Receive a free compilation highlighting and summarizing each month’s key research articles published by Sustainable Research and Analysis.

Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

Rough start to the year January 2022

After delivering very strong equity returns in 2021 along with weak bond market returns, stocks and bonds had a rough start in January 2022. Inflation, concerns about central bank tightening and tensions with Russia over Ukraine agitated markets and led to a sharp increase in volatility. Large cap stocks gave up 5.17%, according to the…

Share This Article:

The Bottom Line: January 2022 has been rough for both stocks, bonds and selected sustainable indices that continue offering value in the intermediate and long-term.

Concerns about inflation, central bank tightening and tensions with Russia over Ukraine agitated markets in January and led to a sharp increase in volatility and negative results

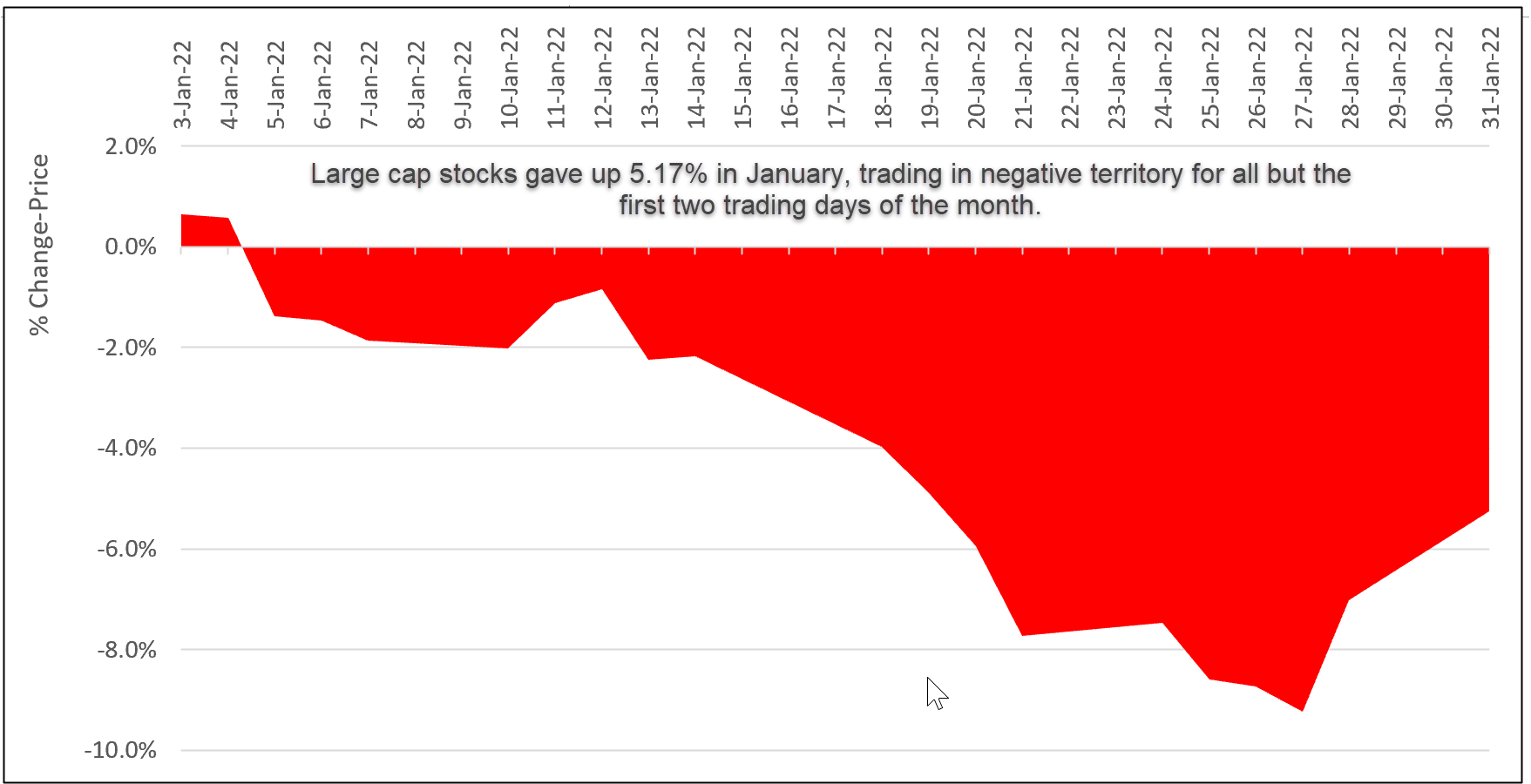

After delivering very strong equity returns in 2021 along with weak bond market returns, stocks and bonds had a rough start in January 2022. Inflation, concerns about central bank tightening and tensions with Russia over Ukraine agitated markets and led to a sharp increase in volatility. Large cap stocks gave up 5.17%, according to the S&P 500, trading in negative territory for all but the first two trading days of January. Starting on January 4th, equity markets edged lower, reaching a month to-date price decline of 9.2% before recovering somewhat during the last two trading days of the month. Of the 20 trading days in January, twelve produced negative returns with six of these exceeding 1%. The Dow Jones Industrial Average posted a 3.2% drop while the NASDAQ Composite gave up 9.0%. Declines in emerging markets were not as steep, giving up 1.89% while the MSCI ACWI ex USA Index posted a drop of 3.69. Rallying oil and gas prices and higher US Treasury yields saw energy and financial stocks significantly outperform the rest of the market, but energy was the only sector to record positive results across the large, mid-cap and small-cap segments. Large cap stocks outperformed small caps, and value stocks eclipsed growth by wide margins.

Intermediate investment-grade bonds, as measured by the Bloomberg US Aggregate Bond Index registered a 2.05% decline—the worst monthly decline since March 2020. 10-Year US Treasury yields moved higher, gaining 27 bps to end the month at 1.79%.

Chart 1: S&P 500 cumulative price performance-January 2022 Source: Yahoo finance/S&P Global

Source: Yahoo finance/S&P Global

Sustainable mutual funds and ETFs

Sustainable funds¹, including a total of 1,232 sustainable mutual funds (including share classes) and ETFs, posted an average decline of 5.66%. Sustainable equity funds registered a decline of7.4% while sustainable fixed income funds gave up an average of 1.75%.

Fund specific total return results extended along a 34.28% range. At one end of the range was the 10.32% total return achieved by the AQR Sustainable Long-Short Equity Carbon Aware Fund R6 (QNZRX). The fund combines ESG integration in constructing its long portfolio with exclusions for tobacco, controversial weapons (including but not limited to cluster munitions, land mines and biochemical weapons) and fossil fuels companies with ESG scores in the bottom 10% of the investment universe, positive tilting in favor of higher ESG rated companies, and targeting a ”net zero” carbon positioning in which the carbon footprint of the companies the fund holds long is netted against the carbon footprint of the companies the fund holds short, such that the portfolio’s overall carbon footprint will be equal to or less than zero on a net notional exposure basis. Short positions may be taken in certain companies and industries with the worst ESG characteristics.

At the other end of the range, Defiance Next Gen H2 ETF (HDRO) led the rear of the pack in January, registering a low of -23.96%. The index tracking thematic fund tracks the performance of a group of globally listed equity securities of companies involved in the development of hydrogen-based energy sources and fuel cell technologies. Other clean energy strategies were also lagging in January.

¹Per Morningstar which, as defined, understates the number of sustainable mutual funds and ETFs in operation.

Three of seven selected sustainable securities market indices outperformed

Repeating last month’s outcome, only three of seven selected sustainable securities market indices across six asset classes or market segments, including two indices that track the US equity market, outperformed their conventional counterparts in January. All indices posted negative results, ranging from -1.10% recorded by emerging markets to -7.88% achieved by small cap ESG stocks, as measured by the MSCI USA Small Cap ESG Leaders Index.

Except for the MSCI USA Small Cap ESG Leaders Index that has been a consistent laggard over the three-to-ten-year intervals, sustainable indices that rely on screening approaches tracked by MSCI and S&P Global continue to post excess returns versus their conventional counterparts in the intermediate to long-term. Another exception is the MSCI USA ESG Leaders Index that underperformed by a narrow margin over the trailing 10-year interval. The benchmark has lagged its conventional counterpart in five of the last ten calendar years, but registered its widest tracking error back in 2012. Refer to Chart 2.

Chart 2: Selected sustainable indices intermediate and long-term total return performance results to January 31, 2022 Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Performance of SRA Select Listed Funds

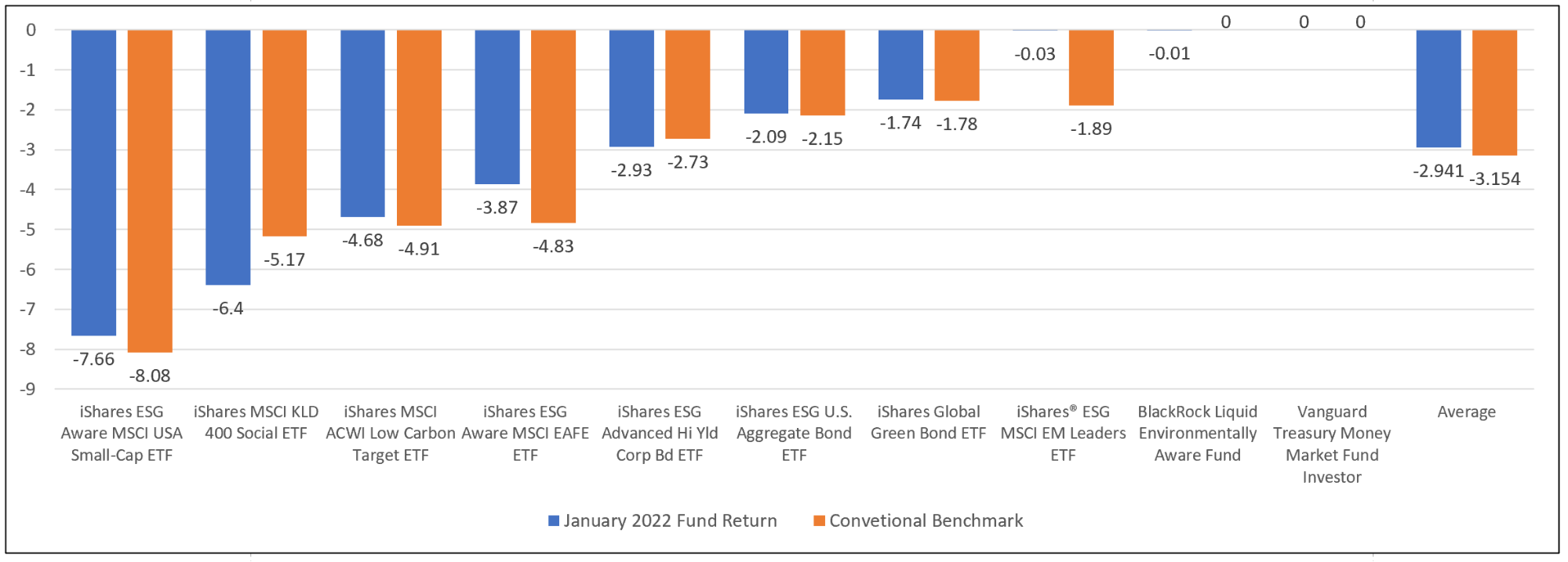

Based on an equal weighting basis, SRA Select funds posted an average decline of 2.9% in January versus an average 3.15% decline registered by the average performance of corresponding conventional benchmarks. Returns ranged from -0.01% to -7.66% recorded by the BlackRock Liquid Environmentally Aware Fund Inv A (LEAXX) and the iShares ESG Aware MSCI USA Small Cap ETF (ESML), respectively. Refer to Chart 3.

Consisting of nine funds² pursuing discrete investment strategies intend for use as building blocks in the creation of a diversified ESG-oriented portfolio, six of the nine funds outperformed their conventional benchmarks in January (Refer to previously published article SRA Select Listing: ESG Integration Investment Fund Q1-2022https://sustainableinvest.com/sra-select-listing-esg-integration-investment-funds-q1-2022/).

Chart 3: Performance of SRA Select listed mutual funds and ETFs-January 2022 Notes of Explanation: Sources: Morningstar Direct and Sustainable Research and Analysis LLC

Notes of Explanation: Sources: Morningstar Direct and Sustainable Research and Analysis LLC

² A tenth fund, the Vanguard Treasury Money Market Fund, is an alternative money market fund

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact