Summary

- U.S. Stocks, as well as investment-grade bonds, delivered positive results in May; small capitalization stocks in general and growth stocks in particular led the pack.

- The SUSTAIN Equity Fund Index gains 1.35% but lagged behind the S&P 500 Index by almost 1.1%.

- Sustainable bond funds gained 0.62% and post best monthly performance results in May but continue to lag the Bloomberg Barclays U.S. Aggregate Bond Index.

U.S. Stocks, as well as Investment-Grade Bonds, Delivered Positive Results in May; Small Capitalization Stocks in General and Growth Stocks in Particular Led the Pack

The Russell 2000 Growth Index recorded a gain of 6.3% whereas the S&P 500 Index posted a total return increase of 2.16%, second only to the 5.73% monthly return recorded so far this year in January. This increase was still not sufficient in magnitude to erase the decline since the peak reached on January 26th. Since that date and through the end of May, the S&P 500 Index is down -5.0% while on a year-to-date basis the benchmark remains in positive territory with a gain of 1.18%. At the same time, U.S. investment-grade bonds, based on the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, almost wiped away April’s -0.74% loss with a gain of 0.71% in May. Even as the Federal Reserve held interest rates steady at the conclusion of its two-day policy meeting at the beginning of the month, interest rates fluctuated widely, with the 10-year Treasury yield moving up to 3.11% on May 16th but closing lower on May 30th at 2.85% versus 2.95% at the end of April. European, Asian and Latin American stocks, dominated by emerging market countries Brazil and Mexico, posted negative returns, ranging from -2.25% to -14.2%.

SUSTAIN Equity Fund Index Gains 1.35% but Lags Behind S&P 500 Index by Almost 1.1%

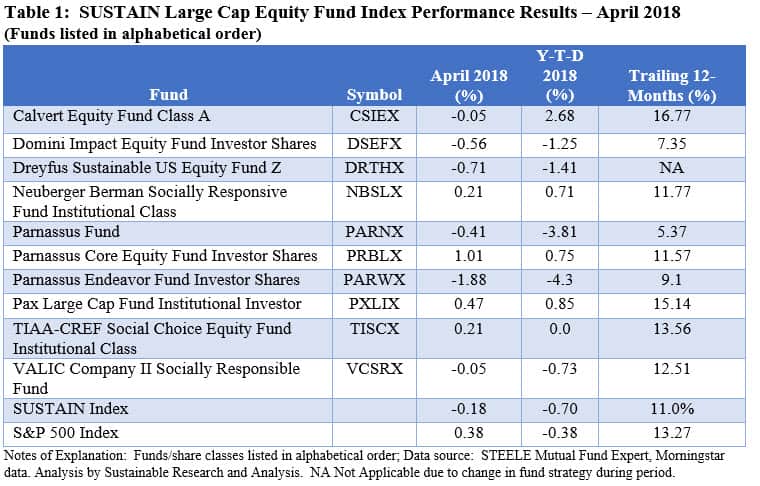

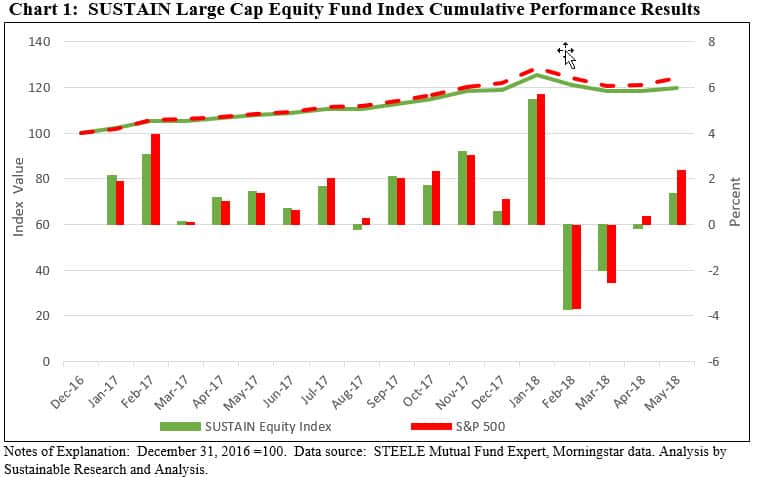

Against this backdrop, the SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity-oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, recorded a gain of 1.35% in May. This compared to a total return increase for the S&P 500 Index of 2.41% and represents a shortfall of almost 1.1%, the widest monthly differential since calculation of the index began as of December 31, 2016. The performance of the SUSTAIN Equity Index was restrained by the fact that only one of its ten constituent funds managed to outperform the S&P 500. The one fund that beat the S&P 500, the VALIC Company II Socially Responsible Fund, posted a gain of 2.43%. The fund benefited from its fully invested position, its large-cap growth tilt and limited exposure to non-U.S. stocks versus its counterparts. On the other hand, the VALIC fund’s overweight exposure to the Financials sector, down -1.12% in May, likely detracted from performance. Positive but below index performance results were also delivered by Neuberger Berman Sustainable Equity Fund-Institutional Class (2.37%) and Parnassus Endeavor Fund-Investor Shares (2.19%).

Bringing up the rear in the month of May were the Parnassus Fund which recorded a decline of -0.37% as well as the Dreyfus Sustainable US Equity Fund-Z Shares, up a slim 0.36%. The fund continues to struggle to find its footing following a name change, strategy shift as well as an investment management switch effective on or about May 1, 2017. For the 12-month period the fund’s 5.19% return places it second from the bottom. Refer to Table 1.

On a year-to-date basis, the SUSTAIN index posted a slight gain of 0.70% versus an increase of 2.02% recorded by the S&P 500 Index. Three of the seven funds that comprise the index trail the S&P 500. The one fund that has pulled the SUSTAIN index along during this interval is the Calvert Equity Fund-A Shares. The fund is up 4.22% and it exceeds the performance of the S&P 500 Index by 2.2%. The fund has benefited from its strong growth orientation as well as sector and stock selection which have been contributing factors. Excluding Calvert Equity Fund-A Shares, year-to-date performance ranged from a low of -4.36 posted by Parnassus Fund to a high of 3.1% delivered by the Neuberger Berman Sustain Equity Fund-Institutional Shares.

For the last 12 months, the spread between the SUSTAIN Equity Index and the S&P 500 expanded to 4.29%. This is the widest differential since the index was launched as of December 31, 2016. Refer to Chart 1.

It should be noted that the name of the Neuberger Berman Sustainable Equity Fund was changed from Neuberger Berman Socially Responsive Fund, effective as of May 1, 2018. This $2.3 billion fund (as of 5/31/2018) with its seven share classes, has been in operation since 1994. While the approach to investing has evolved over the years, the funds’ current sustainable investing strategy remains unchanged and will not be affected by the name change. Similar to the rationale for changing the name of the Dreyfus Third Century Fund to Dreyfus Sustainable US Equity Fund in 2017, the name change reflects a broader marketplace shift away from an emphasis on values based or social investing with the negative performance implications that have long been associated with such approaches to one that focuses on a more systematic and explicit integration of ESG risks and opportunities. That said, the fund’s strategy continues to rely on some exclusions along with shareholder engagement and proxy voting.

Sustainable Bond Funds Gain 0.62% and Post Best Monthly Performance Results in May but Continue to Lag the Bloomberg Barclays U.S. Aggregate Bond Index

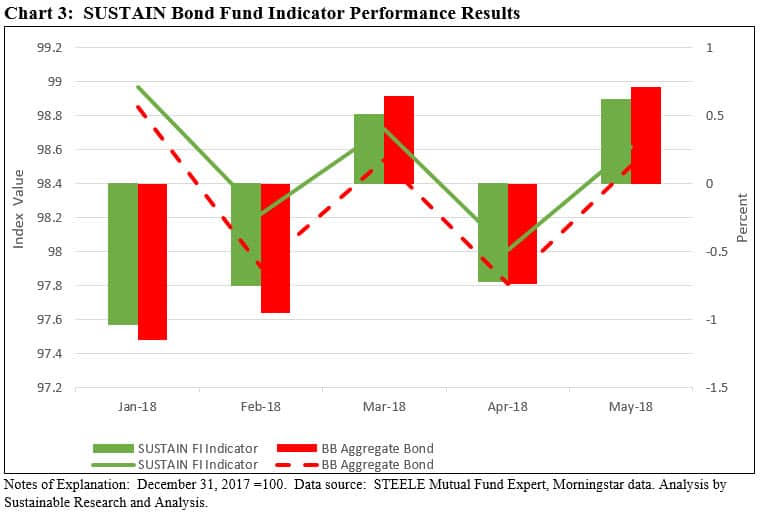

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator posted their best monthly gain this year, adding 0.62%, and in the process rolled back the year-to-date decline which now stands at -1.35%. While May’s positive results trailed by 9 basis points the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, the SUSTAIN Bond Fund Indicator is still ahead on a relative basis year-to-date by 15 basis points. Refer to Chart 2.

All five funds that comprise the SUSTAIN Bond Fund Indicator recorded positive results in May, ranging from a high of 0.73% to a low of 0.54%. Funds with higher and longer-dated exposures to U.S. Treasury securities benefited as this segment of the bond market gained 2.18% in May. This likely contributed to the 0.73% total return achieved by the Pax Core Bond Fund-Institutional Shares, the best performing of the five funds that comprise the SUSTAIN Bond Fund Indicator. The fund was 31.6% invested in Treasury securities. At the same time, its lower allocation to AAA rated securities may have detracted from the fund’s performance results.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index. The five funds include: Calvert Bond Fund-I Shares, Pax Core Bond Fund-Institutional Shares, PIMCO Total Return ESG Fund-Institutional Shares, Praxis Impact Bond Fund-I Shares, and TIAA-CREF Social Choice Bond Fund-Institutional Shares

SUSTAIN Equity Fund Index Gains 1.35% in May but Lags S&P 500 by Almost 1.1%

Summary U.S. Stocks, as well as investment-grade bonds, delivered positive results in May; small capitalization stocks in general and growth stocks in particular led the pack. The SUSTAIN Equity Fund Index gains 1.35% but lagged behind the S&P 500 Index by almost 1.1%. Sustainable bond funds gained 0.62% and post best monthly performance results in…

Share This Article:

Summary

U.S. Stocks, as well as Investment-Grade Bonds, Delivered Positive Results in May; Small Capitalization Stocks in General and Growth Stocks in Particular Led the Pack

The Russell 2000 Growth Index recorded a gain of 6.3% whereas the S&P 500 Index posted a total return increase of 2.16%, second only to the 5.73% monthly return recorded so far this year in January. This increase was still not sufficient in magnitude to erase the decline since the peak reached on January 26th. Since that date and through the end of May, the S&P 500 Index is down -5.0% while on a year-to-date basis the benchmark remains in positive territory with a gain of 1.18%. At the same time, U.S. investment-grade bonds, based on the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, almost wiped away April’s -0.74% loss with a gain of 0.71% in May. Even as the Federal Reserve held interest rates steady at the conclusion of its two-day policy meeting at the beginning of the month, interest rates fluctuated widely, with the 10-year Treasury yield moving up to 3.11% on May 16th but closing lower on May 30th at 2.85% versus 2.95% at the end of April. European, Asian and Latin American stocks, dominated by emerging market countries Brazil and Mexico, posted negative returns, ranging from -2.25% to -14.2%.

SUSTAIN Equity Fund Index Gains 1.35% but Lags Behind S&P 500 Index by Almost 1.1%

Against this backdrop, the SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity-oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, recorded a gain of 1.35% in May. This compared to a total return increase for the S&P 500 Index of 2.41% and represents a shortfall of almost 1.1%, the widest monthly differential since calculation of the index began as of December 31, 2016. The performance of the SUSTAIN Equity Index was restrained by the fact that only one of its ten constituent funds managed to outperform the S&P 500. The one fund that beat the S&P 500, the VALIC Company II Socially Responsible Fund, posted a gain of 2.43%. The fund benefited from its fully invested position, its large-cap growth tilt and limited exposure to non-U.S. stocks versus its counterparts. On the other hand, the VALIC fund’s overweight exposure to the Financials sector, down -1.12% in May, likely detracted from performance. Positive but below index performance results were also delivered by Neuberger Berman Sustainable Equity Fund-Institutional Class (2.37%) and Parnassus Endeavor Fund-Investor Shares (2.19%).

Bringing up the rear in the month of May were the Parnassus Fund which recorded a decline of -0.37% as well as the Dreyfus Sustainable US Equity Fund-Z Shares, up a slim 0.36%. The fund continues to struggle to find its footing following a name change, strategy shift as well as an investment management switch effective on or about May 1, 2017. For the 12-month period the fund’s 5.19% return places it second from the bottom. Refer to Table 1.

On a year-to-date basis, the SUSTAIN index posted a slight gain of 0.70% versus an increase of 2.02% recorded by the S&P 500 Index. Three of the seven funds that comprise the index trail the S&P 500. The one fund that has pulled the SUSTAIN index along during this interval is the Calvert Equity Fund-A Shares. The fund is up 4.22% and it exceeds the performance of the S&P 500 Index by 2.2%. The fund has benefited from its strong growth orientation as well as sector and stock selection which have been contributing factors. Excluding Calvert Equity Fund-A Shares, year-to-date performance ranged from a low of -4.36 posted by Parnassus Fund to a high of 3.1% delivered by the Neuberger Berman Sustain Equity Fund-Institutional Shares.

For the last 12 months, the spread between the SUSTAIN Equity Index and the S&P 500 expanded to 4.29%. This is the widest differential since the index was launched as of December 31, 2016. Refer to Chart 1.

It should be noted that the name of the Neuberger Berman Sustainable Equity Fund was changed from Neuberger Berman Socially Responsive Fund, effective as of May 1, 2018. This $2.3 billion fund (as of 5/31/2018) with its seven share classes, has been in operation since 1994. While the approach to investing has evolved over the years, the funds’ current sustainable investing strategy remains unchanged and will not be affected by the name change. Similar to the rationale for changing the name of the Dreyfus Third Century Fund to Dreyfus Sustainable US Equity Fund in 2017, the name change reflects a broader marketplace shift away from an emphasis on values based or social investing with the negative performance implications that have long been associated with such approaches to one that focuses on a more systematic and explicit integration of ESG risks and opportunities. That said, the fund’s strategy continues to rely on some exclusions along with shareholder engagement and proxy voting.

Sustainable Bond Funds Gain 0.62% and Post Best Monthly Performance Results in May but Continue to Lag the Bloomberg Barclays U.S. Aggregate Bond Index

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator posted their best monthly gain this year, adding 0.62%, and in the process rolled back the year-to-date decline which now stands at -1.35%. While May’s positive results trailed by 9 basis points the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, the SUSTAIN Bond Fund Indicator is still ahead on a relative basis year-to-date by 15 basis points. Refer to Chart 2.

All five funds that comprise the SUSTAIN Bond Fund Indicator recorded positive results in May, ranging from a high of 0.73% to a low of 0.54%. Funds with higher and longer-dated exposures to U.S. Treasury securities benefited as this segment of the bond market gained 2.18% in May. This likely contributed to the 0.73% total return achieved by the Pax Core Bond Fund-Institutional Shares, the best performing of the five funds that comprise the SUSTAIN Bond Fund Indicator. The fund was 31.6% invested in Treasury securities. At the same time, its lower allocation to AAA rated securities may have detracted from the fund’s performance results.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index. The five funds include: Calvert Bond Fund-I Shares, Pax Core Bond Fund-Institutional Shares, PIMCO Total Return ESG Fund-Institutional Shares, Praxis Impact Bond Fund-I Shares, and TIAA-CREF Social Choice Bond Fund-Institutional Shares

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact