The Bottom Line: Clarifying US Senate and House legislation may not actually lead to the accelerated adoption of sustainable investment options in certain retirement plans.

Clarifying US Senate and House legislation may not actually lead to the accelerated adoption of sustainable investment options in qualified employer-sponsored plans in the near-to-intermediate term

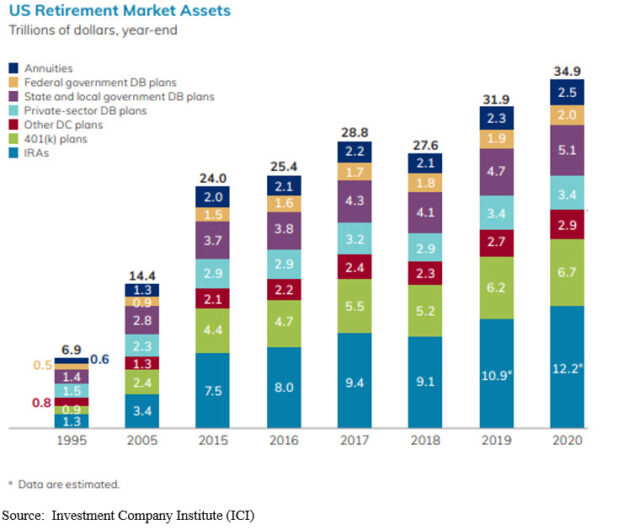

To stimulate the adoption of sustainable investing options in qualified employer-sponsored retirement accounts that include 401 (k) plans, pensions, deferred-compensation plans, and profit-sharing plans, a combined total of about $13 trillion in assets (refer to Chart 1), legislation[1] was introduced on May 20th in the U.S. Senate and House “to provide legal certainty to workplace retirement plans that choose to consider environmental, social and governance (ESG) factors in their investment decisions or offer ESG investment options, including so called default options. Referred to as the Financial Factors in Selecting Retirement Plan Investment Act, the legislation would amend the Employee Retirement Security Act (ERISA) of 1974 and clarify that fiduciaries may consider environmental, social, governance and similar factors in connection with carrying out investment decisions. The action is meant to eliminate any uncertainty that may have been introduced by the Department of Labor (DOL) in the final days of the Trump administration when it issued a rule requiring retirement plan fiduciaries to satisfy their duties of prudence and loyalty by selecting investments based solely on pecuniary considerations—which in any case the Biden administration in March announced it would not enforce. Such actions, whether in the form of a reversal of the Trump DOL rule or via the proposed legislation, if adopted, will add clarity and reduce any lingering uncertainties regarding ESG considerations by fiduciaries. That said, any such clarifications may not lead to the accelerated adoption of investment options in qualified employer-sponsored plans in the near-to-intermediate term.

Several industry surveys referenced by the DOL in a previously issued notice of proposed rulemaking demonstrate that socially responsible investment options or ESG options offered in defined contribution (DC) plans are not pervasive. According to a survey conducted by the Plan Sponsor Council of America, about 3% of 401(k) and/or profit sharing plans offered at least one ESG-themed investment option in 2018 while about 0.1% of total DC plan assets are invested in ESG funds. Also, data provided as of 2018 by Vanguard shows that about 9% of DC plans offer one or more “socially responsible” domestic equity fund option. This is in line with Deloite Consulting’s 2019 survey of about 240 plan sponsors showing that 8% offer socially responsible funds, as compared to 17% percent in 2017.

While any clarification of fiduciary concerns is expected to be beneficial, this action alone will still not address a combination of issues that, taken together, would likely continue to restrict short-to-intermediate-term progress toward the adoption of sustainable investment choices in 401(k) plans. These include: (1) the confusion and misunderstanding that exist around sustainable and ESG investing, (2) the resolution of trade-offs that exist between adding one or more sustainable investment options and a growing recognition that the simplification of and reduction in the number of investment choices leads to better participants experiences, (3) the challenge of satisfying the values orientation or sustainable investing sentiments of large and diversified participant populations with a single or a selected number of investment options, and (4) the limited number of sustainable fund options available at this time with track records that extend to three-to-five years.

Growing confusion and increasingly common misunderstanding regarding sustainable investing invites adoption of standards

In its present form, the legislation does not attempt to clarify the growing confusion and increasingly common misunderstanding that have arisen on the part of stakeholders between values-based investing, reflecting social or ethical investing considerations, and environmental, social and governance (ESG) integration in the investment process, pursuant to which relevant and material risks and opportunities are taken into account in the process of evaluating securities. Even the legislation’s accompanying statement seems to reflect this confusion by interchangeably referring to terms like sustainable investment options and consideration of ESG factors by workplace retirement plans. In order to address the primary sustainable investing sector concerns and challenges that have recently arisen against a backdrop of dramatic growth in the number as well as assets sourced to sustainable investment mutual funds and ETFs in the United States and to promote the adoption of sustainable investment options in defined contribution plans, the final legislation should also promote the adoption of standardized sustainable investing definitions, the creation and acceptance of an industry-wide mutual fund and ETF product classification framework as well as the adoption of minimum reporting and disclosure standards for sustainable investment products[2].

Emphasis in recent years on rationalizing 401(k) plan options conflicts with a desire to expand them by adding sustainable funds

After years of adding investment options to company sponsored 401(k) plans, especially following the introduction of life cycle/target date funds and their adoption as a default option, plan sponsors have begun to reverse course to focus instead on rationalizing and reducing the number of fund choices. This has been in response to research showing that too many investment fund choices tends to confuse plan participants and lead to sub-optimal investment decisions. Also, too much choice actually leads to lower plan participation rates. According to the same Deloitte survey referenced above, there has been a 13% decrease in investment options offered within retirement plans since 2015 and the average number of investment options offered is now below 20.

Against this backdrop, plan sponsors will be faced with having to assess the trade-off between adding a sustainable fund and, in the process, expanding the number of fund offerings or substituting a sustainable fund for an existing option. Substitution may not be a viable option and a related consideration is whether a single sustainable fund offering, such as an active or passively managed domestic equity fund (i.e. growth, value, large, mid or small cap), representing the most commonly available investment option, is sufficient to satisfy the sustainable investment objectives of large and/or diversified employee populations. Individual investors (as well as institutions) have varying opinions when it comes to their values and what matters most to them. It may be difficult to satisfy these with a single or even a complement of sustainable investment funds.

Limited sustainable fund investment options with sufficiently long track records restricts choices for plan administrators

On top of that while options are expanding, a limited universe of recent vintage sustainable equity and fixed income funds are available at this time for evaluation as potential investment choices. It’s true that some sustainable funds have been in continuous operation since the early 1980’s, however, these are mainly socially responsible, values-based, funds that largely incorporate negative screening or exclusionary practices and/or these may be subject to higher fees. In contrast, more recently launched mutual funds and ETFs, both new funds and repurposed funds, that, for example, employ ESG integration practices, limited exclusions, and also engage in shareholder/bondholder advocacy complemented by proxy voting practices, have not as yet established track records that extend to three and five years. Such funds may not as yet qualify for consideration, thereby limiting the number of investment choices available at this time.

Relevant and material ESG factors likely accounted for in conventional investment management processes

In the end the impact of clarifying fiduciary concerns related specifically to ESG integration practices in DC plans may be overstated. The fundamental role of investment managers is to evaluate risks and generate acceptable rates of return for beneficiaries. To the extent that environmental, social and governance factors are relevant and material to investment outcomes, any such related risks and opportunities have likely been taken into account without necessarily labelling these as such. This is in line with their fiduciary obligations as well as the core competency of investment managers to evaluate companies or transactions and to identify risks and opportunities that may affect valuations or impair or enhance an issuer’s ability to service its debt obligations. In recent years, certain physical risks due to climate change, such as fires, hurricanes, droughts, flooding, etc. have been occurring with greater frequency and their impact has been more severe. Also, risks and opportunities linked to carbon transition risks have become elevated as changing political, social and cultural factors have led to the adoption of more far reaching carbon emission reduction legislation that is expected to have a greater impact on company valuations and earnings. In turn, this is likely to play a more prominent role in investment decisions and outcomes.

On the other hand, sustainable investment approaches like values-based investing that embraces ethical, social, moral and/or religious considerations to achieve a positive societal outcome or impact investing, in contrast to ESG integration, may be inconsistent with the standard of conduct for those who manage employee benefit plan assets. Such approaches will typically constitute non-pecuniary considerations that at best may have neutral investment outcomes and at worst may lead to below market returns over time.

[1] Legislation was Introduced by U.S. Senators Tina Smith (D-Minn.) and Patty Murray (D-Wash.) and U.S. Representative Suzan DelBene (D-WA)

[2] Promoting the Continued Growth and Development of Sustainable Investing in US Mutual Funds and ETFs: A Three-pronged Proposal to Address Misunderstanding and Confusion that Have Arisen in the Sector, Michael Cosack and Henry Shilling