In a filing with the Securities & Exchange Commission as of August 4, 2017 BlackRock Fund Advisors recorded substantial reductions in the expense ratios applicable to two international equity oriented ESG Exchange Traded Funds. These ETFs included the iShares MSCI EAFE ESG Optimized ESG ETF (ESGD) and the iShares MSCI EM ESG Optimized ETF (ESGE) whose expense ratios dropped from 0.40% or 40 bps to 0.20% or 20bps and from 0.45% or 45 bps to 0.25% or 25 bps–reductions of 50% and 45%. A third fund, the domestic iShares MSCI USA ESG Optimized ETF (ESGU), also experienced a significant decline in its expense ratio from 0.28% or 28 bps to 0.15% or 15 bps, or a reduction of 46%.

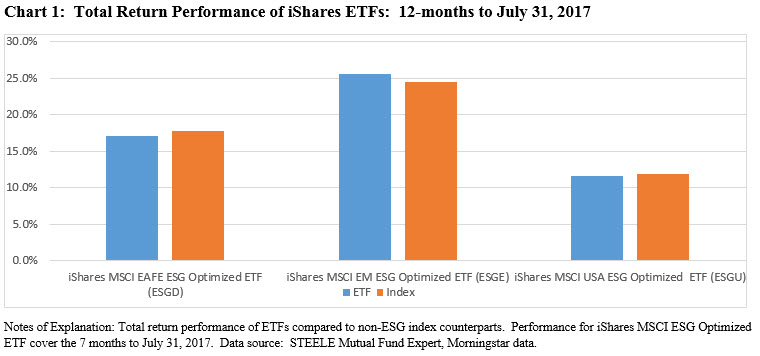

Launched in June 2016 as the iShares MSCI EAFE ESG Select ETF and the iShares MSCI EM ESG Select ETF, the ETFs were renamed as of August 22, 2016. The funds have benefited from strong developed Asian and European equity markets performance as well as emerging markets performance during the 12-month interval to July 31, 2017. The iShares MSCI EAFE ESG Optimized ESG ETF and the iShares MSCI EM ESG Optimized ETF gained 17.08% and 25.57%, respectively and have tracked their corresponding non-ESG indexes, either positively or negatively, within 1.1% or less. See Chart 1.

ESGU was launched as of December 1, 2016 and has registered a gain of 11.62% during the 7-months through July 31, 2017 versus 11.86% for the underlying index.

Since their inception, ESGD, ESGE and ESGU have attracted $122 million, $74.5 million and $5.4 million, respectively. They are three of 56 sustainable ETFs funds that have garnered almost $6.0 billion in assets under management. BlackRock’s fee reduction may be designed to accelerate their growth and improve their competitive position relative to Nuveen Fund Advisors’ recently introduced NuShares ETFs that are focused on similar market segments with their ESG tilts and expense ratios ranging from 35 bps and 45 bps. Regardless, this is a positive development for sustainable investors, especially so since there only a few actively managed international and emerging market ESG funds with attractive attributes that combine sustainable practices, performance and cost.

By lowering their expense ratios to 28 bps, 25 bps and 20 bps, the fees fall into the lowest expense ratio category or first quartile for ETF funds whose expense ratios, based on an analysis of these as of July 31, 2017 adjusted for the new BlackRock fees, average 0.46% and range from a minimum expense ratio of 0.12% and a maximum of 0.95%. Expense ratios that fall into the lowest expense ratio category or first quartile extend from 0.12% to 0.335%[1].

The ESG strategies applicable to the three funds are described below.

iShares MSCI EAFE ESG Optimized ESG ETF (ESGD)

The Fund seeks to track the investment results of the MSCI EAFE ESG Focus Index, an optimized equity index designed to reflect the equity performance of companies that have positive environmental, social and governance (ESG) characteristics as determined by MSCI while exhibiting risk and return characteristics similar to those of the MSCI Market Cap Weighted Index.

The index excludes securities of companies involved in the business of tobacco and controversial weapons companies, as well as securities of companies involved in very severe business controversies (as determined by MSCI). After excluding firms that fall into these categories, MSCI then follows a quantitative process that is designed to determine optimal weights for securities to maximize exposure to securities of companies with higher ESG ratings, subject to maintaining risk and return characteristics similar to the index. For each industry, MSCI identifies key ESG issues that can turn into unexpected costs for companies in the medium to long term. MSCI then calculates the size of each company’s exposure to each key issue based on the company’s business segment and geographic risk and analyzes the extent to which companies have developed robust strategies and programs to manage ESG risks and opportunities. Using a sector-specific key issue weighting model, companies are rated and ranked in comparison to their industry peers.

As of June 30, 2016, the MSCI Market Cap Weighted Index consisted of securities from the following 21 developed market countries or regions: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The index may include large- and mid-capitalization companies. Components of the index primarily include consumer discretionary, financials, healthcare and industrials companies.

iShares MSCI EM ESG Optimized ETF (ESGE)

The fund seeks to track the investment results of the MSCI Emerging Markets ESG Focus Index, an optimized equity index designed to reflect the equity performance of companies that have positive environmental, social and governance (ESG) characteristics (as determined by MSCI), while exhibiting risk and return characteristics similar to those of the MSCI Market Cap Weighted Index.

The index excludes securities of companies involved in the business of tobacco and controversial weapons companies, as well as securities of companies involved in very severe business controversies (as determined by MSCI). After these companies have been excluded from the universe of eligible securities, MSCI then follows a quantitative process that is designed to determine optimal weights for securities to maximize exposure to securities of companies with higher ESG ratings, subject to maintaining risk and return characteristics similar to the MSCI Market Cap Weighted Index.

For each industry, MSCI identifies key ESG issues that can turn into unexpected costs for companies in the medium to long term. MSCI then calculates the size of each company’s exposure to each key issue based on the company’s business segment and geographic risk and analyzes the extent to which companies have developed robust strategies and programs to manage ESG risks and opportunities. Using a sector-specific key issue weighting model, companies are rated and ranked in comparison to their industry peers.

As of June 30, 2016, the MSCI Market Cap Weighted Index consisted of securities from the following 23 countries: Brazil, Chile, China, Colombia, the Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, South Africa, South Korea, Taiwan, Thailand, Turkey and the United Arab Emirates.

The index may include large- and mid-capitalization companies. Components of the index primarily include consumer discretionary, financials and information technology companies.

iShares MSCI USA ESG Optimized ETF (ESGU)

The fund seeks to track the investment results of the MSCI USA ESG Focus Index, an optimized equity index designed to reflect the equity performance of U.S. companies that have positive environmental, social and governance (ESG) characteristics (as determined by MSCI) while exhibiting risk and return characteristics similar to those of the broader, non-ESG oriented, MSCI USA Index. MSCI begins with the MSCI USA Index and excludes securities of companies involved in the business of tobacco and controversial weapons companies, as well as securities of companies involved in very severe business controversies (as determined by MSCI), and then follows a quantitative process that is designed to determine optimal weights for securities to maximize exposure to securities of companies with higher ESG ratings, subject to maintaining risk and return characteristics similar to the MSCI USA Index.

For each industry, MSCI identifies key ESG issues that can lead to unexpected costs for companies in the medium- to long-term. MSCI then calculates the size of each company’s exposure to each key issue based on the company’s business segment and geographic risk and analyzes the extent to which companies have developed robust strategies and programs to manage ESG risks and opportunities. Using a sector-specific key issue weighting model, companies are rated and ranked in comparison to their industry peers. The MSCI USA Focus Index may include large- or mid-capitalization companies. Components of the MSCI USA Focus Index primarily include financials, healthcare and information technology companies.

[1] Based on an analysis of 54 sustainable ETFs as of July 31, 2017. Data source: STEELE Mutual Fund Expert, Morningstar data.