The Bottom Line: Sustainable funds recorded an average gain of 5.05% in Q1 2023, while top performing funds gained 7.2% and bottom funds dropped 5.09%.

0:00

/

0:00

Listen to this article

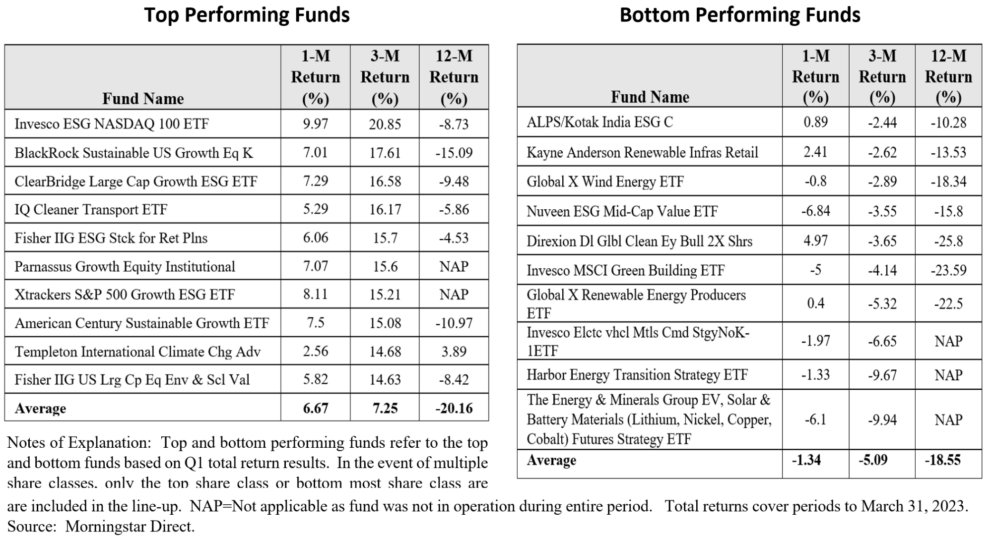

Top and bottom performing sustainable mutual funds and ETFs – Q1 2023

Observations:

- Sustainable mutual funds and ETFs, a total of 1,401 funds/share classes with $312.1 billion in assets under management at the end of March 2023, recorded average gains of 1.78% in March and 5.05% in the first quarter (Q1) as well as a decline of 6.56% during the trailing twelve months. The uptick in the first quarter came after an unsettling 2022 for equities as well as fixed income markets and a surprising show of resilience that overcame stress in the banking system, cryptocurrency meltdowns and uncertainty about what’s ahead for the economy.

- Sustainable international equity funds led over the quarter, followed by US equity and taxable bond funds, adding an average of 7.06%, 6.0% and 2.64%, respectively. Only about 5% of funds/share classes posted negative returns in the quarter.

- The broad S&P 500 Index gained 7.5% in Q1, the S&P 500 ESG Index added an even higher 8.09% and bond prices, based on the Bloomberg US Aggregate Bond Index, also rose, notching a gain of 2.96%, as investors bet that the Federal Reserve won’t raise rates as high as previously expected due to recent banking failures or near-failures, technology stocks soared 20.77% per the Nasdaq 100 Index while oil and gas prices fell and ended the quarter down 4.94% according to the S&P 1500 Energy Index.

- The best performing sustainable mutual funds and ETFs gained 7.25% in Q1, benefiting from an emphasis on large cap growth stocks, exposure to technology stocks and lighter allocations to fossil fuel companies in the energy sector. That said, their strong average gain was not yet sufficient to offset their average -31.6% total return results in 2022. It should be noted that the top 10 funds, apart from the $131.1 million ClearBridge Large Cap Growth ESG ETF, are small in size. At an average fund size of $5.8 million, these funds may not be able to replicate the quarter’s outsized performance results once they begin to attract assets and grow.

- The ten worst performing sustainable mutual funds and ETFs include funds investing in renewable energy sectors such as battery storage, hydrogen, renewable gas, solar PV, offshore and onshore wind and carbon sequestration, to mention just some. The group gave up 5.1% in Q1. Returns ranged from a low of -9.94% to a high of -2.44% versus -0.05% recorded by the S&P/TSX Renewable Energy and Clean Technology Index.