Sustainable Bottom Line: Sustainable Bottom Line: Integrating group annuity contracts into employer sponsored 401(k) plans that offer a lifetime income option for older employees is on the rise.

Introduction

Vanguard Group announced on December 3, 2025, that it is developing a new target-date collective investment trust (CIT) series, Target Retirement Lifetime Income Trusts, that will allow older employees within 401(k) plans to shift some of their savings to buy annuities by incorporating the TIAA Secured Income Account as the lifetime income annuity option. TIAA is a pioneer and leader in guaranteed lifetime income and a major issuer of group annuities (e.g., employer sponsored pension/retirement plan contracts covering many people as contrasted to individual annuities that are bought directly by individuals). According to NAIC/S&P data, TIAA ranks 3rd among writers of group annuities by direct premiums written in 2024. The product design of the annuity, an insurance contract that converts an upfront lump sum payment into a fixed monthly payment for life, will be announced throughout 2026.

Vanguard’s announcement underscores a broader market move of converting a portion of accumulated savings into guaranteed lifetime income inside defined contribution plans. By one estimate, over $100 billion is linked to Target Date Fund (TDA) with embedded guaranteed- income features. While insurers such as Prudential, TIAA, and BlackRock’s LifePath Paycheck Funds (which offer Group Annuity Contracts offered by one or more firms) have already introduced similar structures, Vanguard’s scale may accelerate adoption. The company manages about 40% of the $4.7 trillion in target date funds.

Why annuities are gaining traction is explored below along with the benefits and drawbacks for retirement savers, and how sustainable investors can begin to evaluate group products through a sustainable investing lens.

Why Annuities are entering 401(k) plans

Workers face two persistent risks in retirement: market volatility and longevity risk—the possibility of outliving one’s savings. Traditional target-date funds gradually shift toward bonds to reduce volatility, but they do not guarantee income. Annuities address this gap by converting a portion of assets into predictable payments for life. One recent survey reports that 95% of participants think that it’s important for plans to provide a way to convert savings into consistent monthly retirement income for life. At the same time, 80% of plan sponsors agree that plan participants need in-plan income options. With more employers seeking retirement-income solutions, in-plan annuities are emerging as a structural enhancement to target-date strategies.

Benefits of allocating 401(k) assets to annuities

• Lifetime income stability. Annuities hedge longevity risk by guaranteeing income regardless of market performance. For retirees without defined-benefit pensions, a form of plan that has been largely supplanted by 401(k) plans, this provides meaningful financial reassurance.

• Behavioral advantages. Guaranteed payments reduce the burden of managing withdrawals and help retirees avoid underspending or overspending.

• Portfolio efficiency. By shifting some income responsibility to the annuity, the non-annuitized portion of the portfolio may maintain a more aggressive-oriented allocation so as to achieve higher risk adjusted returns in the long-run.

• Institutional pricing. In-plan annuities often benefit from lower fees than retail annuities, improving payout competitiveness.

Drawbacks and trade-offs

• Loss of liquidity. Once assets are annuitized, they generally cannot be accessed as a lump sum, which may constrain flexibility for unexpected spending needs.

• Interest-rate timing risk. Monthly income levels depend on rate conditions at the time of purchase. Retirees locking in income during low-rate periods may receive smaller payouts.

• Insurer credit risk. Guarantees are only as strong as the issuing insurer; participants must rely on the provider’s financial strength.

• Inflation exposure. Unless an inflation-adjusted annuity is chosen, real purchasing power can erode over time.

A key question for retirement planning is whether annuities, which provide guaranteed lifetime income, undermine the argument that longer life expectancies justify higher equity allocations for longer. In practice, a modest annuity allocation can actually support higher equity exposure: by securing a stable income floor and reducing sequence-of-returns risk, annuities give retirees more capacity to keep the remaining portfolio invested for growth. However, annuities also reduce liquidity, which means the non-annuitized assets must shoulder unexpected expenses, sometimes prompting more conservative allocations. The balance is to use annuities to cover essential income needs while preserving enough liquid assets to justify a growth-oriented equity allocation aligned with longer lifespans.

Evaluating group annuities: An approach for fiduciaries and sustainable investors

The path to adoption of group annuities in 401(k) plans and defined contribution plans (also referred to as DC plans) more generally will require that fiduciaries and sustainable investors, or their financial advisors, to consider a framework for the purpose of evaluating group annuity contracts, both at the contract as well as contract provider level.

Group annuity contracts should be evaluated at the contract as well as group annuity provider level and such evaluations require consideration not only of investment-related environmental, social and governance (ESG) factors but also of fiduciary governance, participant outcomes, product design, and long-dated balance-sheet risk management.

A framework and evaluation methodology developed by Sustainable Research and Analysis that ensures transparency and replicability over time by drawing exclusively from publicly available data relies on seven broad categories and 30 underlying evaluation dimensions or subcategories. These factors include corporate and sustainability governance, retirement/Defined Contribution (DC) plan governance and fiduciary support, general/separate account investment practice, climate and environmental performance, in-plan annuity/DC product design, participant communications, social and inclusion outcomes, governance and business integrity.

This methodology provides a disciplined approach for scoring providers on a 0–4 scale across the seven categories and 30 subcategories, applying weights to reflect the materiality of each dimension, and producing an aggregate sustainability score along a range from 0 to 100.

The following seven broad categories for evaluation forms a framework that draws from publicly available data, such as sustainability reports, National Association of Insurance Commissioners (NAIC) filings, Task Force on Climate-related Financial Disclosures (TCFD)/International Sustainability Standards Board (ISSB) disclosures, general account reporting, DC plan materials, and statutory statements), ensuring transparency and replicability over time.

Corporate and sustainability governance

• Is there clear board-level oversight of climate and sustainability issues?

• Are executive incentives or key performance indicators (KPIs) linked to long-term sustainability or risk objectives?

• Does the firm publish regular sustainability/stewardship or corporate responsibility reports?

Why it matters: Strong governance ensures that sustainability and climate-related risks are identified, monitored, and addressed at the highest levels of the organization. For group annuity providers with long-dated liabilities, board and senior-management oversight is critical to aligning investment strategy, risk management, and capital allocation with long-term financial stability. Weak governance increases the risk that sustainability considerations remain aspirational rather than operational.

Retirement/DC plan governance and fiduciary support

• Does the provider support plan sponsors in meeting fiduciary obligations around in-plan annuities?

• Are due-diligence materials for sponsors transparent (pricing, risks, portability, insurer strength)?

• Is there guidance around Qualified Default Investment Alternative (QDIA) usage, benchmarking and participant outcome analysis?

Why it matters: Group annuities are embedded within employer-sponsored retirement plans, where plan sponsors have fiduciary obligations to act in participants’ best interests. Providers that offer robust fiduciary support, documentation, and guidance help sponsors evaluate in-plan annuities prudently and defensibly. This category matters because weak sponsor support can lead to poor plan design, regulatory risk, and suboptimal participant outcomes.

General/separate account investment practices

• Is there transparent disclosure of general and separate account asset allocation (sector, credit, geography)?

• How are sustainability approaches, including ESG factors, integrated into credit underwriting and portfolio management?

• Are there clear policies on high-risk sectors (e.g., coal, tar sands, controversial weapons)?

• What are guiding policies regarding the allocation of assets to sustainable debt instruments, such as green, social and sustainability bonds and loans? What proportion of assets, if any, are invested in such instruments?

Why it matters: The assets backing group annuity guarantees reside primarily in insurers’ general and separate accounts, making investment practices central to both sustainability and claims-paying ability. How insurers integrate ESG and climate considerations into credit underwriting, portfolio construction, and sector exposure directly affects long-term risk and return. This category is the most financially material, as it links sustainability to the durability of annuity promises.

Climate and environmental performance

• Does the provider report Scope 1–3 emissions and portfolio carbon metrics (e.g., Weighted Average Carbon Intensity (WACI)?

• Has the provider adopted net-zero targets or science-based climate goals?

• Are climate scenario analyses or stress tests used to manage long-dated liabilities and assets?

Why it matters: Climate change poses both transition and physical risks to insurers’ balance sheets and long-duration liabilities. Providers that measure emissions, conduct climate scenario analysis, and articulate transition strategies are better positioned to manage these risks over multi-decade horizons. This category matters because unmanaged climate risk can undermine asset values, capital adequacy, and ultimately retirement income security.

In-plan annuity/DC product design

• Are group annuity solutions designed for portability (e.g., when participants change employers)?

• How are defaults structured in target-date or managed accounts that include in-plan annuities?

• Are fees, guarantees and liquidity terms clearly disclosed and benchmarked?

Why it matters: The design of in-plan annuity solutions determines how effectively guaranteed income supports retirement outcomes. Features such as default integration, portability, liquidity provisions, and fee transparency influence participant adoption and long-term suitability. Poor product design can negate the benefits of annuities, even when the underlying insurer is financially strong.

Participant communication, social and inclusion outcomes

• Does the provider supply clear, jargon-free participant communications about income, risks and trade-offs?

• Is there evidence of efforts to improve access to lifetime income among lower-income or underserved groups?

• Does the provider monitor and report participant outcomes (e.g., replacement rates, use of lifetime income)?

Why it matters: Clear, accessible communication helps participants understand complex trade-offs between liquidity, growth, and lifetime income. Providers that emphasize education and inclusion improve the likelihood that annuity solutions are used appropriately, particularly by lower-income or underserved workers. This category matters because sustainable retirement systems depend on equitable access and informed decision-making.

Governance and business integrity

• Is ESG/Enterprise Risk Management (ERM) integrated into enterprise risk management for the group annuity business?

• Are there any notable governance controversies, regulatory actions or litigation trends?

• How strong are credit ratings, capital adequacy, liquidity and asset–liability management practices?

Why it matters: Strong enterprise risk management, ethical standards, and regulatory compliance underpin trust in long-term retirement products. Governance failures or misconduct can lead to reputational damage, financial penalties, and heightened risk to policyholders. This category ensures that sustainability is evaluated within a broader framework of institutional integrity and risk discipline.

Conclusions

Taken together, the framework suggests that sustainable investors and fiduciaries seeking to evaluate group annuity providers should pay particular attention to:

• The depth and structure of climate and sustainability governance,

• The specificity and quantification of general-account sustainable investment allocations and climate metrics, and

• The quality of DC plan–level integration and participant support around in-plan annuity solutions.

The expansion of annuities inside 401(k) target-date funds marks an important structural evolution in retirement planning. For many participants, a thoughtfully sized annuity allocation can improve retirement income security. For sustainable investors, evaluating these products requires attention not only to financial fundamentals but also to the sustainability profile of the issuing insurer, its investment practices, and its transparency.

That said, this comparative lens does not replace traditional credit analysis or capital-strength evaluations. Rather, it adds a structured, evidence-based sustainable overlay that aligns with the long-dated nature of group annuity liabilities and the retirement outcomes they are designed to support.

A group annuity sustainability framework for evaluating group annuities

This methodology provides a disciplined approach for scoring providers on a 0–4 scale across the seven categories listed above and 30 subcategories, applying weights to reflect the materiality of each dimension, and producing an aggregate sustainability score along a range from 0 to 100.

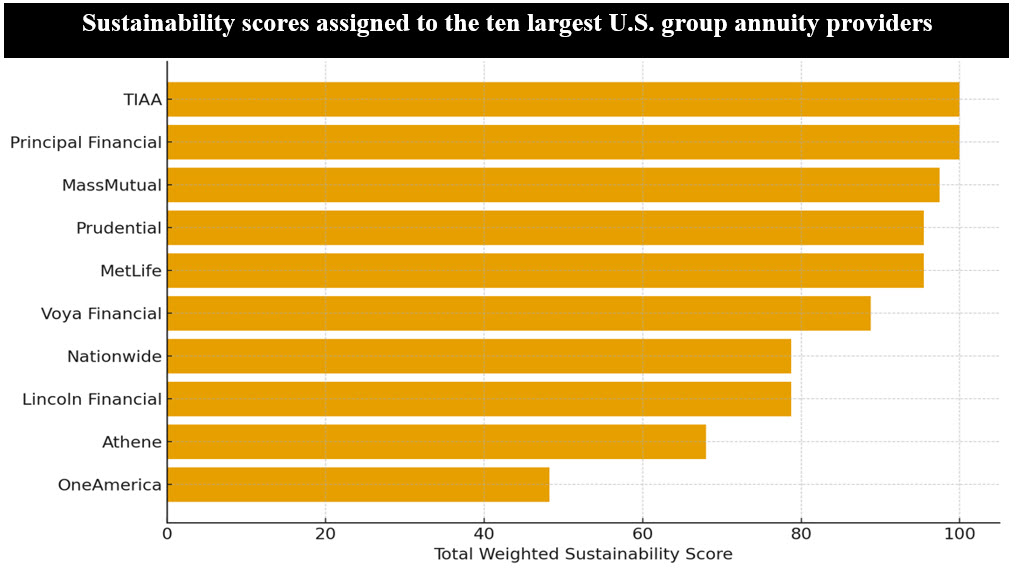

• The group annuity sustainability framework highlights a clear stratification among the ten largest U.S. group annuity providers by direct premiums written. While all are subject to broadly similar regulatory regimes and long-dated liability profiles, their approaches to sustainability, climate risk, and retirement-income design differ materially.

• When this framework and methodology is applied to the ten largest U.S. group annuity providers, TIAA Principal Financial, MassMutual, Prudential, MetLife and Voya Financial form the leading cluster across most criteria. These firms tend to combine: (a) Formal board-level oversight of sustainability and climate risk, often through designated board committees or explicit governance mandates, together with executive accountability for ESG integration, (b) Mature disclosure practices, including sustainability or corporate responsibility reports aligned with Task Force on Climate-related Financial Disclosures (TCFD), the International Sustainability Standard Board (ISSB), or equivalent frameworks, and a growing focus on portfolio-level climate metrics, and (c) Well-developed DC and retirement platforms, where group annuity products are deliberately integrated into plan design, default strategies, and participant-income solutions (e.g., target-date funds, managed accounts, or guaranteed-income tiers).

Notes of Explanation: Companies stratified based on aggregate sustainability scores derived from publicly available information (e.g., sustainability reports, National Association of Insurance Commissioners (NAIC) filings, TCFD/ISSB disclosures, general account reporting, DC plan materials, and statutory statements. Methodology provides a disciplined approach for scoring providers on a 0–4 scale across seven categories and 30 subcategories, applying weights to reflect the materiality of each dimension, and producing an aggregate sustainability score along a range from 0 to 100. Sources: Publicly available information, Sustainable Research and Analysis LLC.

Notes of Explanation: Companies stratified based on aggregate sustainability scores derived from publicly available information (e.g., sustainability reports, National Association of Insurance Commissioners (NAIC) filings, TCFD/ISSB disclosures, general account reporting, DC plan materials, and statutory statements. Methodology provides a disciplined approach for scoring providers on a 0–4 scale across seven categories and 30 subcategories, applying weights to reflect the materiality of each dimension, and producing an aggregate sustainability score along a range from 0 to 100. Sources: Publicly available information, Sustainable Research and Analysis LLC.