The Bottom Line: 49 of 60 top and bottom sustainable fund performers in April integrate ESG, including 11 funds that may account for ESG factors.

Summary

Optimism fueled by bullish sentiments regarding the COVID-19 medical recovery combined with massive Federal Reserve Bank guarantees of unlimited liquidity and rapid federal government fiscal stimulus measures in the form of grants, loans, loan forgiveness and other programs pushed stocks and bonds strongly higher in April to close the month up 12.8% as measured by the S&P 500 and a slightly better 12.85% as measured by the S&P 500 ESG equivalent index. The Bloomberg Barclays US Aggregate Bond Index was up 1.78% while its ESG counterpart was up 1.79%. Across the board, sustainable mutual funds and ETFs[1] extending from money market funds and up to commodities and alternative funds recorded an average gain of 7.79%. These ranged from a low of -4.06% posted by a high yield municipal bond fund to a high of 38.24% registered by a gold and precious metals fund, with Master Limited Partnerships and energy infrastructure funds coming in right behind.

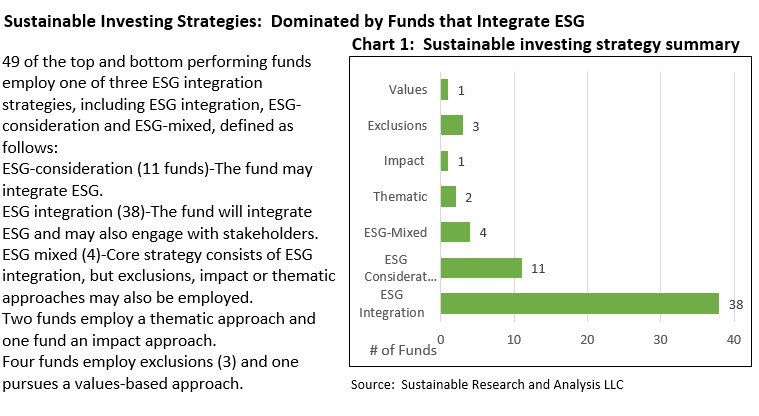

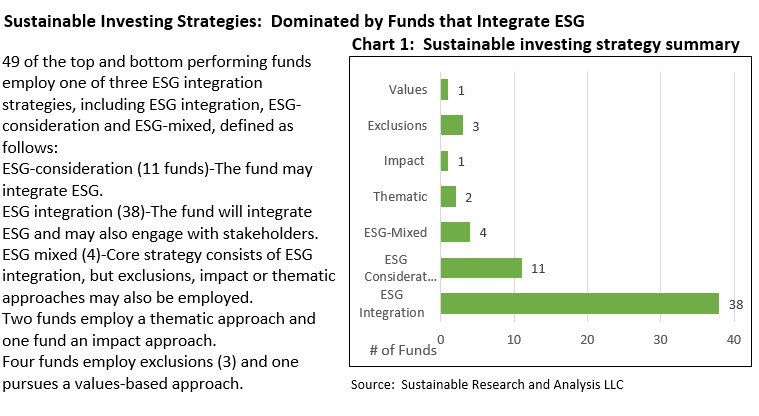

Top and bottom performing sustainable funds, 60 funds in total across three consolidated fund categories posted results that ranged from an average of 27.69% for the top 10 equity funds, including sector funds, to an average of -3.28% achieved by the bottom 10 fixed income funds, including both taxable and municipal bond funds. Sustainable investing strategies pursued by 49 of the 60 top/bottom funds were dominated by investment companies that integrate ESG factors into investment decisions. Included in this segment are 11 funds (22.4%) whose commitment is less definitive (referred to as ESG-consideration) in that they may consider taking on board information about ESG issues in their fundamental research process and when making investment decisions but they are presumably not obligated to do so. The remaining 11 funds employ sustainable strategies that include ESG-mixed, thematic investing, impact investing, exclusions and values-based investing. Refer to Chart 1.

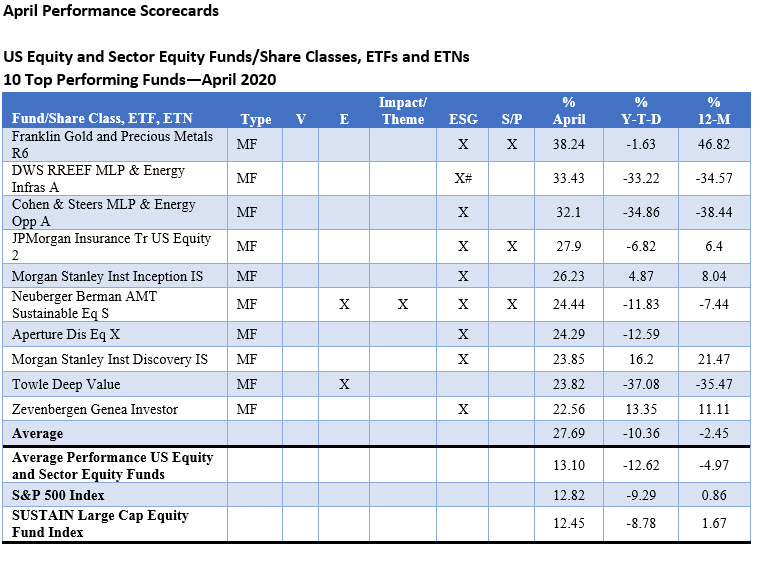

US Equity and Sector Equity Funds/Share Classes: Average Performance 12.45%

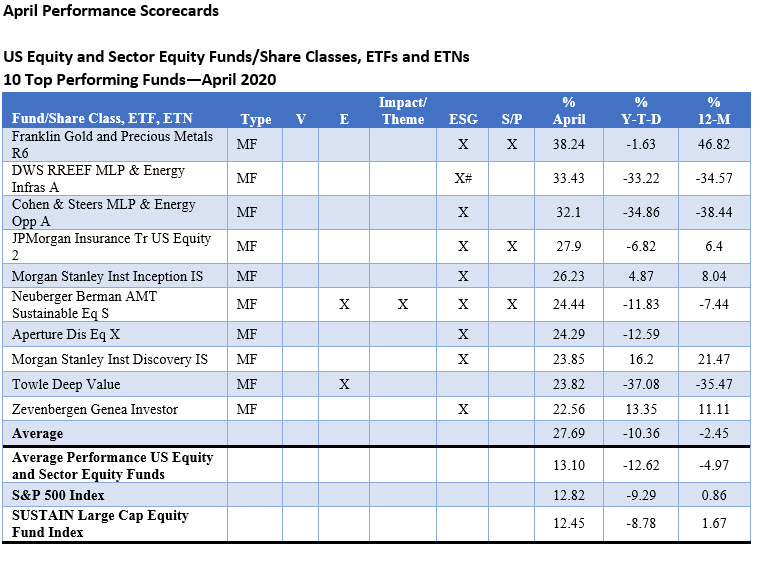

Sustainable equity and sector equity mutual funds and ETFs posted an average return of 12.45% in April while the top 10 funds exceeded the average by wide margins, ranging from 22.56% to 38.24%. All but one fund integrate ESG factors, either consistently or, in the case of the DWS RREEF MLP & Energy Infrastructure Fund A, the fund’s commitment is less definitive as the fund, according to its prospectus, “may consider information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.” Of these nine funds, three employ supplemental approaches, such as investee engagement or in the case of Neuberger Berman, also exclusions and impact. The one exception is the Towle Deep Value Fund, a small cap fund relying entirely on exclusions of tobacco, liquor, or gaming companies, that posted an increase of 23.82% in April.

Top performing funds included sector equity funds invested in gold and precious metals, master limited partnerships and securities issued by energy infrastructure companies.

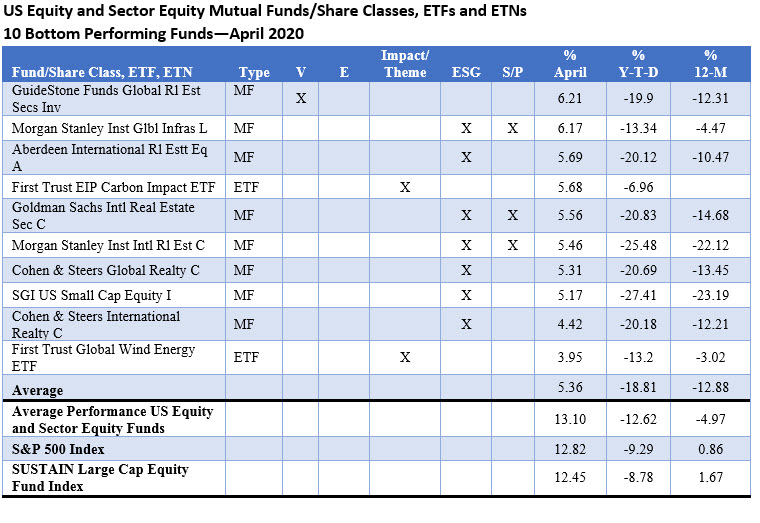

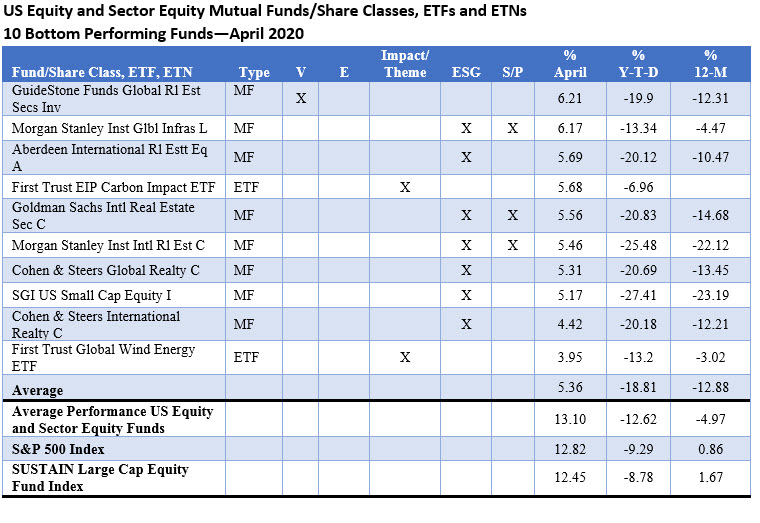

The bottom ten performing sustainable equity and sector equity funds generated a positive but lower average return of 5.36%. More so that the top performing equity funds, bottom performers were dominated by sector funds investing in real estate securities, and also low carbon as well as wind energy securities. At the same time, the sustainable investing strategies of the bottom ten performing funds were more varied. While ESG integration strategies are employed by seven funds, one funds pursues a values-based strategy and two funds, both ETFs, follow a thematic strategy of low carbon and renewable wind energy.

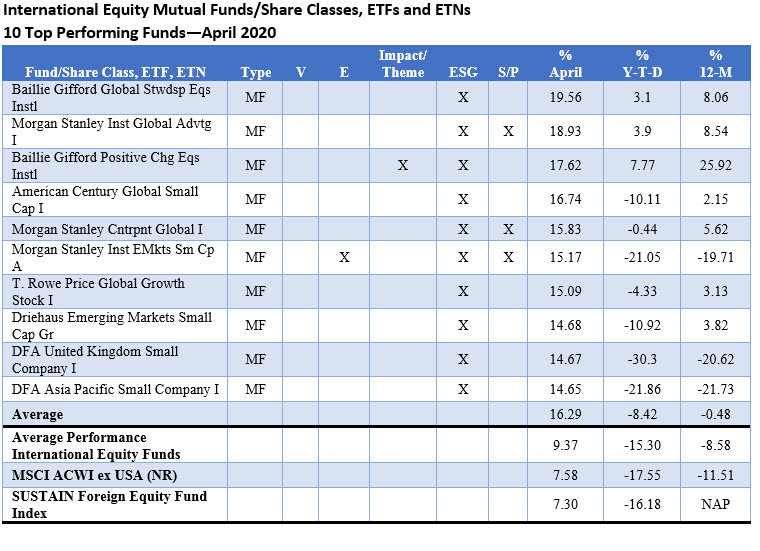

International Equity Funds: Average Performance 7.3%

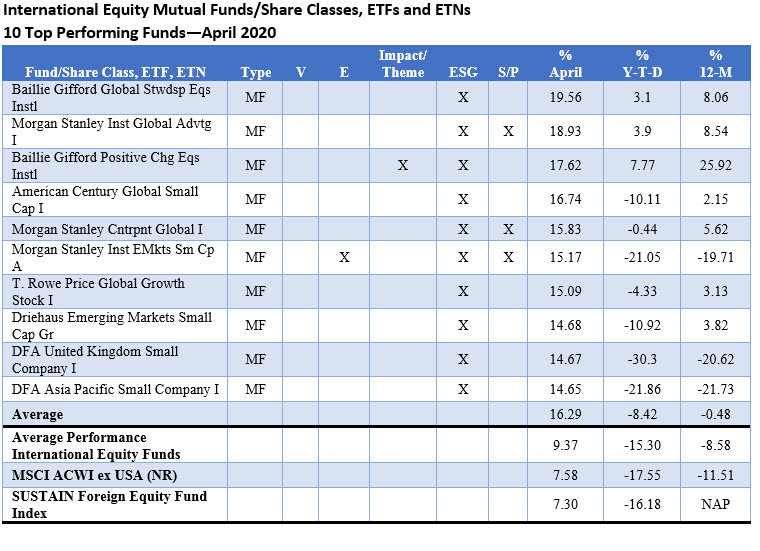

International equity funds posted an average total return of 7.3%, but top performing funds in the category delivered results at least 2X greater. The top 10 funds registered an average return of 16.29% and results ranged from 14.65% to a high of 19.56%. Five of the ten funds focused on small cap stocks, while the other funds are classified as large cap and large cap growth funds. Nine of the ten funds integrate ESG, either exclusively or in combination with exclusions and/or investee engagement. One fund, the Baillie Gifford Positive Change Equities, invests in a portfolio consisting of between 25-50 growth companies which the portfolio managers consider to have core ambitions of delivering a positive change in at least one of the following areas: social inclusion and education, healthcare, the environment, and addressing basic needs and aspirations of the world’s poorest populations. According to the fund’s prospectus, in order to assess positive change in these areas, Baillie Gifford Overseas Limited will monitor the progress of each issuer using metrics and/or milestones” as determined by the manager.

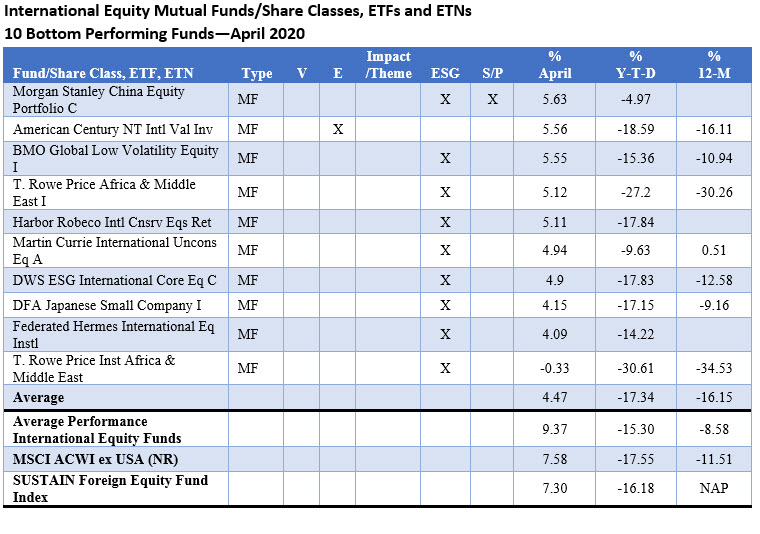

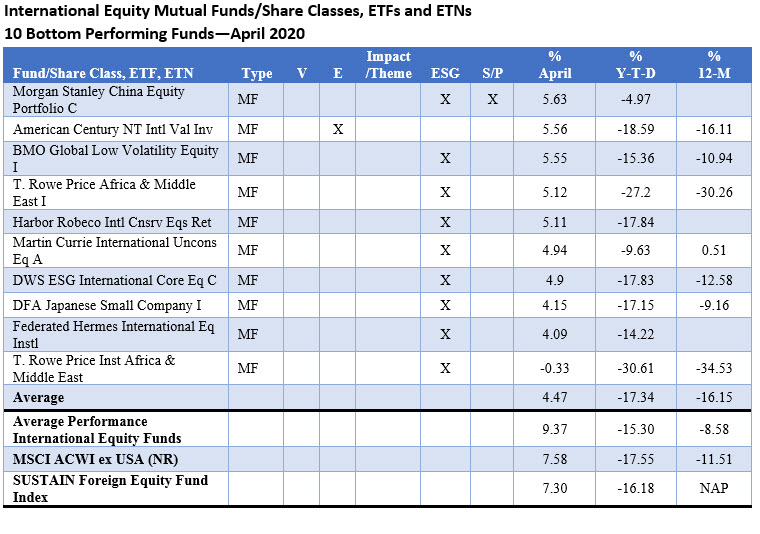

The bottom ten performing international funds gained an average 4.47%, with returns ranging from -0.33% to 5.63%. Four funds, including the poorest performing fund in the category, focus on a region or country while the rest pursued broader more diversified mandates. All but one fund integrate ESG into investment decisions. The exception is the American Century NT International Value Fund that avoids investments in tobacco companies.

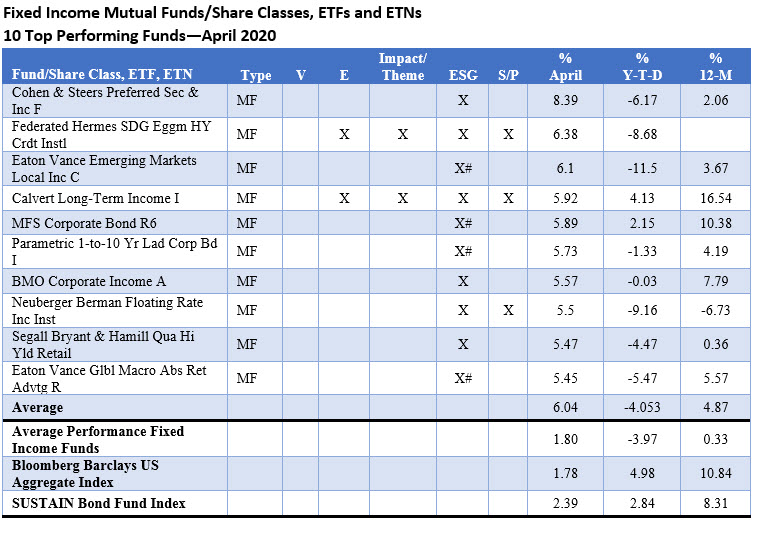

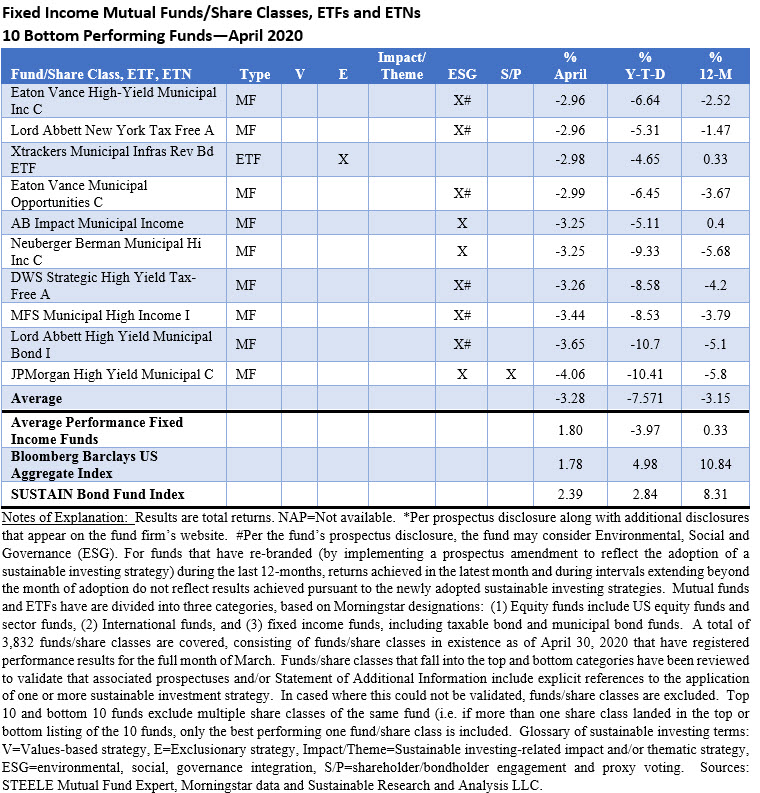

Fixed Income Funds: Average Performance 2.39%

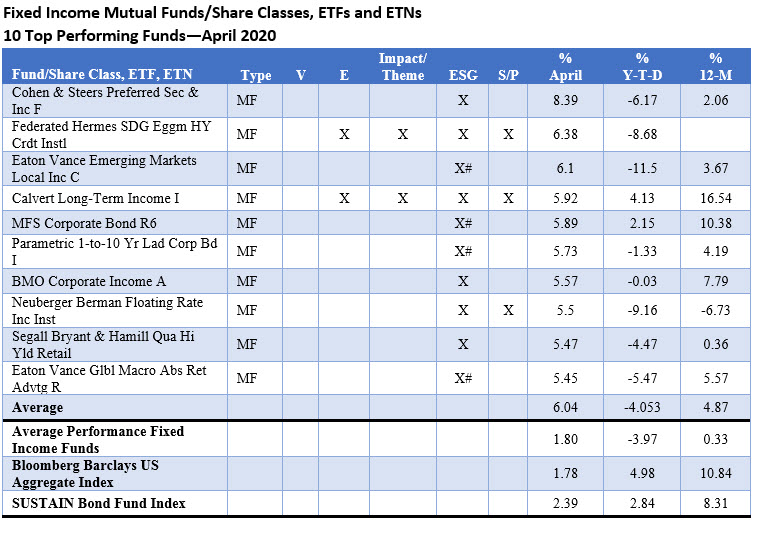

Top performing bond funds eclipsed the average 2.39% performance of all taxable and municipal bond funds by 3.65% in April. Top performers, which posted returns ranging from 5.45% to 8.39%, were dominated by funds investing in high yield securities, corporates, and longer dated instruments, in line with the outcomes captured by fixed income indices. That said, the top performing Cohen & Steers Preferred Securities and Income F, up 8.39%, invests in preferred securities. Nine of the ten top performing funds integrate ESG either exclusively or in combination with supplemental sustainable investing approaches. Four of these funds, however, make a less definitive commitment to integrate ESG based on their prospectus language. The four funds are managed by two firms, Eaton Vance and MFS.

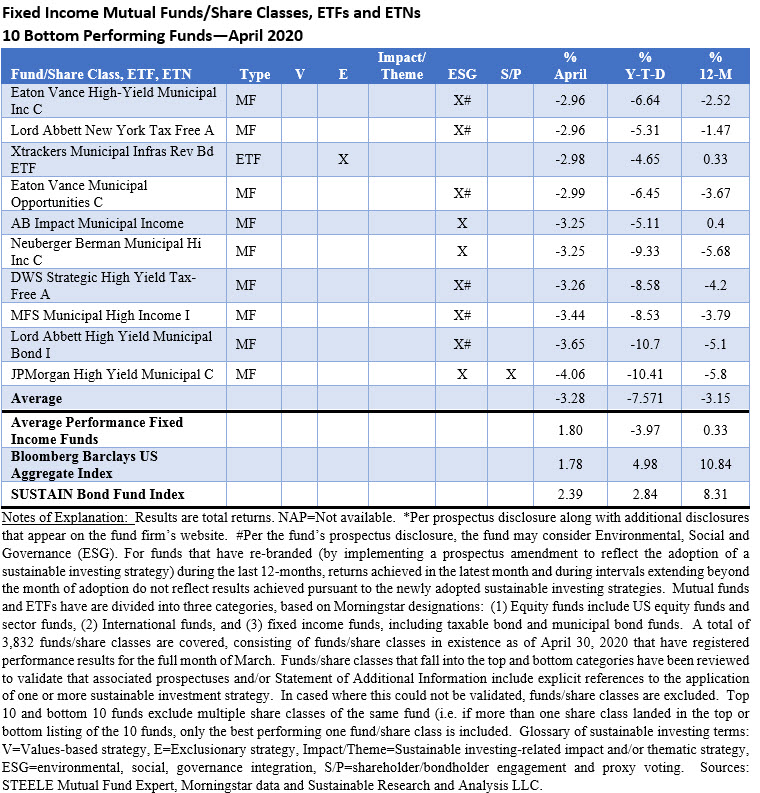

The bottom 10 performing bond funds, posted an average return of -3.28% as all ten funds registered negative results ranging from -4.06% to -2.96%. These were largely high yield municipal bond funds, a category that, on average, gave up -1.3% in April due to municipal bond default concerns arising from the coronavirus pandemic and the resultant decline in municipal tax revenues and rising expenses incurred to fight the pandemic. Excepting a single fund, the DWS managed Xtrackers Municipal Infrastructure Revenue Bond ETF that excludes investments in higher education, pollution control, housing, healthcare and tobacco, the other nine funds integrate ESG factors. This unit of 10 funds, however, is dominated by six funds that like its four top performing counterparts have made less than definitive commitments to integrate ESG. In addition to DWS, these funds are managed by Eaton Vance, MFS and Lord Abbett.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Sustainable Funds Performance Scorecard: April 2020

The Bottom Line: 49 of 60 top and bottom sustainable fund performers in April integrate ESG, including 11 funds that may account for ESG factors.

Share This Article:

The Bottom Line: 49 of 60 top and bottom sustainable fund performers in April integrate ESG, including 11 funds that may account for ESG factors.

Summary

Optimism fueled by bullish sentiments regarding the COVID-19 medical recovery combined with massive Federal Reserve Bank guarantees of unlimited liquidity and rapid federal government fiscal stimulus measures in the form of grants, loans, loan forgiveness and other programs pushed stocks and bonds strongly higher in April to close the month up 12.8% as measured by the S&P 500 and a slightly better 12.85% as measured by the S&P 500 ESG equivalent index. The Bloomberg Barclays US Aggregate Bond Index was up 1.78% while its ESG counterpart was up 1.79%. Across the board, sustainable mutual funds and ETFs[1] extending from money market funds and up to commodities and alternative funds recorded an average gain of 7.79%. These ranged from a low of -4.06% posted by a high yield municipal bond fund to a high of 38.24% registered by a gold and precious metals fund, with Master Limited Partnerships and energy infrastructure funds coming in right behind.

Top and bottom performing sustainable funds, 60 funds in total across three consolidated fund categories posted results that ranged from an average of 27.69% for the top 10 equity funds, including sector funds, to an average of -3.28% achieved by the bottom 10 fixed income funds, including both taxable and municipal bond funds. Sustainable investing strategies pursued by 49 of the 60 top/bottom funds were dominated by investment companies that integrate ESG factors into investment decisions. Included in this segment are 11 funds (22.4%) whose commitment is less definitive (referred to as ESG-consideration) in that they may consider taking on board information about ESG issues in their fundamental research process and when making investment decisions but they are presumably not obligated to do so. The remaining 11 funds employ sustainable strategies that include ESG-mixed, thematic investing, impact investing, exclusions and values-based investing. Refer to Chart 1.

US Equity and Sector Equity Funds/Share Classes: Average Performance 12.45%

Sustainable equity and sector equity mutual funds and ETFs posted an average return of 12.45% in April while the top 10 funds exceeded the average by wide margins, ranging from 22.56% to 38.24%. All but one fund integrate ESG factors, either consistently or, in the case of the DWS RREEF MLP & Energy Infrastructure Fund A, the fund’s commitment is less definitive as the fund, according to its prospectus, “may consider information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.” Of these nine funds, three employ supplemental approaches, such as investee engagement or in the case of Neuberger Berman, also exclusions and impact. The one exception is the Towle Deep Value Fund, a small cap fund relying entirely on exclusions of tobacco, liquor, or gaming companies, that posted an increase of 23.82% in April.

Top performing funds included sector equity funds invested in gold and precious metals, master limited partnerships and securities issued by energy infrastructure companies.

The bottom ten performing sustainable equity and sector equity funds generated a positive but lower average return of 5.36%. More so that the top performing equity funds, bottom performers were dominated by sector funds investing in real estate securities, and also low carbon as well as wind energy securities. At the same time, the sustainable investing strategies of the bottom ten performing funds were more varied. While ESG integration strategies are employed by seven funds, one funds pursues a values-based strategy and two funds, both ETFs, follow a thematic strategy of low carbon and renewable wind energy.

International Equity Funds: Average Performance 7.3%

International equity funds posted an average total return of 7.3%, but top performing funds in the category delivered results at least 2X greater. The top 10 funds registered an average return of 16.29% and results ranged from 14.65% to a high of 19.56%. Five of the ten funds focused on small cap stocks, while the other funds are classified as large cap and large cap growth funds. Nine of the ten funds integrate ESG, either exclusively or in combination with exclusions and/or investee engagement. One fund, the Baillie Gifford Positive Change Equities, invests in a portfolio consisting of between 25-50 growth companies which the portfolio managers consider to have core ambitions of delivering a positive change in at least one of the following areas: social inclusion and education, healthcare, the environment, and addressing basic needs and aspirations of the world’s poorest populations. According to the fund’s prospectus, in order to assess positive change in these areas, Baillie Gifford Overseas Limited will monitor the progress of each issuer using metrics and/or milestones” as determined by the manager.

The bottom ten performing international funds gained an average 4.47%, with returns ranging from -0.33% to 5.63%. Four funds, including the poorest performing fund in the category, focus on a region or country while the rest pursued broader more diversified mandates. All but one fund integrate ESG into investment decisions. The exception is the American Century NT International Value Fund that avoids investments in tobacco companies.

Fixed Income Funds: Average Performance 2.39%

Top performing bond funds eclipsed the average 2.39% performance of all taxable and municipal bond funds by 3.65% in April. Top performers, which posted returns ranging from 5.45% to 8.39%, were dominated by funds investing in high yield securities, corporates, and longer dated instruments, in line with the outcomes captured by fixed income indices. That said, the top performing Cohen & Steers Preferred Securities and Income F, up 8.39%, invests in preferred securities. Nine of the ten top performing funds integrate ESG either exclusively or in combination with supplemental sustainable investing approaches. Four of these funds, however, make a less definitive commitment to integrate ESG based on their prospectus language. The four funds are managed by two firms, Eaton Vance and MFS.

The bottom 10 performing bond funds, posted an average return of -3.28% as all ten funds registered negative results ranging from -4.06% to -2.96%. These were largely high yield municipal bond funds, a category that, on average, gave up -1.3% in April due to municipal bond default concerns arising from the coronavirus pandemic and the resultant decline in municipal tax revenues and rising expenses incurred to fight the pandemic. Excepting a single fund, the DWS managed Xtrackers Municipal Infrastructure Revenue Bond ETF that excludes investments in higher education, pollution control, housing, healthcare and tobacco, the other nine funds integrate ESG factors. This unit of 10 funds, however, is dominated by six funds that like its four top performing counterparts have made less than definitive commitments to integrate ESG. In addition to DWS, these funds are managed by Eaton Vance, MFS and Lord Abbett.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact