Summary

• The second quarter ended as the 2018 proxy season was entering its final weeks, notable for the high level of environmental and social proposals as well as a number of majority vote outcomes.

• During the second quarter, several commentators advocated in favor of long-term strategies combined with an emphasis on advancing society’s goals: These can lead to growth, sustainability and profits.

• The U.S. Department of Labor (DOL) again attempted to clarify social investing rules for plan fiduciaries but managed to sow confusion.

• Green bond, social bond and sustainability bond guidelines were updated; $74.6 billion in green bonds were issued so far this year through the end of the second quarter.

• PIMCO weighed in with its view on ESG investing in fixed income: A quiet but profound shift is underway.

• Sustainable funds ended June at $285.9 Billion, adding $13.9 billion during quarter, largely due to repurposed funds but also including an estimated $1.1 billion in net cash inflows.

• Sustainable funds registered 0.18% average total return for the quarter; similarly managed sustainable equity funds lagged the S&P 500 Index by 135 bps while fixed income funds managed to keep up with the non-sustainable benchmark.

ESG Funds: Quarterly Observations In Brief

The second quarter ended as the 2018 proxy season was entering its final weeks, notable for the high level of environmental and social proposals as well as a number of majority vote outcomes. In addition, the quarter was interlaced with a number of research articles and commentary focused on the theories of shared value creation, corporate profits and purpose, and advocacy for the adoption of long-term strategies on the part of public companies. Some argue that the dynamics in favor of a profits and purpose paradigm are changing, in part, due to shifting investing preferences by millennials. On the investor side PIMCO expressed the view that a “quiet and profound pivot is underway in the sustainable investing space” with respect to fixed income. One potential outcome may be an increase in use of proceeds bonds, such as green bonds which are on course to reach another new high this year but still represent a small fraction of the world’s total bond market. That said, the U.S. Department of Labor (DOL) in April released a Field Assistance Bulletin intended to give further guidance to plan fiduciaries and other interested parties on environmental, social and governance (ESG) integration. In the process the DOL appears to have sown confusion instead by conflating collateral social policy goals, including ESG investing, with the concept of ESG integration. Further, fund investors have yet to activate their preferences in favor of sustainable investing by directing investment dollars at scale to sustainable mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs). While the sustainable funds segment grew by $13.9 billion, much of the gains experienced during the quarter and since the start of the year are largely attributable to repurposed funds rather than net new investor money. Market movement didn’t contribute much either, even as the S&P 500 Index posted an increase of 3.43% while investment-grade intermediate bonds gave up -0.16%, per the Bloomberg Barclays U.S. Aggregate Bond Index. Sustainable funds in operation for the full quarter posted an average 0.18% total return during the second quarter. At the same time, the SUSTAIN Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 2.08% while the SUSTAIN Bond Fund Indicator registered a decline of -0.16%.

2018 Proxy Season Results: High Levels of Environmental and Social Proposals as well as a Number of Majority Vote Outcomes

The 2018 proxy season, which was entering its final weeks at the end of June, revealed high levels of environmental and social proposals as well as a number of majority vote outcomes. According to a report prepared by Gibson Dunn dated July 12, 2018, social and environmental proposals continued this year to be the most frequently submitted proposals. Out of a total number of 788 proposals submitted during the 2018 proxy season, 341, or 43%, were represented by social and environmental proposals. These were followed by governance proposals, corporate civic engagement proposals, executive compensation as well as other proposals.

Social considerations, which cover a wide-range of issues, attracted the largest number of proposals at 202 or 26%. Within this segment, 68 proposals, or 34%, focused on anti-discrimination and diversity-related issues, including board diversity. Environmental considerations, on the other hand, involved 139 proposals (18%). The largest segment, again this year, continued to be climate change proposals, with 72 submitted.

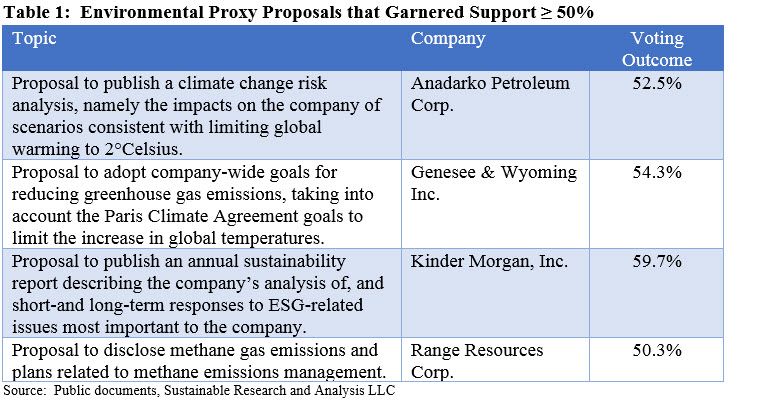

While the level of proposals was somewhat lower than in 2017, the number of majority votes affecting topics like climate change exceeded the record achieved in 2017. Four proposals garnered support in excess of 50%, including two seeking the publication of a report on the impact of climate change policies, one on methane emissions management and one focused on the adoption of company-wide goals for reducing GHG emissions. In the case of Kinder Morgan, the proposal to publish an annual sustainability report received 59.7% of the vote, however, a second environmentally-related proposal applicable to disclosure and mitigation of methane emissions from company operations fell short of garnering majority approval at 30.6% of the vote. Refer to Table 1 for a listing of these.

According to the Harvard Law School Forum on Corporate Governance and Financial Regulation, two-thirds of this year’s 2° Celsius scenario resolutions were withdrawn as companies have been more willing to reach agreements with proponents on climate risk reporting. Increased support from asset managers and proxy advising firms are factors. Another contributing factor may be that companies are planning in any case to respond to the recommendations made in June of 2017 by the Task Force on Climate-Related Financial Disclosures (TCFD). Along with recommendations that disclosures should focus on governance, strategy, risk management, and targets and metrics, one of the Task Force’s key recommended companion disclosures focuses on the resilience of an organization’s strategy, taking into consideration different climate-related scenarios, including a 2° Celsius or lower scenario. Per the TCFD, an organization’s disclosure of how its strategies might change to address potential climate-related risks and opportunities is a key step to better understand the potential implications of climate change on the organization.

Commentators Advocate in Favor of Long-Term Strategies Combined with an Emphasis on Advancing Society’s Goals: These Can Lead to Growth, Sustainability and Profits

Not unlike BlackRock Larry Fink’s letter earlier this year to CEOs on how companies must have a social purpose and pursue a strategy for achieving long-term growth, from the cover story in the latest issue of Korn Ferry Briefings to an article in the Harvard Business Review to the Opinion pages of the Wall Street Journal commentators during the quarter were making the case that long-term strategies combined with an emphasis on advancing society’s goals can lead to growth, sustainability and profits. Indeed, it is being posited that business interests and societal interests can be one and the same and that the dynamics around this appear to be changing. Briefly:

• A cover story published in the latest issue of Korn Ferry Briefings entitled “Profit vs. Purpose-The Duel Begin” postulates that businesses can be profitable and do good at the same time. The article refers to a growing body of research supporting the idea that purpose-driven firms wind up being more profitable for their investors than those whose primary purpose focus is profits. One research study cited by Korn Ferry is attributed to Michael E. Porter and Mark R. Kramer who, together in 2011 and even earlier in an article published in 2006, postulated the idea of “shared value” to describe the redefinition of the purpose of companies which is to generate economic value in a way that also produces value for society by addressing its challenges¹. According to the authors, shared value is not social responsibility, philanthropy, or even sustainability, but rather a new way to achieve economic success by enhancing the competitiveness of a company while simultaneously advancing social and economic conditions in the community in which the company sells and operates. Their research continues to identify countless examples of where creating shared value has been happening and proving to be successful. Examples cited include: Nestlé, Intel, Unilever, The Coca Cola Company and Western Union Company.

• Another article published during the second quarter, this one as of May 31, 2018 that appeared in the Harvard Business Review, is entitled “How Companies, Governments, and Nonprofits Can Create Social Change Together.” The authors, Howard W. Buffett and William B. Eimicke, make the case that profit and purpose can coexist and the capacity to do so effectively depends on the willingness of business leaders to embrace collaboration as a guiding principal, more so than competition. The framework is called “Social Value Investing,” inspired by Berkshire Hathaway’s value investing approach with its emphasis on long-term investment strategy and value creation. The article refers to the authors’ research at Columbia University that has identified many examples by which businesses have benefited when CEOs partnered across sectors with public officials, nonprofit managers and community members.

• In an Opinion article published in The Wall Street Journal on June 7, 2018, Jamie Dimon, Chairman and CEO of JPMorgan Chase & Co. and Warren Buffett, chairman of Berkshire Hathaway Inc. advocated for the adoption of long-term strategies on the part of public companies. Along with nearly 200 chief executives representing major U.S. companies and members of the Business Roundtable, public companies are being encouraged to consider moving away from providing quarterly earnings-per-share guidance on the basis that this practice often leads to an unhealthy focus on short-term profits at the expense of long-term strategy, growth and sustainability. Emphasis on short-term earnings results in companies “frequently hold back on technology spending, hiring, and research and development to meet quarterly earnings forecasts that may be affected by factors outside the company’s control, such as commodity-price fluctuations, stock-market volatility and even the weather.”

The U.S. Department of Labor (DOL) Attempts to Clarify Social Investing Rules for Plan Fiduciaries

On April 23, 2018 the U.S. Department of Labor (DOL) released a Field Assistance Bulletin intended to give further guidance to address questions that may arise from plan fiduciaries and other interested parties about Interpretive Bulletin 2016-01 and Interpretive Bulletin 2015-01. These earlier bulletins clarified the context within which fiduciaries, subject to the Employee Retirement Security Act of 1974 (ERISA), can consider pension plan investments selected for their collateral economic and social benefits in addition to their investment risks and returns. They were widely applauded when issued as a welcome step in advancing sustainable investing practices in the U.S. in that the Bulletins clarified that the selection of plan investments with collateral economic or social benefits were not prohibited on their face.

The guidance seems to confuse collateral social policy goals, including ESG investing, with the concept of ESG integration. When referenced in the DOL’s Bulletin, ESG investing seems to suggest linkage to values-based considerations, such as social, moral, ethical, religious and economically targeted goals. In the writer’s opinion, this conflates the idea of ESG integration which represents the systematic and explicit consideration of relevant and material ESG factors or risks rather than the cursory inclusion of one or more of them. Put another way, the focus is on the consideration of ESG issues for the purpose of achieving a more complete investment analysis and better-informed investment decisions regardless of how the investments may be labeled. This is no different, for example, than assessing companies to determine their intrinsic value using such metrics as price-to-earnings or price-to-book. And in much the same way as definitions and approaches to determining value vary, the same can be said for the integration of ESG given the variety of approaches in use today.

Green Bond, Social Bond and Sustainability Bond Guidelines Updated; $74.6 Billion in Green Bonds Issued During First Half of Year

On June 14, 2018 updated editions of the Green Bond Principles (GBP), Social Bond Principles and Sustainability Bond Guidelines were released by the International Capital Markets Association (ICMA) along with best practice guidelines for external reviewers, a mapping to the United Nations Sustainable Development Goals (SDGs) as well as a framework for social bonds impact reporting.

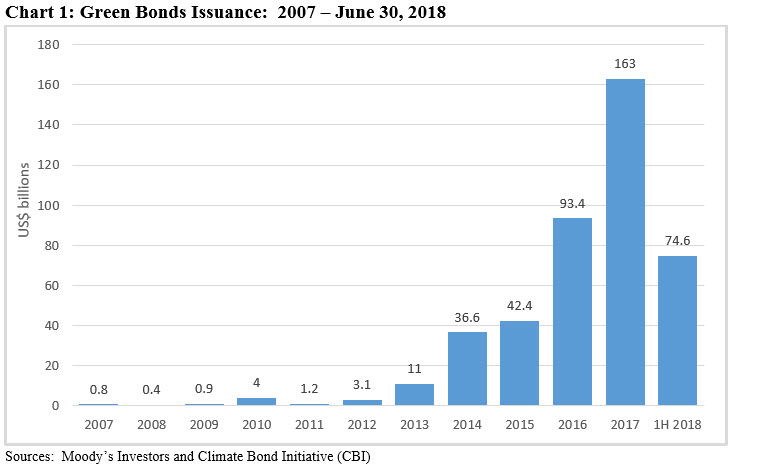

The Green Bond Principles were introduced in January 2014 and they serve as a voluntary best practices standard for green bond issuers who commit to allocating bond proceeds to finance and re-finance environmentally beneficial projects. To meet the GBP standards issuers commit to certain disclosure transparency guideposts around four core components, namely the use of proceeds, process for project evaluation and selection, management of proceeds and reporting. The adoption of a widely accepted standard stimulated green bond issuance which last year reached $163 billion. Another $74.6 billion was issued by 156 organization during the first half of this year, or about 4% increase relative to the same period in 2017². Since the first green bond was launched in 2007, about $431 billion in green bonds have been issued—still a small fraction of the world’s $100 trillion or so bond market. Refer to Chart 1.

PIMCO Weighs in with Its View on ESG Investing in Fixed Income

Until more recently, the application of sustainable investing and related strategies and practices has been largely focused on equity investing. For example, using the prism of mutual funds and ETFs and ETNs, sustainable fixed income products account for only 7.7% of available funds while the net assets sourced to these fixed income offerings stood at $22.1 billion, or just 19.7% of $285.9 billion in sustainable assets under management at the end of June 2018.

PIMCO in a Viewpoints article³ published as of June 2018 proffers that a “quiet and profound pivot is underway in the sustainable investing space – a pivot that, in PIMCO’s view, will reshape markets and elevate fixed income to a place of prominence within the environmental, social and governance field. PIMCO maintains that this is being brought about due to three factors: (1) A growing recognition, reinforced by PIMCO’s own integration of ESG into credit analysis, that ESG issues present relevant and material credit risks for both corporate and sovereign debt, (2) new and innovative fixed income product offerings such as ESG bond funds, green bonds and social bonds, and (3) the overarching influence that the adoption of the U.N. Sustainable Development Goals is expected to have on ESG related fixed income strategies, products and securities.

So far, the uptake in fixed income remains limited. While the number of funds, including share classes, is up dramatically from 85 at the end of 2016 to 202 at June 30th of this year, or an increase of 138%, assets under management added $7.4 billion, for an increase of 51% during the same interval. That said, about 50% of the uptick is attributable to repurposed and reclassified funds, including PIMCO’s own Total Return ESG Fund and Low Duration ESG Fund both of which adopted ESG integration strategies in early 2017 and in the process shifted into the sustainable segment approximately $1.2 billion in assets.

PIMCO’s view is that the long-term nature of the fixed income market makes it uniquely suited to both benefit from and provide finance for ESG-related environmental and social governance efforts. This may be true for values-oriented and impact tilted investment portfolios (these are also referred to as socially responsible portfolios) that wish to adopt and synch up with the UN’s Sustainable Development Goals as the basis for sustainability-focused strategies. Otherwise, investors who integrate ESG considerations in their assessment strictly for the purpose of addressing credit risks and opportunities are still faced with methodological challenges around how to properly calibrate ESG given the still evolving definitions of ESG and the complex nature of the fixed income instruments themselves, starting with the profile of the issuer, bond types, structure as well as maturity of the instrument. To be sure, the same challenges apply to use of proceeds fixed income securities like green bonds, social bonds or sustainability bonds more generally where the risk of repayment is predicated on the financial strength of the issuer.

Sustainable Funds End June at $285.9 Billion, Adding $13.9 Billion During Quarter, Including an Estimated $1.1 Billion in Net Cash Inflows

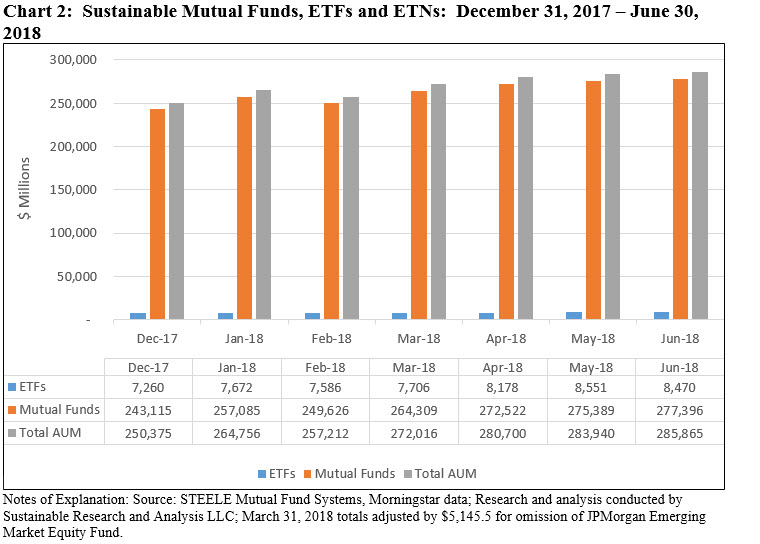

The net assets of 1,025 sustainable funds, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), ended the month of June with $285.9 billion in assets versus $272.0 billion at the end of March. Refer to Chart 2.

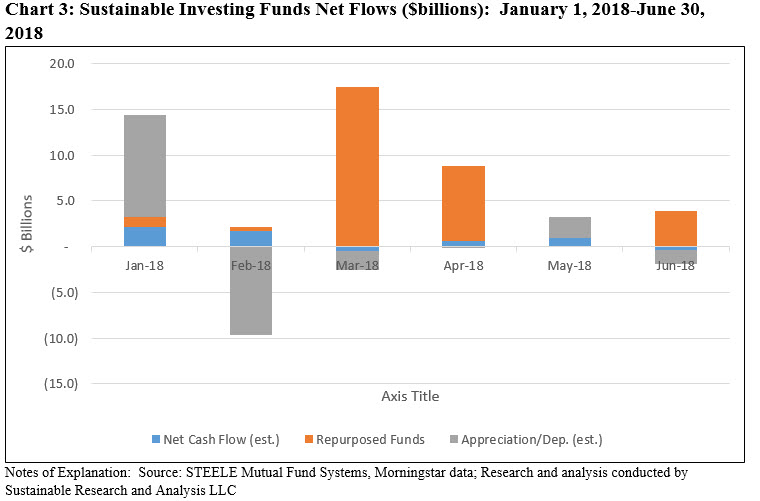

Assets recorded a net gain of $13.9 billion during the three month interval, or an increase of 5.1%. The increase is largely attributable to assets that have been repurposed during the quarter via the adoption of ESG practices codified in fund prospectuses. Repurposed funds shifted $12.0 billion in assets during the quarter, or 90% of the increase experienced by the sustainable sector. These are spread across four fund firms, 27 funds and 115 share classes4.

Since the start of the year, sustainable funds have added $35.5 billion in net assets, but much of that sum, a total of $30.9 billion, or 87%, is also attributable to repurposed funds. Refer to Chart 3.

Within the sustainable funds segment, mutual fund assets stood at $277.4 billion as of June 30th while ETFs and ETNs closed the month at $8.5 billion. The relative proportion of the two segments changed only slightly, shifting from 97.2% for mutual funds to 97% while ETFs and ETNs ended the quarter at 3% of the segments assets. Within the mutual fund segment, assets sourced to institutional only funds versus all other funds ended the quarter at $93 billion, or 33% of the segment’s assets.

Within the sustainable funds segment, mutual fund assets stood at $277.4 billion as of June 30th while ETFs and ETNs closed the month at $8.5 billion. The relative proportion of the two segments changed only slightly, shifting from 97.2% for mutual funds to 97% while ETFs and ETNs ended the quarter at 3% of the segments assets. Within the mutual fund segment, assets sourced to institutional only funds versus all other funds ended the quarter at $93 billion, or 33% of the segment’s assets.

The 1,025 sustainable funds in operation at the end of June, including share classes, were offered by 115 fund groups. This reflects a net increase of 125 funds and share classes during the quarter, largely attributable to repurposed funds (92%), but also reflecting new fund launches as well as the introduction of additional share classes by existing funds. Three new fund groups introduced new funds or relaunched existing funds while two previously listed fund groups consolidated their fund offerings under one name.

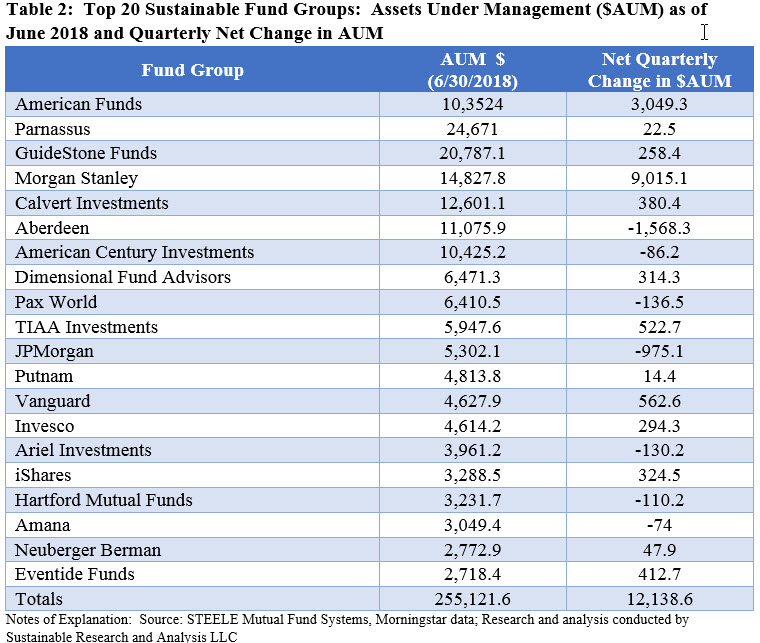

Firms Ranking in Top 20 Remain Unchanged but Four Fund Groups Shift Slightly

The universe of 115 sustainable fund groups is dominated by the top 20 groups that accounted for $255.1 billion in sustainable assets, or 89.2% of the segment’s total assets. There was limited but still some movement within the ranking of the top 20 fund groups. Refer to Table 2.

Sustainable Funds Register 0.18% Average Total Return for the Quarter; Similarly Managed Sustainable Equity Funds Lag S&P 500 Index by 135 bps while Fixed Income Funds Keep Up with Benchmark

During a quarter in which market performance was influenced by strong economic growth prospects and some positive geopolitical news that eventually gave way to global trade war concerns and higher interest rates, the universe of 990 sustainable funds in operation for the full quarter, including share classes, posted an average 0.18% total return during the second quarter and an average of 8.7% for the 12-month period. Average returns for the quarter ranged from -0.71% for taxable and tax-free fixed income funds while all other funds, largely equity oriented, posted an average gain of 0.40%. Individual returns ranges from a high of 14.91% recorded by Eventide Healthcare & Life Sciences Fund-I Shares to a negative -17.67% registered by the Morgan Stanley Institutional Frontier Markets Fund-C Shares.

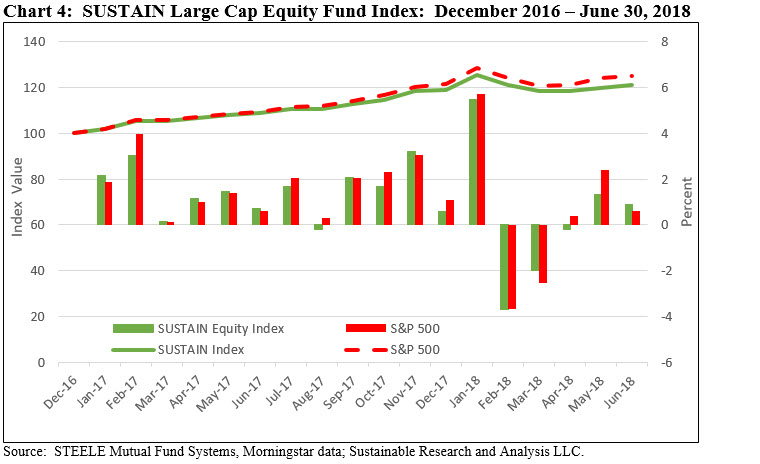

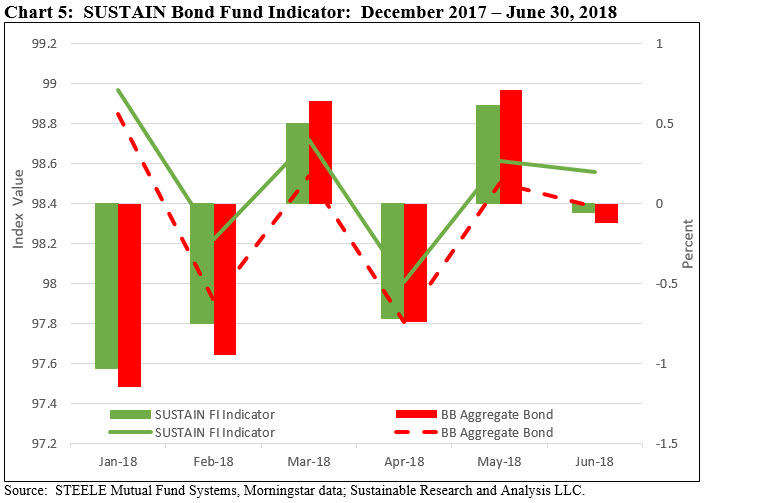

By way of comparison, the S&P 500 Index, which recorded an increase of 3.43%, the Bloomberg Barclays U.S. Aggregate Bond Index, down -0.16% and the MSCI EAFE (Net) Index that registered a loss of -1.24%. At the same time, the SUSTAIN Equity Fund Index,

which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, posted an increase of 2.08% over the quarter or 135 basis points behind the S&P 500 Index. On the other hand, the SUSTAIN Bond Fund Indicator, comprised of five similarly managed sustainable fixed income funds, closed the quarter lower at -0.16% but ever so slightly ahead by of its counterpart non-sustainable benchmark.

For further information regarding these benchmarks, refer to the latest Monthly Sustainable Portfolios Performance Summary: June 2018.

1. Advantage and Corporate Social Responsibility by Michael E. Porter and Mark R. Kramer, HBR 2006 and Creating Shared Value by Michael E. Porter and Mark R. Kramer, HBR 2011.

2. Source: Climate Bond Initiative (CBI).

3. ESG Investing and Fixed Income: The Next New Normal? by Mike Amey and Gavin Power.

4. Includes 6 funds with $434 million in net assets that were reclassified.