SRI funds add $106 billion and end April with $733.5 billion in assets under management

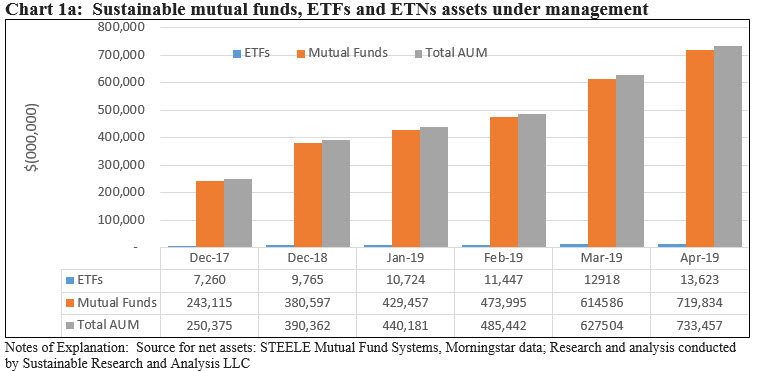

For the sixth consecutive month, sustainable funds, including mutual funds, ETFs and ETNs, registered another monthly all-time high of $733.5 billion in assets under management as of April 30, 2019. A total of $106.0 billion in net assets were added in April versus net additions of $137.2 billion during the month of March and net additions of $45.3 billion and $49.8 billion, respectively, in January and February. Of this sum in April, $85.2 billion, or 80.5% of the total, is attributable to re-branded or repurposed funds, an estimated $18.2 billion, or 17.2%, is sourced to market movement while an estimated $2.5 billion, or 2.3%, is due to net new cash flows.

Sustainable mutual funds versus ETFs

Sustainable mutual fund assets and their corresponding share classes, a combined total of 1,986 funds/share classes, added $105.2 billion, for a gain of 14.6%, while the 96 ETFs, including two newly launched ETFs, expanded by $704.8 million, or 5.5%.

Equity and related funds, at $627.5 billion, account for a combined 85.6% of total mutual fund, ETF and ETN assets under management. At the same time, $105.2 billion is invested in fixed income funds, including money market funds, taxable as well as municipal funds. Refer to Chart 1a.

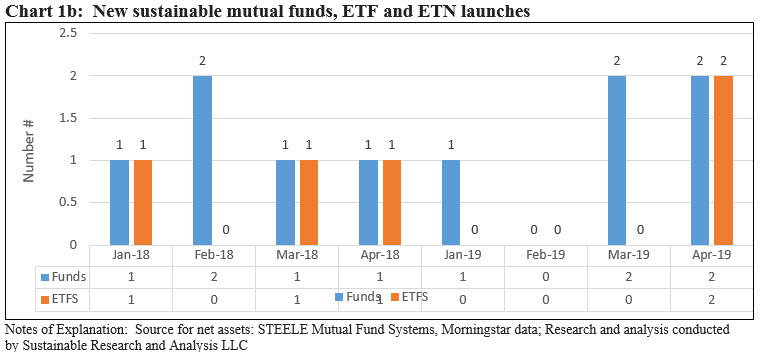

New Funds in April: Two new funds launched and two new ETFs

Two new sustainable mutual funds and a total number of eight share classes, as well as two exchange traded funds, were launched in April, adding $6.0 million in net assets. This compares to a single fund and one ETF that were launched in April 2018.

That said, a similar number of sustainable mutual funds were launched over the four month to April time period in 2018 while so far this year two ETFs were brought to market, both in April, versus three during the same time interval last year. At the same time, 37 new mutual fund share classes were launched this year versus 14 last year. Refer to Chart 1b.

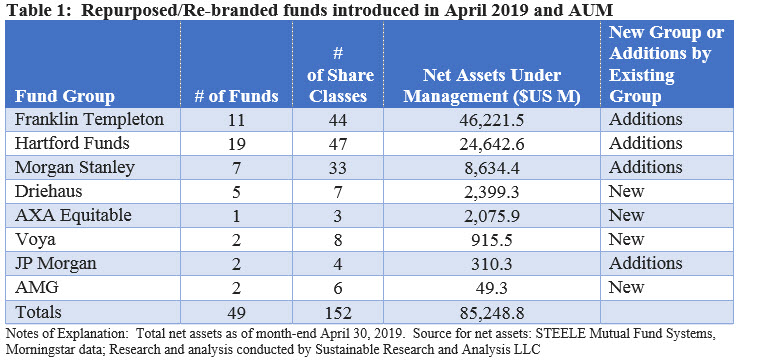

Repurposed or re-branded funds: At $85.2 billion, second largest inflow so far this year

Eight fund firms repurposed or re-branded existing funds in April, including four entirely new fund firms. These new funds, a total of 49 and 152 share classes, added $85.2 billion in assets. This represents the second largest inflow so far this year attributable to repurposed funds as compared to $131.4 billion recorded in March. Refer to Table 1.

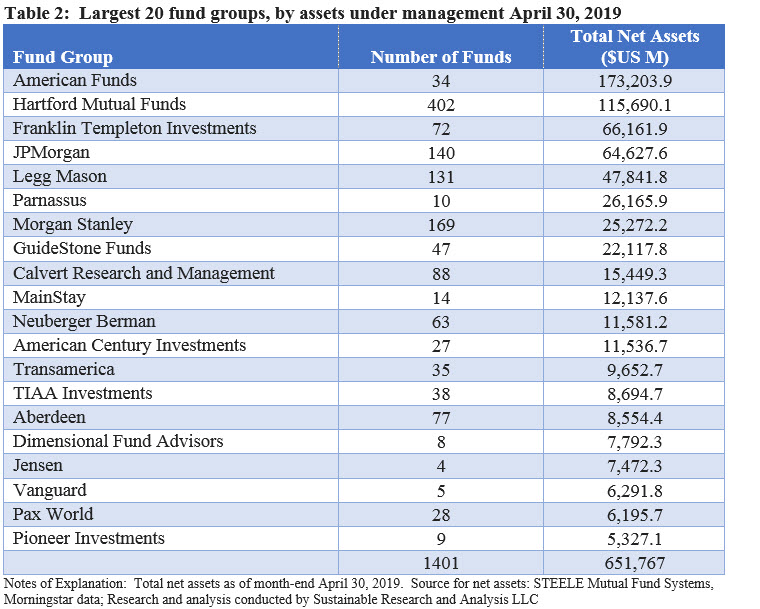

Largest Fund Groups: Top 20 sustainable fund groups account for 88.8% of net assets

The largest fund groups represent $651.8 billion or 88.8% of net assets under management. Franklin Templeton, previously ranked 7th in terms of sustainable assets, moved up to rank 3rd as the firm repurposed $46.2 billion in fund assets. Refer to Table 2.

American Funds continues in the lead with its Washington Mutual Fund and the more recently added American Mutual Fund that exclude alcohol and tobacco stocks, but its market share has shrunk since the start of the year from 38.4% to 23.6% of sustainable assets under management even as the second fund was added.

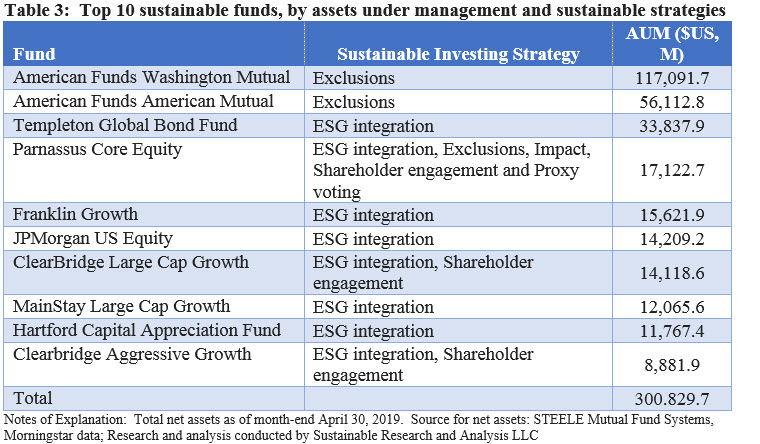

Largest sustainable funds by net assets account for $300.8 billion or 41.0% of assets in segment

The largest funds by net assets as of April 30, 2019, including all related share classes, account for $300.8 billion in net assets, or 41.0% of the sustainable segment’s total assets under management. Refer to Table 3.

For a more in-depth analysis of April’s cash flows and additional details regarding new funds and their strategies, refer to Sustainable Monthly Cash Flows In-Depth Report: April 2019 posted in the Sustainableinvest Premium section of the website by month-end.