The Bottom Line: Plans announced yesterday by UBS to acquire Credit Suisse should not result in any immediate impact on the management of investment funds.

0:00

/

0:00

Listen to this article now

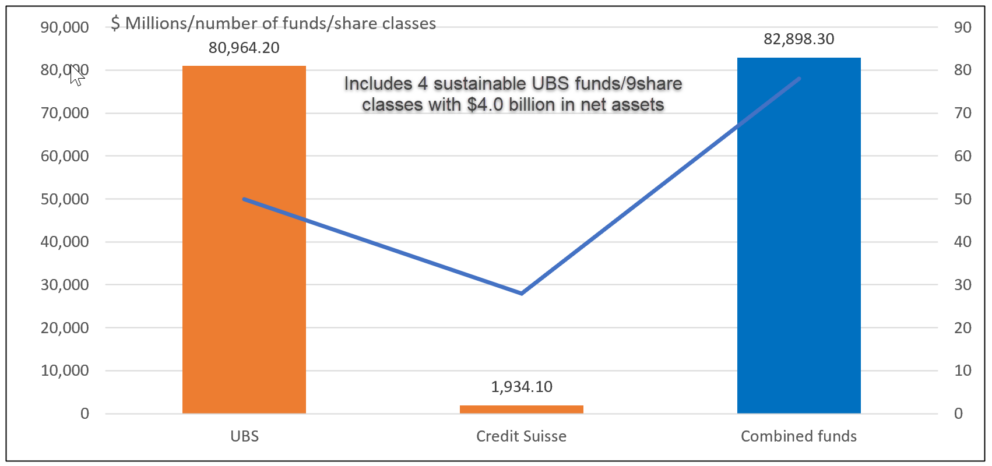

Mutual funds, ETFs and ETNs managed by UBS and Credit Suisse as of February 28, 2023 Notes of Explanation: Sources: Morningstar Direct and Sustainable Research and Analysis LLC

Notes of Explanation: Sources: Morningstar Direct and Sustainable Research and Analysis LLC

Observations:

- In a transaction still subject to shareholder approval that is intended to rescue Credit Suisse from a confidence and liquidity spiral and as well as to support financial stability, UBS announced yesterday that it plans to acquire the 167-year-old financial institution for more than US$3 billion along with support from the Swiss National Bank. According to the UBS announcement, the combination is expected to create a business with more than US$5 trillion in total invested assets and sustainable value opportunities. It will further strengthen UBS’s position as the leading Swiss-based global wealth manager with more than US$3.4 trillion in invested assets on a combined basis.

- Investors in Credit Suisse mutual funds and ETNs, in total 18 funds/20 share classes with US$1.9 billion in assets under management as of February 28, 2023 which would remain segregated in case of bankruptcy, should not expect any immediate consequences. After the transaction closes and management contracts are amended, however, investors should anticipate potential adjustments in the line-up of their funds, management as well as investment strategy changes. For now, and baring any unanticipated developments, investors should closely monitor events relating to the acquisition transaction and any announced plans by UBS regarding the status of Credit Suisse’s investment product offerings.

- In the US, UBS maintains the larger asset management franchise. The firm offers 31 mutual funds, ETFs and ETNs, some 51 share classes in total, with US$81 billion in assets under management as of February 28, 2023.

- In the sustainable investing sphere, Credit Suisse does not offer any explicitly tagged sustainable investment products. Rather, Credit Suisse had been applying a systematic approach to sustainable investing across portfolios, pursuant to which ESG factors are taken into account at various stages throughout the investment process. The firm’s sustainable investing strategies employ ESG criteria when defining the investment universe (e.g. ESG Exclusions), integrating ESG factors directly into the investment process, extending traditional research views to encompass sustainability considerations, and reflecting on ESG factors when selecting and defining exposure to securities. Furthermore, Credit Suisse represents that it supports sustainability initiatives through proxy voting, participation in annual general meetings (AGMs), and engagement with investee companies.

- On the other hand, UBS manages four sustainable investing funds/nine share classes, with almost US$4 billion in net assets under management. Sustainable investing approaches across its offerings of equity, bond and money market funds range from ESG integration that relies on positive screening with an emphasis on maintaining a higher sustainability profile overall as well as exclusions to the selection of companies with the ability to have a positive impact on human well-being and environmental quality. These investment approaches are not expected to be impacted and UBS’s relative ranking within the universe of sustainable investment fund managers will not be affected directly. The firm ranks 16th within a universe of 168 fund firms that manage registered sustainable investment products.