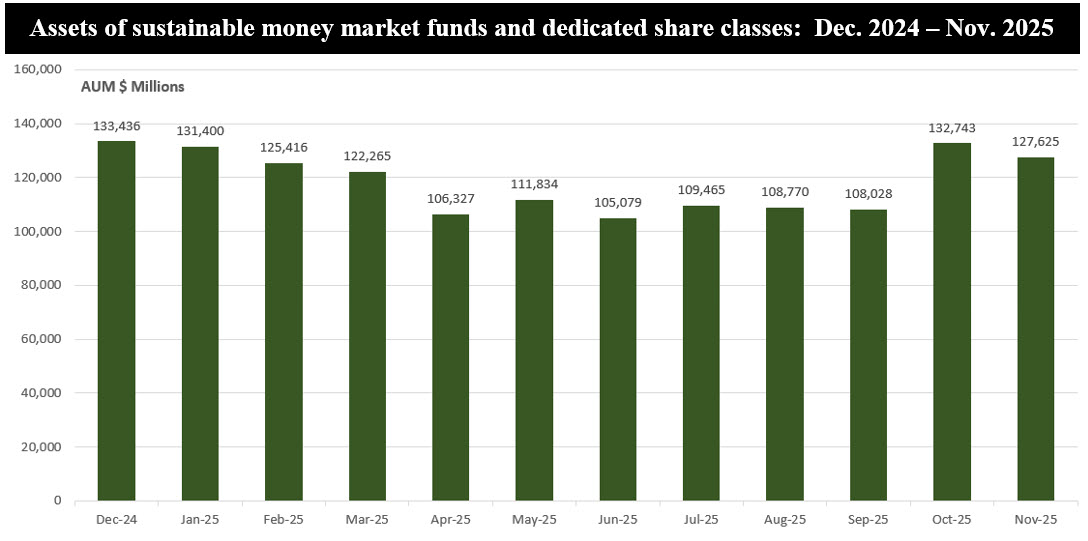

Sustainable Bottom Line: Sustainable money market funds, or funds that employ portfolio-based sustainability and “structural sustainability,” settled at $127.6 billion in assets in November 2025.

Notes of Explanation: Sources: Crane Data, publicly available information, Sustainable Research and Analysis LLC.

Observations:

• Sustainable money market funds, covering funds and dedicated share classes within funds, ended November 2025 with $127.6 billion in net assets, based on data compiled by Crane Data. Year-to-date, sustainable money market funds, which hit a low point at the end of June, declined by $5.8 billion, from $133.4 billion at the end of December 2024.

• As defined here, most of the sustainable money market funds under consideration do not change what they invest in. Rather than portfolio and ownership-based approaches that may employ a values-based method, exclusions, screening, thematic investing, impact investing, ESG integration and/or stewardship or proxy voting, most of the sustainable money market funds captured in this $127.6 billion segment modify how the funds operate or where fund revenues flow in support of diversity, equity and inclusion, and thematic initiatives. At the same time, they preserve the primary fund objective of seeking capital preservation and liquidity. In each case, the method is explicitly described in fund offering documents. This sustainable investing approach offers three distinct outcomes-oriented pathways, including portfolio-based sustainability, process-based sustainability and revenue-based sustainability. The latter two categories are referred to here as “structural sustainability,” reflecting their focus on market processes and economic flows rather than on portfolio composition or issuer engagement.

• Comprised of 23 funds and 47share classes, this segment extends to funds offered by thirteen firms, including the following top five asset managers: Goldman Sachs, JPMorgan Asset Management, Invesco, BlackRock and Dreyfus (BNY Mellon affiliate). Together, these five firms manage 14 funds and dedicated share classes and $91.1 billion in assets under management and account for 71% of the segment’s assets at the end of November.

• The three distinct outcomes-oriented pathways are, as follows: 1) Portfolio‑based sustainability. Of the 47 funds and dedicated share classes, this approach is the least common, being employed by one fund, the $5.7 billion BlackRock Wealth Liquid Environmentally Aware Fund (WeLEAF) with its five share classes designated for institutional and retail investors. The fund explicitly applies environmental practices criteria to the evaluation of an issuer or guarantor environmental performance, considering such factors as emissions, energy and water intensity, waste generation, green revenues and environmental disclosure levels. Furthermore, the fund excludes certain securities or guaranteed by entities that derive a portion of their revenues from fossil fuels mining, exploration or refinement or from thermal coal-based power generation. 2) Process‑based sustainability. This is the most common approach, extending to $52.9 billion in assets, that emphasizes the themes of diversity and inclusion, pursuant to which fund transactions are placed with minority‑, women‑, or veteran‑owned broker‑dealers. Further, share classes are distributed through designated social or veteran intermediaries for the exclusive use by their clients, and 3) Revenue‑based sustainability. Under this thematic approach, covering some $37.4 billion in assets, the fund advisor commits a defined share of fees or revenues to charities. Donations may be client‑directed or programmatic.

• Omitted from this $127.6 billion segment of sustainable money market funds are other money market funds (and also to most other funds) managed by firms like BlackRock, JPMorgan Asset Management, Dreyfus (a BNY Mellon affiliate), and State Street Global Advisors, to mention just a few, that, as a matter of investment practice, integrate ESG into their investment decision making. In these cases, financially material ESG factors are considered systematically firmwide in investment analysis. Further, this approach does not alter a strategy’s core objective or reduce the investable universe by itself. It should be noted, however, that these approaches are not explicitly described in each fund’s offering documents but rather via each company’s regularly published stewardship reports as well as other related documents.