Introduction

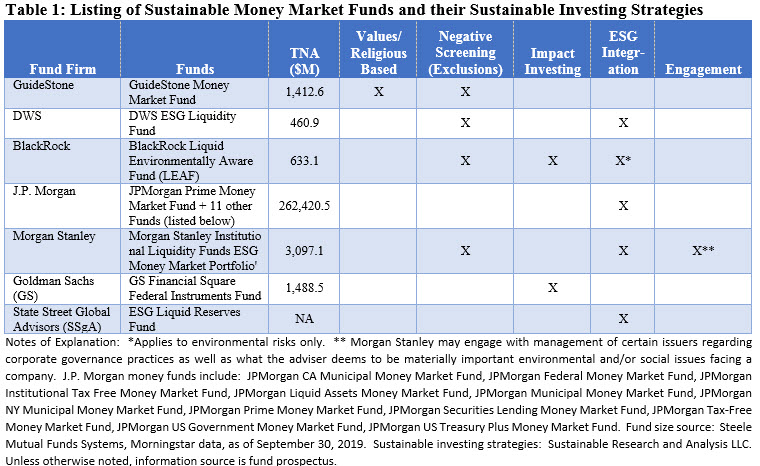

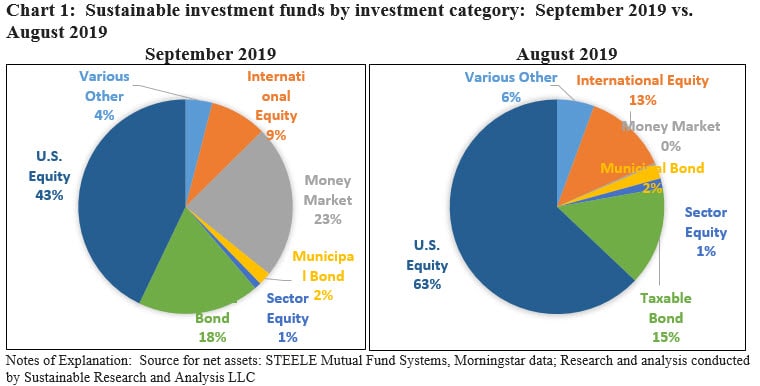

Additional money market funds have jumped onto the sustainable investing[1] parade by launching or converting existing money market funds to reflect the adoption of various sustainable investing approaches, ranging from negative screening (exclusions) to ESG integration, engagement, and even some variations of impact investing. In the last five months or so, a total of 15 funds comprised of 87 share classes, a mix of prime, government and municipal money funds with constant and fluctuating net asset values (NAVs), were added to an already expanding universe of sustainable money market funds. These 15 investment vehicles, which added a combined total of $267.5 billion in net assets, consist of both existing funds whose mandates have been updated via prospectus amendments or newly launched funds offered by J.P. Morgan, Morgan Stanley, Goldman Sachs and State Street. On top of the three funds available from GuideStone, BlackRock and DWS that were already in operation, this brings the total number of sustainable money market funds currently offered to institutional investors and, to a lesser extent, retail investors, to 18 funds with about $269.5 billion in net assets as of September 30, 2019[2]. Managed by seven different firms, each one of these money market funds employs a different sustainable investing approach and methodology, including two unique impact investing strategies introduced by BlackRock and Goldman Sachs. As previously reported, the conversions and fund additions have transformed the profile of the sustainable investing landscape by ballooning the money fund segment such that it now accounts for about 23% of total sustainable investment funds under management, up from less than 1% the month prior. Additional money market fund entrants into the sustainable investing landscape is expected.

Sustainable investing approaches vary across the seven firms

As noted in Table 1 that lists the money market funds currently offered along with their sustainable strategies, the approaches vary across the seven firms. Even as their methodologies vary, only two firms have adopted a strictly ESG integration approach. The other five firms have each adopted varying approaches that combine one or more strategies, with two firms implementing a unique impact investing tactic either alone or in combination with other approaches. In the end, five firms have incorporated the consideration of ESG risks and opportunities into the investment decision process. This, even as the impact of environmental (E) and social (S) factors on credit and liquidity risks, on top of fundamental financial considerations, are likely to have limited impact and no upside effect given the short-term tenor of money market eligible securities, especially when such securities are held to maturity.

What follows is a description of the sustainable investing strategies adopted by each of the firms and their money market funds.

Guidestone Money Market Fund

The fund employs a faith/religious–based approach that relies on negative screening (exclusions). As a Christian-screened mutual fund family, GuideStone aligns its investments with Christian values. The fund, like the other GuideStone funds, may not invest in any company that is publicly recognized, as determined by GuideStone Financial Resources of the Southern Baptist Convention (GuideStone Financial Resources), as being in the alcohol, tobacco, gambling, pornography or abortion industries, or any company whose products, services or activities are publicly recognized as being incompatible with the moral and ethical posture of GuideStone Financial Resources.

BlackRock Liquid Environmentally Aware Fund (LEAF)

The fund employs a combination of a modified ESG integration approach and negative screening (exclusions) along with an impact investing tactic. LEAF invests in a broad range of money market instruments whose issuer or guarantor has better than average performance in environmental practices. According to the prospectus filing, BlackRock uses data from independent ESG ratings vendors and may employ the use of its own models. The fund will also prohibit any investments in companies that earn significant revenue from the mining, exploration or refinement of fossil fuels or from thermal coal or nuclear energy-based power generation.

BlackRock has also made a commitment to purchase or retire carbon offset credits with a portion of its revenues from the fund and make an annual payment to the World Wildlife Fund (WWF) to help further global conservation efforts.

DWS ESG Liquidity Fund

The fund combines ESG integration and negative screening (exclusions). Excepting for municipal securities, the fund’s prospectus notes that a company’s performance across certain ESG criteria is summarized in a proprietary ESG rating that is calculated by an affiliate of the DWS on the basis of data obtained from various ESG data providers. Only companies with an ESG rating above a minimum threshold determined by the DWS are considered for investment by the fund. The proprietary ESG rating is derived from multiple factors, including the level of involvement in controversial sectors and weapons, adherence to corporate governance principles, ESG performance relative to a peer group of companies and efforts to meet the United Nations’ Sustainable Development Goals.

DWS calculates ESG ratings for municipal securities by applying a combination of positive and negative screens. From the investable universe of municipal securities, positive screens will automatically include green bonds that meet minimum standards and negative screens will exclude municipal securities with exposure to weapons, issues where more than 10% of the business is attributable to nuclear power or more than 25% of the business is derived from coal, and issues related to gambling, lottery, the production or sale of tobacco, and other sectors deemed controversial by DWS.

The remainder of the investable universe of municipal securities are then scored on key performance indicators in each of three pillars: environmental, social and corporate governance. Only municipal securities with a cumulative score across all three pillars above a minimum threshold determined by DWS are considered for investment by the fund.

GS Financial Square Federal Instruments Fund

The funds invests only in government securities, generally securities issued or guaranteed by the United States or certain U.S. government agencies or instrumentalities, including securities issued by the Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac) and Federal Home Loan Banks, or repurchase agreements that are collateralized fully by cash or U.S. Government Securities.

An additional mandate adopted by the fund is to prioritize buying from bond dealers that are certified as being owned by minorities, women and veterans. According to its prospectus, the fund, which buys about half of its assets from such dealers, has since doubled in size, attracting $850 million in the first half of 2019.

J.P. Morgan Money Market Funds

In September, J.P. Morgan Asset Management re-branded 12 money market funds, both taxable and tax-exempt, comprised of 67 share classes with $262.4 billion in net assets by amending fund prospectuses to reflect that as part of its security selection strategy, the adviser also evaluates whether environmental, social and governance factors could have material negative or positive impact on the cash flows or risk profiles of many companies in the universe in which the funds may invest. These determinations may not be conclusive and securities of issuers that may be negatively impacted by such factors may be purchased and retained by the funds while the funds may divest or not invest in securities of issuers that may be positively impacted by such factors.

Morgan Stanley Institutional Liquidity Funds-ESG Money Market Portfolio

Formerly called the money market portfolio, the fund revised its name and amended its prospectus effective as of October 31, 2019 to reflect the incorporation of ESG risks and opportunities. The fund’s investment process incorporates information about ESG issues, using a proprietary ESG scoring methodology that combines third-party ESG data with proprietary views, to explicitly consider the risks and opportunities ESG factors pose to money market instruments. A rules-based process is employed to construct the portfolio that relies on security selections based on minimum ESG scores. Excluded from consideration are corporations that generate revenue from the manufacturing or production of tobacco, corporations that generate revenue from the manufacturing or production of landmines and cluster munitions (i.e., an explosive weapon that randomly scatters sub-munitions), corporations that generate revenue from the manufacturing or production of firearms, corporations that generate revenue from the mining of thermal coal or coal fired power generation and corporations that primarily generate revenue from the fossil fuel industries that Morgan Stanley has determined produce a certain level of carbon emissions.

The fund may invest in green commercial paper issued by companies that would otherwise be subject to fossil fuel exclusions so long as Morgan Stanley has determined that the proceeds will not be used to finance fossil fuel generation capabilities. Finally, Morgan Stanley may engage with management of certain issuers regarding corporate governance practices as well as what the firm deems to be materially important environmental and/or social issues facing a company.

State Street ESG Liquid Reserves Fund

State Street Global Advisors (SSgA) integrates ESG risks and opportunities by considering ESG criteria at the time of purchase, with some exceptions that extend to U.S. government securities, securities of governments other than the U.S. government, or securities of issuers for which ESG data is limited. SSgA uses an ESG-related metric for each fund investment based on a proprietary scoring system developed by SSgA that assigns an ESG rating to each issuer. Each issuer score is comprised of two underlying components. The first measures the performance of a company’s business operations and governance as related to financially material ESG challenges facing the issuer’s industry based on an industry specific financial materiality framework published by the Sustainability Accounting Standards Board (SASB). The score for each applicable issuer draws on a number of independent data sources and is created using two types of industry-recognized frameworks. While these can change, at the time of launch, data metrics on a variety of ESG topics were provided by Sustainalytics, ISS-ESG (formerly, Oekom Research), Vigeo-EIRIS, and ISS Governance. Scores are subject to change at the discretion of SSgA. The second component of the score is generated using region-specific corporate governance codes developed by investors or regulators. The governance codes describe minimum corporate governance expectations of a particular region and typically address topics such as shareholder rights, board independence and executive compensation, using data provided by ISS Governance.

Transforming the sustainable investment funds landscape: Money funds now account for 23% of assets

Even before taking into account the sustainable funds launched by State Street, Goldman and Morgan Stanley, the rebranding of J.P. Morgan’s money market funds helped to reshape the sustainable investing landscape in part by shifting the profile of allocated assets by pushing up the value and percentages of money market funds as well as bond funds while also lifting the proportion of sustainable assets sourced to institutional investors. Based on data as of September 30, 2019, the money market funds category now ranks second with 23% of assets after US equity funds with $491.2 billion and 42.9% of the segment’s $1.1 trillion in assets. Refer to Chart 1.

[1] While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

[2] Total net assets for State Street ESG Liquid Assets Fund not available at the time of this writing.