The Bottom Line: Eight thematic sustainable investment vehicles investing in futures contracts on carbon credits and voluntary offset credits are listed, but volatilities are high.

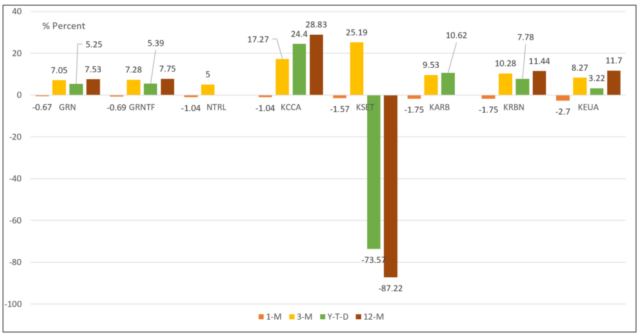

Performance of thematic sustainable investment funds investing in carbon credits and voluntary offset credits, to August 31, 2023 Notes of Explanation: Eight funds include, iPath Series B Carbon ETN (GRN), iPath Global Carbon ETN (GRNF), Global X Carbon Credits Strategy ETF (NTRL), KraneShares California Carbon Allowances ETF (KCCA), KraneShares Carbon Offset ETF (KSET), #Carbon Strategy ETF (KARB), KraneShares Global Carbon ETF (KRBN) and KraneShares European Allowances ETF (KEUA). #Actively managed fund. Performance data source: Morningstar Direct. Funds data: Sustainable Research and Analysis.

Notes of Explanation: Eight funds include, iPath Series B Carbon ETN (GRN), iPath Global Carbon ETN (GRNF), Global X Carbon Credits Strategy ETF (NTRL), KraneShares California Carbon Allowances ETF (KCCA), KraneShares Carbon Offset ETF (KSET), #Carbon Strategy ETF (KARB), KraneShares Global Carbon ETF (KRBN) and KraneShares European Allowances ETF (KEUA). #Actively managed fund. Performance data source: Morningstar Direct. Funds data: Sustainable Research and Analysis.

Notes of Explanation: Eight funds include, iPath Series B Carbon ETN (GRN), iPath Global Carbon ETN (GRNF), Global X Carbon Credits Strategy ETF (NTRL), KraneShares California Carbon Allowances ETF (KCCA), KraneShares Carbon Offset ETF (KSET), #Carbon Strategy ETF (KARB), KraneShares Global Carbon ETF (KRBN) and KraneShares European Allowances ETF (KEUA). #Actively managed fund. Performance data source: Morningstar Direct. Funds data: Sustainable Research and Analysis.

Notes of Explanation: Eight funds include, iPath Series B Carbon ETN (GRN), iPath Global Carbon ETN (GRNF), Global X Carbon Credits Strategy ETF (NTRL), KraneShares California Carbon Allowances ETF (KCCA), KraneShares Carbon Offset ETF (KSET), #Carbon Strategy ETF (KARB), KraneShares Global Carbon ETF (KRBN) and KraneShares European Allowances ETF (KEUA). #Actively managed fund. Performance data source: Morningstar Direct. Funds data: Sustainable Research and Analysis. Observations:

- Exchange traded funds (ETFs) and exchange traded notes (ETNs) investing in carbon credits, usually via futures in carbon credits across at least four markets, and, in one case, investing in futures contracts on voluntary offset credits, a total of eight investment vehicles with total net assets of $892.1 million, posted an average decline of 1.4% in August. This was still slightly ahead of the S&P 500 Index, down 1.59% in the same month.

- Returns applicable to these seven passively managed and one actively managed (noted above) thematic sustainable funds ranged from a drop of 67 basis points recorded by the $46.1 million iPath Series B Carbon ETN (GRN), an unsecured index tracking debt obligation of Barclays Bank PLC that provides exposure to the Barclays Global Carbon II TR USD Index, to a decline of 2.7% posted by the passively managed $23 million KraneShares European Carbon Allowance Strategy ETF (KEMA), a fund that tracks the performance of carbon credit futures linked to the value of emissions allowances issued under European Union (EU) Emissions Trading System or cap and trade regime.

- On the other hand, three-month average returns were positive, adding 11.2%. Average year-to-date as well as trailing 12-month returns would also be positive if not for the inclusion of the recently launched $1.2 million KraneShares Global Carbon Offset Strategy ETF (KSET), a fund that tracks the performance of the S&P GSCI Global Voluntary Carbon Liquidity Weighted Index. The fund invests in futures contracts on voluntary carbon offset credits which represent projects that seek to reduce the impact of greenhouse gas emissions in an effort to curb climate change. KSET posted disastrous year-to-date and 12-month returns, likely due to the shrinkage experienced in the voluntary carbon markets for the first time in at least seven years, as companies reduced buying and studies found that several forest protection projects did not deliver promised emissions savings. Preserving forests is viewed as crucial to meeting international goals to limit global temperature increases to prevent the most extreme consequences of global warming. The fund’s results dragged down otherwise positive returns achieved by the remaining six or five funds that invest in carbon credit futures linked to the value of emissions allowances issued under one or more of cap-and-trade regimes, including the European Union (EU) Emissions Trading System, the California Carbon Allowance, the Regional Greenhouse Gas Initiative and the UK Emissions Trading Scheme.

- Recently, the allowances trading under the EU’s Emission Trading Scheme reached an all-time high of €101 per metric ton of CO2. But prices, which are determined based on supply and demand of allowances, can be highly volatile. For example, in March 2022 the outbreak of the Russia-Ukraine war caused prices to crash to less than €60 per metric ton of CO2 due to the expected ban on Russian energy imports in Europe. In this way, funds investing in carbon allowances can be exposed to significant volatility. Annualized standard deviations of returns for three funds that have been in operation for three years or more extends from 27 to 37 as compared to 18 for the S&P 500.

- According to the World Bank, almost a quarter of global greenhouse gas emissions (23%) are now covered by 73 instruments, and this is expected to expand. An Exchange Traded Scheme places a limit on the amount of greenhouse gas emissions, and it allows emitters with lower emissions to sell their extra emission units or allowances to higher emitters, thereby establishing a market price for emissions. Carbon pricing can be an effective way to incorporate the costs of climate change into economic decision making, thereby incentivizing climate action and enabling a more rapid transition to a low carbon energy future.

![COW-9-18-2023istockphoto-1398104046-612×612-1[1] Carbon neutral, CO2 emission reduction concept banner label icon set Stop global warming, zero carbon footprint, carbon credit, greenhouse effect Green eco friendly design elements vector illustratio](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/COW-9-18-2023istockphoto-1398104046-612x612-11-qkowuqd13yf4g1kn1yi0uwwo9rje0l1ygctturw9t8.jpg)