Actively managed sustainable ETFs gaining some traction

The bottom line: Actively managed conventional as well as sustainable ETFs have been gaining some traction, but investors should carefully consider their alternative investing options. Performance of top 10 actively managed sustainable ETFs relative to designated market index: Trailing 12-months to July 31, 2023Notes of Explanation: *Dimensional US Sustainability Core 1 ETF, Dimensional International Sustainability […]

What does the FTX debacle have to do with ESG?

The Bottom Line: The FTX Trading Ltd. debacle, like previous implosions due to governance failures and fraud, should give ESG integration skeptics pause for thought. Summary According to published accounts, the rapid bankruptcy filing of FTX Trading Ltd., an exchange for trading cryptocurrencies founded in 2020 by Sam Bankman-Fried, and more than 100 related entities, […]

Uninvestability of Russian stocks and bonds affects ESG and conventional fund investors

The Bottom Line: Both conventional and ESG fund investors may be exposed to Russian securities that have declined in value primarily in emerging market funds. The Russian invasion of Ukraine led to suspensions in trading and likely modest portfolio losses in some active and passively managed funds primarily focused on emerging markets The Russian invasion […]

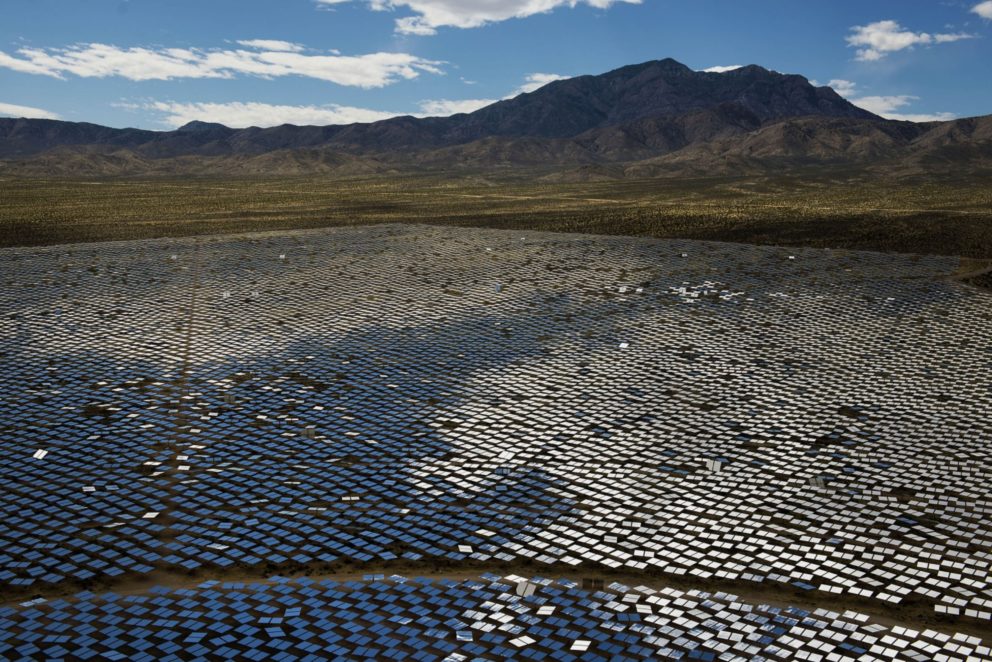

Environmental considerations for sustainable cryptocurrency investors

The Bottom Line: Advocating for improved disclosures and renewable energy sources, considering lesser energy consuming cryptocurrencies and purchasing carbon credits are options for sustainable investors. Summary and options for sustainable cryptocurrency investors In the 13 or so years since the publication of a white paper by Satoshi Nakamoto¹ that launched the cryptocurrency digital wave with […]

Methods for Building Sustainable Investment Management Expertise

The Bottom Line: Article on building sustainable investment products published in connection with webinar conducted on April 14, 2020 by Steve Schoepke and Henry Shilling. Introduction and summary As interest in sustainable investing continues to rise, judging by the growth in fund firms, sustainable fund investment products and assets under management that as of March […]

What are Publicly Listed Asset Managers Saying about Sustainable Investing/3Q/4Q 2019 Earnings Calls?

The Bottom Line: Senior executives at leading publicly listed asset management firms acknowledge the growing role and strategic importance of sustainable investing in their business. What asset management companies are saying about sustainable (and ESG) investing? Based on publicly listed asset management company 3Q 4Q 2019 earnings calls comments and Q&A. Coverage of excerpted comments […]

Sustainable Investing Growth–We’ve Made It!….or Have We?

The Bottom Line: In this, the first of two research papers, Michael Cosack and Henry Shilling examine the most recent growth trends in sustainable investing. Download

Developments in the US Sustainable Fund Marketplace-What the Future May Bring

Introduction: Continued, But Uneven Growth Sustainable investment funds(1) have been available to US retail and institutional investors for a number of years. Earlier versions principally relied upon exclusionary screening processes. This is changing as fund managers are placing more emphasis on sophisticated and multi-layered ESG-integration approaches. Overall, the number and types of sustainable funds on […]