Continued investment in Wells Fargo stock offers a window into differentiated approach by ESG funds versus conventional funds

Wells Fargo & Company’s (WFC) pervasive and persistent misconduct, starting with the revelations, some as early as 2011, that the bank made a practice of opening millions of unauthorized accounts, exposed the bank’s poor governance and risk management practices. In addition to harming its customers, employees and shareholders in the process, the bank also attracted controversy because of its involvement in the Dakota Access Pipeline (DAPL) project. These developments uncovered weaknesses within the bank’s operations and elevated its risk exposures such that the bank’s governance and social profile suffered. This is illustrated by the ratings or scores[1] provided by third-party ESG publishers, including such firms as MSCI and Sustainalytics. [ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]Even as the bank moved to address its deficiencies and repair its damaged reputation, sustainable large cap equity mutual funds sold off their Wells Fargo common stock investments. In fact, within a universe of the ten largest similarly managed large cap sustainable equity funds, the ten funds that comprise the Sustainable (SUSTAIN) Large Cap Funds Index, nine of the ten funds have no current exposure to Wells Fargo stock even as the company represents a 0.9% position in the S&P 500 Index[2]. This contrasts with the portfolio composition of the ten largest actively managed conventional large cap mutual funds. According to our research, nine of the ten largest large cap funds continue to invest in Wells Fargo, with stock positions ranging from 0.31% to 3.64% of portfolio net assets. Possible valuation considerations aside, this variation offers a window for investors into the type of outcomes that can be expected when funds pursue a sustainable mandate, in this instance, largely in the form of an environmental, social and governance (ESG) integration approach or strategy that can impact portfolio construction and stock selection. Although difficult to measure, in the short-to-long run this can also have an impact on portfolio performance results.

Wells Fargo faces numerous regulatory issues, exposing the bank to governance, operational and social risks and considerations

Wells Fargo has struggled in recent years to overcome numerous regulatory issues, including, revelations that bank employees, starting as early as 2011, were responsible for creating more than 3.5 million unauthorized deposit accounts for existing customers and transferring funds to those accounts from their owners’ other accounts, all without the knowledge of their account holder customers, or their consent, in an effort to generate illicit fees. In addition to paying full restitution to all victims, this led to the imposition by the Consumer Financial Protection Bureau (CFPB) of a $100 million fine in September 2016 and thereafter to the ouster of the bank’s CEO John Stumpf. But that was not all as other high profile violations came to light, involving overcharging hundreds of thousands of homeowners for appraisals ordered after they defaulted on mortgage loans and charging customers for auto insurance policies that they did not need after taking out car loans with Wells Fargo. While the bank has taken many actions to remediate its deficiencies and restore customer confidence and its reputation, regulators are still not satisfied with Wells Fargo’s progress. As recently as March 11th, the Office of the Comptroller of the Currency issued a written statement noting that the bank regulator continues to be disappointed with Wells Fargo’s performance under its consent orders and the bank’s inability to execute effective corporate governance and a successful risk management program. The written statement noted that national banks are expected “to treat their customers fairly, operate in a safe and sound manner, and follow the rules of law.” In addition, as noted earlier, the bank was involved in financing the Dakota Access Pipeline (DAPL) project. This controversial pipeline project caused an uproar across the nation, leading to closely watched protests and negative sentiment towards companies involved in its construction. A consortium of seventeen banks, including Wells Fargo, lent money to finance the DAPL.

ESG integration strategies are expanding rapidly

ESG integration is a rapidly expanding investment strategy that represents one approach within a broader sustainable investing landscape focused on the idea that investors can achieve a positive societal outcome or impact with their investments. Optimally, this should be accomplished without sacrificing long-term financial returns.

Sustainable investing is an umbrella term that encapsulates ethical investing, socially responsible investing and responsible investing. It also seems that the term sustainable investing may be morphing into ESG investing. While the definition has been changing over time, today sustainable investing refers to a range of five overarching investment approaches or strategies. Most practitioners agree that these encompass the following strategies:

- Values-based investing

- Negative screening or exclusions

- Impact and thematic investing

- ESG integration

- Shareholder/bond engagement and proxy voting

ESG integration, in particular, refers to the systematic and explicit inclusion of ESG risks and opportunities in investment analysis where such risks are considered to be relevant and material.

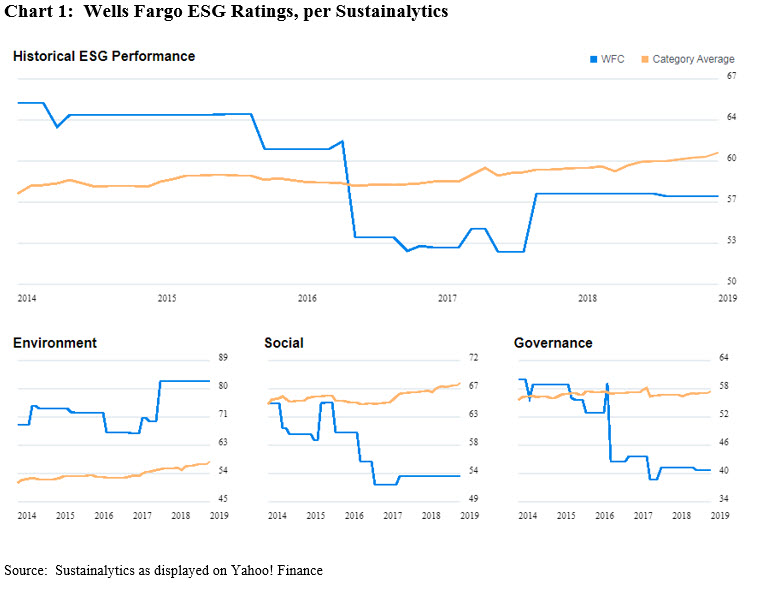

Wells Fargo’s ESG risk profile and ratings take a tumble starting in 2016

Another consequence of the developments affecting Wells Fargo as described above is that the firm’s ESG ratings tumbled. These are company level assessments of ESG qualities or characteristics that, according to one of the leading ESG rating or scoring firms, Sustainalytics, placed Wells Fargo above the sector average through early 2016[3]. Then in early 2016, following almost two years of revelations regarding the new accounts schemes and a settlement with the regulators, Wells Fargo’s overall ESG ratings, including its governance and social scores, began to drop and these have not fully recovered since that time. Calculated on a scale from 0 to 100, Wells Fargo’s ESG rating declined from 61.83, versus a category average of 58.35, to a low of 52.71 versus a category average of 59.27. Most recently, the company’s ESG rating stood at 57.29 versus a category average of 60.94. The firm’s S & G scores dropped too, while the overall ESG rating was bolstered by the firm’s above sector Environmental score that continues to top the category average at 82.7 versus 57.5. While these are by no means the only inputs, it should be noted that ESG ratings or ESG scores are often used by asset owners and investment managers to inform their evaluation and analysis of stock valuations. Refer to Chart 1.

In the course of these developments, the largest similarly managed sustainable large-cap equity mutual funds that hadn’t already sold their Wells Fargo stock holdings did so by the end of the calendar year 2017. One exception was Parnassus Core Equity Fund, a $16.4 billion fund that “invests in U.S. large-cap companies with long-term competitive advantages and relevancy, quality management teams and positive performance on ESG criteria.” The firm held on to Wells Fargo shares until 2018 while engaging with the firm across a number of issues, including its involvement in and financing of the Dakota Access Pipeline (DAPL) project. The steps that the bank had taken to address its management and operational deficiencies, employee and customer relations and its involvement in DAPL gave Parnassus management the confidence to hold on to the stock. But that finally gave way in 2018. In the end, only one of the ten largest similarly managed sustainable large cap funds based on assets as of December 31, 2018, continues to maintain a position in Wells Fargo. This is the JP Morgan US Equity Fund, an existing $12.4 billion fund that rebranded its mandate effective November 1, 2018 when the fund amended its prospectus to disclose that the fund’s adviser seeks to assess the impact of environmental, social and governance factors on the cash flows of many companies in which it may invest.

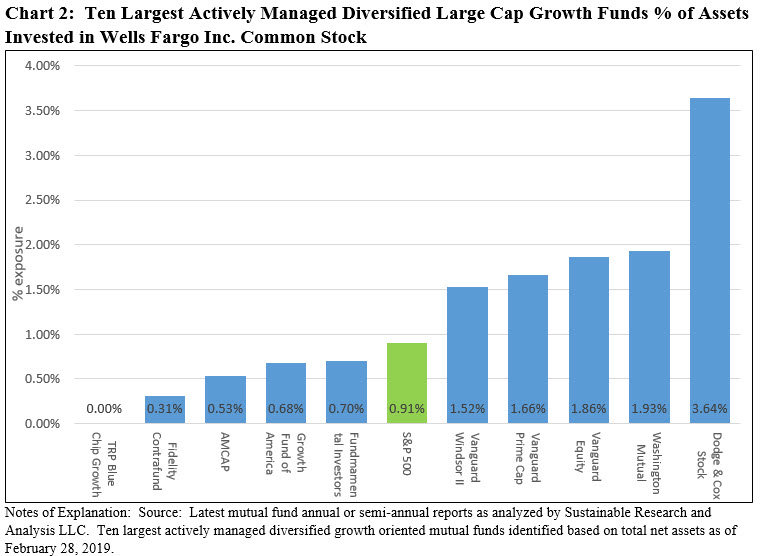

By way of comparison and contrast, nine of the ten largest conventional large cap equity mutual funds continue to hold their investments in Wells Fargo stock. This is illustrated in Chart 2 which displays the percentage of portfolio assets invested in Wells Fargo & Company stock on the part of the ten largest actively managed large cap equity growth mutual funds. Based on data of the latest annual and semi-annual reporting dates, nine of the ten funds continue to invest in Wells Fargo, with stock positions ranging from 0.31% to 3.64% of net assets. Of these, five funds actually have investments in Wells Fargo that exceed the percentage of the firm tracked by the S&P 500 Index. Otherwise, the only exception is the T Rowe Price Blue Chip Growth Fund, a $59.3 billion growth oriented mutual fund[4] that has not had a position in Wells Fargo.

[1]For purposes of this article, ratings and scores are used interchangeably.

[2] The ten largest funds exclude multiple funds managed by the same manager. The Sustainable (SUSTAIN) Large Cap Equity Fund Index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds in excess of $50 million in net assets must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

Effective December 31, 2018, only the largest single fund or share class managed by an investment management firm will be included in the index. Also, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of net assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index was reconstituted as of December 31, 2018 to reflect changes that occurred during 2018 in the profile of the sustainable US equity universe of mutual funds due to the expansion in the number of funds offered in this market segment by mainstream investment management firms and the expansion in the universe of available like funds from which to select the ten index constituents. As a result, the index was reconstituted to reflect the substitution of three large funds. These include the JPMorgan U.S. Equity Fund R6, Pioneer A and Putnam Sustainable Leaders A. These three funds replace Dreyfus Sustainable US Equity Fund Z, Parnassus Fund and Parnassus Endeavor Fund Investor Shares.

The combined assets associated with the ten funds stood at $45.8 billion and represent about 16.1% of the entire sustainable US equity sector that is comprised of 446 funds/share classes, including actively managed funds and index funds, with $283.8 billion in assets under management.

[3] According to Sustainalytics, its ESG ratings measure how well companies proactively manage the environmental, social and governance issues that are the most material to their business and provide an assessment of companies’ ability to mitigate ESG risks. The ESG rating is a quantitative score on a scale of 1-100, based on a balanced scorecard system.

[4] TNA as of February 28, 2019

[/ihc-hide-content]