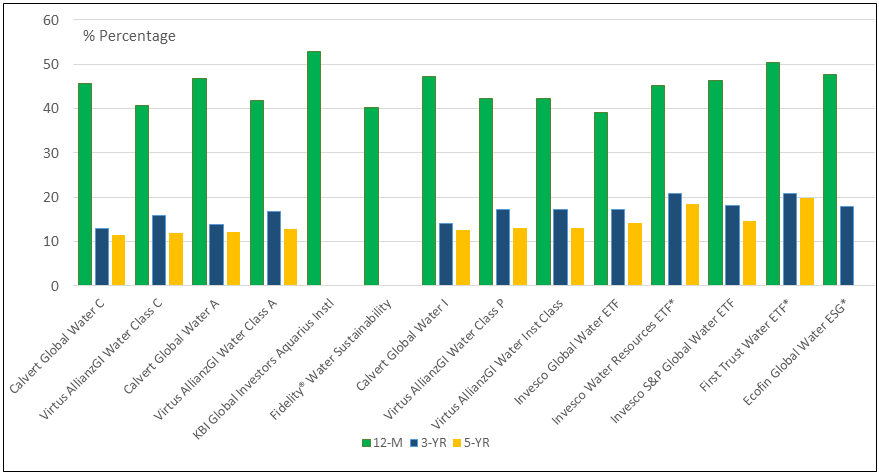

Investing in water-related stocks, including, for example, companies whose main business is in the water-related resource sector, such as water treatment, engineering, filtration, environmental controls, water related equipment, water and wastewater services and water utilities, to mention just a few, offers investors an opportunity to diversify their portfolios, gain exposure to a theme with favorable prospects and at the same time integrate a sustainable investing strategy into a broader portfolio that aims to emphasize sustainable investing through long-term value creation. While returns can be attractive over short-to-intermediate time frames, as illustrated by the average trailing 12-month returns of 45.7% for the segment of water-related mutual funds and ETFs versus 40.3% for the S&P 500 Index, investors should also be prepared for bouts of volatility. In 2018, some funds gave up as much as -14.21% while the S&P 500 posted a drop of -4.4%.

Investors who wish to focus on water-related investments have a number of mutual fund and ETF pure plays to consider. These are thematic funds that qualify as sustainable investments based on their sector orientation. At the same time, some of the funds also engage in ESG Integration approaches as detailed in Table 1. Table 2 lists the same funds along with their expense ratios, size and performance track records for intervals ending as of May 31, 2021 while Chart 1 displays average annual rates of return for intermediate-term time intervals.

Summary analysis

- Ten equity water-related mutual funds and ETFs are in operation, including five ETFs.

- The segment is dominated by passively managed funds (index funds), but three actively managed mutual funds are also available.

- Eight of ten funds invest in stocks of US companies as well as foreign firms; two ETFs invest in companies listed in the US, including American Depositary Receipts (ADRs) that provide some foreign exposure.

- Five funds and ETFs pursue an explicit sustainable investing strategy. That said, the approaches vary and investors should consider funds that align with their sustainability preferences.

- The ETFs in the segment have posted the some of the best performance track records over time periods extending to five years, reaching 18.5% and 19.7% in two instances; these funds also levy the lowest expense ratios. In fact, the funds with the best intermediate term track records are offered to investors at the lowest fees—displaying expense ratios that fall within the lowest quartile up to 57 bps. These also correspond to the largest ETFs in terms of assets under management. The largest funds with the lowest expense ratios correlate highly with the best total return results.

Top picks

- First Trust Water ETF (FLOWX), one of the largest in the segment at $996.3 million in assets with a 54 bps expense ratio that was up an average annual 19.74%, 20.8% and 50.4% for the 5-, 3- and one-year periods ended May 31, 2021.

- Invesco Water Resources ETF (PHO), the largest fund in the segment at $1,661.4 million in assets, the fund charges 60 bps and returned 18.5%, 19.0% and 45.8% for the 5-, 3- and one-year intervals ended May 31, 2021.

- Ecofin Global Water ESG ETF (ECOAX) is considerably smaller than the first two picks and it hasn’t been around as long (its current tracking index was adopted as of June 15, 2018). The fund is subject to the lowest expense ratio at 40 and unlike the other two picks, the fund employs and explicit ESG integration approach.

| Fund Name | MF/ETF | Active/Passive | Geographic Mandate | Explicit Sustainable Investing Approach |

| Calvert Global Water C | MF | P | G | ESG Integration Mixed |

| Virtus AllianzGI Water Class C | MF | A | G | ESG Integration-Mixed (1) |

| Calvert Global Water A | MF | P | G | ESG Integration Mixed |

| Virtus AllianzGI Water Class A | MF | A | G | ESG Integration-Mixed (1) |

| KBI Global Investors Aquarius Instl | MF | A | G | ESG Integration |

| Fidelity® Water Sustainability | MF | A | G | None |

| Calvert Global Water I | MF | P | G | ESG Integration-Mixed |

| Virtus AllianzGI Water Class P | MF | A | G | ESG Integration-Mixed (1) |

| Virtus AllianzGI Water Inst Class | MF | A | G | ESG Integration-Mixed (1) |

| Invesco Global Water ETF | ETF | P | G | None |

| Invesco Water Resources ETF* | ETF | P | US Listed | None |

| Invesco S&P Global Water ETF | ETF | P | G | None |

| First Trust Water ETF | ETF | P | US Listed | None |

| Global X Clean Water ETF* | ETF | P | G | Thematic (2) |

| Ecofin Global Water ESG* | ETF | P | G | ESG Integration |

| Fund Name | MF/ETF | Expense Ratio (%) | Assets ($millions) | 1-Month Return (%) | 12-M Return (%) | 3-YR Return (%) | 5-YR Return (%) |

| Calvert Global Water C | MF | 1.99 | 42.6 | 1.43 | 45.71 | 12.94 | 11.41 |

| Virtus AllianzGI Water Class C | MF | 1.97 | 70 | 2 | 40.68 | 15.94 | 11.95 |

| Calvert Global Water A | MF | 1.24 | 239.5 | 1.49 | 46.82 | 13.78 | 12.25 |

| Virtus AllianzGI Water Class A | MF | 1.22 | 270.7 | 2.08 | 41.72 | 16.81 | 12.79 |

| KBI Global Investors Aquarius Instl | MF | 1.1 | 175.5 | 2.59 | 52.8 | ||

| Fidelity® Water Sustainability | MF | 1 | 55.5 | 1.71 | 40.2 | ||

| Calvert Global Water I | MF | 0.99 | 266.9 | 1.52 | 47.17 | 14.09 | 12.59 |

| Virtus AllianzGI Water Class P | MF | 0.94 | 318.7 | 2.12 | 42.22 | 17.14 | 13.1 |

| Virtus AllianzGI Water Inst Class | MF | 0.93 | 293.7 | 2.12 | 42.19 | 17.15 | 13.11 |

| Invesco Global Water ETF | ETF | 0.75 | 281 | 3.15 | 39.19 | 17.2 | 14.18 |

| Invesco Water Resources ETF* | ETF | 0.6 | 1661.4 | 1.71 | 45.11 | 20.92 | 18.51 |

| Invesco S&P Global Water ETF | ETF | 0.57 | 944.3 | 2.92 | 46.25 | 18.21 | 14.6 |

| First Trust Water ETF | ETF | 0.54 | 996.3 | 1.28 | 50.41 | 20.79 | 19.74 |

| Global X Clean Water ETF* | ETF | 0.5 | 3.2 | 2.58 | |||

| Ecofin Global Water ESG* | ETF | 0.4 | 42.6 | 2.58 | 47.8 | 17.95 | |

| Total/Average | 0.98 | 5,661.9 | 2.09 | 44.88 | 16.91 | 14.02 |