Receive a free compilation highlighting and summarizing each month’s key research articles published by Sustainable Research and Analysis.

Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

Another difficult month-February 2022

A rough start to the year for both stocks and bonds was followed in February by another difficult month as the Russian invasion of Ukraine intensified and the West responded with an unprecedented, coordinated response in the form of sanctions and a U.S. ban on imported Russian oil, liquified natural gas and coal. Returns across…

Share This Article:

The Bottom Line: Another difficult month for stocks and bonds but returns posted by clean energy funds show value of patience and long-term investing horizon.

Negative year-to-date results for stocks and bonds widened in February: S&P 500 -2.99% and Bloomberg Aggregate -1.12%

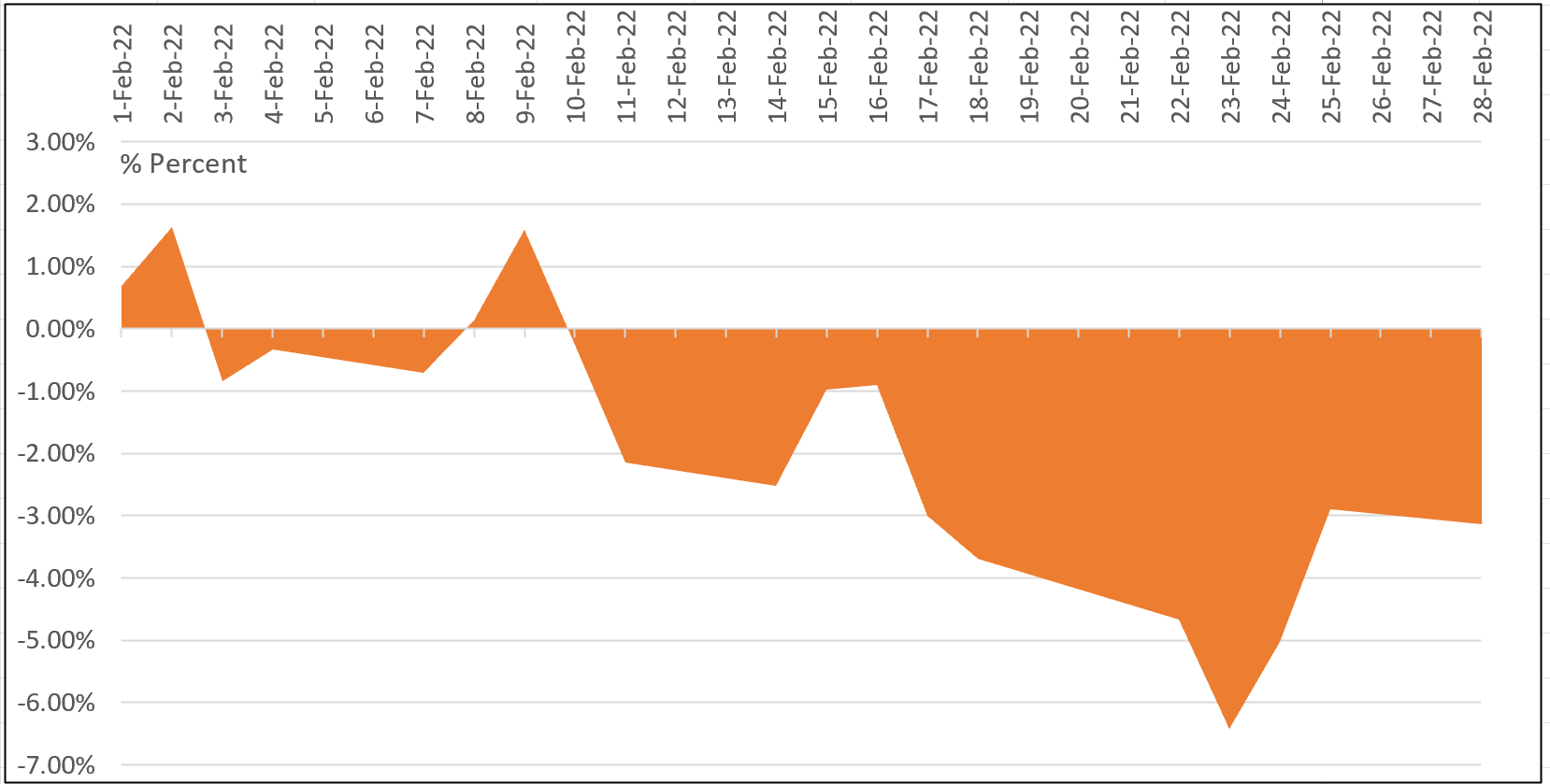

A rough start to the year for both stocks and bonds was followed in February by another difficult month as the Russian invasion of Ukraine intensified and the West responded with an unprecedented, coordinated response in the form of sanctions and a U.S. ban on imported Russian oil, liquified natural gas and coal. Returns across indices ranged from as high of 14.1% recorded by gold, metals and mining and Brent Crude, to a low of -42.76% posted by the MSCI Emerging Markets Eastern Europe NR USD Index. The S&P 500 gave up 2.99% in February and recorded a year-to-date decline of 8.01%. Of 19 trading days, the S&P 500 experienced 10 daily declines, with six of these exceeding 1%. Refer to Chart 1. The Dow Jones Industrial Average gave up 2.01% while the NASDAQ Composite posted a drop of 3.35%. Small cap stocks and mid-cap stocks, both registering positive results, outperformed large caps while value stocks outperformed growth stocks.

Chart 1: S&P 500 cumulative price performance-February 2022 Source: Yahoo finance/S&P Global

Source: Yahoo finance/S&P Global

Overseas markets, according to the MSCI ACWI ex USA Index, registered a 1.98% decline while the narrower MSCI EAFE Index was off 1.77%. Emerging markets, measured by the MSCI Emerging Markets Index, declined -2.99%.

Bond market investors, who were concerned about slowing economic growth in response to central bank efforts thus far to curb inflation by raising interest rates, lowered somewhat their expectations with regard to the number of likely interest rate increases this year and their severity following the Ukraine invasion. Yields on 10-year Treasuries moved up from 1.79% to 2.03% on February 16 and then down to 1.83% by month-end. Against this backdrop, the Bloomberg US Aggregate Bond Index gave up 1.12% in February and -3.25% year-to-date—a likely jolt to fixed income investors.

Sustainable mutual funds and ETFs posted an average return of -1.94% in February

The universe of sustainable mutual funds and ETFs, as defined by Morningstar, a total of 1,319 funds, posted an average return of -1.94% in February. Together, fixed income mutual funds and ETFs dropped 1.5% in February while equity-oriented funds gave up 2.22%.

Returns ranged from a high of 19.82% to a low of -10.23%. The best return was recorded by the Direxion Daily Global Clean Energy Bull 2X Shares (KLNE), a fund that seeks to magnify the daily performance of the S&P Global Clean Energy Index. The index tracks the performance of companies from developed markets whose economic fortunes are tied to the global clean energy business. Funds investing in alternative and clean energy posted very strong returns in February and led the list of the best performing funds for the month. In doing so, funds in operation for 12-months or longer reversed between a third to 56% of the declines experienced during the trailing 12-months. Refer to Table 1 for a list of the top 10 fund performers.

At the other end of the range was the Ashmore Emerging Markets Equity ESG Fund A which was likely impacted by its reported 10.08% exposure to Russian stocks as of its October 31, 2021 fiscal year-end. Some or all the fund’s holdings were likely carried into the February 24 invasion of Ukraine. The fund qualifies eligible securities on the basis to an ESG scoring methodology that helps identify high quality companies with strong performance or potential when measured against Ashmore’s ESG criteria. The fund also avoids investing in issuers that the adviser determines have significant involvement (i.e., more than 10% of revenues) in the manufacture, distribution or sale of fossil fuels or tobacco products and in gambling, pornography or defense (including controversial weapons) industries, or other issuers that engage in business practices that the adviser determines to be sub-standard from an ESG or sustainability perspective in relation to their industry or sector.

Table 1: Top performing sustainable investment funds in February 2022

Fund Name

$ AUM

TR

February 2022 (%)

TR

Year-to-Date (%)

TR

Trailing 12-Months (%)

Direxion Dl Global Clean Energy Bull 2X Shares (KLNE)

6.8

19.82

-7.04

Global X Hydrogen ETF (HYDR)

28.3

15.12

-11.87

VanEck Green Metals ETF (GMET)

26.6

12.96

8.92

Global X Solar ETF (RAYS)

9.4

11.81

-6.56

iShares Global Clean Energy ETF (ICLN)

5,192.1

10.62

-2.18

-18.84

Defiance Next Gen H2 ETF (HDRO)

56.2

10.57

-15.93

Global X CleanTech ETF (CTEC)

109

10.34

-8.21

-31.27

Direxion Hydrogen ETF (HJEN)

35.3

9.91

-6.87

Invesco Solar ETF (TAN)

2,214.9

9.68

-7.78

-29.34

Fidelity Clean Energy ETF (FRNW)

25.7

9.63

-5.54

Notes of Explanation: $AUM in millions. Blank cells=fund was not in operation during entire interval. Source: Morningstar Direct.

Only two of six selected ESG equity and bond indices outperformed their conventional counterparts in February

Only two of six ESG equity and bond indices outperformed their conventional counterparts over the month of February, including investment-grade intermediate term bonds as well as small cap stocks.

The MSCI ESG Focus Aggregate Bond Index beat the Bloomberg US Aggregate Bond Index by a wide margin of 85 bps, and now leads the conventional benchmark over the tailing one-year and three-year intervals. ESG screened US small stocks outpaced non-ESG small cap stocks in February by 30 bps. While ESG screened small-caps also widened their lead over the one-year interval, the MSCI USA Small Cap ESG Leaders Index continues to lag over the intermediate and long-term.

Stocks indices tracking large and mid-cap stocks in the US and foreign markets, developed as well as emerging markets, trailed their conventional benchmarks in February, underperforming within a range that extends from 40 bps to 143 bps.

While not included in the analysis of the six ESG equity indices, it’s instructive to note that the MSCI USA ESG Leaders Index, with its February return of -3.33%, trailed by 70 bps the -2.63% return registered by the S&P 500 ESG Index. Both indices track large and mid-cap US stocks but differing construction methodologies leads to sector and individual stock differences, both in terms of holdings and their weights. In fact, the S&P 500 Index has outperformed the MSCI USA ESG Leaders over short, intermediate and long-term time horizons, illustrating that index selection can matter.

Chart 2: Selected sustainable indices intermediate and long-term total return performance results to February 28, 2022

Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

SRA Select List of funds posted an average decline of -2.17% in February

Based on an equal weighting basis, SRA Select funds posted an average decline of 2.17% in February versus an average -1.71% decline registered by the average performance of corresponding conventional benchmarks¹. Excluding money market funds, returns ranged from 1.08% posted by the iShares ESG Aware MSCI USA Small-Cap ETF (ESML) to a low of -5.94% registered by the iShares ESG MSCI EM Leaders ETF (LDEM). Refer to Table 2 for a complete rundown of SRA Select list of mutual funds and ETFs and their February performance results.

Consisting of nine funds² pursuing discrete investment strategies intend for use as building blocks in the creation of a diversified ESG-oriented portfolio, only three of the nine funds outperformed their conventional benchmarks in February (Refer to previously published article SRA Select Listing: ESG Integration Investment Fund Q1-2022 https://sustainableinvest.com/sra-select-listing-esg-integration-investment-funds-q1-2022/).

¹ To avoid duplications, these results exclude Vanguard Treasury Money Market Fund and S&P 500.

² A tenth fund, the Vanguard Treasury Money Market Fund, is an alternative money market fund.

Table 2: Performance of SRA Select listed mutual funds and ETFs

Fund Name

Expense

Ratio (%)

$ AUM

1-

Month Return (%)

12-Month Return (%)

3-Year Average (%)

iShares ESG Advanced Hi Yld Corp Bd ETF (HYXF)

0.35

169.6

-1.32

-0.99

4.18

iShares ESG Aware MSCI EAFE ETF (ESGD)

0.2

7,300.9

-3.48

2.47

8.28

iShares ESG Aware MSCI USA Small-Cap ETF (ESML)

0.17

1,531.6

1.08

0.6

13.47

iShares ESG U.S. Aggregate Bond ETF (EAGG)

0.1

1,985.9

-1.12

-2.78

3.21

iShares Global Green Bond ETF (BGRN)

0.2

262

-2.34

-4.27

2.35

iShares MSCI ACWI Low Carbon Target ETF (CRBN)

0.2

1,243.2

-3.09

7.64

13.87

iShares MSCI KLD 400 Social ETF (DSI)

0.25

3,765

-3.32

15.82

18.97

iShares ESG MSCI EM Leaders ETF (LDEM)

0.16

71.4

-5.94

-10.08

BlackRock Liquid Environmentally Aware Fund (LEAXX)

0.45

1136.7

-0.01

-0.05

Vanguard Treasury Money Market Fund Investor (VUSXX)

0.09

34,199

0.01

0.02

0.74

Average Returns*

-2.17

0.93

9.19

S&P 500 Index

-2.99

16.39

18.24

MSCI USA Index

-2.93

14.38

18.43

MSCI USA Small Cap Index

0.9

-0.67

11.22

MSCI EAFE Index

-1.77

2.83

7.78

MSCI ACWI Index

-2.58

7.81

13.41

MSCI Emerging Markets Index

-2.99

-10.69

6.04

Bloomberg U.S. Treasury Bill (1-3 M)

0.01

0.04

0.08

Bloomberg U.S. Aggregate Bond Index

-1.12

-2.64

3.3

Bloomberg High Yield Index

-2.39

-3.91

3.02

ICE BofML Green Bond Hedged US Index

-2.49

-6.29

1.08

Average Returns

-1.71

0.10

7.15

Notes of Explanation: $AUM in millions. Blank cells=fund was not in operation during entire interval. *Average returns exclude the Vanguard

Treasury Money Market Fund Investor. Source: Morningstar Direct.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact